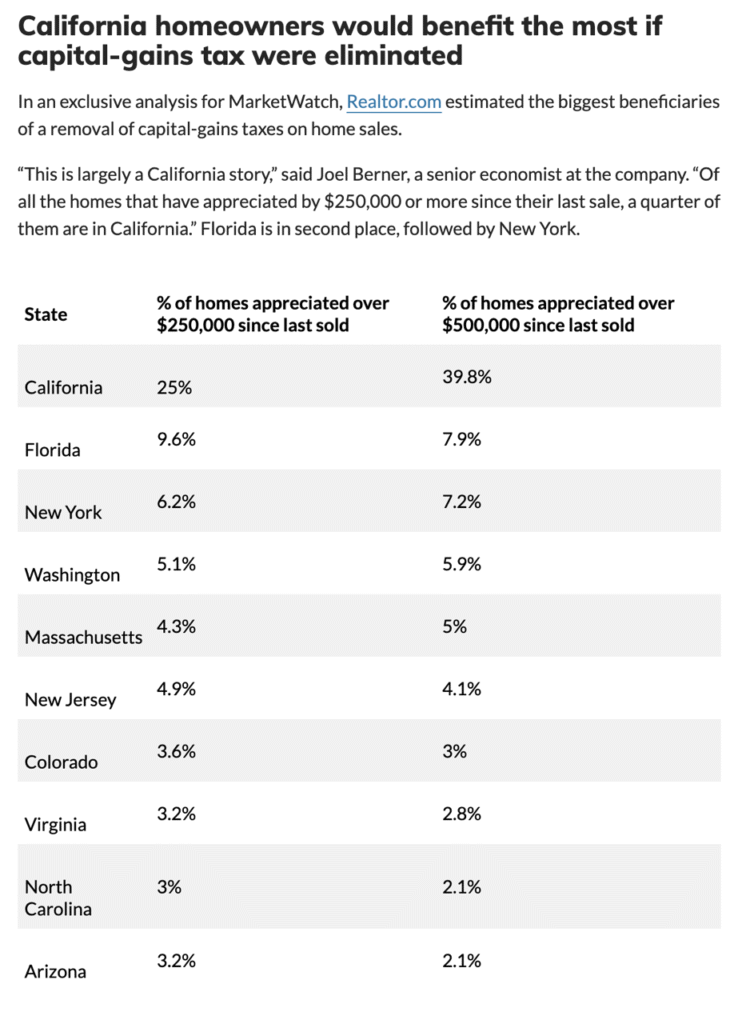

Virtually every homeowner around here would benefit greatly from the capital-gains tax being removed from home sales. Only those who bought in the last 3-4 years don’t have a $250,000+ gain already ($500,000 for married couples), but they bought their forever home and aren’t going anywhere. Virtually every NSDCC listing that was purchased prior to 2020 is priced at 50% over what they paid!

All that matters now is what Trump thinks about it:

President Donald Trump says he’s eyeing the elimination of capital-gains tax on home sales as a way to coax more people into selling their homes, amid a housing market that’s been frozen for nearly three years by high prices and high interest rates.

Oh great – aren’t the potential home sellers going to wait-and-see if this bill gets passed before listing their home for sale? Could this be what finally slows the surge of inventory?

First we had people (buyers and sellers) waiting for rates to go down, and now more sellers will want to wait for months or longer to list their home for sale.

An artificially-screwed up market….again!

Then once we know when the bill might pass, there will be a hyper-stimulated surge of new listings as sellers recognize that it will be better to get out early on this one. It’s going to be insane, and unlike anything we’ve ever seen before!

0 Comments