The key components of Prop 19:

Now, older homeowners (55+) can take their old property-tax basis with them when they buy a more expensive home anywhere in the state — up to three times. Homeowners with disabilities will be able to do the same, plus victims of wildfires and other natural disasters and hazardous waste contamination will be able to do so after their home is damaged.

The number of times that a tax assessment can be transferred increased from one to three for persons over 55 years old or with severe disabilities (disaster and contamination victims would continue to be allowed one transfer).

If they pay equal or less in price, the property-tax basis from their previous home transfers.

If they buy up in price, the difference between sales price of old home and purchase price of new home is added to the tax basis (pay full tax on the difference).

New residence must be purchased within two years of the sale of the previous residence.

The measure goes into effect on April 1, 2021.

In California, parents or grandparents could transfer primary residential properties to their children (or grandchildren if all parents are deceased) without the property’s tax assessment resetting to market value. Other types of properties, such as vacation homes and business properties, could also be transferred from parent to child or grandparent to grandchild with the first $1 million exempt from re-assessment when transferred. The ballot measure eliminates the parent-to-child and grandparent-to-grandchild exemption in cases where the child or grandchild does not use the inherited property as their principal residence, such as using a property as a rental house or a second home. When the inherited property is used as the recipient’s principal residence but is sold for $1 million more than the property’s taxable value, an upward adjustment in assessed value would occur. The ballot measure also applied these rules to certain farms. Beginning on February 16, 2023, the $1 million amount would be adjusted each year at a rate equal to the change in the California House Price Index.

https://elections.cdn.sos.ca.gov/ballot-measures/pdf/aca11.pdf

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

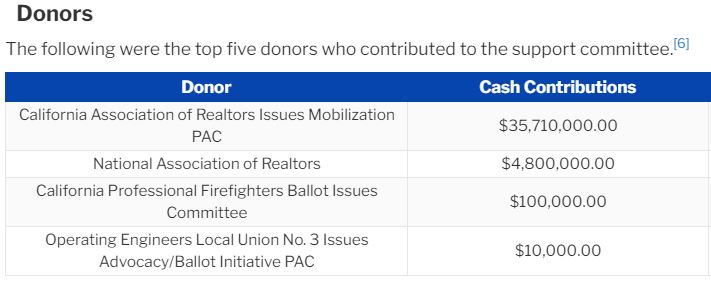

Real estate interests raised more than $39 million to support Proposition 19’s passage. Realtors are expected to benefit from increased home sales, both by older homeowners deciding to take advantage of their new tax benefits to move and heirs preferring to sell their parents’ properties rather than pay higher property taxes.

Much of the Realtor-backed campaign for Proposition 19 focused on benefits to wildfire victims and increased funding for wildfire response. But disaster-affected homeowners constitute well under 1% of those eligible for tax relief under Proposition 19, according to an analysis by the California Budget and Policy Center, which found the benefits mostly accruing to older white homeowners.

And while the measure does reserve new tax revenue for wildfire response, the state’s nonpartisan Legislative Analyst’s Office believes that the vast majority of the wildfire funding will not start flowing until 2025 at the earliest.

Should be a boom for beach communities. Lots of folks always wanted to spend retirement by beach who could afford to move up but didnt want to give up that tax basis for themselves and heirs. Expect it to be a big plus for NCC especially west of 5

Can you game the system somehow buy moving into a old long term rental that you own for a few years then moving up to a big new place and take that low property tax with you?????????