Taking a cash offer is a sexy option but no guarantee to get past the home inspection. The best buyers work with the best agents, and another variable worth considering when selecting the winner.

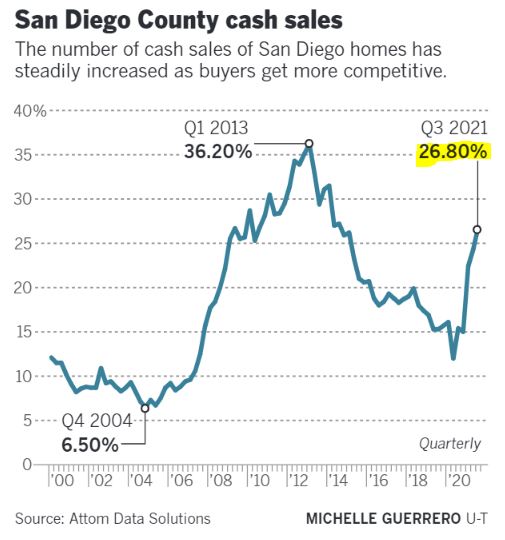

Almost 27 percent of San Diego County home sales were in cash in the third quarter — the highest in seven years. Attom Data Solutions said cash purchases, instead of loans, were up from 15.4 percent at the same time last year.

Sellers typically prefer cash buyers because it guarantees money for the home quickly, whereas mortgages can be delayed — or fall through — for a variety of reasons. San Diego has seen an increase in cash offers before, said Attom records going back to 2000. The real estate data provider said 36.2 percent of homes were purchased with cash in the first quarter of 2013 as the region came out of the Great Recession. At the time, many loan programs were still suspended from the housing crash and that made cash sales more of a necessity. The last highest level for cash sales was in the third quarter of 2014, with 27.2 percent.

The difference now is potential buyers face increased competition for a limited number of homes for sale and are trying to make the best offer possible, said Raylene Brundage, a Windermere agent who sells in several North County communities. “If it’s not contingent on a loan, there is less that can go wrong,” she said.

Brundage said sellers often go for cash sales over other loan types designed for first-time buyers and the military. Those types of loans require appraisals and inspections, making it possible a transaction could be halted. Cash sales not only mean money flows quickly into bank accounts but inspections, which are needed on loans, are often waived. A deal with a mortgage could take a month or longer to complete.

Brundage said she worked with two millennial couples this year who borrowed money from parents so they could make cash offers. Both were successful in getting homes. The majority of cash sales are coming from typical homebuyers, not investors.

Attom said 7.9 percent of the San Diego County sales in the third quarter came from institutional investors, which was lower than much of the nation.

In Atlanta and Phoenix, investors are making up 19.5 percent of sales; in Charlotte, 19.3 percent; in Jacksonville, Fla., 19.1 percent; and Tucson, Ariz., 18.4 percent. Parts of the South and Midwest have some of the smallest interest from institutional investors. In Madison, Wis., investors made up 2.3 percent of sales.

Cash sales can come from buyers who get loans from family, as well as institutions that have cash reserves to make a purchase easily. Without those options, first-time homebuyers, active military and veterans could be at a disadvantage.

FHA loans (for first-time buyers) require a minimum of 3.5 percent down and VA Loans, guaranteed by the U.S. Department of Veterans Affairs, typically do not require a down payment. It can be used by veterans and active service members. The VA says roughly 90 percent of its loans are made without a down payment.

With both loan types, buyers need to get an appraisal of the property from a lender. If a bank, or whoever is issuing the loan, appraises the property at a lower price, it means a deal could fall through. That isn’t happening much these days, says Brundage. However, it could still be in the mind of sellers who would want to go with a cash sale to play it safe.

Buyers using a typical, 30-year, fixed-rate mortgage who put 20 percent down have more opportunities to make their offer attractive. In addition to less strict appraisals, they can wave contingencies — whereas FHA and VA loans need termite clearance and other inspections. Still, even large loans for luxury properties, called jumbo mortgages, are often not as appealing to sellers as cash.

Another advantage of a cash sale is you don’t need a credit check, said Mark Goldman, a real estate analyst with C2 Financial Corp. It may seem like a minor factor, he said, but sellers are given access to credit reports of potential buyers and may feel less thrilled about a transaction if they have a low score.

“Cash sales just eliminate a lot of uncertainty for the seller,” he said.

It isn’t always a guarantee that sellers will take cash. Brundage said she had an active-duty buyer, using a VA loan, get a single-family home in Escondido a few years ago over other offers because the seller wanted to support the military. Jan Ryan, a RE/MAX agent based in Ramona, said she recommends her sellers avoid cash offers because those buyers tend to be more demanding with repairs and are less enthusiastic about living there than a first-time buyer.

Goldman said a lot of institutional investors may be pulling away from the market because many have been overpaying for homes. Zillow’s homebuying program, Zillow Offers, was suspended in November as the company wrote down losses of more than a half-billion dollars on the value of its remaining homes, said The Wall Street Journal .

“They are getting their clocks cleaned a bit,” Goldman said. “A lot of those guys, like Zillow, were paying too much for properties.”

Link to UT article

Jim, do you think this house in escrow is worth it? I live up the hill and Zillow says my newer house is only $2 million with 3000sf. This one is 60 years old on same size lot and realtor said it’s going over ask

https://www.zillow.com/homedetails/208-E-Glaucus-St-Encinitas-CA-92024/16708886_zpid/?utm_campaign=iosappmessage&utm_medium=referral&utm_source=txtshare

Thanks ????

do you think this house in escrow is worth it?

My least-favorite question these days and all I can say is that it’s worth it to someone or someones!

Most likely somebody who doesn’t own a beach house yet, and has no other choice but to pay the price if they need a beach house bad enough this year. I say a beach house but it’s a bit of a trek to the sand from there.

There are plenty like that one.

We had buyers pay $640,000 for this model just two years ago. Now look:

https://www.compass.com/listing/6972-batiquitos-drive-carlsbad-ca-92011/927760146867939489/

For the E. Glaucus house in Escrow, does that now mean homes in that stretch of Encinitas (west of 5 around Hermes and Hygeia) are going to really be $1500 a square foot? I live in the area too and if that’s true – I’m ready to hire you.

Las Playas condos are now 1 Million….?!??!! And this is an interior unit?!?!

There must be money laundering involved……

Hi Bob,

Maybe, but it will depend on the other variables about your property.

For example, can Marge just hit her calculator to determine her value? $1,500/sf x 3,000sf = $4,500,000?

Yes, maybe – but it will depend more on how upgraded the home is, backyard size and usability, and view.

This recent comp got $1,600/sf using the square footage from the tax record (3,344sf):

https://www.compass.com/listing/303-hillcrest-drive-encinitas-ca-92024/840659893144012169/

I saw this one and even though it had the upside-down floor plan, it had the newer modern look and the ocean view was pretty good. The private access road was a little wonky but those can get you to the premium view spots in the area so it’s tolerated and probably not any negative impact.

On the other hand, there are recent comps nearby that closed under $1,000:

https://www.compass.com/listing/270-hillcrest-drive-encinitas-ca-92024/798584088733056145/

I think we’re at the point where the land value in your area is approaching $2,000,000 for decent-sized lots, and how much you get above that depends on your house, upgrades, and yard/view. And that the $/sf metric is not very accurate in custom-home areas.

How does that sound? Want me to come over? 🙂

So how can a 1940’s home be 1500sf — but a gorgeous new home with view is 1500sf also. I’m not following the logic on buyers? My home looks just like the 2.5 million Hillcrest but larger. I don’t see it getting over 3 mill. But comps apparently support $4.5 mill. So confused!!!!!!!!

From my previous comment:

And that the $/sf metric is not very accurate in custom-home areas.

Start with the land value being $2,000,00-ish, and then calculate for improvements. If Glaucus closes around $2,500,000, then the basic house is worth around $500,000.

Two other complications for those who are trying to make sense of the numbers:

1. The entry level for every market is especially desperate right now. On the low-end, people are paying whatever it takes to get in.

2. The frenzy is dependent upon crazier buyers coming in later and paying the same, or more.

There are going to be sellers in 2022 that will wait and see how much crazier this will get – and then list their home the moment they sense the market is stalling…..which should be around May.

but a gorgeous new home with view is 1500sf also

Let’s also note that it closed for $5,350,000, or double what Glaucus will get. The $/sf metric will never make sense again, except in tract neighborhoods.

So if I had it to do over again, 15 years ago, I should of bought 2 junker entry level homes in my area than 1 really nice home. Dammit. LOL. Thank you again for your insight.

You’re welcome.

Don’t be kicking yourself later that you didn’t sell in 2022!

I have open appointments at 10am and 2pm tomorrow. Which one would work best for you?

I want to sell it but even netting out over $3 million on a paid off home I don’t know where else to go in San Diego. If there was a new home I could buy I would do it but it seems like those don’t exist anymore. I would love to get a brand new single level 2500 square-foot home in Carlsbad or Encinitas area but there’s no developments that I know of.

If you don’t mind driving 20 minutes, you can buy this one today:

https://www.compass.com/listing/2493-san-clemente-avenue-vista-ca-92084/942181789429541257/

I want to sell it but even netting out over $3 million on a paid off home I don’t know where else to go in San Diego.

How do you feel about paying the capital-gains tax on your profit? You’ll get the first $500,000 in net profit tax-free, but after that, it’s going to cost you…..probably six figures.

Once you mentally get past that hurdle, then you will quickly figure out that you need to move a good distance away from where you are – like Vista or Fallbrook – to make it worth it.

Or leave the state! 😆

D.R. Horton is building a ton of new homes in Phoenix, AZ! Just crank up the AC during the hot months!

https://www.drhorton.com/arizona/phoenix#