This is turning into the February mortgage-rate massacre, and there’s no real end in sight. But home sellers aren’t going to believe for weeks or months that they might have to back off their price, so don’t expect any changes.

To say that bond market volatility has been elevated recently is an understatement of extreme proportions. Things are happening that haven’t happened in years. Some measures of volatility rival the March 2020 panic surrounding covid, only this time, there’s no catalyst other than the market movement itself.

Today was by far the worst of the bunch when it comes to this most recent spate of volatility.

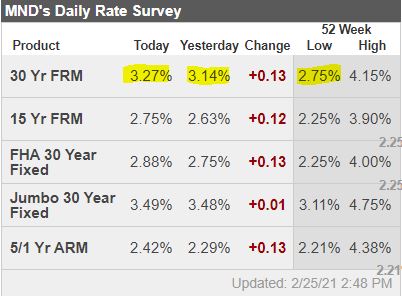

Most any mortgage lender added another eighth of a percent to their 30yr fixed rate offerings. Over the course of the past week, most lenders are .25-.375% higher. And compared to the beginning of last week, many lenders are a full HALF POINT higher. In other words, what had been 2.75% is now 3.25%. What had been 2.875% is now 3.375%.

Are this high rates in a historical context? Not at all. Before covid, they’d be in line with record lows.

But relative to the recent lows, this rate spike is getting to be about as abrupt as we’ve seen in the past few decades–not quite on par with the worst offenders, but close enough to be in their same league.

http://www.mortgagenewsdaily.com/consumer_rates/968604.aspx

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

P.S.

NSDCC Actives: 358

NSDCC Pendings: 356

What a race!

Who’s going to blink? Buyers or Sellers? Sellers have equity and locked in a super low interest rate. Buyers have stock gains and a ton of competition for low inventory.

Don’t think and don’t blink!