With mortgage rates bouncing back into the mid-4s (with no points), JBREC published this article on the effect of higher rates on home sales:

Mortgage rates have risen 1.0% or more ten times in the last 43 years, with little impact on home sales and prices when the economy was also strong. Here is the paper we shared with our clients a few years ago. Historically, rising confidence, solid job growth, and higher wages have more than offset reduced demand for housing resulting from higher mortgage rates. When rates rise during a weak economy, home sales and prices get crushed.

Today’s economic backdrop clearly supports continued home buying demand. Confidence among consumers and businesses continues to hit multiyear highs. Job and wage growth remains solid, with an increasing number of workers rejoining the workforce.

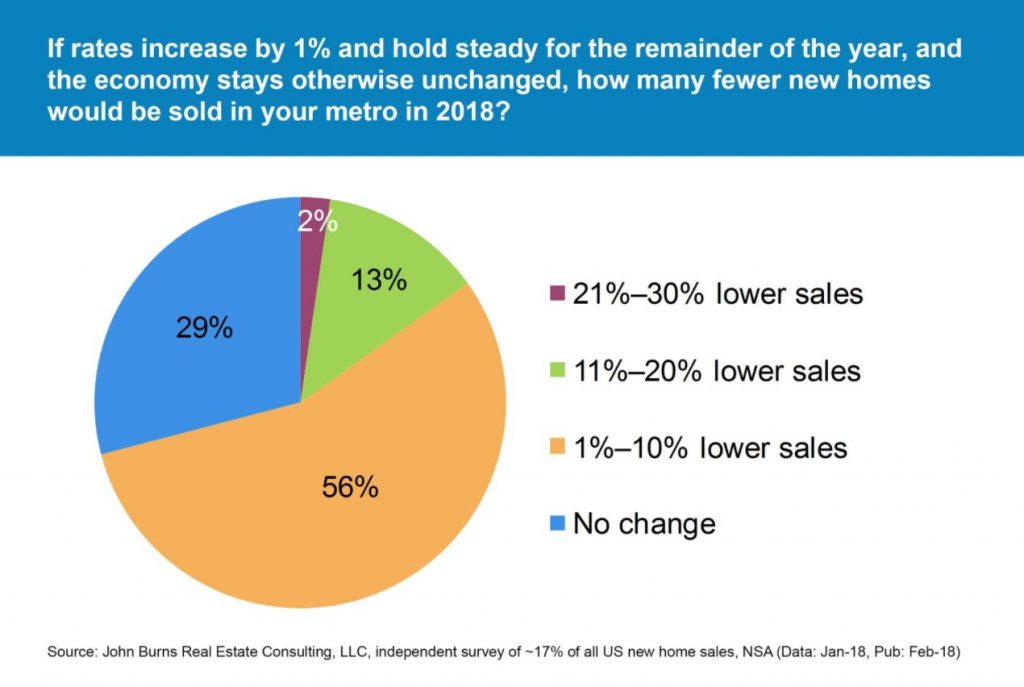

Home builders agree. In our survey of 300+ home builders this month, 85% said sales would decline less than 10% if rates were to rise all the way to 5.0%. Twenty-nine percent (generally luxury and active adult builders whose buyers are quite affluent) don’t believe sales will fall at all.

Builder stocks typically overreact very strongly to rising and falling rates, so don’t follow builder stock prices to assume what will happen to new home sales and pricing.

For perspective, mortgages rates have increased from 3.78% in September 2017 to 4.32% today, equating to a 6.7% increase in one’s mortgage payment.

Rates rose even more last spring, jumping from 3.41% in July 2016 to 4.30% in March 2017 (11.5% spike in mortgage payment). Despite rising rates, housing had its best spring since 2013 last year, with a strengthening economic backdrop more than offsetting reduced demand from higher rates. All signals point to a similar scenario for builders as we kickoff spring 2018, with rising rates unlikely to ruin housing’s recovery.

Link to article