98 Years Young

Another reason to move when you’re young and have email!

Another reason to move when you’re young and have email!

Buyers have become more reluctant about executing the terms of the contract – and the NBPs are back!

Here is the explanation on how they work:

Q. My buyer was sent an NBP on Wednesday. My question is does the NBP expire 48 hours from delivery/reception, or at 11:59:59 Thursday night?

A. The Notice to Buyer to Perform (“NBP”) provides for a two-day notice to performance (it is not calculated as forty-eight hours – there is a difference). For example, if the NBP was issued on Wednesday, day one is Thursday, and the deadline for performance would be Friday at 11:59pm. The seller may issue a Cancellation of Contract (“CC”) at 12:01am Saturday.

Conversely, if the NBP was issued Thursday, then day one is Friday and day two would end at 11:59pm on Saturday BUT the last day for performance cannot land on a weekend or holiday. In this example, the buyer would have until 11:59pm on Monday (assuming Monday does not land on a legal holiday) to perform (except under the the San Francisco Purchase Agreement).

Remember the NBP can be issued no earlier than two days prior to the Scheduled Performance Day in order for the NBP to be served in accordance with the purchase agreement. If the NBP is served improperly it would have to be sent again thereby extending the timeline for performance.

The local market conditions appear to be getting worse every day, mostly because the headline writers and social-media experts are piling on now. What can listing agents do?

When most agents are content to show their listings and then go wait by the phone, there are alternatives. Hat tip to our manager Steve Salinas for bringing up the Reverse Offer technique in our sales meeting!

For two years, the buyer-agents have just been telling their clients to bid hundreds of thousands of dollars OVER the list price, so now they may need some help with advising their buyer on how to proceed in this market. When a buyer shows some interest in the home, the listing agent can reach out to the buyer’s agent with more than just a casual request for feedback.

The Reverse Offer is where the listing agent suggests price and terms to the buyer-agent that might be the foundation of a potential deal. It needs to be handled tactfully, and with the seller’s knowledge so it’s not a breach of fiduciary or a waste of time.

It can be as casual as mentioning any needs the seller might have in their exit plan, or for terms that would be advantageous to the buyer like seller financing or rate buydowns. But it can also be as formal as issuing written offers signed by the seller for the waiting buyers to consider – here’s more:

https://www.alexwang.com/blog/considering-the-reverse-offer

It’s worth considering because what’s the alternative? To just sit by the phone and hope it rings, and when it doesn’t, go tell the seller to dump on price?

This is the Wait-and-See period when buyers are so comfortable on the fence that it’s going to take something different to get them to buy a home. Dumping on price during the Wait-and-See period only makes the home buyers think that if they just wait longer, the prices will go down more.

Agents should offer their sellers some alternatives to that!

We were discussing the “mold” found by a home inspector, who wasn’t qualified to comment on the subject – though that didn’t stop him from trying to scare the daylights out of the buyer just so he could CYA.

I suggested that it was the garden-variety mildew that could be removed with a squirt of bleach and a wipe of a cloth. After all, it tested ‘dry’ and the minor stain under the kitchen sink looked like it was years old.

Of course, they asked, “What do you know about mold?”

Plenty, lady…..plenty:

Over the last few years there are two groups of buyers who have been left behind; the self-employed who have a tough time qualifying for a mortgage, and the contingent buyers because there have been enough non-contingent buyers that sellers would prefer.

There hasn’t been any relief for either group, and probably none forthcoming.

Those who want to use the equity in their home to purchase their next house can usually find a solution if they want to move bad enough. You can always do the double move, where you sell first, then rent and wait patiently to buy the next one. You can get a bridge loan, though expensive and qualifying isn’t easy. You can leverage yourself to the hilt and buy the next home before selling.

But for some, those options don’t fit. Just the ease of having the next purchase be simply tied to the sale of the last home might be a relief for some sellers to get comfortable with moving. But will listing agents consider an offer that is contingent upon the sale of another?

They just might – especially over the next four months. Those who should consider it are the listing agents of the 171 homes for sale between La Jolla and Carlsbad that have been on the market for more than 60 days (41% of the total number of active listings).

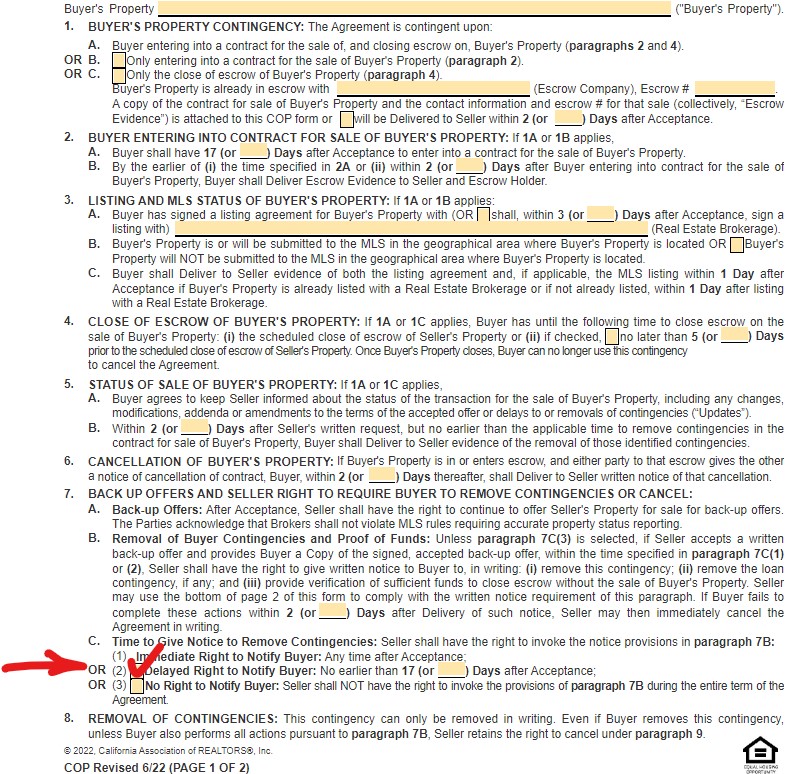

The CAR just revised the COP form in June:

I’m sure all of these paragraphs are necessary, but they leave out the most important ingredient and the fact that would make a difference – the listed price of the contingent property!

If I had a listing that had been on the market for 60+ days and was heading into the 2022 off-season (otherwise known as the Post-Frenzy Apocalypse), I’d consider an offer contingent upon the buyer’s home selling – and I’d give them the 17 days in paragraph 7C2 checked in red above. But I’d want to know what your list price is!

If I thought the buyer’s home was priced aggressively, then what do I have to lose? Seventeen days of market time, during which I can still be looking for back-up buyers……in an era when I might not get another showing, let alone an offer?

Heck yeah, I’d consider a contingent offer – if I just knew what the list price was!

If I was representing the buyer, I’d include my signed listing of the buyer’s home to show – and sell – the listing agent on how our contingent offer would be a viable solution. Let’s do it!

Whoever advertises the most, wins the game. I know agents who spend $25,000 to $50,000 per month!

Aug. 4, 2022- Zillow, Inc. and Opendoor Technologies Inc. have announced a multi-year partnership that combines two category leaders to transform how people start their move. The partnership will allow home sellers on the Zillow platform to seamlessly request an Opendoor offer to sell their home.

Selling a home can be full of uncertainty for many consumers who would rather focus on their next chapter than on the stresses of moving. Potential sellers on Zillow apps and sites may request and view an offer directly from Opendoor and easily compare it to an open-market sale using a real estate agent. Opendoor offers will be available on Zillow, and customers will be able to use the service as a standalone offering or package it with other Zillow home shopping services such as financing, closing and agent selection. Additionally, Zillow customers will be able to work with a licensed Zillow advisor who will serve as a helpful guide in understanding these options.

“Zillow is the most visited brand in online real estate. As we bring the housing super app to life, we’re empowering our millions of visitors to understand all their options and transact in the way that best meets their housing needs,” said Zillow Chief Operating Officer, Jeremy Wacksman. “We know choice is important for customers and they can make the best decision when they see all of their selling options up front — including selling on the open market with a Zillow Premier Agent partner and getting a cash offer from Opendoor. This exclusive partnership will pair Zillow’s audience and brand power with Opendoor’s selling solution in one easy place, so customers can evaluate their selling options and easily package it with other Zillow services to buy and finance their next home.”

“At Opendoor, we’re working to turn what is often viewed as one of life’s most stressful moments — the home move — into an e-commerce experience that’s simple, certain and fast. By bringing together Zillow’s market-leading audience and Opendoor’s e-commerce platform, more consumers will have the option to sell to Opendoor and save themselves the stress and uncertainty of a traditional sale process,” said Opendoor President Andrew Low Ah Kee. “For parents looking to upsize, a young professional moving for a new job, and millions of others who regularly use Zillow to explore their home selling options, we will provide them with the ability to move with a tap of a button.”

Zillow and Opendoor are working together to launch this new product experience with the goal of serving shared customers nationwide in the coming months and years.

It seems like there are open-house signs on every corner now.

Some may think that it’s a sign of trouble, but recognize that it’s realtor training in progress.

The industry is dominated by realtor teams now. Their leaders send out the trainees to do open house every Saturday and Sunday, even though the chance of selling the open house that day is close to zero.

They do it to pick up new buyer prospects.

Attendees are told that the seller insists that everyone registers their contact information, and they are rather insistent about it. The information is then used by the trainees who call you until you buy or die.

They will also be practicing their closing line, “Do you have any questions?”

If you want to see how they are doing with their training, respond with, “Can I buy this for 10% off?”

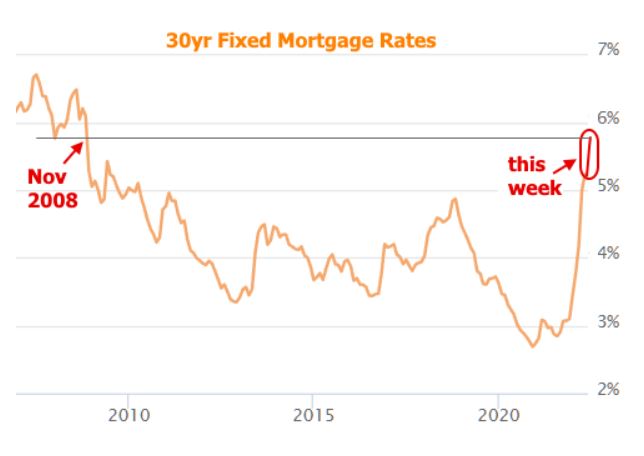

I picked a great day to start the mortgage-rate tracker in the right-hand column! >>>>

Mortgage rates haven’t been in the 6% range since 2008:

How many agents have operated in a 6% environment? It will be less than half of the active agents today. To check, their license number would have to be around 01850000 or lower (real estate license numbers in California are sequential).

Wondering how to cope? Here are my tips:

While the impact on the buyers’ monthly payments is real, it’s the market psychology that will make it worse. Buyers will be expecting lower prices, so instead, consider one of my tips above as an alternative.

Hoping for a big finish today – I’ll be there 12-3pm!

This week, the Wall Street Journal ran a story entitled, ‘How Should Realtors Get Paid’.

The author is a general freelance writer who describes herself as ‘a versatile writer with experience covering a wide range of topics. As a freelancer I contribute regularly to the Wall Street Journal, writing about personal finance, healthcare, aging and technological innovation’. Because she isn’t a real estate expert, she relied on three college professors for content:

https://www.wsj.com/articles/how-should-real-estate-agents-be-paid-11645568774

They went off on some crazy tangents and no realistic conclusions were found, other than to note that there are discount brokers if you want to pay less.

My thought:

Would you do your job for the same pay if these were part of your job description:

There should be a hefty bonus for those factors.

That being said, I would agree that the majority of realtors are grossly overpaid, relative to the services provided.

I see it every day, and if you go to open houses, you’ll see it too. The standard agent knows how to identify each room (this is the kitchen, this is the family room, etc.) and then ask you if you have any questions. Most can complete the fill-in-the-blank contracts too.

But they aren’t professional salespeople who can deliver expert advice on the fly, recognize good and bad features and assign costs/values on the fly, and put the correct price on a home based on the complete package of home’s condition and location, market conditions, and buyer pool….on the fly. Those are the realtors that deserve full compensation because the piece of mind delivered is worth extra. It is a service that is more than just taking an order.

Unfortunately, the order-takers are prevailing though, because consumers don’t know the difference and we all get paid the same. The industry isn’t motivated to disclose this to consumers because they get paid more on the lousy/inexperienced agents, so it will be up to consumers to seek out the experts in a quickie, push-button world.

Eventually, companies like Zillow will determine the values, and consumers will decide if they can live with that. Most will – it is what they are being fed by the new-age disrupters who are advertising the most. It should be just a matter of time before they prevail, and the old guard packs it up.

There will be lower costs eventually, and virtually no good help.