by Jim the Realtor | Dec 1, 2020 | Boomers, Jim's Take on the Market, Market Buzz, Market Surge, Sales and Price Check, What's Hot, Why You Should List With Jim |

Remember when it seemed to make sense that because home prices were escalating, people would be buying smaller homes? Boy, did Covid-19 change that – now the larger homes are driving the market, which suggests that the move-up market has come alive:

(To keep a healthy sample size, let’s combine October and November)

NSDCC Sales and Pricing Over/Under 3,000sf

| Oct + Nov |

# of Sales Under 3,000sf |

Median SP |

# of Sales Over 3,000sf |

Median SP |

| 2019 |

265 |

$1,135,000 |

204 |

$1,800,000 |

| 2020 |

362 |

$1,255,444 |

320 |

$2,150,000 |

| % Diff |

+37% |

+11% |

+57% |

+19% |

Rapidly-increasing prices aren’t slowing down sales….and may be speeding them up!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Could the increase in larger-home sales be due to more inventory?

No – actually we have had fewer Over-3,000sf homes listed this year than in 2019:

NSDCC Total Listings between Jan-Nov

| Jan-Nov |

# of Listings Under 3,000sf |

# of Listings Over 3,000sf |

| 2019 |

2,454 |

2,307 |

| 2020 |

2,273 |

2,127 |

| % Diff |

-7% |

-8% |

The larger-home sales were already benefiting from multi-gen buyers needing a place for Mom. Add to that demand the move-uppers who may not need a place for Mom yet, but if they sense it might be coming in the near future, then might as well buy bigger now – and maybe get granny to throw in some of her dough!

by Jim the Realtor | Nov 25, 2020 | 2021, Frenzy, Jim's Take on the Market, Market Buzz, Market Surge, North County Coastal |

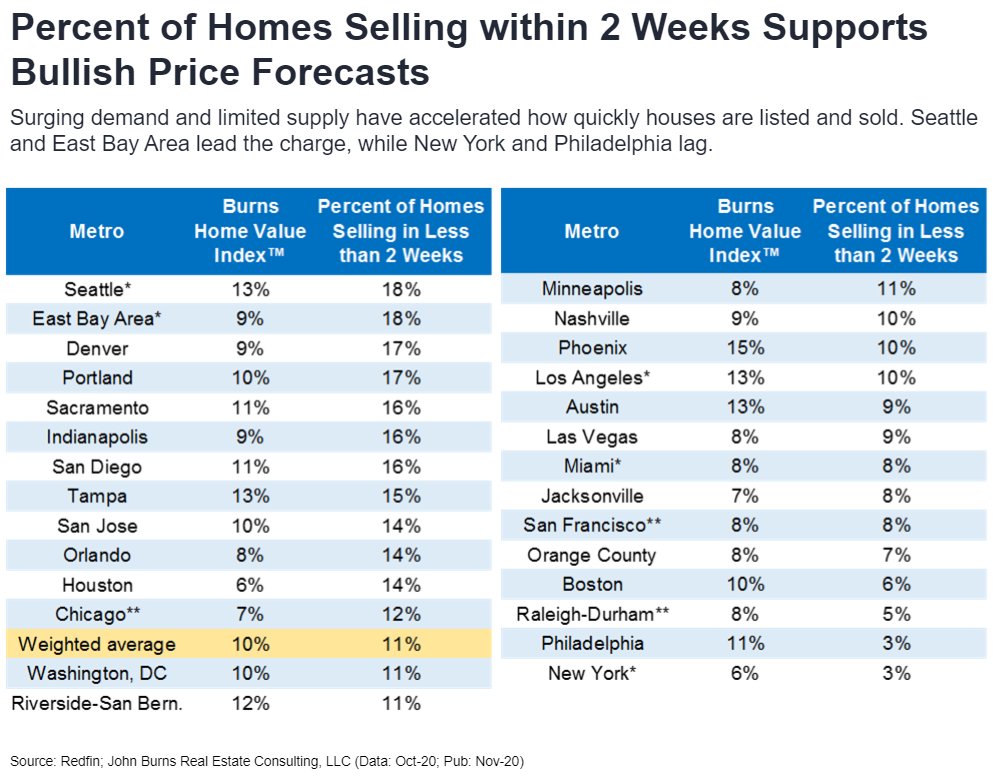

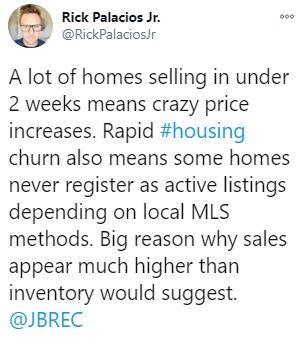

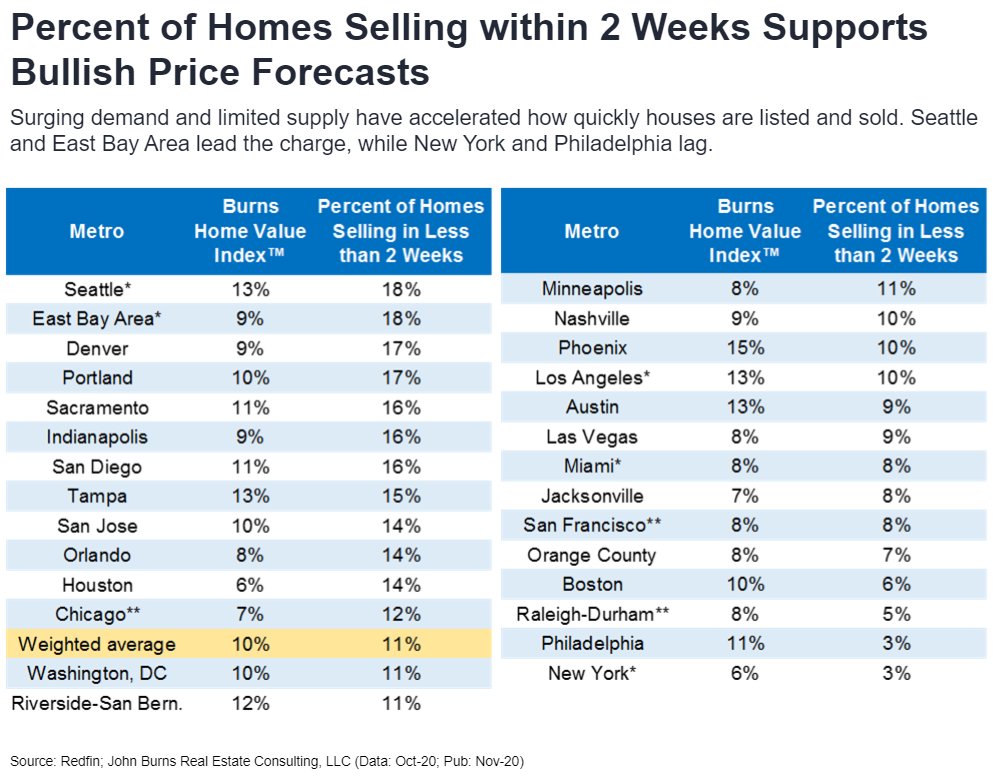

I agree that homes selling quicker – evidenced by the lower market times – means crazy price increases. Sellers can get away with pricing their home at 5% to 10% above comps and buyers still come running.

How crazy is it?

More than half of our sales are finding their buyer in 14 days or less!

NSDCC November Sales

| Year |

Total # of Sales |

Sales with <14 DOM |

% of Sales <14 DOM |

| 2019 |

219 |

74 |

34% |

| 2020 |

251 |

136 |

54% |

Let’s also note that by the time we’re done, there will be close to 300 sales this month, which is unheard of for November!

by Jim the Realtor | Nov 24, 2020 | 2021, Frenzy, Jim's Take on the Market, Market Buzz, Market Surge, Mortgage News, No-Foreclosure as Banking Policy, REOs Coming to Market, Strategic Defaults, The Last Move, Thinking of Selling?, Why You Should List With Jim |

Health, unemployment, stairs, taxes, finances, politics…….selling your home is becoming the answer for everything!

More than 2.5 million American homeowners have stopped paying their mortgages, taking advantage of penalty-free forbearance periods offered by lenders.

What happens when the free pass fades away next year?

Not much, and certainly nothing approaching the flood of foreclosures that defined the Great Recession, according to the emerging consensus among economists. While some homeowners are sure to feel the pain of forced sales, housing experts increasingly expect the end of forbearance to be a non-event for the gravity-defying housing market.

That’s largely because home prices have risen sharply during the coronavirus pandemic. As a result, homeowners who find themselves unable to pay their mortgages when their forbearance periods end likely will be able to sell for a profit, rather than going into foreclosure.

“If they have equity, they can always sell off the house and pay the mortgage,” says Ralph DeFranco, global chief economist at mortgage insurance company Arch Capital Services. “It’s not a great outcome, but it’s less terrible than letting the bank take it and sell it.”

Link to Article

by Jim the Realtor | Nov 19, 2020 | Bidding Wars, Jim's Take on the Market, Market Buzz |

I ran into a 3-offer bidding war yesterday where we were competing against a buyer who had offered a $50,000 non-refundable deposit. The seller wanted us to match it to stay in the game.

We didn’t like the sound of non-refundable (or their price), even though we agreed that it would be unlikely that a judge would allow a home seller to double-dip – unless there were actual damages. If the buyer did end up cancelling, and the seller sold it again for the same price or higher, is the seller damaged? Not really, but we didn’t want to risk potentially having to battle it out in court to find out.

Here is a great article about a case involving a non-refundable deposit of $620,000 – and how the courts felt about the seller trying to keep it:

https://www.neufeldmarks.com/when-nonrefundable-means-refundable/

The article also discusses the liquidated damages clause, and that selling an option-to-purchase to the buyer would be a better strategy for getting them to commit non-refundable money.

by Jim the Realtor | Nov 13, 2020 | Jim's Take on the Market, Market Buzz |

For buyers, it’s Don’t Blink, and Don’t Think!

by Jim the Realtor | Nov 9, 2020 | 2021, Encinitas, Jim's Take on the Market, Market Buzz |

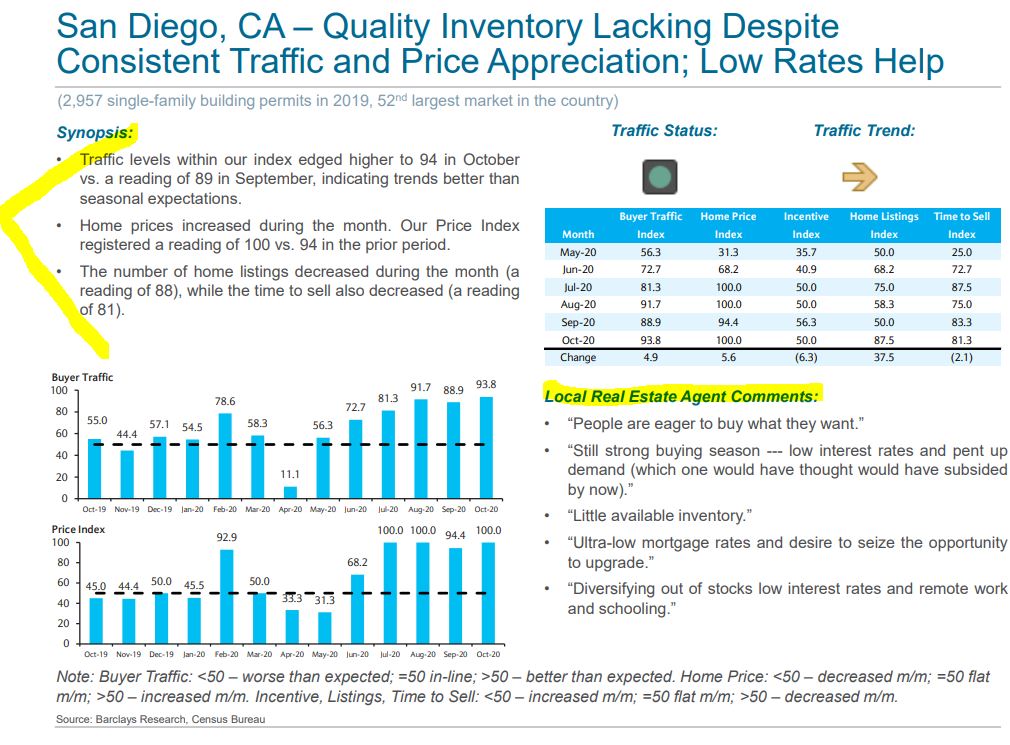

The election season is over (even if the election is not), and the vaccine news today is positive – which should bring more certainty, and relief, to the real estate market. If we just had more homes to sell!

What’s hot these days?

Yesterday, I got the last appointment to show this one-story home in Encinitas, listed for $1,600,000:

https://www.compass.com/listing/2222-silver-peak-place-encinitas-ca-92024/635047271721032977/

It must have been shown at least 20 times between Fri-Sun, and the agent said she had received multiple offers before we arrived. All in the November rain during the week of a heavily-contested election!

Here are the NSDCC counts for the last six weeks:

New SFR listings: 408

New SFR pendings: 509

Median list price of pendings: $1,595,000

SFR closed sales: 500

Median list price of solds: $1,605,000

These numbers are staggering for ANY six-week period!

For the market to be this red-hot leading up to the election, during a raging pandemic, is truly remarkable. These conditions should continue too, as long as new listings keep coming!

by Jim the Realtor | Nov 7, 2020 | Encinitas, Graphs of Market Indicators, Jim's Take on the Market, Local Flavor, Market Buzz |

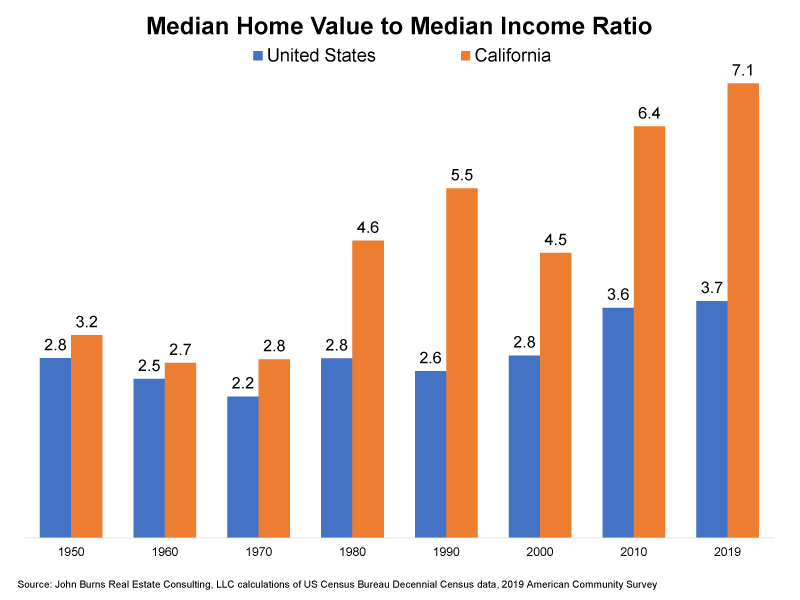

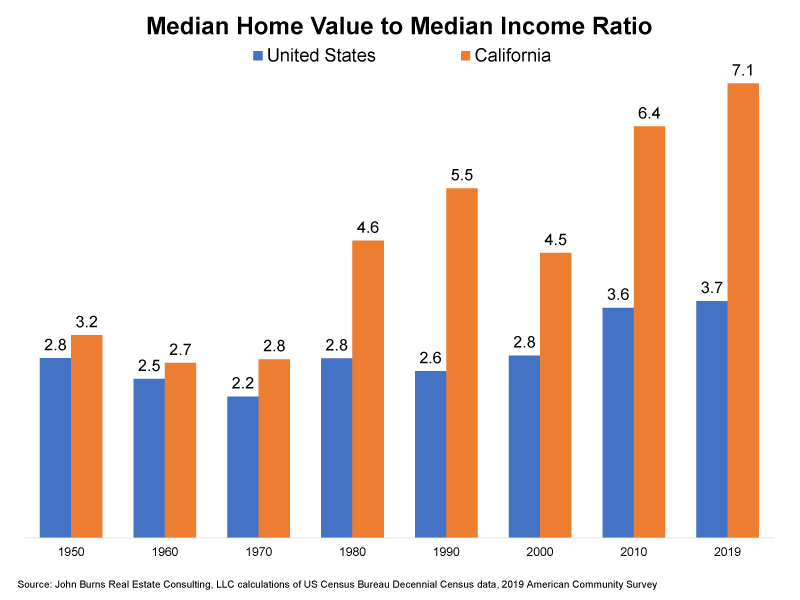

If there is anyone left who still believes in market fundamentals, here’s a graph that shows how the traditional 3:1 price-to-income ratio is still a decent measuring stick in the rest of America. But in California, it has escalated to dizzying heights!

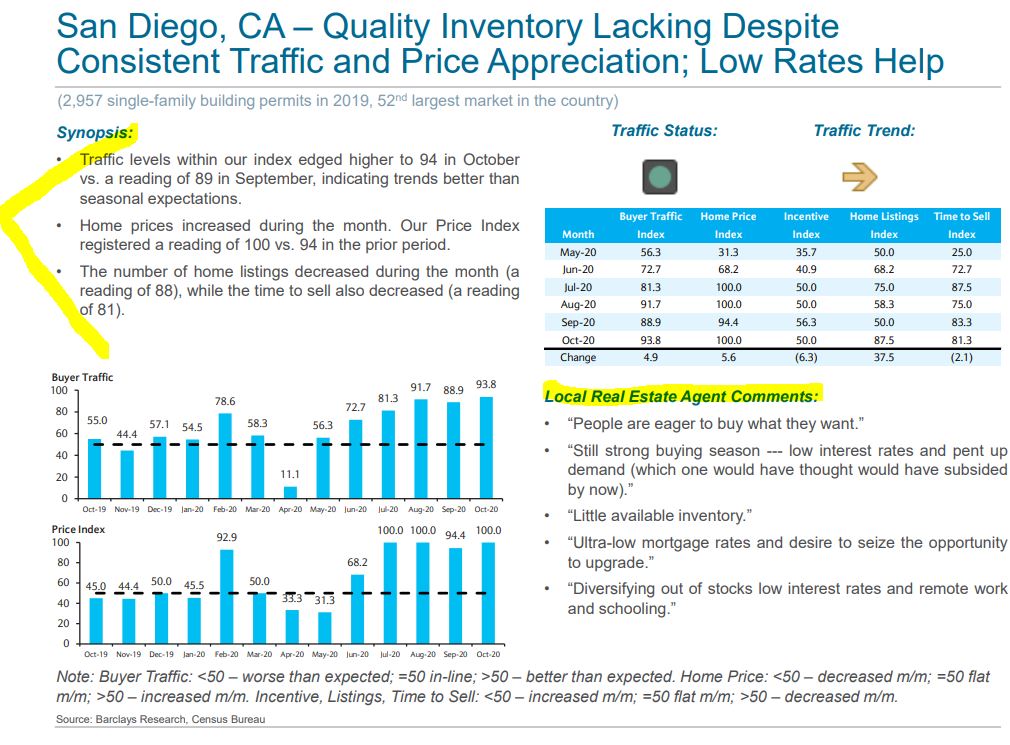

San Diego County

Median Household Income: $75,456

Median Sales Price, YTD: $705,000

Price-to-Income Ratio: 9.3

Encinitas

Median Household Income: $113,175

Median Sales Price, YTD: $1,465,000

Price-to-Income Ratio: 12.9

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

With the affluent in full control of the real estate market, expect these numbers to get dizzier!

by Jim the Realtor | Oct 29, 2020 | Frenzy, Jim's Take on the Market, Market Buzz, Market Surge |

Of the places benefiting from the people fleeing California, Phoenix has to be #1 on the list. Their Case-Shiller Index had the biggest increase in the nation this week (+9.9%), and look at the average market time:

PHOENIX — The greater Phoenix housing market has already returned to pre-pandemic levels and could be on track for a record October in total homes sold, according to Valley housing analyst Tina Tamboer with The Cromford Report.

“The pandemic may as well have been a decade ago now,” she told ABC15.

“We soared in contract activity between May and June and [that activity] stayed relatively high,” Tamboer said, adding that the increase coincided with the state beginning to ease COVID-19 restrictions on businesses.

In April, Tamboer said the median time for a Valley home to move under contract was 21 days. Today, that time frame is less than eight days. October is also on track to see 30% more Valley homes sold than a “normal” year. She said typical factors that could delay a home purchase — like vacation plans and children returning to school — have been impacted.

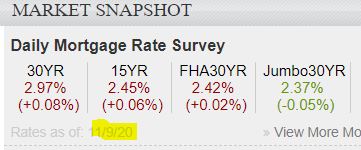

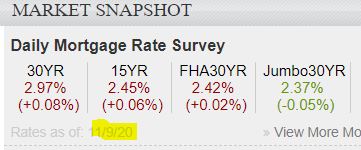

Even as home prices rise, the CARES Act could allow potential homebuyers to access their savings early — from a 401k account, for example — without penalty. Mortgage rates have also set record lows, which could offset any increase in total home price when calculating a monthly payment.

Link to Article

While we’re at it, let’s also mention the CARES Act benefits, which may not help many homebuyers in San Diego but could keep homeowners afloat who have lost jobs:

In response to our massive economic downturn and sudden unemployment affecting 30 million-plus Americans, Congress passed new legislation in March to make it easier to access your retirement savings.

To that point, an individual can now take a withdrawal of up to $100,000 from eligible retirement plans, including 401(k) plans and IRAs, without the 10% penalty applying.

Additionally, the IRS recently released guidance broadening the number of people who can take coronavirus-related distributions from 401(k) plans and IRAs. For example, if your spouse has lost his or her job due to coronavirus or had a job offer rescinded due to the pandemic, you can take up to $100,000 from your own retirement account.

These coronavirus-related distributions are only available in 2020, so it’s a consideration that would need to be taken over the next six months as the legislation stands today. Note that while the 10% penalty has been temporarily waived, the tax liability on the distribution has not. The good news is you will have up to three years to pay the tax liability on the amount of your distribution, which is designed to ease what might look to be a major tax hit.

Link to Article

by Jim the Realtor | Oct 28, 2020 | 2021, Frenzy, Jim's Take on the Market, Market Buzz, Market Surge |

So what’s your take on the strength of the housing market now and how the election could change it?

BARBARA CORCORAN: I don’t think the election is going to have much to do with the housing market. It’s like a horse that’s run out of the bar– the barn at about 100 miles an hour, and there’s no stopping it. Of course, it’s on an even market. The suburban areas, the wealthier vacation areas, the country areas are all skyrocketing with the shortage of listings and prices going up far beyond what’s reported. Because you have to realize, when price increases are reported by any organization, it’s based on closings, not on deals that were just made, which are always made three months in advance.

So I think the housing market is exploding well beyond what’s being reported, and I think that’s going to come out in the next couple of months. But so far as how the election will affect it, it’s amazing. It’s almost like the strength is beyond the election that nobody’s paying attention.

For every two buyers, there’s one house to be had. So there’s an extreme slanted market with a shortage of inventory. The housing market is so hot, I almost feel like I should apologize for it. It’s not even my market, OK?

But the housing market is so strong right now, we’re not going to make up for this lost time for a lot of months to be coming up, and prices are going to price out all the starter homes, of course, as time goes on. But every other market is going to be going like hotcakes. And you can count on it for the next three to six months easily. There’s too much pent up demand. There’s too short a supply, and it’s going to take a while to even that score out.

Link to Yahoo Article

by Jim the Realtor | Oct 23, 2020 | Frenzy, Jim's Take on the Market, Market Buzz |

The signs are everywhere – the super-frenzy is building. I spoke with a friend in Phoenix yesterday who said the cheaper homes for sale there are flying off the market in 1-2 days:

While restrictions are driving people out California, newfound freedom is allowing others to come to San Diego and set roots.

San Marcos resident Logan Lidster is 99% sure his family will be moving to Texas despite living for years in San Diego.

With two kids planning to make the jump to the Lone Star State, Lidster said he had been considering an exit out of California for a while. But then COVID-19 advanced the possibility, and the Lidsters realized his family needed to become more self-sufficient.

“We’ve got a little bit of property here, but everything from regulations of what we can do with our homeowners’ association to what things we’re allowed to grow, there’s so much red tape,” Lidster explained. The pandemic brought things full circle for the Lidsters. In a time when things are difficult to access as is, he’s seen a need to grow his own crops and raise his own chickens in preparation for what might lie ahead.

And Lidster isn’t the only one turning his eye beyond the Golden State. Marie Bailey, a real estate agent in Texas, said her business has tripled since the pandemic hit, citing sales specifically tied to Californians on their way out.

The unstable job market in California brought on by the pandemic has played a part in the exodus, Bailey said. “It has exacerbated the politics so lots of companies have been shut down,” Bailey said. “People are unhappy with how California is handling it.”

And in San Diego, a similar migration pattern is forming. Chris Hasvold, a broker at Coldwell Banker Village Properties, said he’s seeing people make the dash out of California for more affordable locations.

“We’re seeing people leaving in droves,” Hasvold said. “They’re going to the most common places…that I’m working with are Florida, Arizona, Idaho, Texas, and Tennessee.”

But Hasvold said he’s not just witnessing movement out of California. He’s also seeing people pour into Northern San Diego. The shift to remote working has given them the flexibility to live where they want, Hasvold said.

“They just are not restricted to a certain area now because they can work remotely and so that’s opened up a whole new world for people,” Hasvold explained.

Hasvold said some of his clients desire more of a return to nature where they can have more land and space.

https://www.nbcsandiego.com/news/local/restrictions-drive-californians-out-while-newfound-flexibility-draws-others-in/2429761/