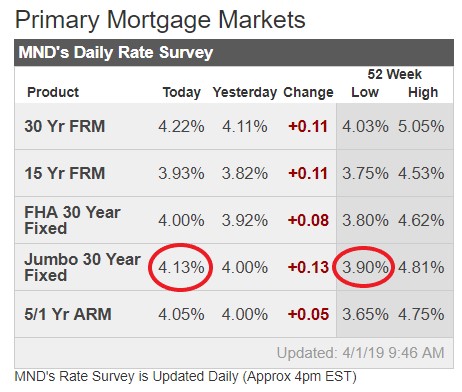

Add at least 1% to the cost if you want a rate in the high-3s:

Mortgage rates spiked quickly today, capping a 3-day run leading back up from the lowest levels in more than a year. Today’s move was by far the biggest and it leaves the average lender offering rates that are at least an eighth of a percentage point (0.125%) higher compared to most of last week.

Part of the reason for the size of this move is the size of the move in the other direction over the past two weeks. For instance, compared to 2-3 weeks ago, the average lender is quoting rates that are still an eighth of a point lower. In other words, the bigger the rally, the bigger the potential bounce.

Whether or not this bounce continues may have a lot to do with the week’s remaining economic data and events. Today’s data was almost universally stronger than expected and stronger data tends to coincide with higher rates. There are important economic reports on 3 of the 4 remaining days of the week with Friday’s jobs report being the biggest consistent market mover of any economic report.

Loan Originator Perspective:

Bond markets pulled back sharply today, as last week’s gains all but vanished. Stronger than predicted retail sales and manufacturing data prompted the selloff. The trend is now our enemy, time to lock those closing within 45 days.

Link to Article

0 Comments