We’re coming off tax season – how was your mortgage-interest deduction? It only benefits those in high-cost areas. Should we initiate a real tax-reform package, and start with eliminating the MID when it’s impact is low?

Chronically low interest rates may have accomplished something that the housing lobby has spent millions of campaign contributions and decades of political pressure to prevent.

Did the mortgage interest deduction, long the holy grail of homeownership, become worthless eight years ago when low rates and falling prices so reduced the value of the interest that owners can deduct that the MID has minimal impact?

Even when the MID is combined with the dedication owners receive for property taxes, would many middle class homeowners do just as well tax-wise by renting?

“We believe we have found one of the primary reasons why entry-level home buying has not recovered—and why homeownership has been plunging,” wrote real estate consultant John Burns in an eye-opening blog post circulated April 13, two days before income tax deadline day.

The standard marital deduction has risen from $1,300 in 1972 to $12,600 today, meaning that the first $12,600 of itemized deductions has no benefit to consumers. Today, a typical first-time home buyer financing 95% or less of a median-priced US home pays less than $12,000 in mortgage interest and property taxes, which is not enough to warrant itemizing. Even with other deductions that bring the taxpayer over the $12,600 limit, the tax savings are minimal, argues Burns.

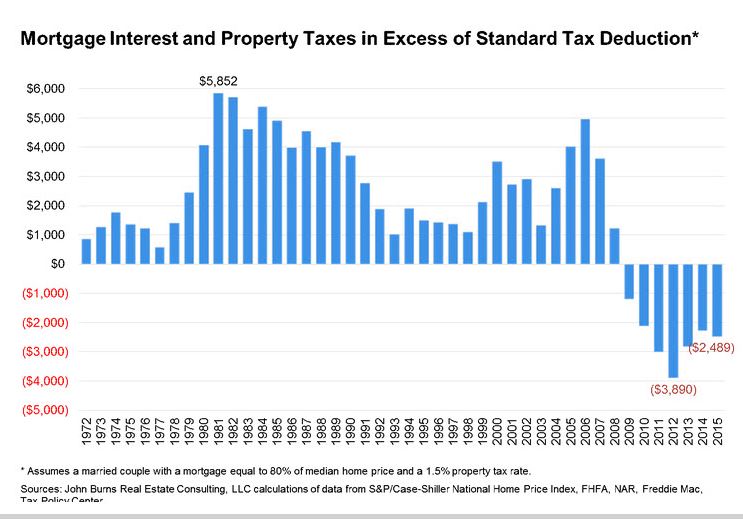

“In the graph, we show the change over time for a typical homeowner couple with an 80% loan-to-value mortgage and a 1.5% property tax rate on the median-priced US home. That owner paid mortgage interest and property taxes in excess of the standard deduction every year from 1972 to 2008. Today, that homeowner’s deductions fall nearly $2,500 short of the standard deduction,” Burns wrote.

“We believe we have found one of the primary reasons why entry-level home buying has not recovered—and why homeownership has been plunging”

There’s a simpler reason: homes are too expensive. Even with good financing (rock bottom interest rates), the prices are just too high.

Right now the MID is a subsidy for folks in high cost areas (such as Ca) from folks in the center of the country. Take Indianapolis as an example the median home price there is $130,400 according to Zillow. Assume 20% down and you get a 104k mortgage which yields less than 4700 in Mid so even if you add in property taxes and state taxes it would be hard to top 12,600 in itemized deductions by much.

The way I see it currently in the San Diego area, buying at high prices with low interest mortgage results in paying a high property tax rate for life and a questionable MID from interest and prop taxes.

Whereas, if interest rates go back up, house prices will need to come down due to affordability. With lower house prices, so will my property tax be a lower amount, for life. Or until I sell the house. And perhaps at the higher interest rate, then the MID might be better than the standard.

Moral of the story, as HungryHowie commented, prices are just too high.

We will wait and continue to accumulate cash while we rent. Given the lackluster inventory available at inflated prices, it’s not worth it to buy at the current time.

Banks need to start foreclosing again. Without foreclosures theres no downward pressure on prices. This is the real problem. Markets are made up of winners and losers. Without foreclosures all we have is winners and freeloaders/deadbeats. Flush out out the deadbeats and prices will have some downward pressure and young people will have opportunities to buy again.

Lylw, somehow Indiana figures out how to make up that “subsidy” they are providing us greedy Californians!:

http://www.theatlantic.com/business/archive/2014/05/which-states-are-givers-and-which-are-takers/361668/

http://cdn.theatlantic.com/assets/media/img/posts/2014/05/Slide3/966724856.jpg

“why homeownership has been plunging”

One man’s “plunge” is another man’s “return to historic levels after abnormal inflation caused by a period of excessively permissive lending.”

http://www.calculatedriskblog.com/2016/01/hvs-q4-2015-homeownership-and-vacancy.html

As for affordability, when demand exceeds supply, prices rise, so build more units. See Jim’s earlier post, “How to Throttle Prices”