by Jim the Realtor | Mar 13, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News, Mortgage Qualifying, Why You Should List With Jim |

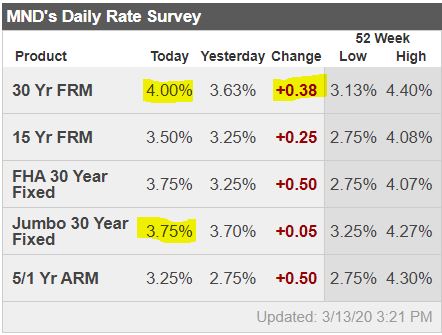

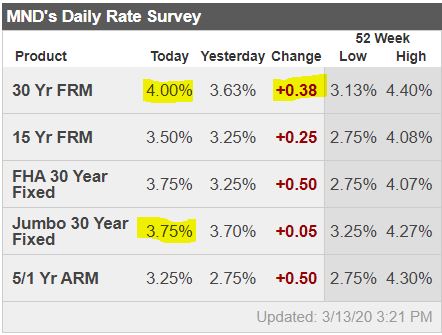

Rates changing from 2.875% to 4.0% in less than a week – wow!

There is some hope that the Fed will throw more money at the MBS market next week. From MND:

With all that in mind, some smart people are convinced the Fed will announce such a balance sheet juicing at or before next week’s meeting. A subset of those smart people are convinced the Fed will make MBS a part of that new “true QE” (which will likely involve a higher monthly dollar amount than we’ve seen previously). I haven’t been keen to agree with this point for a few reasons.

The Fed wouldn’t want to increase refi demand in an already overloaded market. Or if they do, they’re dumb. The Fed also would probably wait to see if spreads heal on their own, which is only in question due to the super low Treasury yields we’re currently seeing. Otherwise, the precedent has been well established for MBS to not freak out to the extent they require Fed intervention since 2012. Even then, there was no telling if the problem would have self corrected, but the Fed left nothing to doubt with QE3 in September 2012 (which specifically targeted MBS, as if to say “don’t worry… we won’t let spreads blow out”).

Those have been my counterpoints anyway. Now today, watching MBS spreads blow out yet again, it’s starting to look like the market is attempting to force the Fed’s hand. I’m not saying to count on a new round of Fed MBS buying, but I am saying I wouldn’t rule it out as of today.

The 10-year yield closed under 1.0% today, so a spread of 3% seems overly cautious and rates should settle down next week.

If rates don’t come back into the mid-3s, I’d expect home buyers to get real comfortable on the sidelines and only consider homes for sale that are a perfect match for their wants and needs.

Sellers – offer to pay down the buyer’s mortgage rate. You’ll be one of the few doing it!

by Jim the Realtor | Mar 2, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

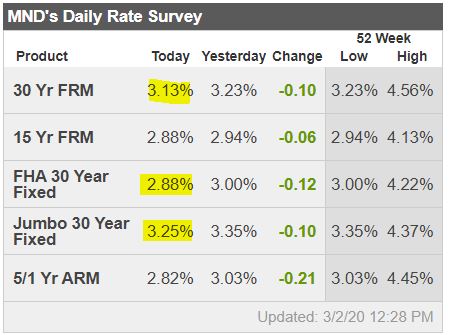

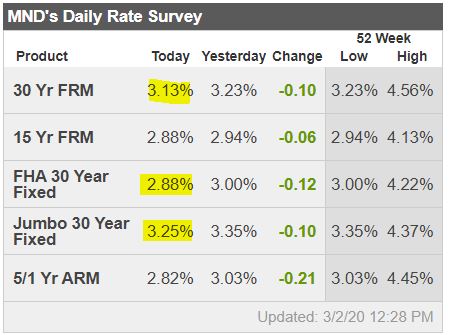

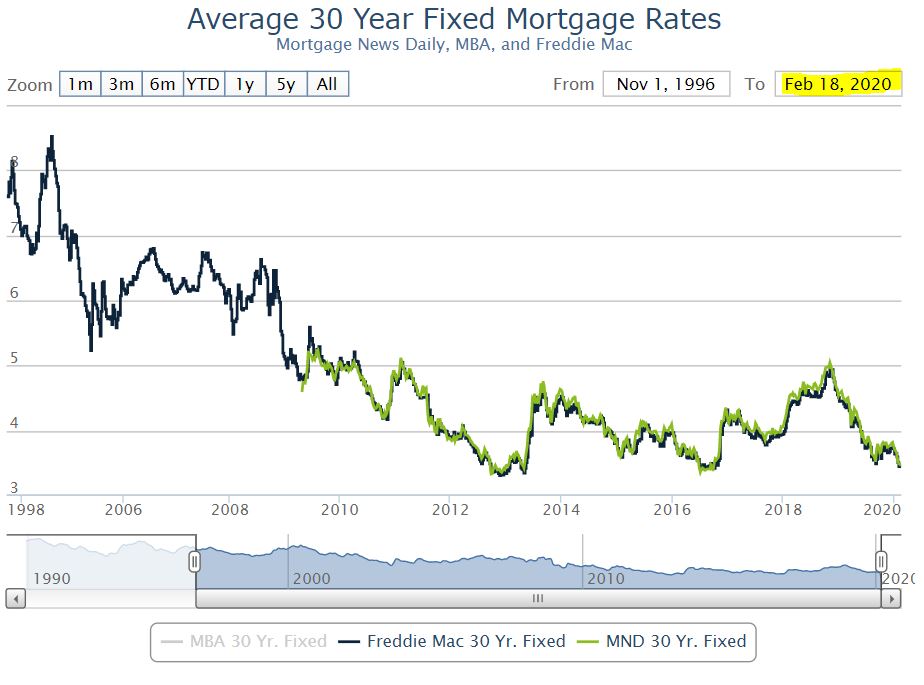

Mortgage rates officially hit all-time lows this morning. Even so, it continues to be the case that Treasury yields (often referred to as the basis for mortgage rates) are falling much faster. That’s because Treasuries aren’t actually the basis for mortgage rates. They’re simply a very important source of guidance and momentum in the bigger picture for all kinds of rates.

When rates are this low and when they’ve fallen this fast, the question of locking vs floating is about as prevalent as I ever see it. The easiest advice for those willing to take some risk is to float and continue to watch Treasury yields (specifically, the 10yr). Since mortgage rates have been lagging so badly, they should be able to hold fairly steady for a day or two even if the 10yr signals a bounce. Of course this requires preparation and planning. Be sure your mortgage is ready to lock and to have a realistic idea of your ability to make that happen in a matter of a few hours or less on any given day. In other words, if you’re floating, make a “locking game-plan” with your friendly neighborhood mortgage professional.

Link to Article

by Jim the Realtor | Feb 28, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

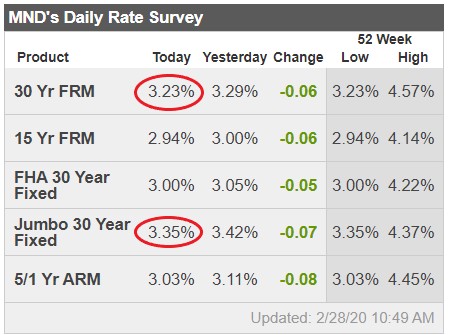

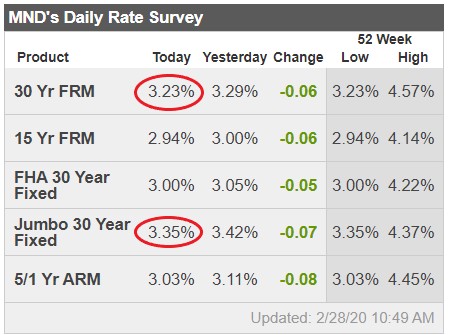

The MND’s survey above are today’s rates with no points, which means that homebuyers who are willing to pay a point or so will be getting a mortgage rate starting with a 2!

While there is certainly a big concern about the coronavirus affecting the world economy – and putting a dent in the down payments – these record-low rates should keep homebuyers engaged!

by Jim the Realtor | Feb 19, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Market Buzz, Mortgage Qualifying, Spring Kick |

| Mortgage Amount |

30-Yr Rate |

Monthly Payment |

| $540,000 |

9.0% |

$4,345 |

| $688,000 |

6.5% |

$4,349 |

| $810,000 |

5.0% |

$4,348 |

| $885,000 |

4.25% |

$4,354 |

| $1,000,000 |

3.25% |

$4,352 |

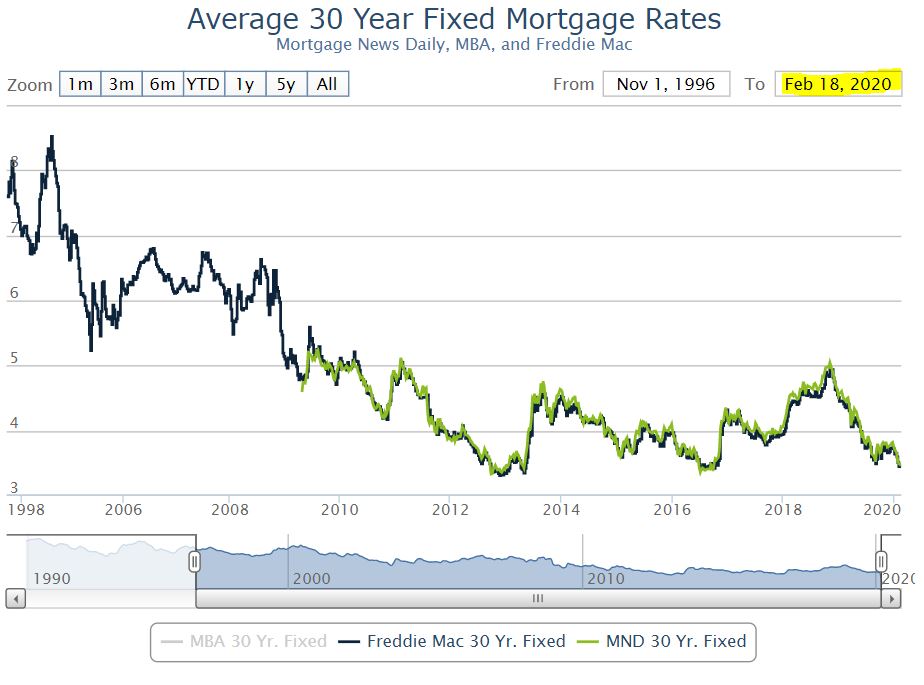

The same buyer who qualified for a $810,000 loan amount just 15 months ago can now borrow $1,000,000 and get the same monthly payment – a whopping 23% increase!

No wonder sellers expect +11% year-over-year!

by Jim the Realtor | Sep 16, 2019 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

Did you hear that rates bumped up 1/4% in the last week?

It doesn’t take much!

Doug Duncan, Fannie Mae chief economist, discusses if the rise in mortgage rates could help the housing market (causing those buyers on the margin to jump in quickly):

http://www.mortgagenewsdaily.com/video/archive/2019/9/16.aspx#921700

by Jim the Realtor | Jun 10, 2019 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

The latest easing of FHA underwriting, which usually means trouble – but don’t fear, they have ‘levers’:

Link to Article

Excerpts:

According to the FHA’s report for its fiscal second quarter (which covers Jan. 1 to March 31, 2019), the average credit score for an FHA borrower fell to 665 in the second quarter. That’s the lowest level since 2008, and is “well below” the FHA lending peak credit score of 703, which happened in 2011.

According to the FHA report, the share of 680–850 credit scores continues to decline among FHA borrowers, while lending to borrowers with credit scores below 640 continues to rise.

The FHA report shows that in 2011, nearly 60% of borrowers had credit scores above 680. Now, only 34% of FHA borrowers have credit scores above 680. Meanwhile, the share of FHA lending to borrowers with credit scores below 640 has increased to nearly 30%.

“This increase shows a much riskier population of mortgages being endorsed by FHA,” the report states. “Performance of these mortgages will be closely monitored to determine when policy changes should be implemented.”

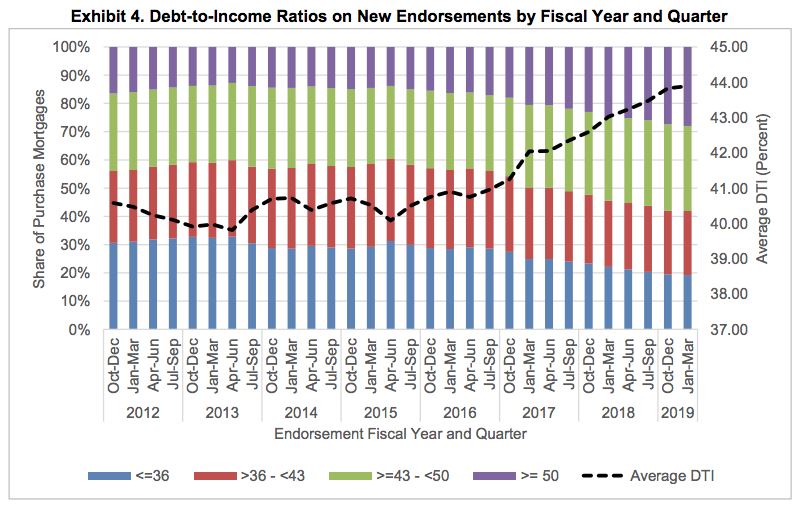

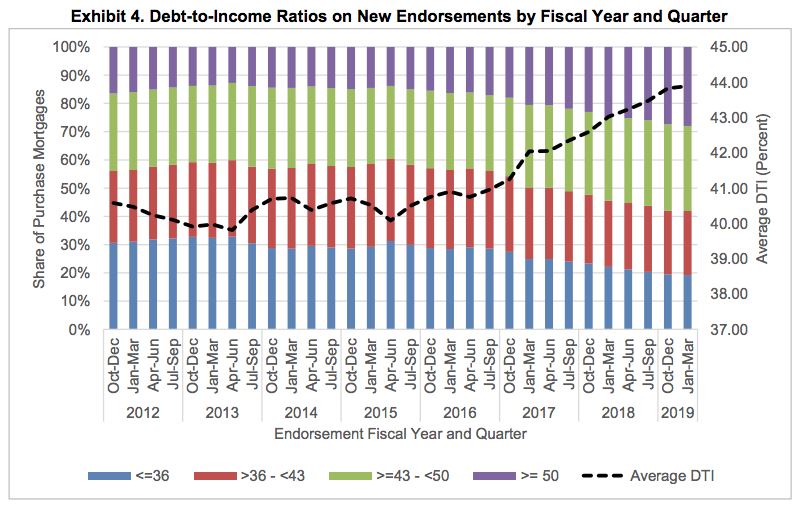

Beyond that, FHA loans have also seen a sharp increase among loans with high debt-to-income ratios, meaning borrowers are taking on more debt compared to their income level.

According to the FHA report, in 2018, nearly 25% of all FHA purchase mortgages had a DTI ratio above 50%. And that number has been rising for several years, a trend that FHA noted as concerning last year.

But despite noting that concern, the percentage of borrowers with DTIs above 50% continued increasing in the second quarter, climbing to 28% of all FHA purchase loans. According to the FHA, that’s the highest percentage of high-DTI loans in a single quarter since “at least the year 2000.”

The FHA notes in its report that this increase shows that its loans are getting riskier.

“This is a risk to the MMIF that the FHA is attempting to manage and mitigate through various policy levers,” the FHA said.

by Jim the Realtor | Apr 22, 2019 | Jim's Take on the Market, Market Conditions, Mortgage Qualifying |

Another example of someone getting caught while exploiting a loophole, who then tries to use discrimination as their lever:

Link to Article

The Trump Administration is cracking down on national affordable housing programs because of concern over growing risk to the government’s almost $1.3 trillion portfolio of federally insured mortgages.

The effort targets providers of money for borrowers who can’t afford the 3.5 percent down payment typically required on Federal Housing Administration loans. Such help — from government agencies and families — enables 4 in 10 FHA loans. Borrowers in government down-payment assistance programs become delinquent at about twice the rate of those who put up their own money.

A new U.S. Housing and Urban Development guideline, published on its website late last week, would be particularly harmful to the Chenoa Fund, one of the largest down-payment programs in the U.S.

A Utah mortgage entrepreneur named Richard Ferguson runs the Chenoa Fund on behalf of the Cedar Band of the Paiutes, a tribal government in Utah. It is providing about $100 million a month in loans to borrowers who can’t meet FHA down-payment requirements.

While many cities, counties and state housing finance agencies also provide similar help, they typically limit the loans to local residents. Chenoa operates nationally. HUD said government agencies must document that they are helping borrowers buy property only within their jurisdictions. Tribal governments, it said, may only offer assistance to members living on tribal land or elsewhere.

“This is obviously very concerning,” Ferguson said in a phone interview. “It appears that HUD is trying to put the tribe back on the reservation.”

(more…)

by Jim the Realtor | Apr 2, 2019 | Jim's Take on the Market, Mortgage Qualifying, North County Coastal |

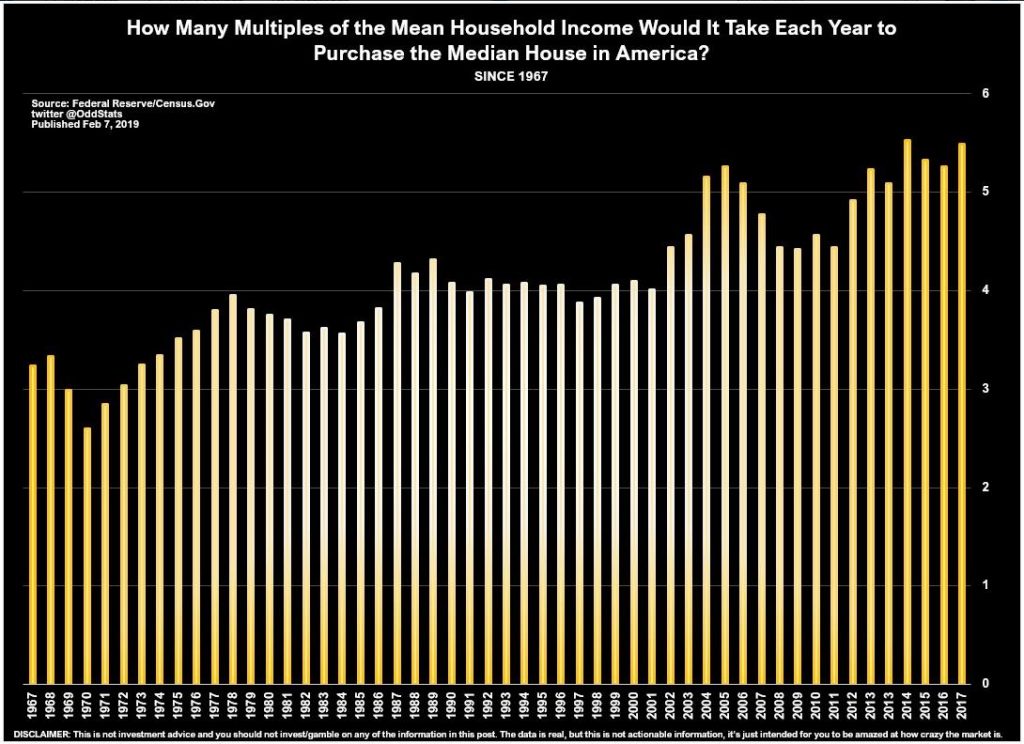

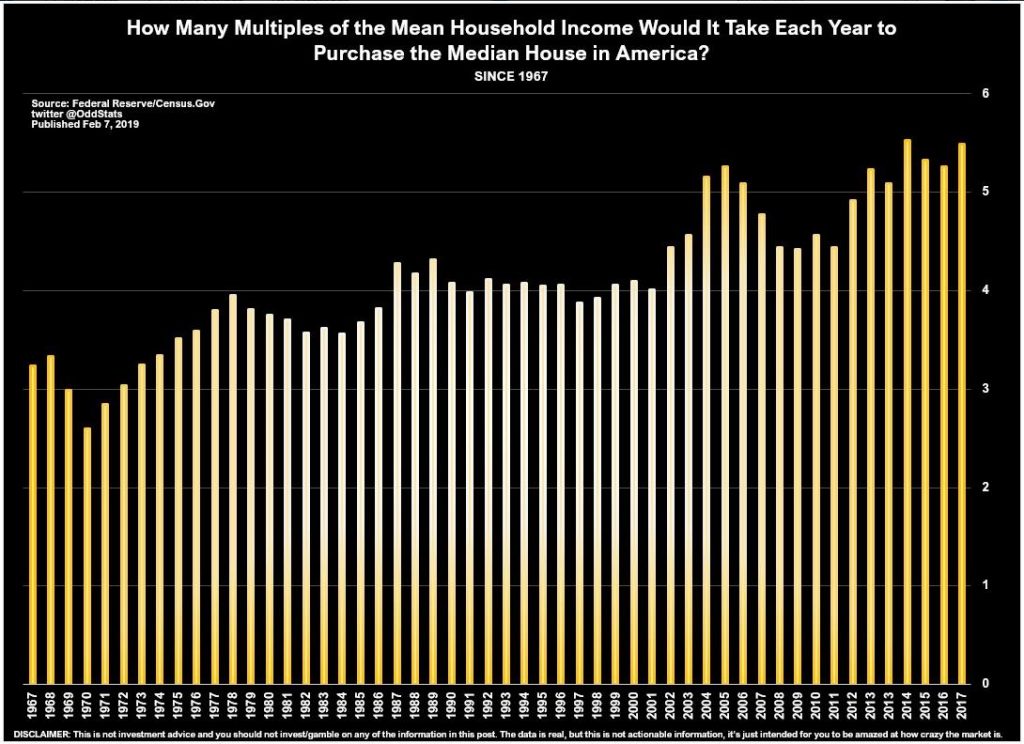

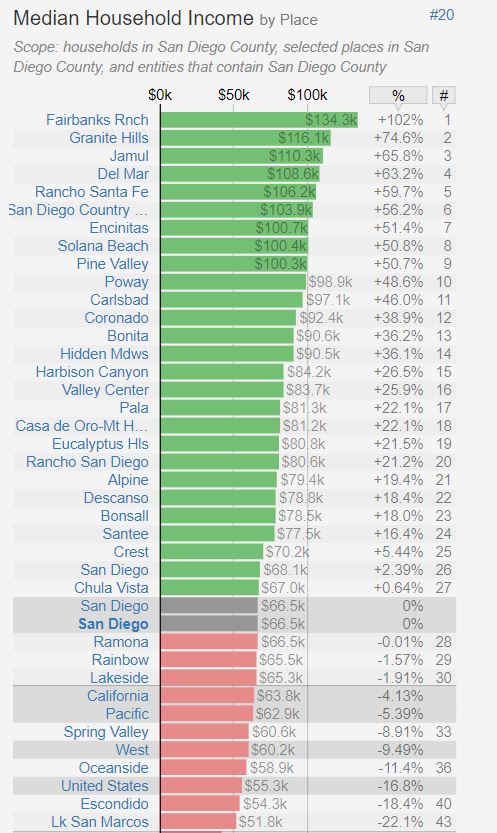

The graph above is for ‘America’s home’.

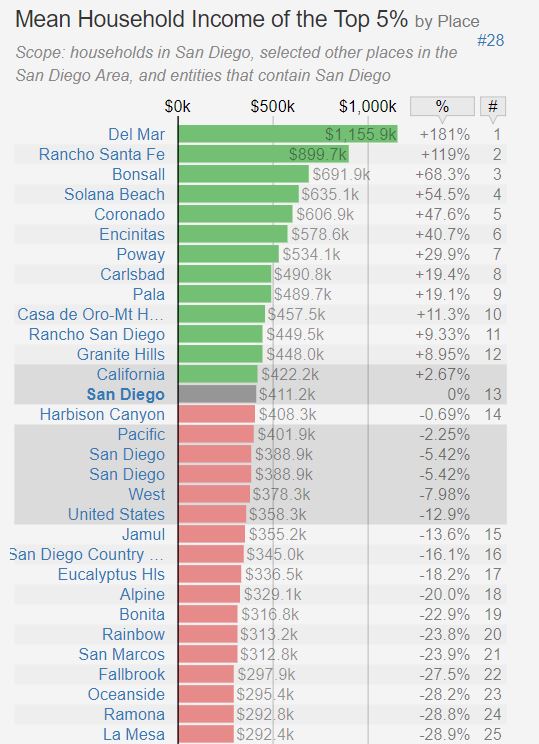

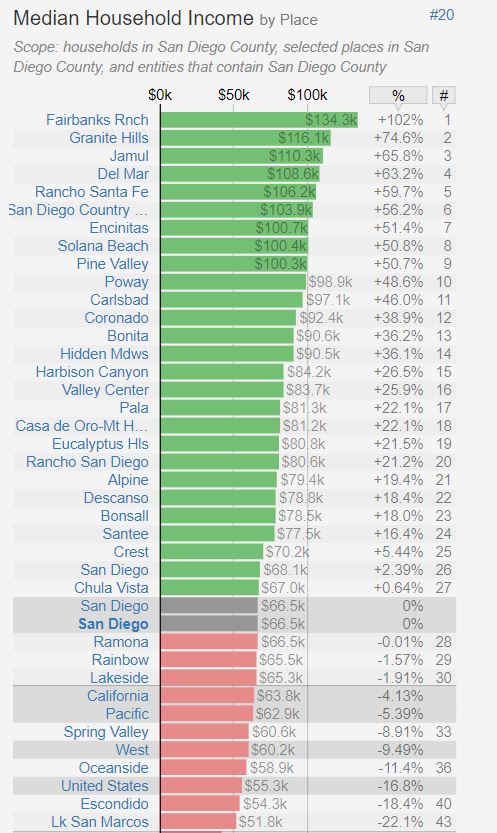

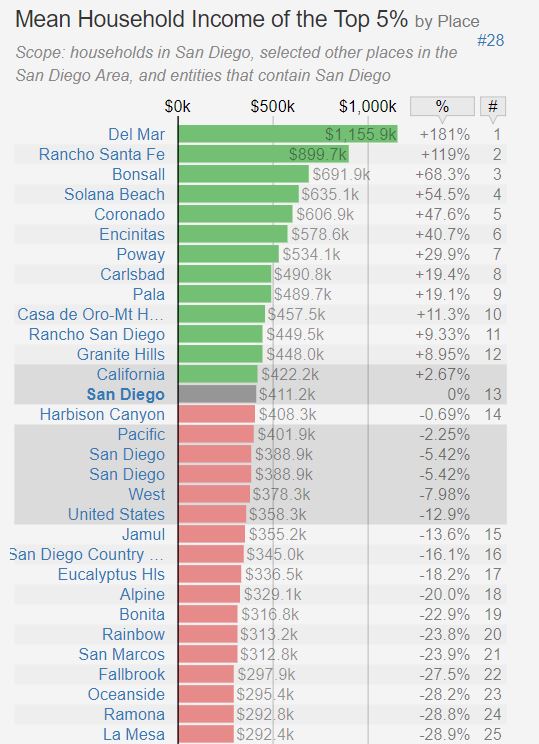

The 2019 NSDCC median sales price is $1,288,000, and somewhat reasonable for the Top 5% – about the only folks left who can afford a coastal home:

https://statisticalatlas.com/place/California/San-Diego/Household-Income

Mrdot wants to use the median income:

by Jim the Realtor | Feb 3, 2019 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

Everyone who is financing a home purchase should strongly consider the standard 30-year fixed-rate mortgage.

Though I recommend you move every 6 to 12 months (it’s good for business) these days most people are in it for the long-term. Even if you knew it wasn’t going to be a lifetime house, consider keeping it as a rental when you move.

But for those who have very strong income, or know they have an inheritance coming, a business or property to sell, or know their lucky Lottery numbers are going to pay off sooner or later, you may want to consider today’s version of exotic financing.

You should only take an alternative to the 30-year fixed rate if you had a solid plan to pay it off early. Don’t get an ARM thinking you’ll refinance someday, because it’s likely you’ll never get around to it – the fixed rate loan will have a higher payment, and you’ll shrug it off.

Here’s a choice today for mortgages up to $1,500,000:

3.875% fixed rate at 1.25 points, or

4.375% interest-only for ten years, no points.

Let’s say you want to finance $1,500,000:

The 30-year fixed option is $7,054 per month, and will cost $18,750 up front.

The ten-year ARM is $5,469 per month for ten years, with no points.

A benefit of the regular 30-year fixed-rate mortgage is the principal reduction every month – it’s a forced savings plan. After ten years, you will only owe $1,137,917, instead of the full $1,500,000 with the interest-only loan.

The ARM will feel like a fixed-rate loan with no payment change for ten years – which could lull you to sleep, and come back to haunt you 8-9 years from now.

Don’t take the 10-year deal just to get a lower payment. Take it because you know you have the ability to pay it off in the next ten years.

by Jim the Realtor | Jan 23, 2019 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying, Neg-Am |

Hat tip to both Rick and Richard sent in this article from the WSJ on alternative underwriting for mortgages, which is on the rise:

https://www.wsj.com/articles/no-pay-stub-no-problem-unconventional-mortgages-make-a-comeback-11548239400

Excerpted – bold added:

Aryanna Hering didn’t have pay stubs or tax forms to document her income when she shopped around for a mortgage last year—a problem that made it tough for her to get a loan.

But the nursing student who works part time providing home care for children and the elderly eventually hit pay dirt: For a roughly $610,000 home loan, a mortgage company let her verify her earnings with 12 months of bank statements and letters from clients.

Ms. Hering’s case highlights how a flavor of mortgage once panned for its role in the housing meltdown a decade ago is making a comeback. These loans, aimed at buyers with unusual circumstances such as those who can’t provide the standard proofs of income, are growing rapidly even as rising interest rates and higher home prices crimp demand for mortgages.

Lenders issued $34 billion of these unconventional mortgages in the first three quarters of 2018, a 24% increase from the same period a year earlier, according to Inside Mortgage Finance, an industry research group. While that makes up less than 3% of the $1.3 trillion of mortgage originations over that period, the growth is notable because it came as traditional home loans declined. Those originations fell 1.2% over the same period and were on track for a second down year in 2018.

Tom Jessop, the loan consultant at New American Funding who handled Ms. Hering’s loan, said he has seen demand for unconventional loans double over the past 18 months and they currently makes up more than one-third of his business. “I think it’s just catering to an audience that’s been neglected for years,” Mr. Jessop said. “Now they have an opportunity to get financing finally.”

At the same time, Wall Street investors who buy home loans are scooping up unconventional mortgages that have been packaged into bonds, edging back into a corner of the market that is riskier but provides higher returns. There were $12.3 billion of such residential-mortgage-backed securities sold in 2018, nearly quadruple from a year earlier, according to credit-rating firm DBRS Inc.

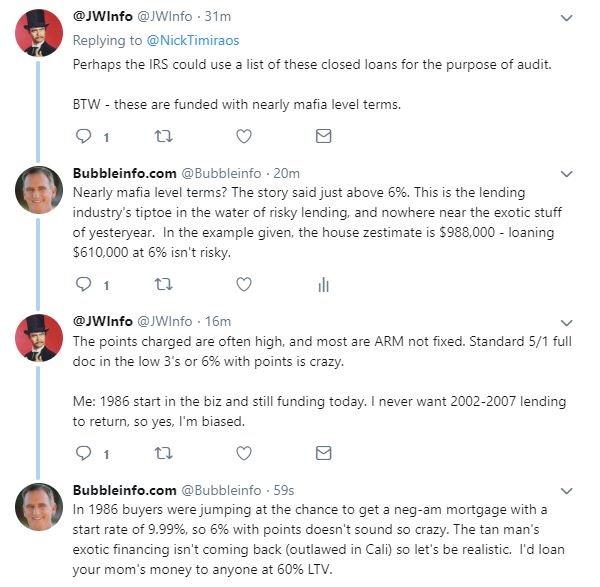

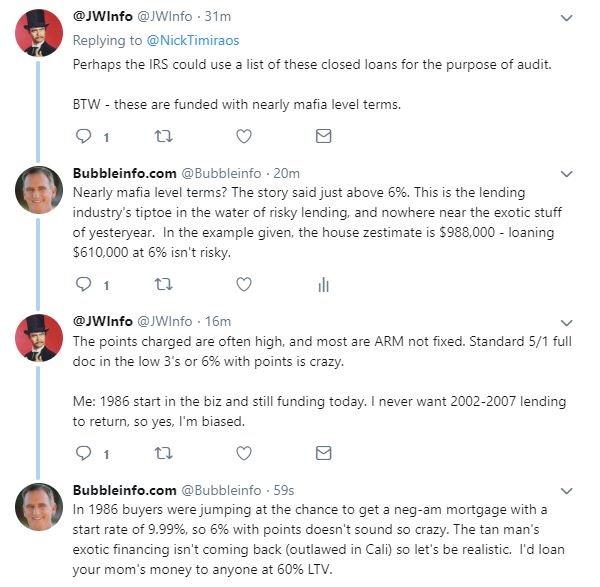

Nick also put it on twitter, where I responded:

Back in 2006-2007, Countrywide was funding neg-am mortgages up to $1,500,000 with no money down and just a decent credit score – the example given is far from that.

The mortgage industry needs to find a balance in between – it’s not out of line to finance a borrower who can show income via bank statements and has substantial equity/skin in the game.