The market has changed significantly and buyers have gained considerable negotiating power. Those who take advantage of it will likely earn a decent discount for the remainder of 2025.

But how much discount?

And where is it going over the next few years?

Surely, we can count on these guys:

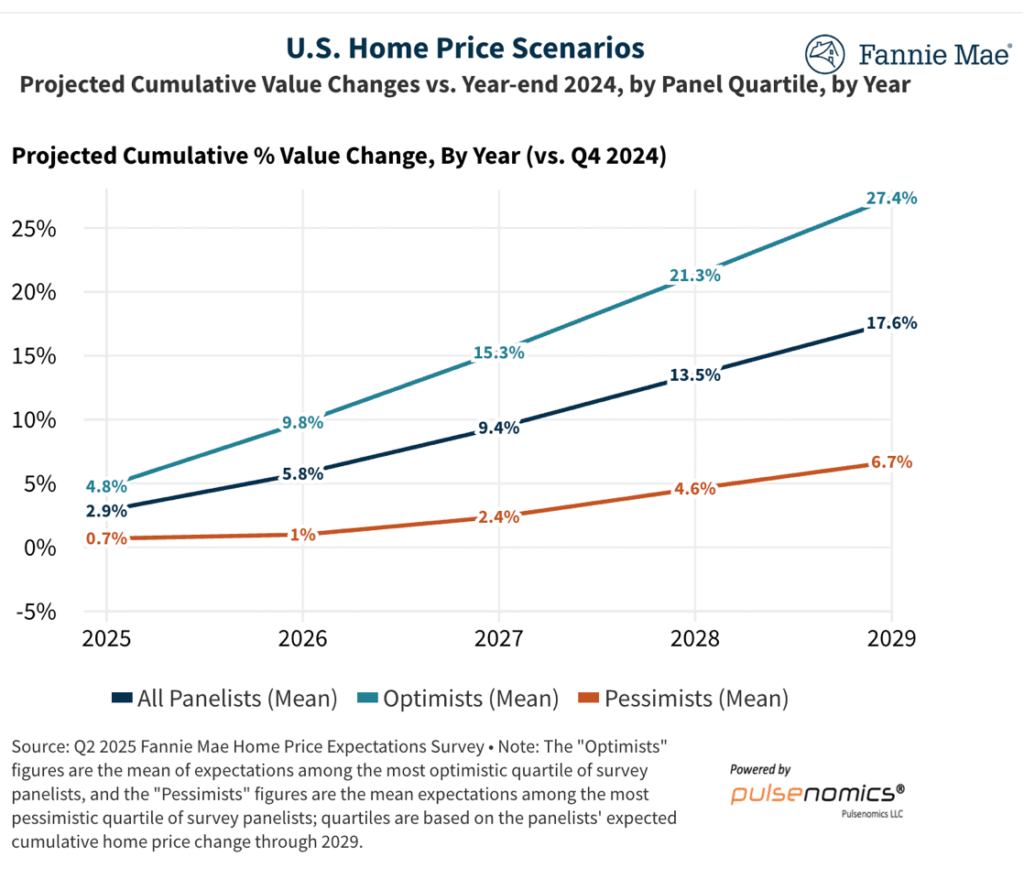

Fannie Mae’s Home Price Expectations Survey (HPES), produced in partnership with Pulsenomics, LLC, polls over 100 housing experts across the industry and academia for forecasts of national home price percentage changes in each of the coming five calendar years, with the Fannie Mae Home Price Index as the benchmark.

https://www.fanniemae.com/data-and-insights/surveys-indices/home-price-expectations-survey-hpes

Let’s be conservative and adopt the view of the pessimists, which means their 0.7% this year is virtually flat. Let’s call their 1% for 2026 flat too, so for the next 18 months there won’t be any measurable price change, according to the experts.

Is that a reasonable conclusion?

Bill thinks that 2025 will be flat too.

My hypothesis is that the selling season has been reduced to January and February. For pricing to be flat for the year, it means January and February, or at least the first quarter of each year will carry the burden of propping up the pricing for the rest of the year.

Hopefully, we won’t have a Liberation Day every April that sucks the life out of the market. We may even enjoy lower mortgage rates that have the potential to create mini-frenzy conditions – wouldn’t that be something!

But for this discussion, let’s assume the usual chaos over the next three years will keep things relatively the same as they have been recently. Because it’s the high prices that are keeping a throttle on our local market, and there would need to be a monumental change in pricing for sales to pick up.

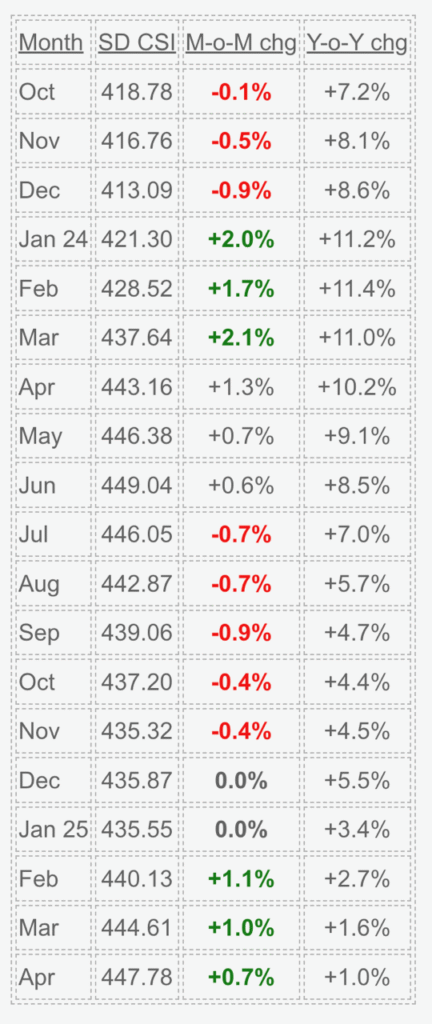

This is where the San Diego metro has been, and the NSDCC has done better:

San Diego Case-Shiller Index

In the last half of 2024, the Case-Shiller Index declined 3.1% – and that’s including a flat December. I think that the rest of 2025 will be at least that bad.

It probably means that our pricing will decline by 5% between now and 2026.

It’s not a big deal, and you will hardly notice it.

All you see now is a lot of homes not selling. It would take a huge drop – like 10% or so – for it to be obvious. Most buyers and sellers are ready to check out for the rest of the year, and they will all come back hungry in January. I’ll say it is very possible that values will rise again by that same 5% in the first quarter of 2026 – especially if rates are under 6%.

I heard the story yesterday of one of the losers from my bidding war on Clemens where we sold the home for 20% over the list price. The next home these buyers saw with a big view, they made an offer that was +10% over list and demanded an answer within 24 hours. The sellers took it.

Crazy will still be in the air (1/4 of the NSDCC sales last month closed over their list price), and sales of the creampuffs will help buoy the general pricing statistics.

Fixers, dated, unusual, bring your imagination,.. until we start seeing unpolished properties prices will keep rising. I’m going to start using that phrase; “unpolished properties.” I’m sure many here recognize the phrase “polishing a …”

Thing is before we see price declines there needs to be a crushing of the flipper industry. They will take away all these opportunities before retail customers see them. Hopefully the switch to agency listings will cut out the flippers but…

Don’t get me started on how many flippers are out there. I get 3-5 solicitations EVERY day.

My rental properties are Zillguess priced so low I get unsolicited inquiries almost daily. My only solace is that these bottom feeders have paid for our numbers.