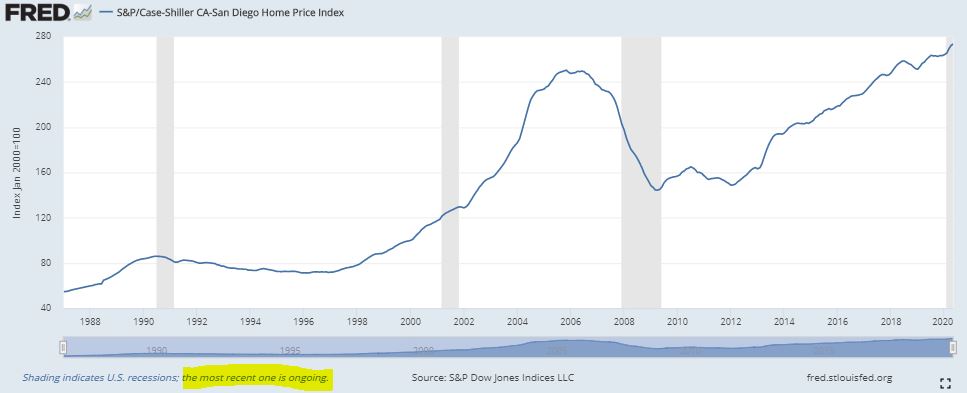

The index in May and June might ‘decelerate’, but the usual seasonal surge in our Case-Shiller Index should be delayed this year. The index is hitting all-time highs while we are in a recession, officially!

San Diego Non-Seasonally-Adjusted CSI changes:

| Observation Month | |||

| January ’19 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| June | |||

| July | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov | |||

| Dec | |||

| Jan ’20 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May |

From cnbc:

Nationally, prices rose 4.5% annually in May, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index. That is down from the 4.6% gain in April.

Home prices in the 10-city composite increased 3.1% annually, down from 3.3% in the previous month. The 20-city composite rose 3.7% year over year, down from 3.9% in April (Detroit was excluded from the composite due to data collection issues).

“More data will obviously be required in order to know whether May’s report represents a reversal of the previous path of accelerating prices or merely a slight deviation from an otherwise intact trend,” said Craig Lazzara, managing director and global head of index investment strategy at S&P Dow Jones Indices. “Even if prices continue to decelerate, that is quite different from an environment in which prices actually decline.”

Home values increased in all 19 of the cities for which data was available, but the gains accelerated in just three. Prices were accelerating in 12 cities in April and 18 cities in March.

Regionally, price gains in Phoenix, Seattle and Tampa continued to be the strongest in the nation. Phoenix posted a 9% year-over-year price increase, followed by Seattle with a 6.8% increase and Tampa with a 6% increase. Price gains were smallest in Chicago, New York and San Francisco.

Link to Article

we are in a parallel universe for sure. Did one of the Avengers forget to replace the Time Stone or something?

The virus is in control of the economy and it will be for a long time. Now that we have eviction moratoriums and monetary help going to renters, we shouldn’t be surprised if we see sub-2% rates within a year.

If that were to happen, I suspect that would *not* be a good thing.

Maybe the Padres having the best record ever for this far into the season.