Zillow, Goldman Sachs, and every economist thought the 2023 market would be all negative.

But now….

Goldman Sachs originally forecasted home prices to fall by double digits. However, they have released a report titled – “As interest rates climb, the global housing market is surprisingly stable”. In it, they stated: “House prices [are] leveling out more quickly and at a higher level than would normally be expected given the rapid rise in mortgage rates. Home prices are defying expectations and RISING in major economies such as the U.S., Australia and Canada.”

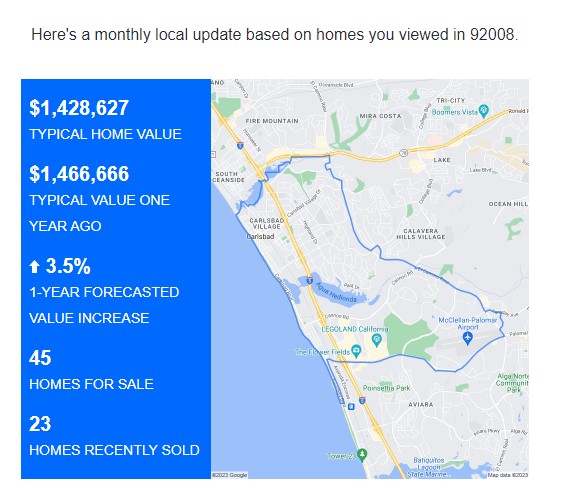

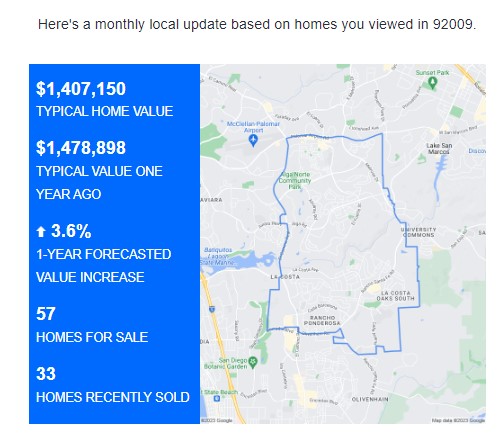

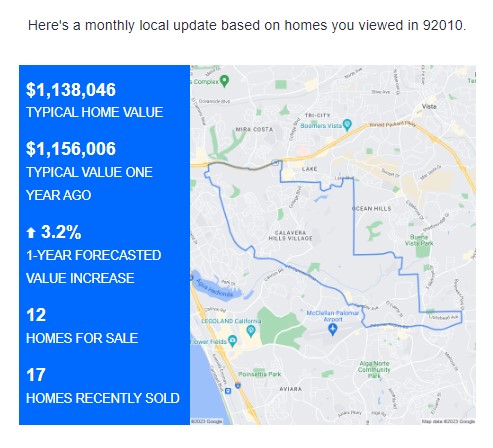

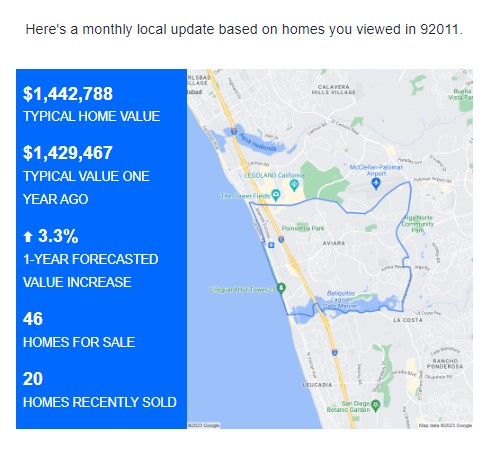

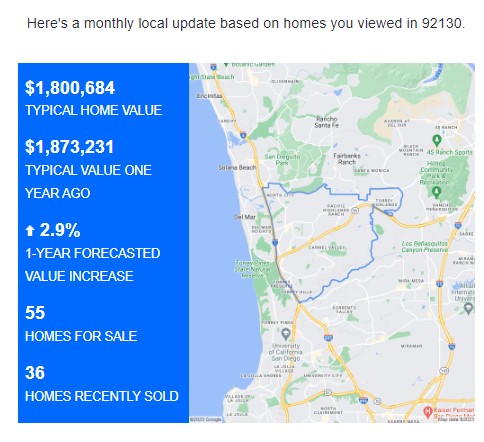

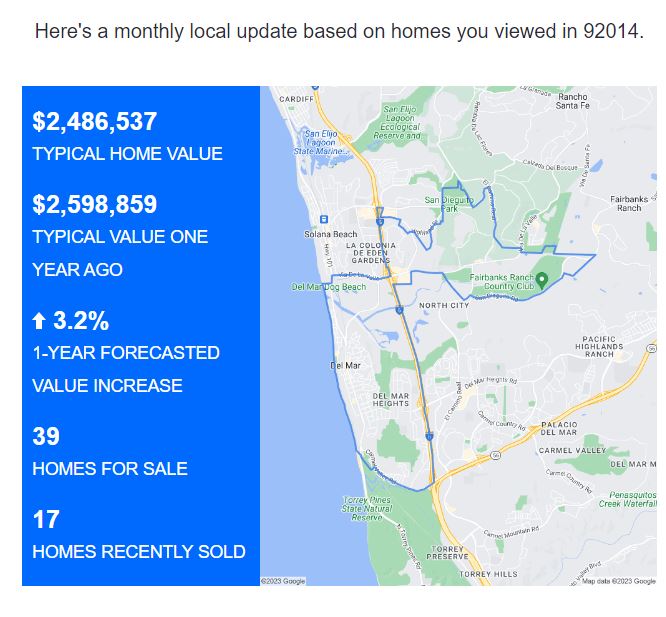

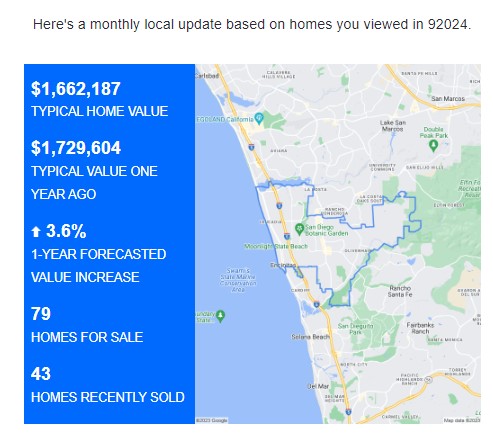

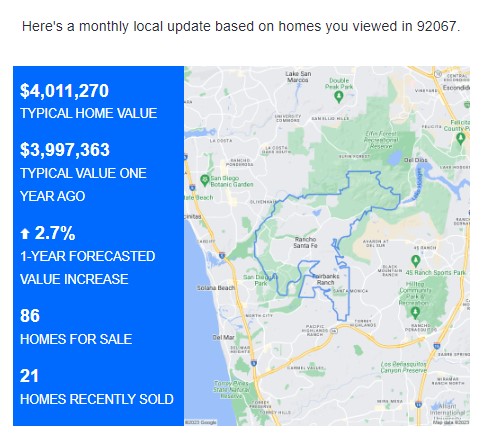

Now Zillow is forecasting 3%-ish appreciation here for the next year – which sounds like the old normal:

NW Carlsbad – 92008

SE Carlsbad – 92009

NE Carlsbad – 92010

SW Carlsbad – 92011

Carmel Valley – 92130

Del Mar – 92014

Encinitas – 92024

Rancho Santa Fe – 92067

As long a banks dont foreclose it keeps the housing supply limited.

As long as the housing supply is limited prices will remain “high”.

San Diego is constrained on all sides which makes new houses hard to build which also keeps prices up.

Builders in citys that arent constrained are starting to see drops in prices primarally because of higher interest rates.