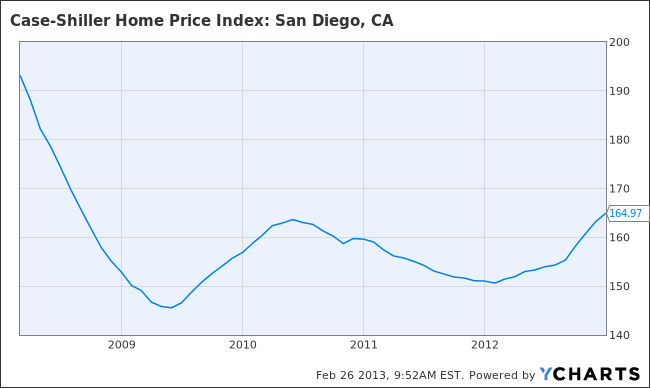

The San Diego Case-Shiller Index rose 9.2% year-over-year.

While a 9.2% increase in home prices would have been shocking a year ago, we have come to expect it today.

The month-over-month increase was 1.07%, which should be about what we see for the rest of 2013. If the Case-Shiller Index didn’t exclude flips owned less than six months, the number would be even higher.

Today’s SA reading is 14.2% higher than the trough reached in April, 2009.

Case-Shiller Home Price Index: San Diego, CA data by YCharts

Both the seasonally-adjusted, and non-seasonally-adjusted numbers rose by the same percentage, which has happened the last few months.

This guy needs to get out of his Barcalounger:

WSJ: Did we finally hit a floor in home prices last year?

Mr. Shiller: The trend in home prices seems to be up now. It has been going up. That’s upward momentum, which by my general rule of forecasting has been good for the future. I’ve been tentative about that. It may well be the turning point.

But I’m not sure about that. I’m more worried than most people that it could be a short-lived turnaround. It could be like the 2009-10 upturn where we saw home prices rising right after President Obama took office and right after the home-buyer tax credit was instituted. In that upturn there were some cities that did quite spectacularly. And then that fizzled. I’m not too sure that this one will extrapolate either.

WSJ: Why are you more worried than most people?

Mr. Shiller: Part of the reason the indexes have gone up is because the foreclosure boom has receded. Foreclosed homes sell at a lower price, and the share of those sales has been falling. People might be deceived by this by looking at the indexes. The question is whether the gains will be sustained.

There isn’t any sign of the real enthusiasm we saw during the last bubble. The question is whether this could be the very vague beginning of a new boom? I guess it could. I just don’t know. Then there are issues with what the government does to support housing. They’re doing everything they can. They say they’re going to stop some day. When will people start worrying about that?

WSJ: There are some people who look at the double-digit annual price increases in Phoenix and elsewhere and wonder whether we’re seeing new “mini-bubbles.” Is that a concern you share?

Mr. Shiller: Home prices are back down to a reasonable level. Why should they go up a lot? It means you have to have a succession of eager buyers that would bid them up. Historically major bubbles tend to occur at widely separate intervals. Once it bursts, usually, historically, people are fed up for a long time.

WSJ: What’s your outlook for home prices?

Mr. Shiller: It’s especially hard to say. We could be looking at a 1-2% increase a year for the next five years. That’s a reasonable scenario—1-2% a year, and it might go up more than that. I don’t know. My main message is that it’s a market with risk in it. We don’t know the future. That’s the most important message to convey.

dude is out of touch with reality.

“I don’t know. My main message is that it’s a market with risk in it. We don’t know the future. That’s the most important message to convey.”

I’ve bought and sold 12 homes since 1987 in up, down and flat markets and the one thing they all had in common was that they were all sphincter-pucker-inducing experiences because “we don’t know the future”.