More doomer talk at Wolfie’s, though he doesn’t say much other than some slight skittishness in the Case-Shiller Index equates to home prices going down – click here for 131 comments:

https://wolfstreet.com/2019/04/30/the-most-splendid-housing-bubbles-in-america-april-update/

He should consider the dearth of home sellers who would sell for any price. Other bubbles have popped by banks giving away properties, but now that foreclosures got phased out and mortgage delinquencies are at all-time lows, who is going to cause a crash?

It’s much more likely that our market will stall/plateau, with the worst-case being a gradual decline over several years/decades. I think other factors besides price will play an increasing role in the decision-making too, where well-located newer one-story homes continue to be very popular.

It will fracture the market further, where dumpy old two-story tract houses will need flippers to revive them while trendy new homes sell for a premium. Newer condos closer to work are more desirable to many buyers than the older SFRs way out in the burbs.

Market statistics will become less reliable than ever.

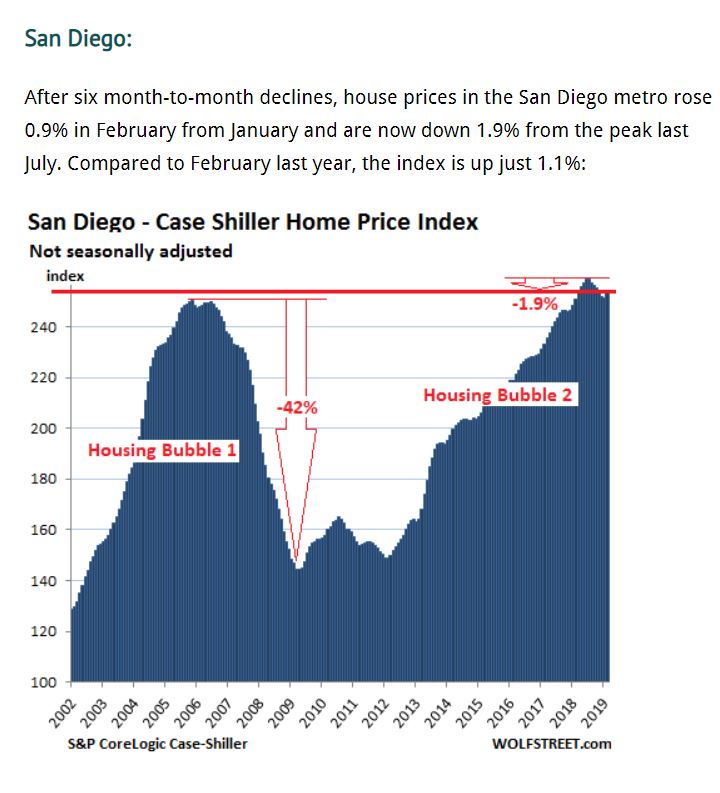

Interesting to note that of all the metro areas he features in his article, San Diego had the lowest increase over the previous peak. Others like Dallas and Denver are 50% above their previous peak!

If the Fed and banks were playing by the same rules that existed before 2008/2009, then I would agree that the housing market was in trouble. But, that’s not the case today. The rules have been permanently changed and the great majority of mortgages are owned by the Fed (Fannie Mae, etc.)

It’s very, very rare to see “foreclosure” signs anywhere and banks have to offer loan mods, etc. before even reaching foreclosure status.

Meanwhile rents will continue to go up exponentially!