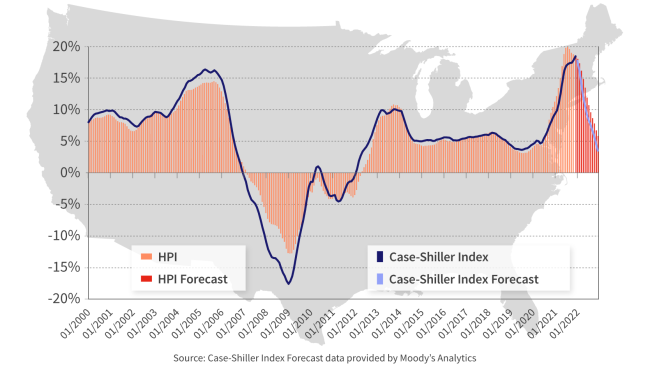

Casual observers might think this graph is saying that home prices will drop, but instead it is just the YoY change that is moderating. The MoM changes will become more interesting than the YoY changes over the next 12 months.

Home prices averaged year-over-year gains of 15 percent over the 12 months of 2021 compared to an average gain of 6.0 percent in 2020. CoreLogic’s Home Price Index (HPI) ended the year up 18.5 percent compared to the prior December. Despite indications earlier in the year that price gains were beginning to decelerate, they rose 1.3 percent in December, identical to the monthly gains reported in each of the previous three months. The annual growth is up from 18 percent in September and October.

CoreLogic says, “Consumer desire for homeownership against persistently low supply of for-sale homes created one of the hottest housing markets in decades in 2021 – and spurred record-breaking home price growth. Home price growth in 2021 started off at 10 percent in the first quarter, steadily increasing and ending the year with an increase of 18 percent for the fourth quarter.”

CoreLogic’s price forecast for this year anticipates that appreciation will exceed 10 percent for the first months of the year but will fall steadily to 3.5 percent by December 2022. The annual increases will average 9.6 percent.

The company dismisses questions about whether the nation is currently in a housing bubble. The report says its Market Risk Indicators suggest only a small probability of a nationwide price decline, pointing instead to the larger likelihood that falling prices will be limited to specific, at-risk markets. Those locations with a high probability, over 70 percent, include Prescott and Lake Havasu City-Kingman, Arizona; Merced, California; and Worcester, MA.

“Much of what we’ve seen in the run-up of home prices over the last year has been the result of a perfect storm of supply and demand pressures,” said Dr. Frank Nothaft, chief economist at CoreLogic. “As we move further into 2022, economic factors – such as new home building and a rise in mortgage rates – are in motion to help relieve some of this pressure and steadily temper the rapid home price acceleration seen in 2021.”

Prices of detached residential properties posted an annual increase of 19.7 percent in December. This was 5.5 percent higher than the appreciation of attached properties at 14.2 percent.

The state with the greatest increase continues to be Arizona at 28.4 percent, It is followed by Florida at 27.1 percent and Utah at 25.2 percent. Two Florida cities, Naples, and Punta Gorda, posted the largest gains among metro areas at 37.6 and 35.7 percent, respectively.

https://www.mortgagenewsdaily.com/news/02012022-corelogic-hpi

I’m reading this article but all I can think about are donuts. Thanks Jim.

did someone say….”donuts”..??