by Jim the Realtor | Nov 17, 2022 | Interest Rates/Loan Limits, Jim's Take on the Market |

The jumbo rate above is 6.1% at no points, which means you can get into the mid-to-high 5s with the buyers – or sellers – paying a point or two.

I’m going to mention it in the description of the new listing.

With the discounts already in place in some areas, and last week’s drop in the mortgage rates, this might be the best combination of discounts/declines that we will see in the next 1-2 years.

The Fed is going to keep raising their fed funds rate. Powell, Bullard and others have said that the FFR needs to be at least 1% higher, and they intend to get there next year. They don’t determine the mortgage rates, but you can imagine the impact on the bond/MBS markets.

What they won’t consider is where potential home sellers are going to draw the line.

Today, we might find sellers who are willing to consider a price that is 10% below peak, with an occasional 15% or 20% off. But you can bet that when it comes to selling for 20% to 30% below peak prices, most sellers will become highly resistant.

How many will quit instead? Or not even bother with trying to sell? Plenty.

I think the higher rates go, the lower the inventory will be.

The difficulty of finding the right house, at the right price, will keep getting harder and harder.

If you can find something close to the perfect home today, consider it strongly!

by Jim the Realtor | Nov 10, 2022 | Interest Rates/Loan Limits, Jim's Take on the Market |

It sure seemed like there was plenty of extra buffer built into the recent mortgage rates. With the CPI report coming out more favorable than expected, the markets reacted – and boom, a half-point drop!

If buyers get the feeling that both rates and prices are coming their way, it should keep them looking. If there were just a few more quality homes to sell!

by Jim the Realtor | Sep 27, 2022 | Interest Rates/Loan Limits |

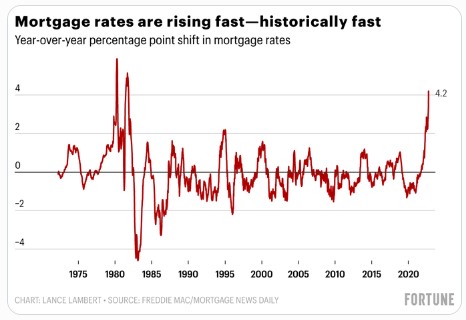

Hat tip to Garry and Rob Dawg who predicted that we’d hit 7% this year, for the first time in over 20 years!

It was in April, 2002 that rates were over 7%, back when the NSDCC median sales price was $635,000. This month it’s $2,075,000!

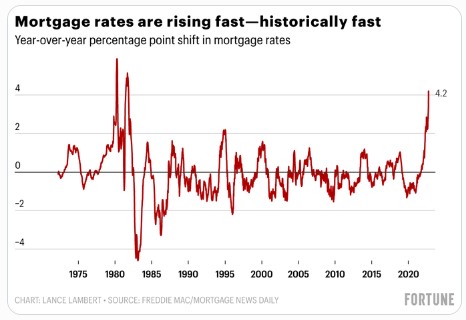

Rates have never doubled this quickly, and the increase looks like the fastest since 1981:

And it will probably keep going!

by Jim the Realtor | Sep 26, 2022 | 2022, Interest Rates/Loan Limits |

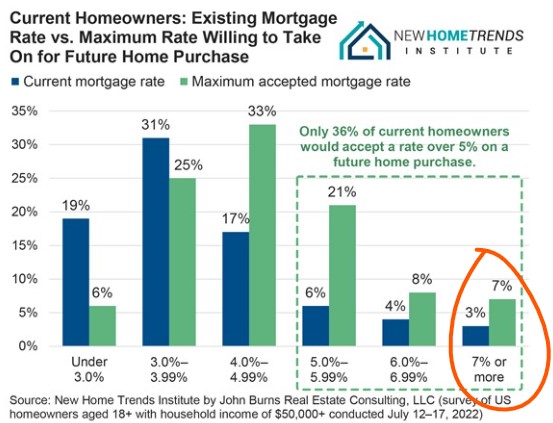

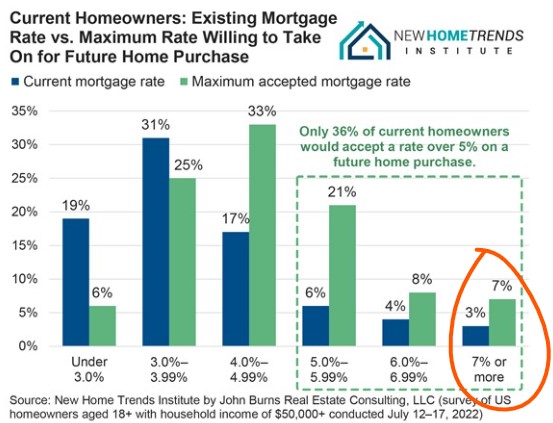

Graph from JBREC:

- Only 36% of current homeowners said they would move if rates were 5%+,

- Only 15% said they would move if rates were 6% or higher, and

- ONLY 7% OF CURRENT HOMEOWNERS WOULD MOVE IF RATES WERE 7% OR HIGHER.

If the market of move-up and move-down buyers has seized up like an old Ford, then who is left? Who are the buyers who will stay in the hunt?

It will be those who don’t own a house here and are hoping to find a cooperative seller:

- 1031 exchangers

- Parents buying with/for kids.

- Out-of-towners

- First timers

The buyer pool is probably shrinking daily – great news for those who have the guts to keep looking!

by Jim the Realtor | Sep 21, 2022 | Interest Rates/Loan Limits |

The Fed raises their rate by 0.75%, and what happens?

That’s right, the conforming 30-year fixed rate went down this afternoon.

Chairman Powell said again that intends to cause a reset in the real estate market, but our rates really shouldn’t go up much the rest of the year because at least 1% is already built into the current rates. If it weren’t for Powell’s threats, the 30-year fixed would be around 5.25% today (10-yr T-bill index + 1.75%).

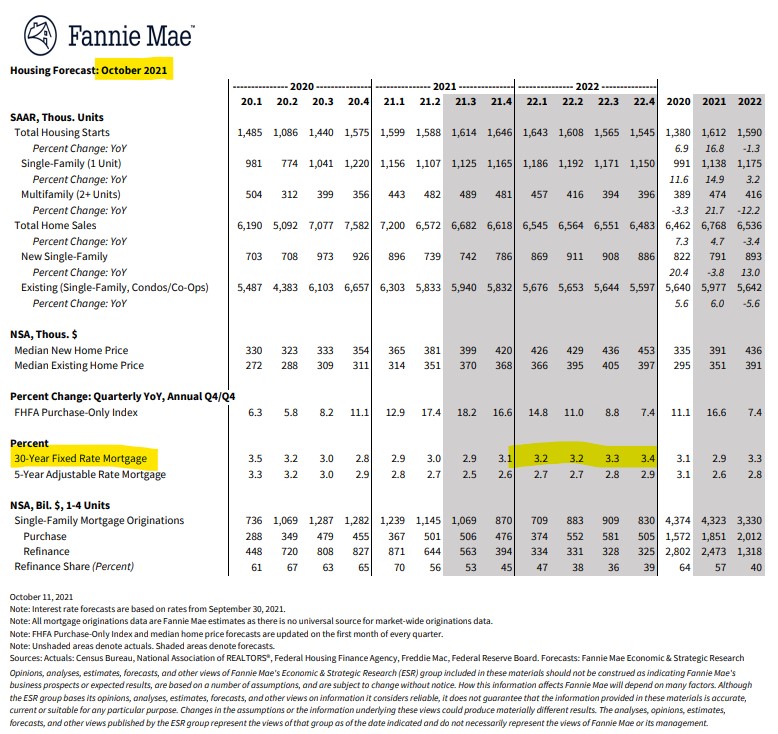

Rob Dawg and Garry might have to wait until next year before we have a chance of seeing a 7% mortgage rate, and those of us in the higher-priced areas should keep our focus on the 30-year jumbo rate. It will be what most financed buyers around the coast will be getting.

by Jim the Realtor | Sep 10, 2022 | Forecasts, Interest Rates/Loan Limits, Jim's Take on the Market |

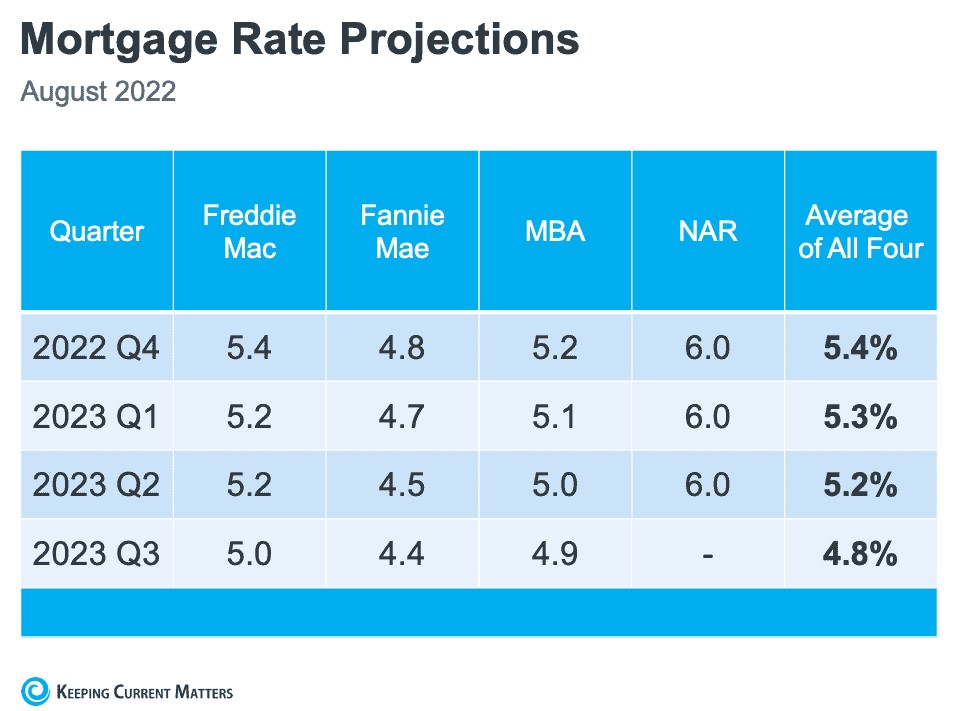

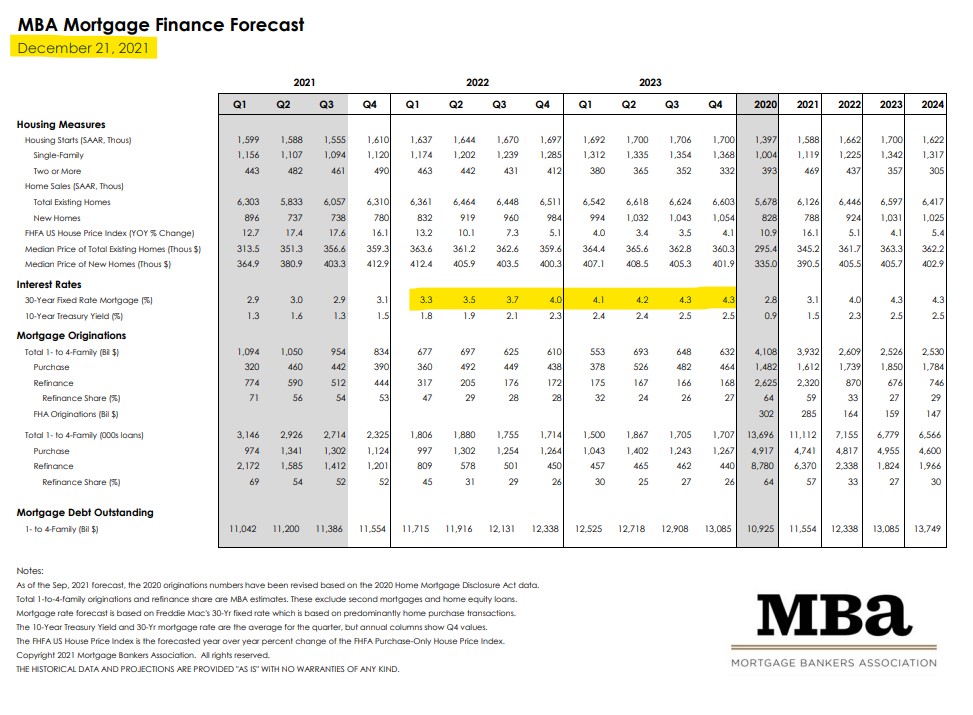

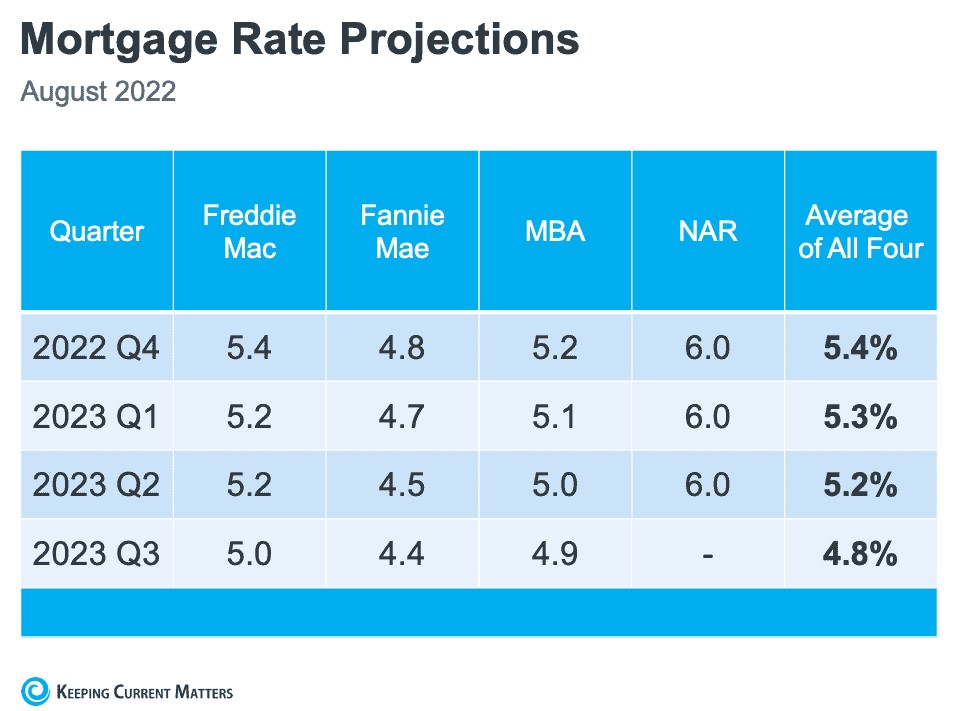

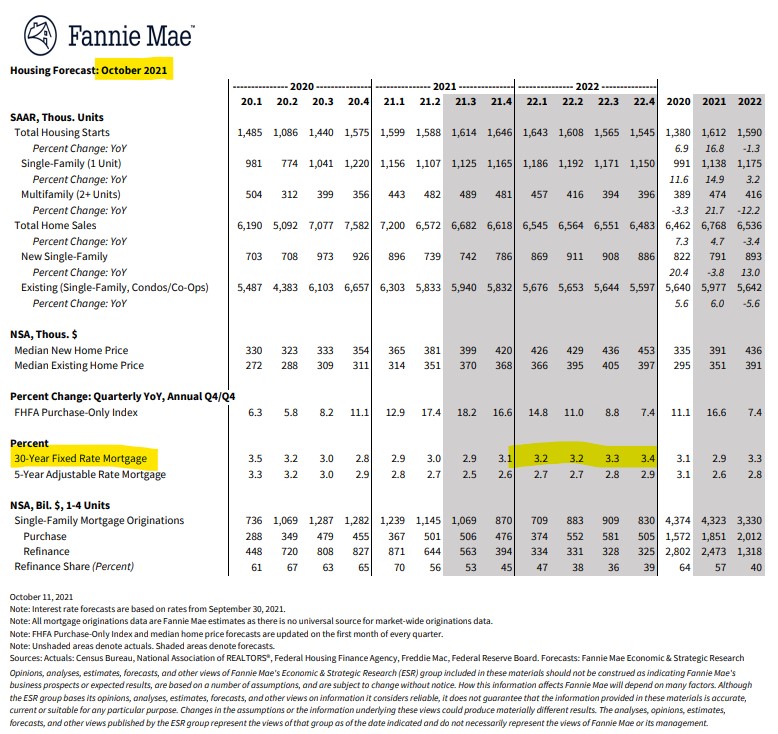

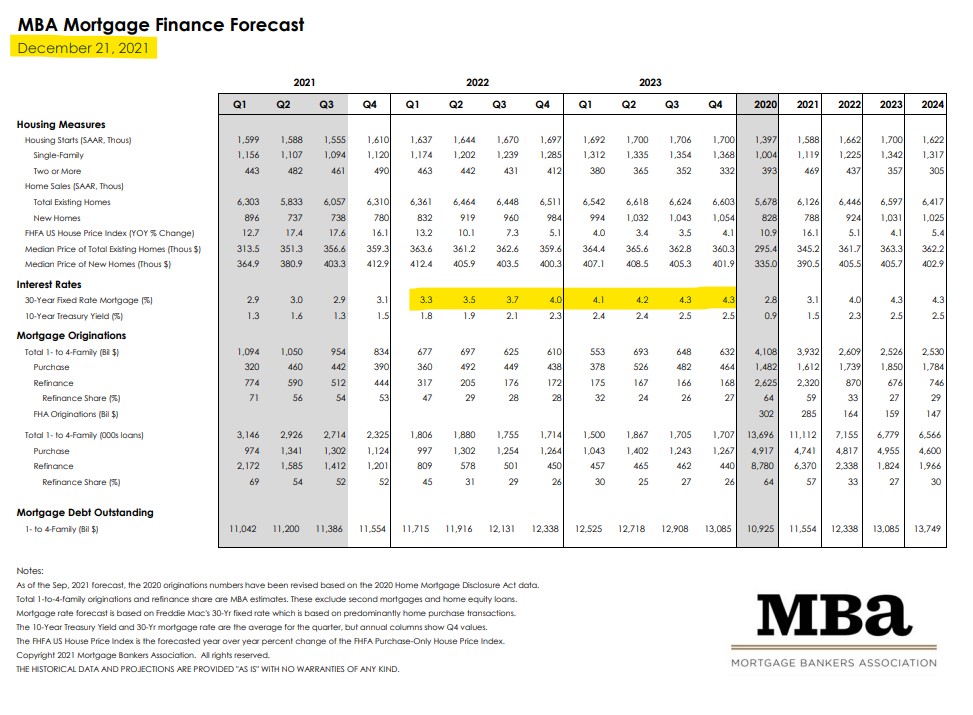

If rates would stay around 5% over the next four quarters, the market should digest it and get comfortable with the new era. But how reliable are these experts? After all, they are the mortgage business – shouldn’t their forecasts be pretty close? Well, hmm, no:

by Jim the Realtor | Sep 3, 2022 | 2023, Interest Rates/Loan Limits, Market Conditions |

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Trying to predict what will happen to our local real estate market in the short-term?

No surprise that mortgage rates will play a big role in how it plays out, and they have been extremely volatile lately. But it’s just not about affordability, and ‘losing’ buyers. They can always recalibrate by either looking at cheaper homes or cough up more down payment if they really need to buy a home. But will they?

The invisible impact on the market will be how buyers expect higher mortgage rates to convince sellers to lower their price. But sellers aren’t very empathetic, and most will go with their retail list price based on the highest comps ever recorded, and hope that cute young couple with 2.2 kids falls in love and just pays what it takes to win it.

If rates miraculously drop back down to 5% and under, then buyers won’t have a good reason to expect better pricing, and they will be tempted to give in and just pay what it takes. But if rates are 6% and higher, they have a rallying cry and the Big Standoff will be on.

How much lower will prices need to be to satisfy those buyers? They probably won’t have a number in mind, and the answer will just be ‘less’. It will likely end up being a binary decision – either rates are low enough that we’ll just go ahead and pay these prices, or we won’t.

When the bigger challenge is to find the right house, it will be most interesting to see if the superior homes – the real creampuffs – sit for long, or if they blow out to cash buyers or to those who care more about getting the right house, than the right mortgage rate.

If there is a steady trend of creampuffs selling, it will help to get more buyers to engage.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-09022022

by Jim the Realtor | Sep 2, 2022 | Coffee Bet, Doomer, Interest Rates/Loan Limits |

After mortgage rates went over 6% again yesterday, the doomers will be burying the real estate market over the next few months. You can see why – rates have been dropping for a generation; for them to now go up from 3% to 6% in a few months is unprecedented for today’s buyers:

But having the majority of buyers paying over the list price (especially those paying $100,000+ over list) was unprecedented too. Those who haven’t bought a house yet must be suffering from real estate whiplash today!

Where is it going to go now?

Is there any sort of precedent to reflect on? When this blog was in its infancy, I made the now-infamous Grand Poobah of Predictions on September 16, 2006 on how I thought the market was going to unravel. It was contested by many, and Rob Dawg issued his challenge which evolved into the Coffee Bet.

If you’d like to revisit history, scroll down to the bottom here and read the comments too:

https://www.bubbleinfo.com/category/coffee-bet/

Yesterday, I told Rob that I will post my latest thoughts on Monday, and asked him to do the same – or at least critique what I had to say. It will give me a couple of days to think of all the variables – which there are several now that have never been in play before!

Come back next week with your thoughts too!

by Jim the Realtor | Jul 28, 2022 | Forecasts, Interest Rates/Loan Limits |

The Fed did what they said they were going to do and raised their fed funds rate target by another 0.75%.

What happened to mortgage rates? They went down!

Read the story here.

Yes the -0.01% isn’t much, but didn’t every casual observer think mortgage rates were going to rise again? That we were heading for 6% or 7% or 8%?

Everyone is going to get used to mortgage rates in the 5s, and by springtime this will all settle down and we’ll get back to a relatively normal market again.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Late afternoon add – rates improved a lot today:

by Jim the Realtor | Jul 24, 2022 | Interest Rates/Loan Limits |

The traditional spread between the 10-year Treasury Yield and the 30-yr fixed mortgage rate has been 1.75%. Today it is 2.7%, which sure makes it look like the next Fed increase is already priced in. This week, we will see if mortgage rates will moderate and stay in the fives after the Fed bumps again!

When 10yr Treasury yields are dropping, mortgage rates are typically following, even if the proportion can vary. Mortgages definitely don’t benefit as much when it comes to overseas developments, but the sense of a big picture reversal is the same in either case. By Friday afternoon, the average mortgage rate was just a hair lower than those seen in early July. You’d have to go back another month to see anything lower.

Any conversation about big drops in rates requires an asterisk right now. Rate quotes can vary greatly depending on the scenario and the lender, but they’re not necessarily as different as they may seem. The reason is the role of “upfront costs” in the current market. Historically, it tends to make more financial sense to avoid paying additional upfront costs (aka “points”) in exchange for a lower rate. Many borrowers may still agree.

Nonetheless, points are packing a bigger punch than normal due to trading levels in the bond market, and that is having an impact on many loan quotes. For example, there are some scenarios where a single discount point can drop the rate by more than half a percent. Historically, that point would only be worth 0.25%.

There’s no universal recommendation here. If you find yourself comparing one quote to another, just make sure you’re taking the upfront costs into consideration.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-07222022