Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

My money sense is tingling on this one.

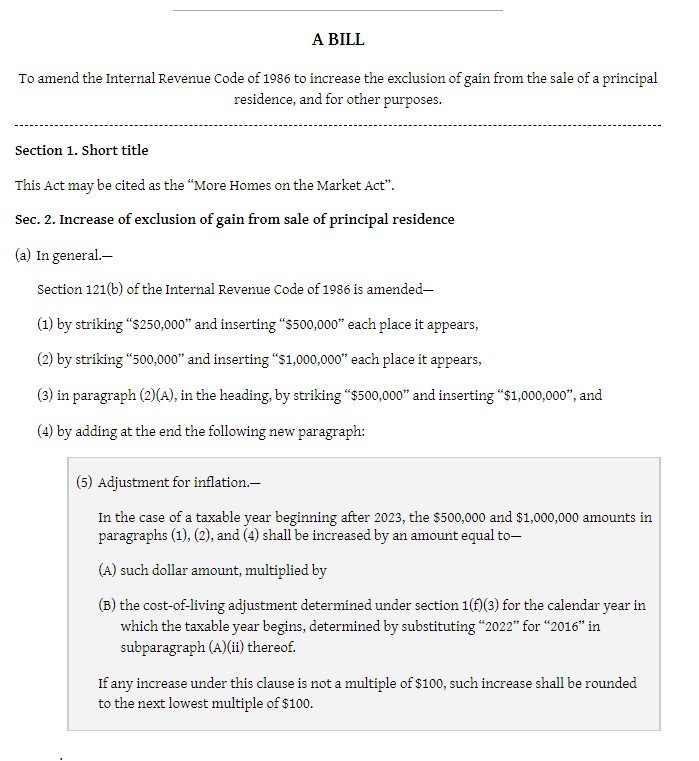

The upside is that changing capitol gains from 500k to 1000000k is that initially youd get more sales.

The downside is that people would quickly start flipping properties + everything would end up being around $1000000 as the starting price.

Personally I think the 500k limit is stupid. It encourages people to live in a situation where their house is always under 500k in equity + moving up the ladder. It’s a disincentive to actually own something when you cant sell it + realize the full amout of profit if over 500k in equity.

Shadash, do you have any actual evidence this would result in increased sales? Prop 19 was supposed to do that, but I have yet to see any evidence it did. Like Prop 19, this is another specialty tax cut for upper incomes greenwashed as some socially progressive initiative (and I say that as a CA homeowner and upper income person). Even a 2nd generation Democrat politician understands the vote-getting potential of tax cuts. I call male bovine excrement.

It can be a matter of basic fairness. Imagine a scenario where a man ditches his wife to marry a much younger woman he meets overseas. They marry, return to America, buy a house and sell it 3 years later, making a profit and receiving a capital gains exclusion as a married couple for half a million. Meanwhile the ex- wife years later who has been living in a house she now owns alone after the divorce with a special needs adult child from the failed marriage goes to sell after six years ,and can only realize a $250,000 tax exemption, though because of the divorce her entire financial situation ( and the child’s especially) is much more precarious than her ex’s or his new younger wife’s .

Yes but if her ex-husband mysteriously dies and then she sells the house within two years, she would get the full $500,000 exemption :).

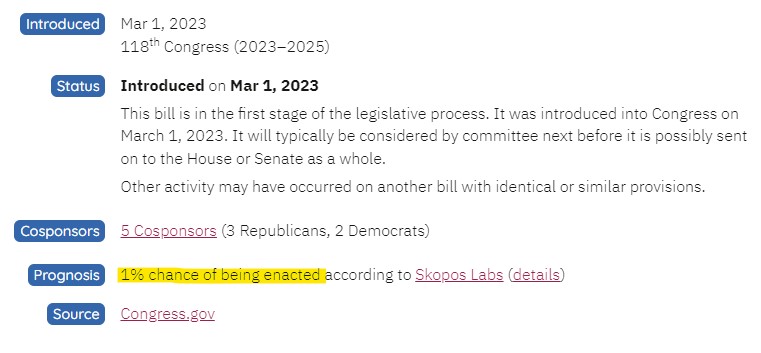

I am 63 years old lower middle class, not “upper income.” Single, divorced. Raised by single mom in not so great neighborhood in San Diego. Put my self through college. Did without a lot of things to have and keep my house, maintain and improve it. LARGE ADU, and two Jr. ADU’S now built next door. Lost privacy, quiet enjoyment of my property, the ability to park and harassment by the tenants who block my driveway, trespass, etc. I cannot move because the capital gains tax will prevent me from purchasing what I have somewhere else in San Diego. Everyday I look to see if there has been any progress of HR 1321