When you look at our local incomes/wages and other traditional metrics, it is hard to make sense of how the market keeps going. But it has!

How does that happen?

There are three sources of buyers that don’t rely on a regular job to buy.

We see younger buyers being funded by the Bank of Mom and Dad to generate larger down payments, or to pay cash outright, and many are inheriting big bucks when an elder’s estate – probably full of rental properties – is liquidated.

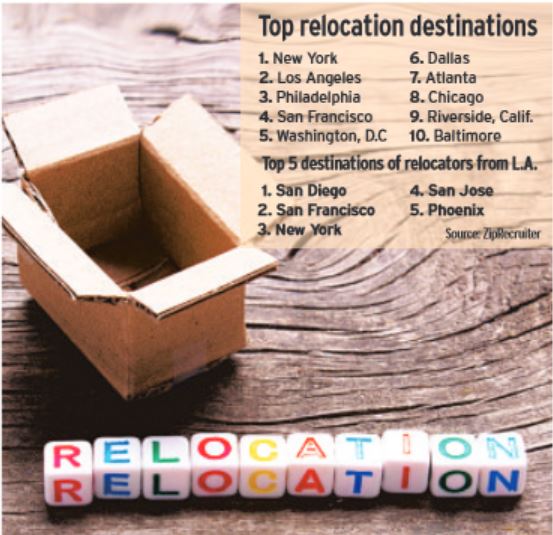

But another segment that is fueling our demand are the buyers from more expensive areas – places that make the San Diego metro area look cheap. Buyers from the LA/OC and those from the Bay Area come here and think we are giving them away!

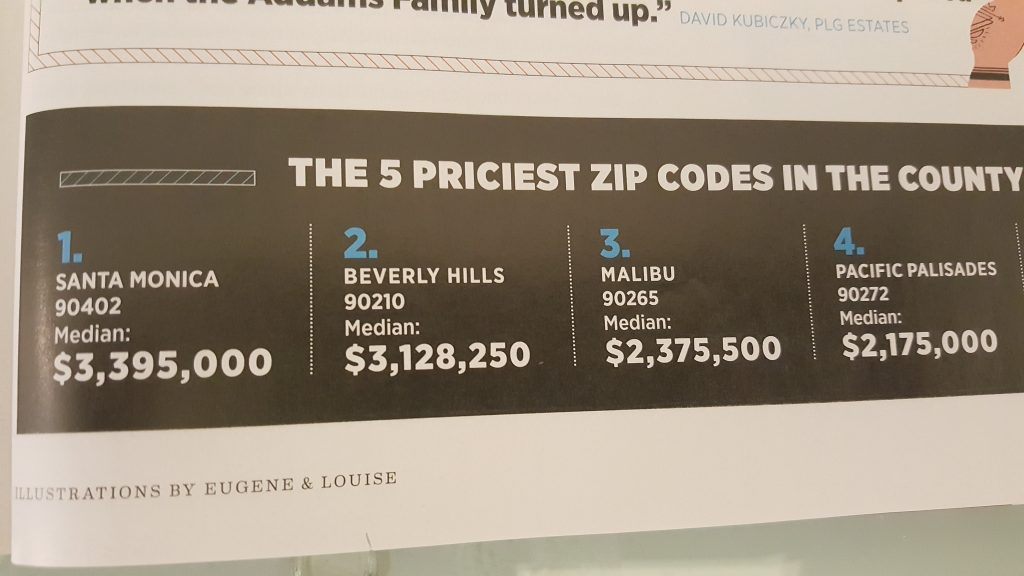

Look at these median sale prices from Los Angeles Magazine – and when I checked these for the last 90 days, they are even higher now:

Our market is connected to others nearby, and as long as we all keep moving together, the sorting of the haves and have-nots will continue.

I used to look at Manhattan Beach prices on the old MB Confidential blog during the bubble. Those prices were crazy.

Now Encinitas has those same prices.

I would rather live in Encinitas…especially bang for the buck.. compared to LA and look at the prices now in MB. San Diego on the coast still is a bargain but not for long compared to OC and LA. If you are sitting on the fence and you can get in under 1 mil with a view you had better jump.

What’s the 3rd source of buyers? The Chinese?

Reminds me of my grandpa when I was a kid. I’d complain about some kind of unfairness my little brain had somehow detected, and my grandpa would say, “Stop talking. Look at me. You paying attention? Now listen… nobody cares.” He didn’t say that about everything. Just some things.

Political policy that foments population growth in a country that is no longer a frontier means… home prices and rentals are going up, and that’s just how the exponential cookie crumbles. Our current immigrant quota, along with our undocumented folks, probably gives us a yearly increase of 1.5-2 million a year. Those immigrants have kids. Later, they also import grandma and grandma, and aunt mumu. Families need to stay together. That’s the size of 4 new cities, every year-plus the kids on the way.

Applied globalist theory in a welfare state is unsustainable. This may make people feel bad, but… math doesn’t care. If math doesn’t care, complaining won’t help.

Stewing won’t mitigate the problem. Yelling at the TV when Tucker Carlson is interviewing a liberal democrat is a fool’s errand. Discovering a Trump lie, and Facebooking your discontent may get you a thousand “likes,” but your rent is still going up. That house you had an eye on in that neighborhood you like? Price went up 12K this month. Just like last month, and the month before.

Population is increasing in prime areas in California, new construction can’t keep up, people need a place to put their stuff, it ain’t stopping anytime soon, because… nobody cares.

Just like in that movie, “titanic,” when the crow’s nest guy yelled, “iceberg! right ahead,” and then everyone kind of stood around on the deck, bummed out as the massive ship slowly approached the ‘berg. The crow’s nest guy was was just speaking shorthand for “a lot of math is about to take place.”

Some people used the ice that broke off onto the deck, for their drinks. Some kicked the ice around like it was a game. Some complained to the ship hands that their wives were slipping on the ice. Some noticed the ship listing. The smartest of those were the men, who ran down to their cabin, put on their wife’s wig, and demanded to be referred to as “Thelma.”

Buy a house now in those nice areas if you can. If you have the means, or the cleverness, acquire rental properties, storage facilities, and warehouse properties.

Be like “Thelma.”

Then: “Nobody goes there anymore. Too crowded.”

Now: “Nobody buys there anymore. Too many bidders.”

What’s the 3rd source of buyers?

1. Bank of Mom and Dad

2. Inheritances

3. Out-of-towners coming from more affluent areas.

4. Foreigners in general.

Not in that order, just the four categories of buyers who can afford to keep paying these prices.

New Zealand has just now forbidden foreign home purchases. I suspect that will show up in SD as increased Asian interest.

“Not in that order, just the four categories of buyers who can afford to keep paying these prices.”

How ’bout another category, “bought 10K shares of Facebook at 18 a share.” or, “bought 2K shares of Apple at 80, rode it up to 1100 a share, then the stocks split and dividends were increased, my life rocks, how ’bout yours?”

File under the category, “there’s a party going on, and most of you aren’t invited.”

Daytrip: thank you for one of the best posts I have read on the “bubble”. Your dark humor rings true, although I understand why some immigrant’s would want a better life.When prices hit the top the issue will be either pullback or just remain the same for a while until inflation catch’s up.

But I think on the bottom end you are not gonna that much if any of the correction that the upper end will see.

The best buy out there is a SFR in Encinitas, Carlsbad, or Cardiff under 1 Mil….Look what has happened to South Park…and the prices.

2020 they say are population is going to 40 MIl..at what point is Sacramento gonna admit enough is enough..

Another category:

https://www.cnbc.com/2017/10/17/this-family-bet-it-all-on-bitcoin.html

Reminds me of the idiom “Never put all your eggs in one basket.” Living in the Netherlands, at least they’ll have lots of government safety nets to support them if daddy’s bitcoin gamble doesn’t pay off.

As I mentioned before, Goldman Sachs said they’re going to try to throw in behind bitcoin, and they don’t like to lose. I’d imagine it would be part of their strategy to contend with Russia, India, China, Iran, and some others creating their own enclosed monetary system to bypass the “petrodollar” which will essentially be “online” by the beginning of next year.

This will undermine the World Bank, the IMF, and our sanctioning power. In fact, they could sanction US! Meanwhile, China is lassoing in Africa, paying chump change for massive land leases to the local tribal dimwits, so China won’t run out of primary resources anytime soon–but we might.

A massive historic monetary power shift is coming up, and most americans are completely unaware of it, much less understand the ramifications. It’s a big deal.

2018 is gonna rock, like we haven’t seen in a while. Tomfrickery galore. A big bitcoin bet isn’t so crazy.

daytrip: how do you feel this massive monetary power shift wiill effect hard assets such as southern cali real estate in your opinion.

Franklin, I think hard assets is the place to be. It’s your hedge against hell’s reign.

Jim, you know me fairly well at this point. We do not fall in any of those categories; are we the outliers? I am aware that a number of my friends — I live in coastal North County — are relying on inheritances in lieu of savings (I’m counting 3/10 of my friends)… but I didn’t think that was the norm. Is it?

but I didn’t think that was the norm. Is it?

I don’t know what the exact percentage would be, but a WAG would be 25% to 50% of sales. But no matter what it is, you don’t know which of the comps were bought with this easy money, which really makes their sale prices unreliable. Which half? What if half the data is questionable…….and the other half is relying on it being correct?

It used to be that the cash buys were made by the most savvy buyers – that’s how they got so much cash, by being smart on price! But today you see some of the craziest-high prices being paid by cash buyers – way over value. The money came too easy.