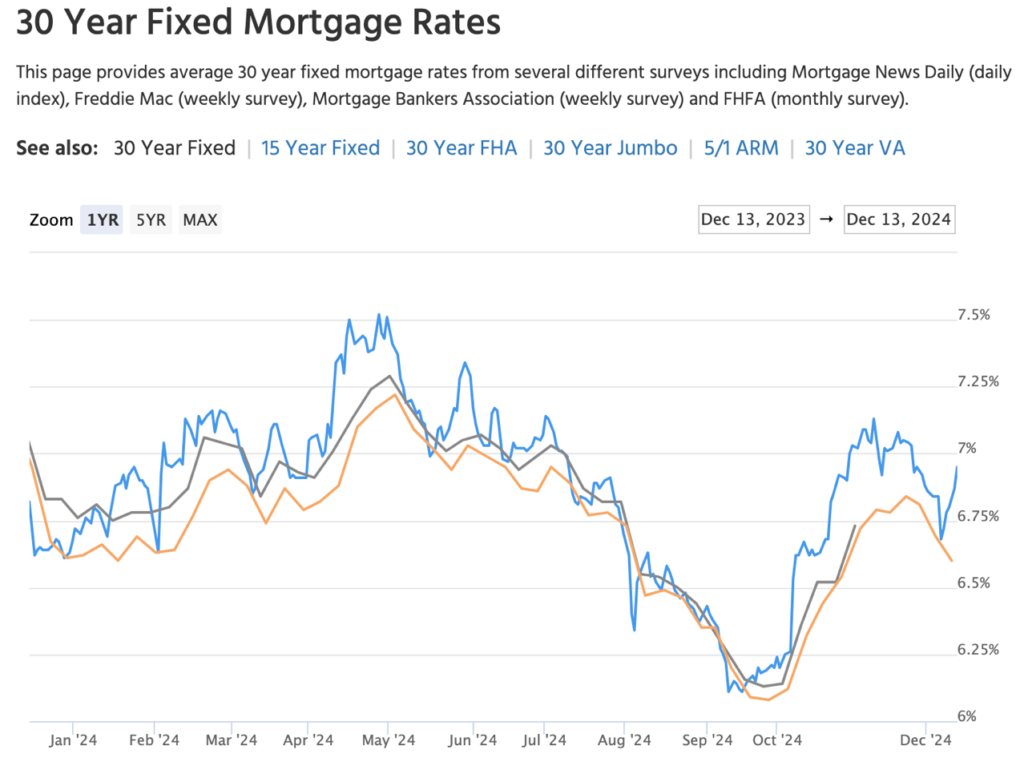

John is talking about builders here but I couldn’t pass up his mention of last January and February being sensational, and then fizzling out. If rates start climbing again (and it was a bad week – see above), we could have a surge of new listings colliding with rising rates that together really scare off the buyers.

First, a look back

- After more than a few rough spots in 2023, January and February of this year were nothing short of sensational. But that soon fizzled as mortgage rates regained their unwelcome upward momentum and sapped much of the wind out of the sails of the spring selling season. As Dillan said, “Once we got into those core spring selling season months—March, April, May—rates went up to 7%–7.5%,” and momentum slowed.

- Part of this is the return of normal seasonality to the housing market. Cara highlighted this: “Seasonality has returned, and people have to accept that.” She noted that builders are learning to navigate a market where traditional patterns are re-emerging post-Covid, offering some stability amid uncertainty.

- But that beginning-of-the-year head fake has possibly colored how we view the year. The housing market took every punch high rates had to offer yet was still standing by year’s end. That many see 2024 as a disappointment, then, seems unfair. Maybe LeBron cooled off after a monster first quarter, but he still wound up with a solid 25 points. (That’s two sports analogies in one bullet. Nice.)

Some things change, some things don’t

- Though the Sunbelt and more affordable markets remain the growth loci, high-flying states like Florida and Texas have seen setbacks. Rising listings and new home inventory have softened sales in many markets in those states, even while other parts of the Southeast continue to thrive.

- One thing that has not changed is the continuing dominance of larger builders. Jody called the growing market share of public builders—nearly half of all new home sales— “mind-boggling” (obviously, she hasn’t seen Blades of Glory). Access to capital and land, the ability to negotiate national contracts, and integrated information systems give bigger builders an edge.

- Smaller private builders, though, are still in the game. They can carve out a niche with their local knowledge, long-term relationships, nimbleness in going after land, and sometimes partnering with bigger players. As Jody explained, “Private builders are often very well-connected locally.…They dominate specialty sites, like close-in transit-oriented locations, that public builders shy away from.”

- If it is changing at all, affordability is another item that is trending for the worse. Home sales to first-time buyers are at record lows while rising prices and still-high mortgage rates don’t offer much hope for improvement. Affordability is something we are all keeping an eye on.

Not sure if you noticed, but we had an election

- While there are some potential pluses with a new administration, like regulatory relief that could lower building costs or a friendlier development environment, uncertainties are looming over 2025. A couple of those stand out:

- Threatened tariffs against Mexico, Canada, and China have the potential to reinflame inflation. High inflation means higher rates, which worsens affordability and makes builder buydowns more expensive—and more necessary.

- Immigration restrictions would likely exacerbate labor shortages and raise labor costs. They could also deplete demand, particularly if there are restrictions on the H1B visas that many high-earning tech sector workers rely upon.

- Though builders face these uncertainties, they have proven adept at figuring out ways to find buyers. With buydowns, more speculatively built homes to maintain absorption levels, and tapping into resale broker networks, builders have found ways to succeed. Success breeds optimism, and most builders forecast sustained growth for 2025.

The full podcast here:

0 Comments