The total number of pendings have been rapidly descending with frenzy-escrows closing out. But new listings should taper off from now on, so we’ll see which drops faster:

NSDCC Actives and Pendings

| Town/Area | ||||||||

| Cardiff | ||||||||

| Carlsbad NW | ||||||||

| Carlsbad SE | ||||||||

| Carlsbad NE | ||||||||

| Carlsbad SW | ||||||||

| Carmel Vly | ||||||||

| Del Mar | ||||||||

| Encinitas | ||||||||

| La Jolla | ||||||||

| RSF | ||||||||

| RSF | ||||||||

| Solana Bch | ||||||||

| NSDCC |

In the previous FM, I said that the March-May period had to be the hottest of all-time, but we had 400+ pendings from June 22nd to November 30th last year – with a peak of 491 pendings on September 7th.

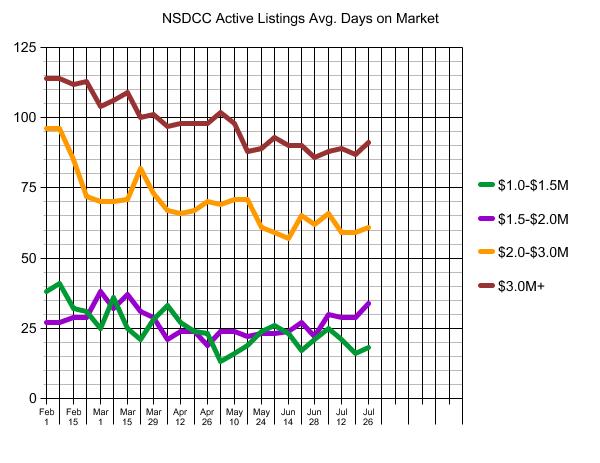

We can also track the average market times too. Any upward trends here would indicate market slowing:

There is slowing of market times in all price ranges but averages of large sample sizes don’t move quickly.