The other big ibuyer has begun operations in San Diego County.

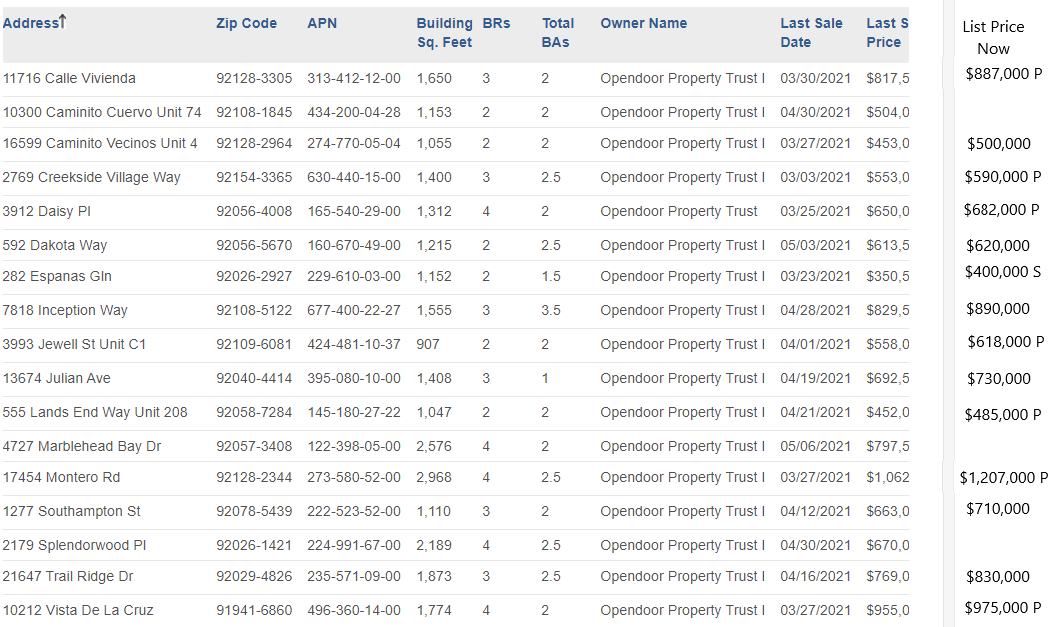

How are they doing? The P is for pending sale, and the S is their first sold:

Three of the homes aren’t on the market yet, but let’s look at 14 properties that are.

They are happy to offer you a sales price that is close to the retail book value on paper, but then when they come out to visit in person, they find stuff wrong and have to deduct a big chunk to compensate.

The Zillow fee is 8.5%, and theirs will be similar. Let’s use the same:

Cash purchases: $9,418,000. Their 8.5% repairs/commissions fee: $800,530.

Net proceeds to sellers: $8,617,470.

How does it compare to selling the old analog way? Let’s assume the sellers Got Good Help, and reap the benefit of the frenzy conditions (instead of the ibuyer) when their sales price gets bid up. Let’s apply the standard 5% over-list premium to the total of the list prices above:

$10,124,000 x 1.05 = $10,630,200. Our avg. 7% repairs/commissions fee: $744,114.

Net proceeds to sellers: $9,886,086.

Difference between selling to OD, and selling with me: $1,268,616/14 = average $90,615 more per seller.

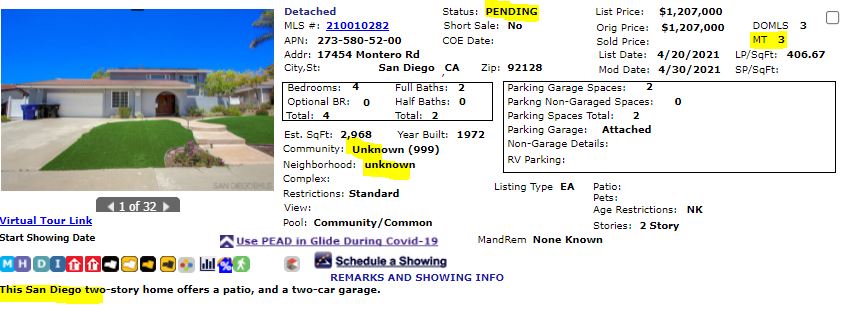

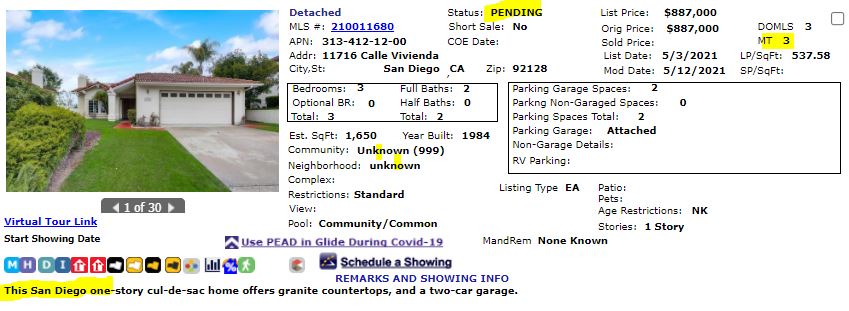

How are they selling their properties? The first few were listed with an Orange County broker, but now they have gone in-house and are listed with their Phoenix-based brokerage and agent – who got his California license less than a year ago. Hey, it’s Frenzy-2021 so they don’t have to try too hard to get properties into escrow. They offer 2% commissions with a brief description and boom – off to escrow:

The frenzy is helping to accelerate the dumbing-down of the real estate business.

There are sellers who get a postcard in the mail that offers quick cash and because the price is more than it used to be, they roll over and take it, all in the name of convenience.

Get Good Help!

0 Comments