Solar power is a great idea, but do you buy or lease the system?

If you purchase your solar panels, then when you go to sell the house, it should provide some extra value to the buyer. Exactly how much is tough to estimate, but it wouldn’t be more than 50 cents on the dollar – it is a feel-good feature.

If you lease your system, there are pitfalls when selling:

- The buyers have to assume the lease. I don’t think the actual assuming of the lease is that big of a deal. Buyers already have their financials handy to get their loan, and mortgage underwriters are tougher than solar-lease underwriters. It is the additional hassle that can irk a buyer.

- The seller and listing agent have to initiate the lease-assumption process. The solar-lease company won’t talk to the buyers until the lease application has been submitted, which means the seller and listing agent need to request it. The leasing company has 10 days to respond, but the listing agent expects the buyer to release all contingencies within 17 days – which is only going to happen if the listing agent knows to request the lease application promptly.

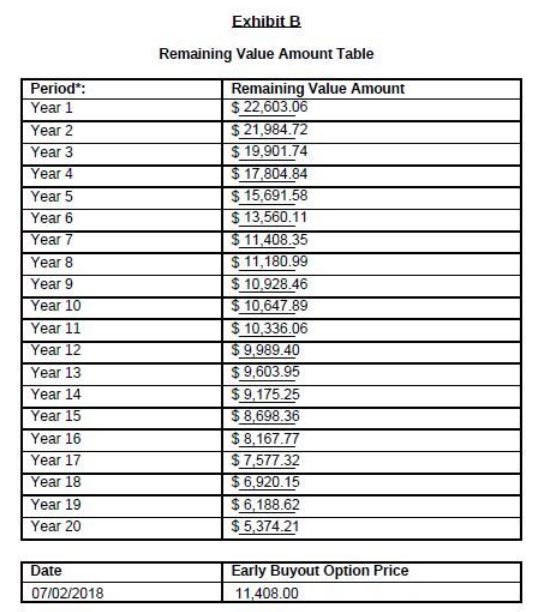

- There is a buyout. This is where the fun begins. On one hand, the buyer gets the benefit so the seller expects you to take the full package as-is. But the lease goes for 20 years, and the lease payments total around $34,000. Plus, there is a buyout on top of that? Buyers don’t expect that additional buyout cost, and would like some negotiation.

Here is a typical buyout schedule:

4. The solar-lease company records a UCC-filing against the property, which prevents the seller from selling or refinancing without permission from the solar-lease company.

Do sellers fully understand what they are signing when they lease solar panels? Probably not, and if they try to sell their house over the next 20 years, they will get a not-so-friendly reminder.

Below is a link to a general discussion about solar panels:

I purchased my solar system, which meant that I received the federal tax credit. There is about a 7 year payback on the upfront cost (net of the tax credit). That equates to about a 14% return. If you can afford to purchase, that is the way to go.