Mike has now teamed up with another guy and both are believing that when (if) mortgage rates come down, it will spur more demand and sales. They are basing this belief on historical trends:

https://home-economics.us/if-mortgage-rates-fall-what-will-happen-to-inventory/

But we haven’t had these market conditions before!

Variables that make a difference:

- Excess inventory is already upon us, and more sellers will be pouring onto the market in early 2026. There will be many more sellers than buyers.

- Buyers are enjoying their new-found negotiating power, and are digging how even nice homes are still for sale a week or two or three later.

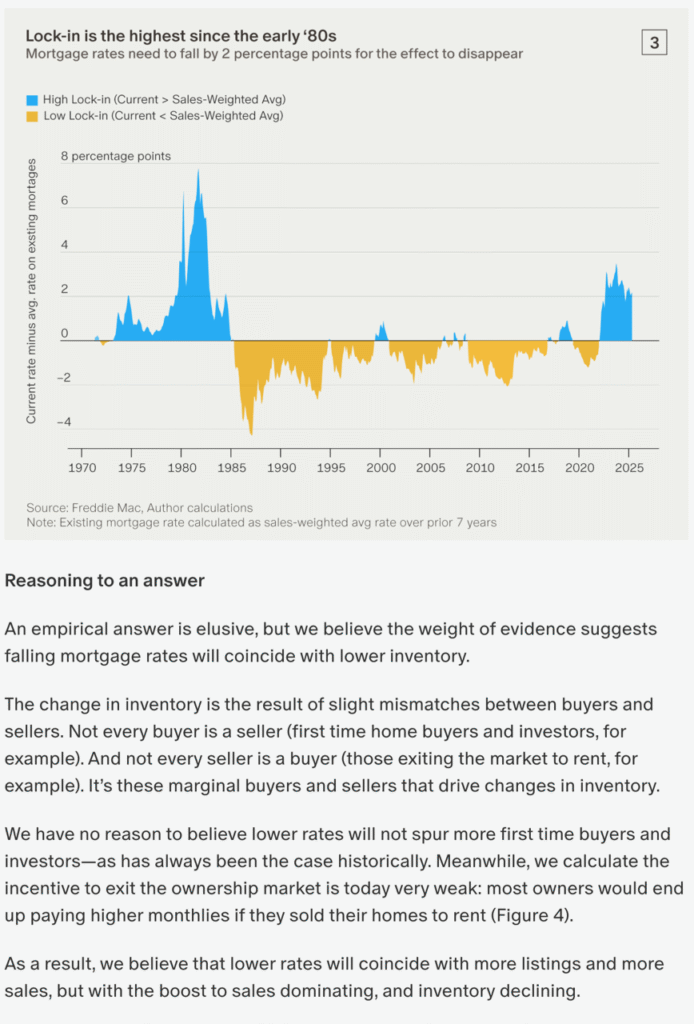

- The lock-in effect is a myth and will have little or no bearing on the outcome.

The authors think that the active inventory will decrease because buyers will be gobbling up everything just because rates are lower. But if rates don’t go down much….or if sellers flood the market early…..or if buyers adopt a wait-and-see attitude….then the 2026 Spring Selling Season could be a dud. Again.

Lower rates might generate some additional sales but it wont change the fact that valuations are flat. Meaning yes buyers can buy more but the “value” of the house wont be going up creating equity.

What would spin the market upside down is if capital gains taxes were dropped. This would allow old timers to get out quick and these are the ones with the most equity who can price at whatever they want for fast sales.