I’ve seen two new listings mention that their close of escrow must be after April 1st!

We are within range now, so hopefully we’ll see more Prop 19 sellers putting their home on the market in the coming weeks and months. The California Association of Realtors still says that this will benefit ‘millions of seniors’ and will open up ‘tens of thousands’ of new homebuying opportunities:

-

Removes location and price restrictions on property tax transfers for homeowners who are 55+, severely disabled, or victims of wildfire or natural disaster and allows them to transfer the property tax base of their existing home to a new home anywhere in California, regardless of price (with an adjustment upward to their tax basis if the replacement property is of greater value).

-

Creates housing opportunities to build more senior housing and retirement communities for millions of seniors and Baby Boomers to retire with Prop 19’s tax benefits.

-

Generates homebuying opportunities for tens of thousands of renters, young families, and first-time homeowners.

-

Provides new revenues annually for fire protection, emergency response, local government, and school districts.

For those who like to move, you can transfer your old tax basis up to three times (though there is conflicting commentary on whether disaster and contamination victims would get three chances or continue to be allowed just one transfer).

Other nuances:

If you buy a more-expensive home, the difference between the sales prices is added to the tax basis. Example: If you sell for $800,000 and buy at $900,000, the extra $100,000 is added to the old tax basis.

You can buy the new home first, and then sell the old one.

If the sale or purchase of a primary residence takes place before April 1, 2021, and the subsequent sale or purchase takes place within two years and on or after April 1, 2021, then you may qualify. The Association is seeking clarification – check with your attorney.

The ballot measure eliminated the parent-to-child and grandparent-to-grandchild exemption in cases where the child or grandchild does not use the inherited property as their principal residence, such as using a property as a rental house or a second home. When the inherited property is used as the recipient’s principal residence but is sold for $1 million more than the property’s taxable value, an upward adjustment in assessed value would occur.

The C.A.R. is working with the state to create a streamlined process to easily transfer the old tax basis. There are rumblings about additional legislation being needed to clarify other points – stay tuned!

https://www.boe.ca.gov/prop19/#FAQs

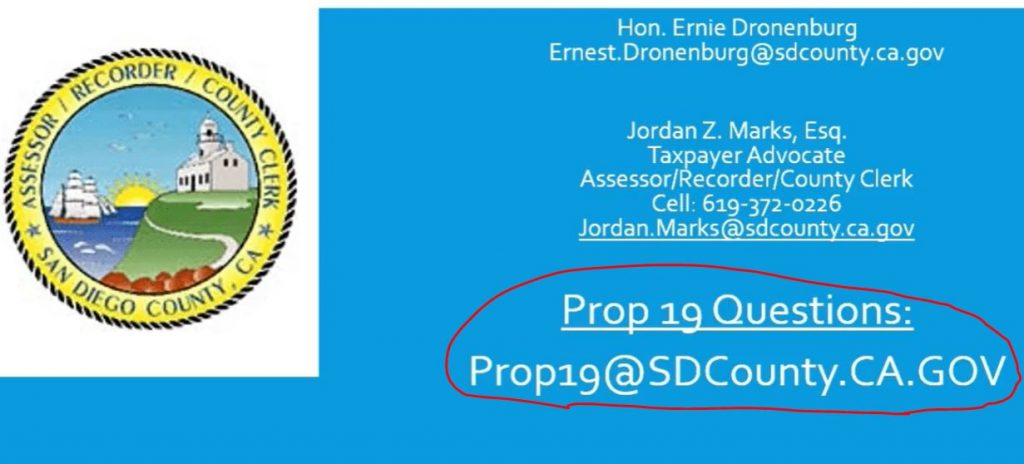

The San Diego County Taxpayer Advocate is available for questions:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

0 Comments