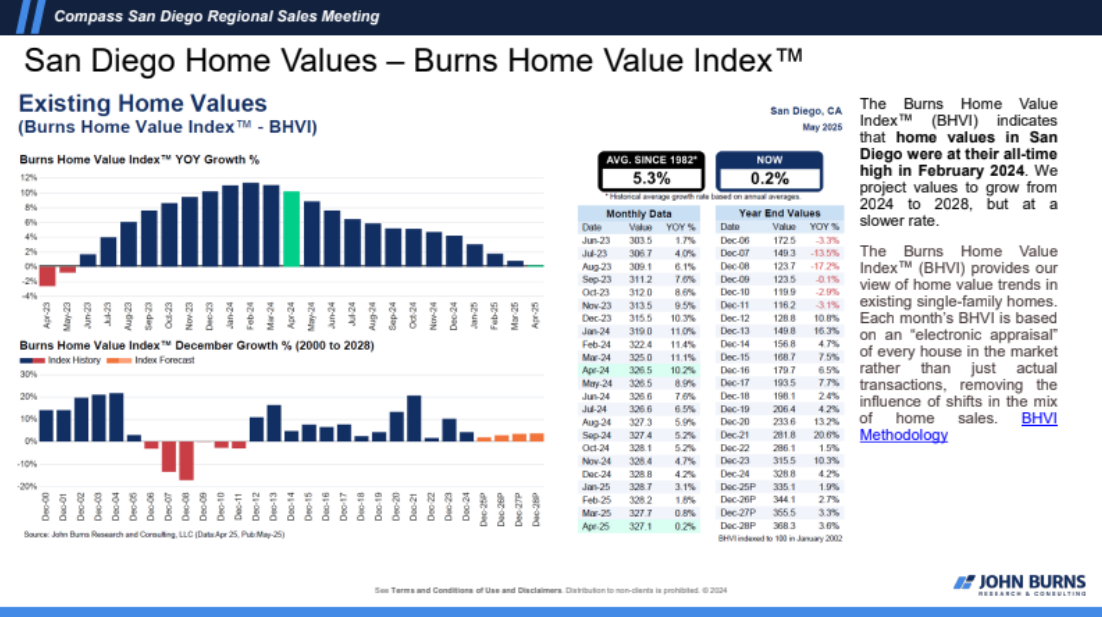

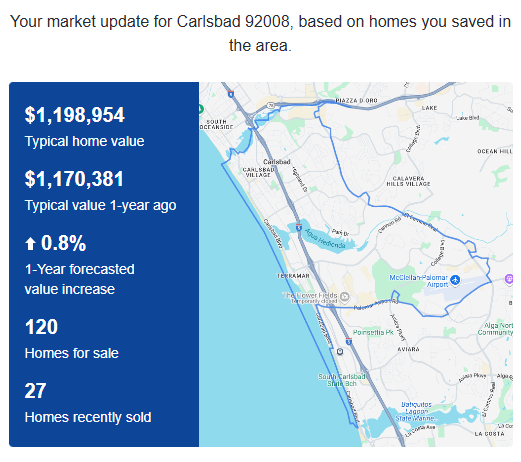

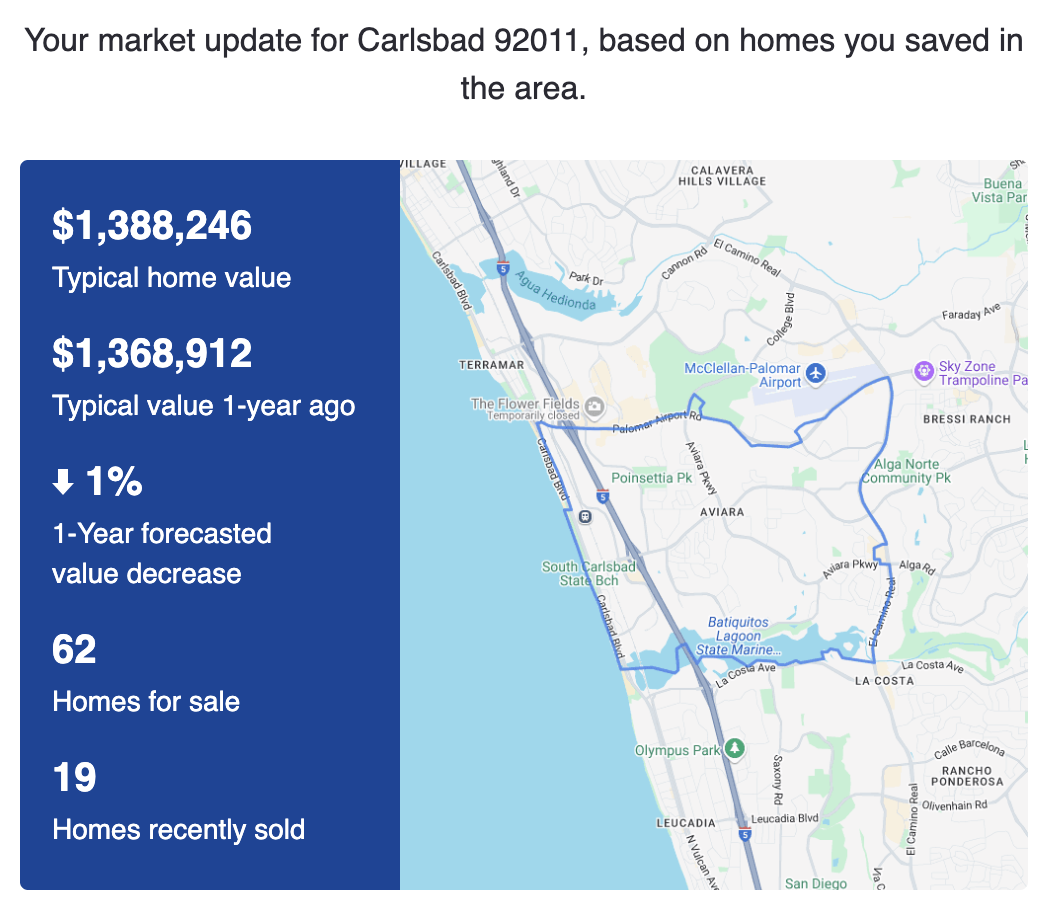

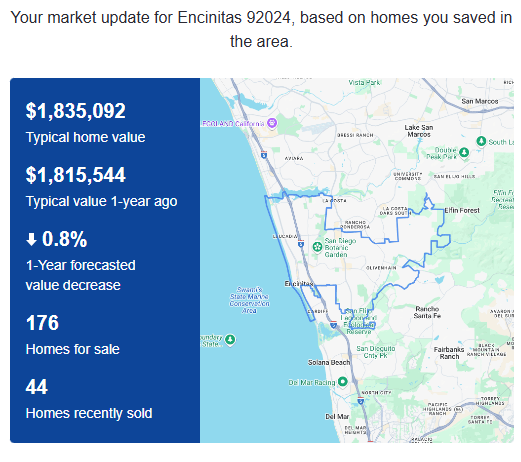

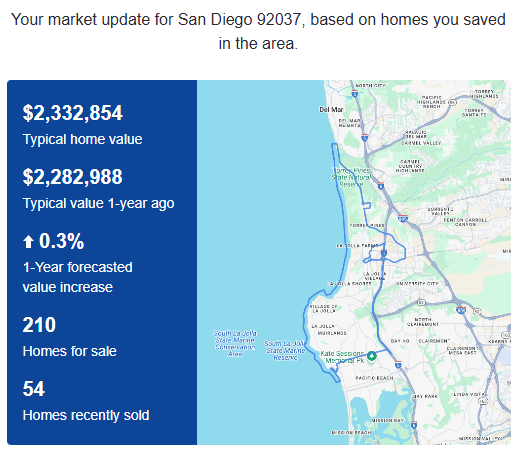

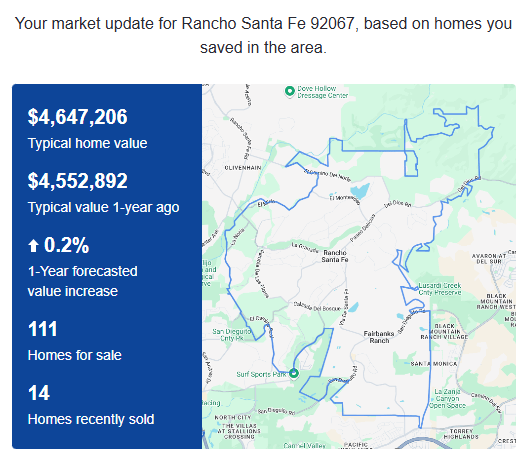

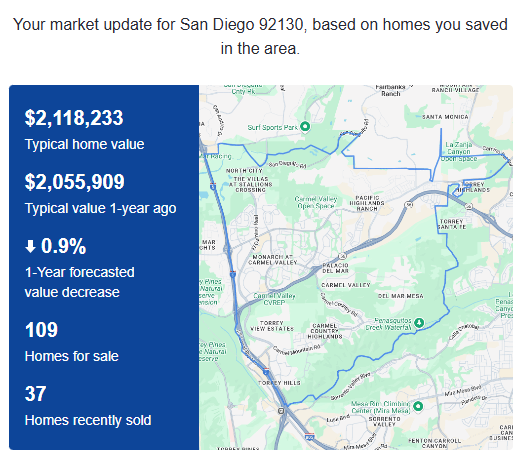

JB is predicting that the local appreciation will be positive for the next few years, though not by much. Zillow thinks the same thing, and if it bounces around in a tight range for the next 3-5 years, it probably won’t surprise many.

It means there won’t be much, if any, benefit in waiting – for buyers or sellers. Rates aren’t going down significantly, and America minted 379,000 new millionaires last year, or more than a thousand each day – combine that with the generational wealth transfer and the buyers’ ability to purchase should be there.

Could there be a boomer liquidation event? It’s probably the biggest threat to pricing, and it could pick up speed in areas where several boomers are aging in place. But how can you time that?

Buy when you find the right house, and sell when you have good comps and low competition!

Carmel Valley going down? I’ll have to see it, to believe it!

Trump is pushing hard on the Fed to lower rates. They can only hold out for so long.

But, if the Fed does continue to keep rates higher houses will to lose “value” as the dollar gains purchasing power because inflation is slowing down.

However, as the article said things will just stay at equilibrium or close to it in desirable areas like SD. To get 2007 price decreases banks would need to start foreclosing again.

Remember when $1m+ was to collect the high end outliers?