The San Diego Case-Shiller Index for April showed a higher reading, as expected. The February/March/April period was the hottest of the year, and hopefully the index will start moderating in the coming months.

San Diego Case-Shiller Index, Seasoanlly-Adjusted

| Month | CSI-SD |

| Apr ’12 | 152.74 |

| Mar ’13 | 170.38 |

| Apr ’13 | 175.15 |

M-O-M = +2.8%

Y-O-Y = +14.7%

Blitzer is auditioning for Yunnie’s NAR-cheerleader job:

This latest report only tracks prices on a three-month moving average through the end of April, well before mortgage rates began their climb. Still Blitzer contends rising rates will not slow price gains.

“Home buyers have survived rising mortgage rates in the past, often by shifting from fixed rate to adjustable rate loans. In the housing boom, bust and recovery, banks’ credit quality standards were more important than the level of mortgage rates. The most recent Fed Senior Loan Officer Opinion Survey shows that some banks are easing credit restrictions. Given this, the recovery should continue,” he said in the report.

The more realistic view that applies to bubble areas:

“Today’s Case-Shiller numbers may reflect where the housing market has been in some of the frothier metros, but they are not indicative of where it’s headed. The housing market worm has turned over the past few weeks – inventory levels are beginning to show signs of easing, and mortgage interest rates are creeping up. Going forward, both of these factors will help mitigate extreme price spikes caused by very strong housing demand and very low housing supply,” said Zillow Chief Economist Dr. Stan Humphries.

“Runaway appreciation in many of the large, coastal metros that form the backbone of the Case-Shiller indices will begin to moderate. Home value appreciation in some of these areas will have to slow down, or potentially fall, as higher bottom-line prices are no longer masked by rock-bottom mortgage rates. In general, the national housing recovery is strong and sustainable, but pockets of volatility will emerge as local fundamentals shift. Buyers expecting home values to continue rising at this pace indefinitely may be in for a shock.”

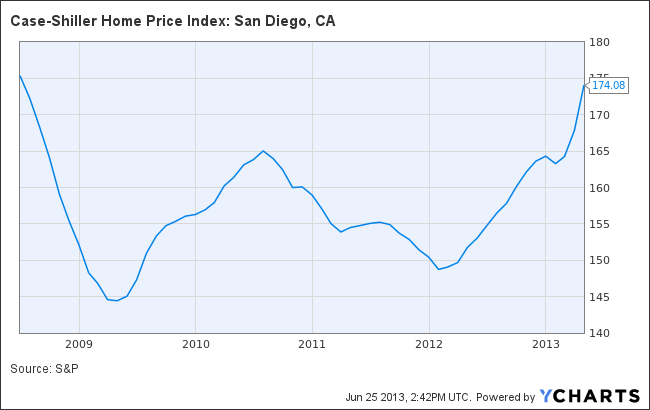

Non-Seasonally Adjusted:

Case-Shiller Home Price Index: San Diego, CA data by YCharts

Shiller says, “prices likely to go up for the next year”:

0 Comments