by Jim the Realtor | Oct 12, 2023 | 2023, Frenzy Monitor |

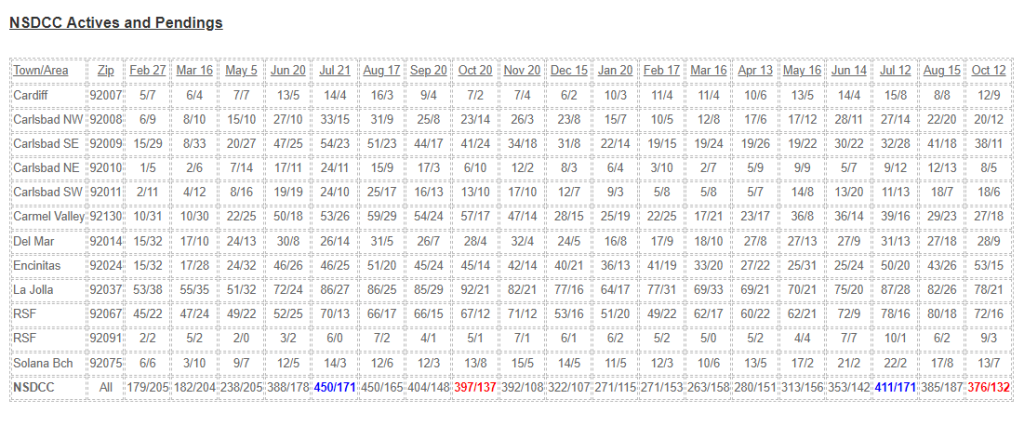

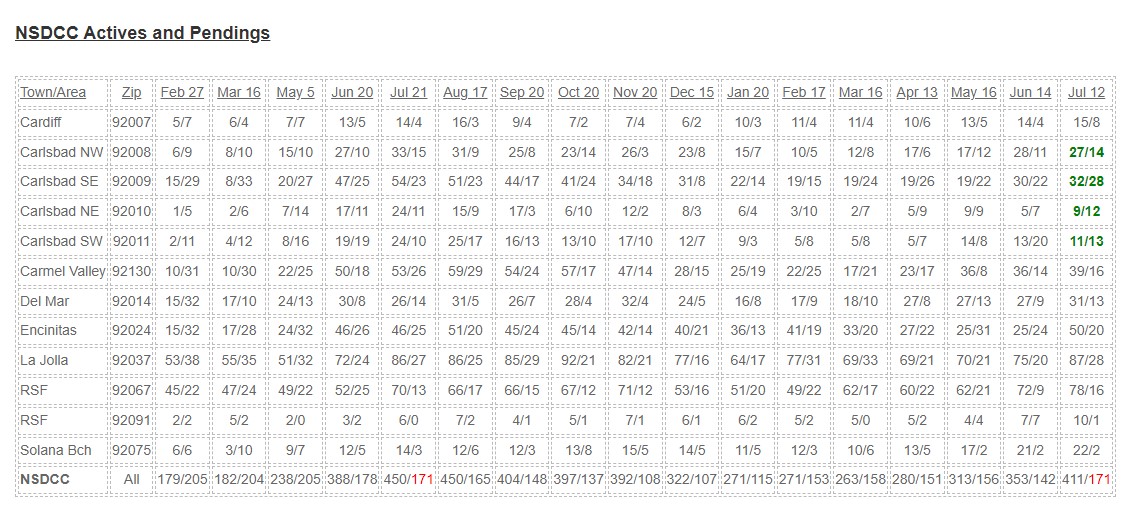

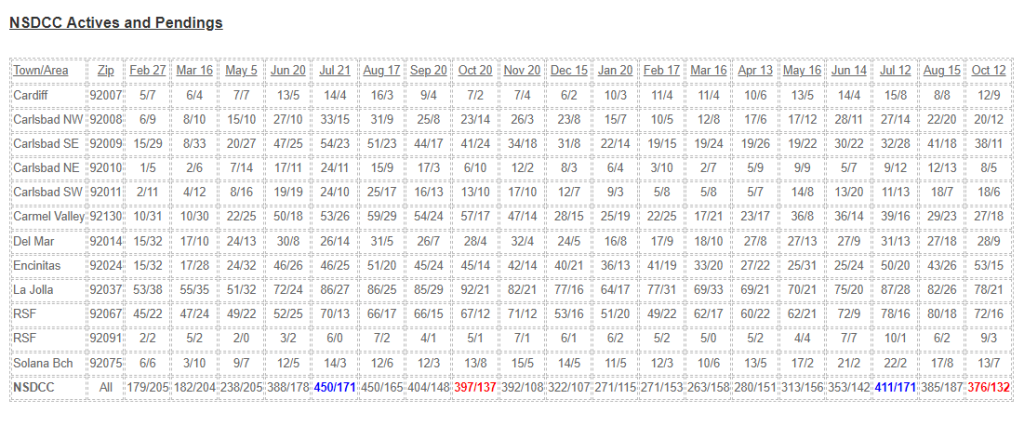

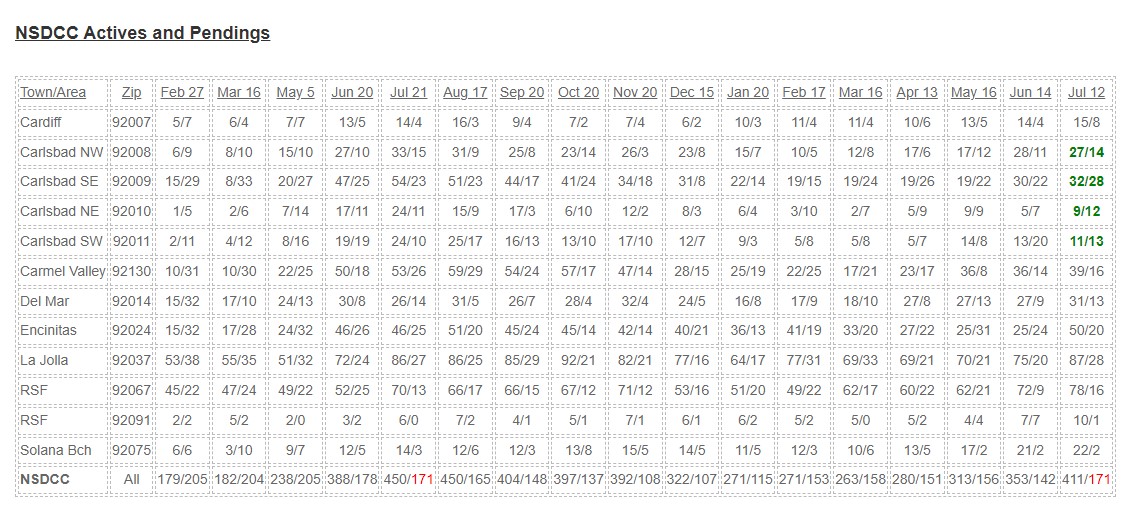

Here are the active and pending listings for each area.

We consider a ratio of 2:1 actives-to-pendings to be a healthy market, and five of the 12 areas are 2:1 or better, and seven of 12 are 3:1 or better. For everything we’ve been through, that’s pretty good!

Two areas (SE Carlsbad and Encinitas) are a little light on pendings compared to last year at this time, but price will fix that. It is remarkable how similar July and October were to last year, and the other months weren’t too far off either.

Will it be like this in 2024? Probably!

by Jim the Realtor | Oct 4, 2023 | 2023, Carmel Valley, Jim's Take on the Market, Why You Should List With Jim |

As we roll into the Lowball Season, we’re reminded of what happened in Carmel Valley at the end of 2022. Everyone’s home equity was built up fast and easy over the last 3.5 years, and the more desperate sellers might give it back in big chunks if they had to….and with 8% mortgage rates, they might have to.

How did it turn out last year?

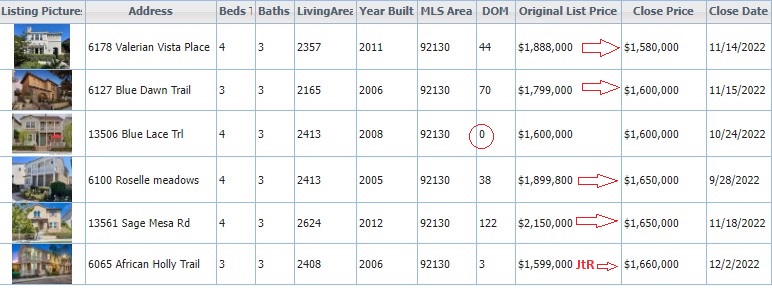

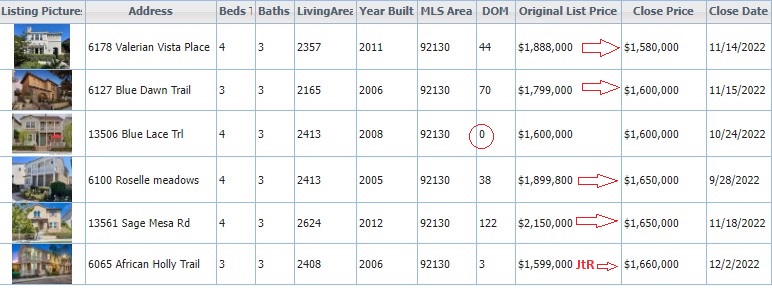

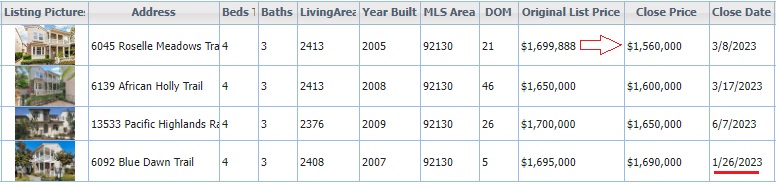

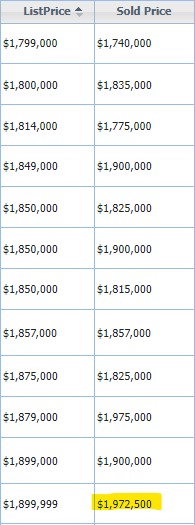

The fourth quarter of 2022 was brutal for the entry-level homes in Pacific Highlands Ranch:

The list pricing was fairly optimistic, and after 30+ days on the market, the lowballers came out. By the time my listing hit the market (the last on the list), our list price was revised down to $1,599,000 to ensure we would sell right away – and hopefully for more, which we did, and stop the trend.

Did the pricing bounce back this year?

The first sale of 2023 closed right away for $1,690,000, and it seemed like the comeback was underway. But then the next sale was $1,560,000 – and it has hampered the pricing ever since:

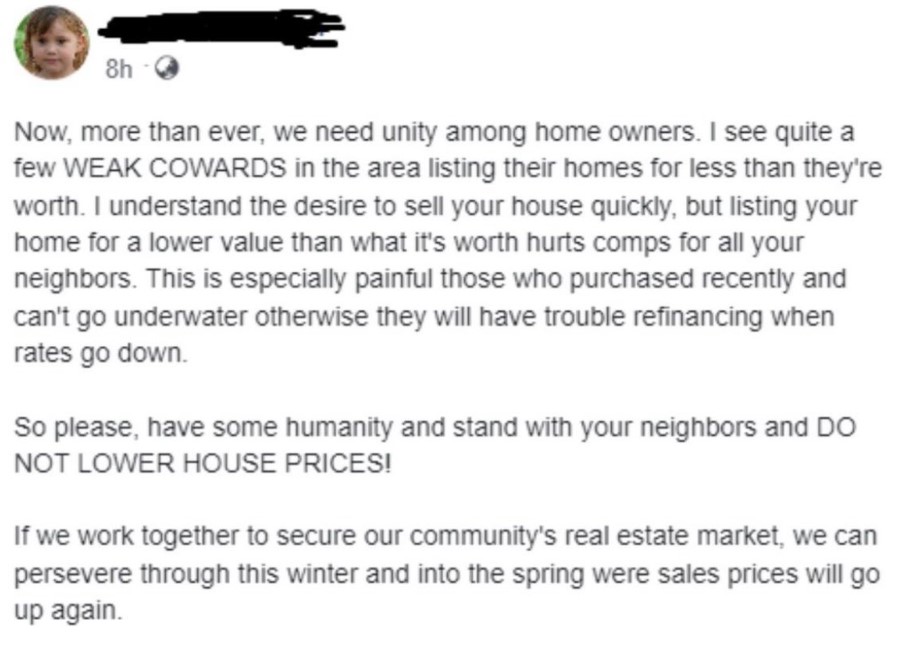

The big threat isn’t going to be foreclosures. It will be the equity-rich sellers who dump on price to get out – and they will impact future sales. A couple of lowballs can turn into a trend!

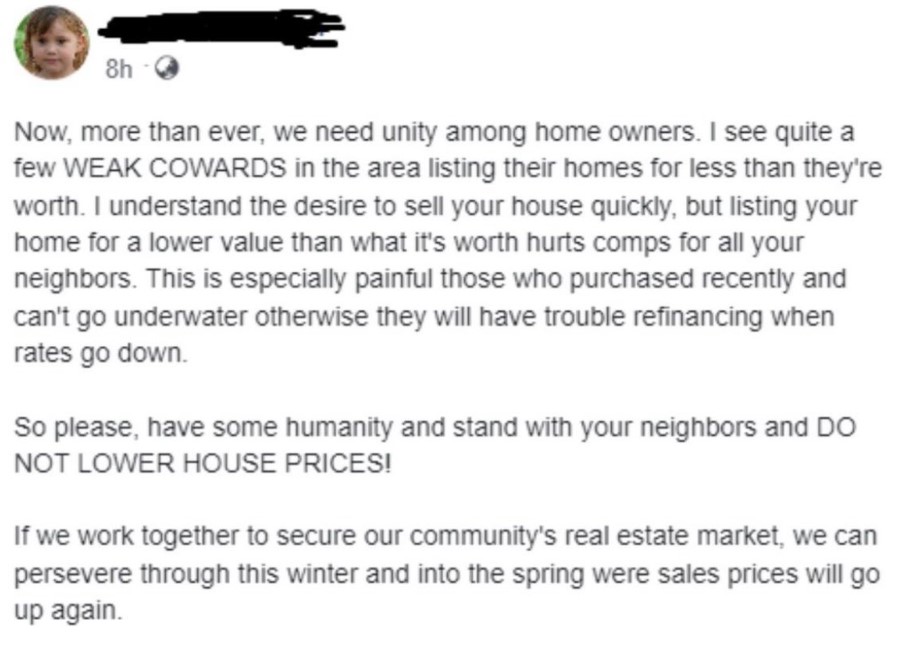

Letters like these probably won’t help either:

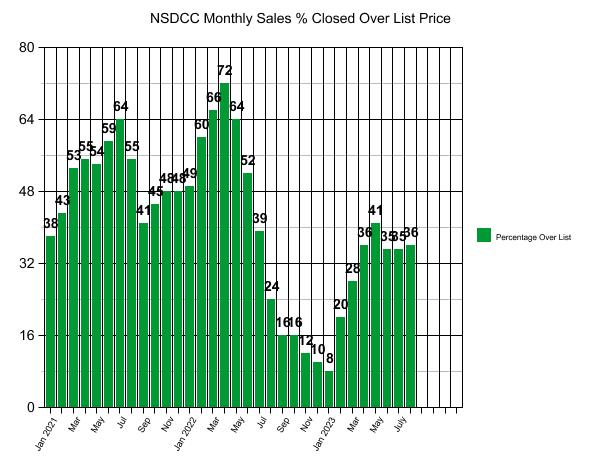

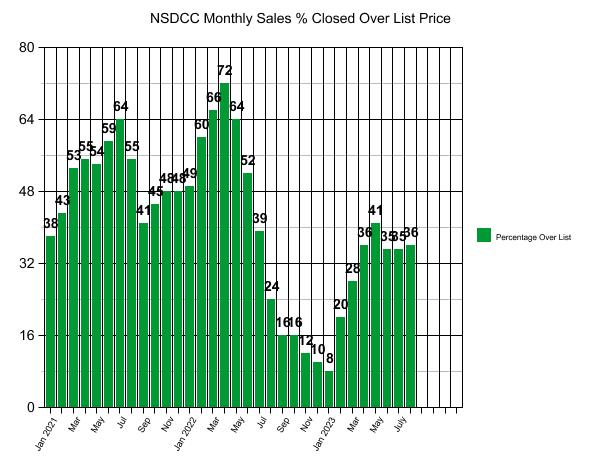

by Jim the Realtor | Sep 13, 2023 | 2023, Frenzy, Over List |

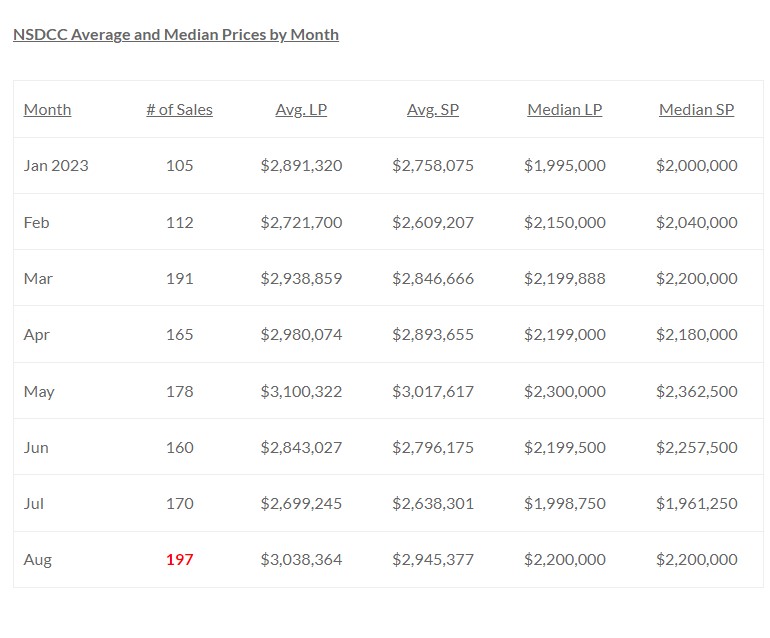

Given that mortgage rates have been above 7% since the beginning of July, it’s incredible to see August having the highest sales count for 2023!

September is looking pretty good too – there have already been 57 closings this month.

The pricing is holding up too. What a market!

It’s never been like this – Get Good Help!

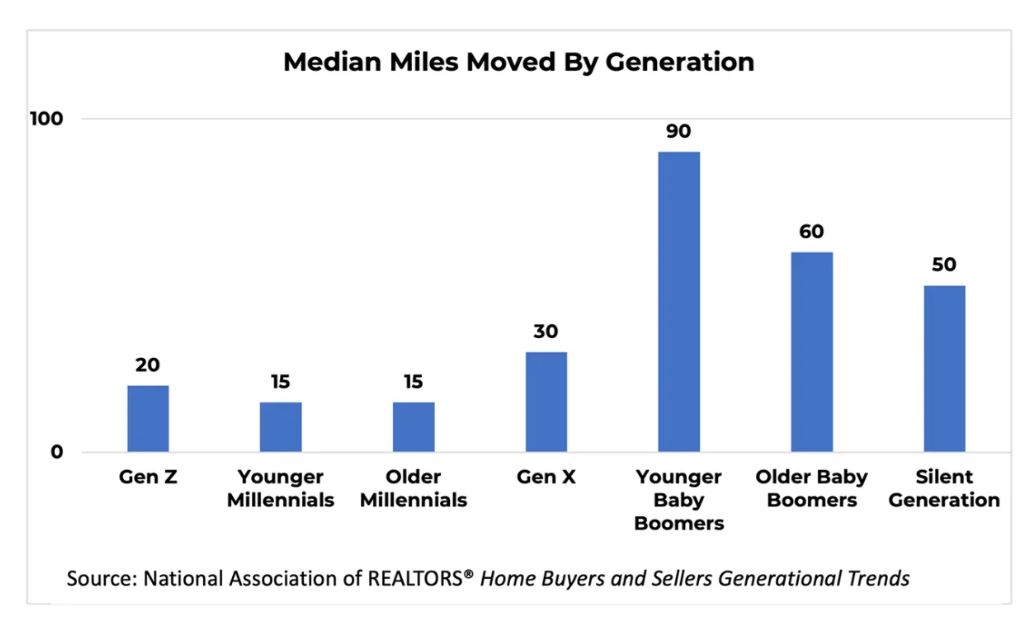

by Jim the Realtor | Aug 23, 2023 | 2023, Boomers, Market Conditions, Where to Move |

Unless you are among the very affluent, you need to move out-of-state to make it worth selling your home in San Diego. If that looks inevitable, do it while you are younger and can handle the challenge! Start by going through your stuff – your kids don’t want it and will dump most everything you leave behind.

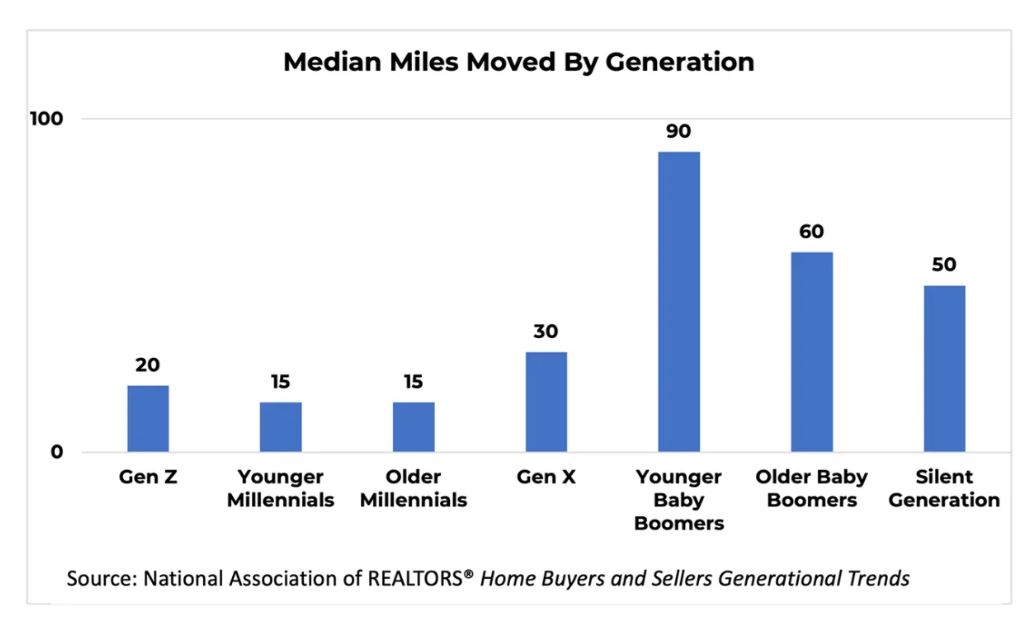

While the median distance moved in the 2022 Profile of Home Buyers and Sellers was 50 miles, one-quarter of buyers traveled over 470 miles to find their new home. Traditionally, buyers have stayed close to their past homes. From 1989 to 2021, the median distance moved was just 10 to 15 miles.

Based on this generational trend, it is not surprising that those who moved more than 470 miles from their past residence were more likely to be repeat home buyers. Just 11% were first-time buyers. This dispels one potential myth that has abounded in the last year: that first-time buyers are the ones making the move to find their first property far from their rental unit. It does happen, but it is more likely a repeat buyer who is making the distance move.

https://www.nar.realtor/blogs/economists-outlook/long-distance-movers-why-did-they-move-and-how

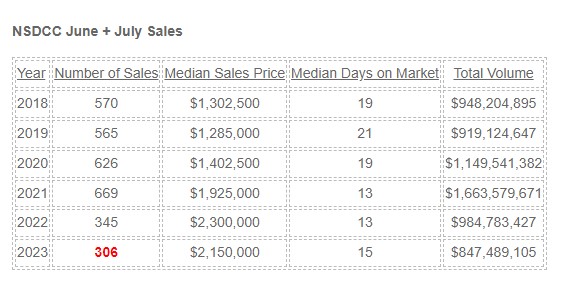

by Jim the Realtor | Aug 4, 2023 | 2023, Jim's Take on the Market, Realtor |

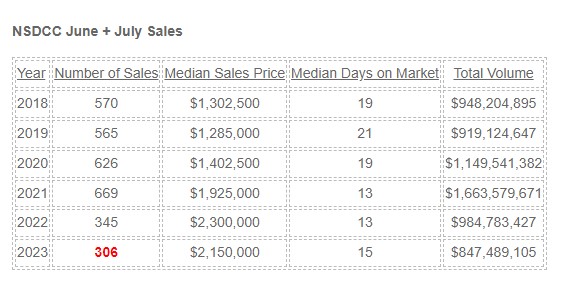

It’s good to see that last month had more sales (159 vs 147) than in June – which also had two more business days! Let’s combine the two months to soften the July drop median sales price and compare to previous years.

The plunge in sales has to be discouraging to potential buyers who can now only expect 2-3 chances per year to buy a desirable home in their preferred area of choice – and you can count on being beat out by a crazier buyer on at least one of those, and be victim to realtor shenanigans on at least one other. It happened again this week when the listing agent grabbed the first offer within 24 hours even while allowing other showings to motivated buyers, but then denied them a chance to submit an offer.

With that much frustration in the air, the pricing will likely stay elevated.

by Jim the Realtor | Aug 3, 2023 | 2023, Jim's Take on the Market, Sales and Price Check |

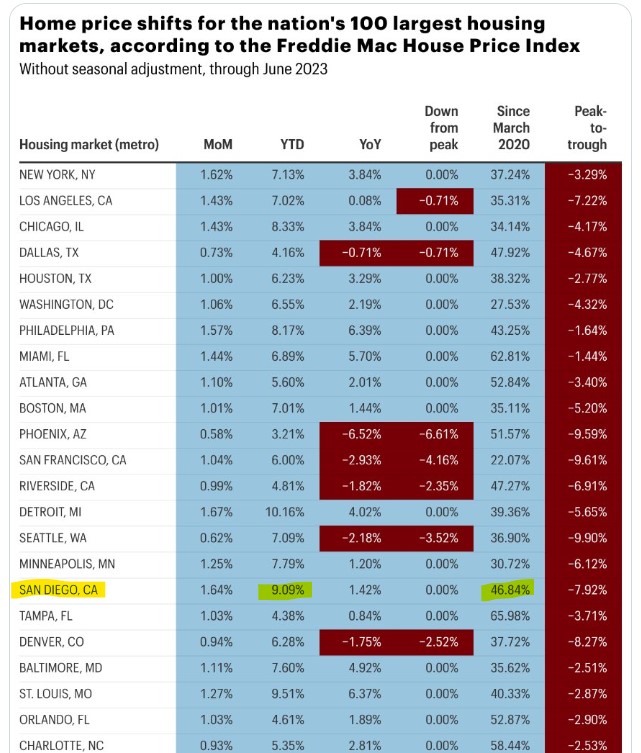

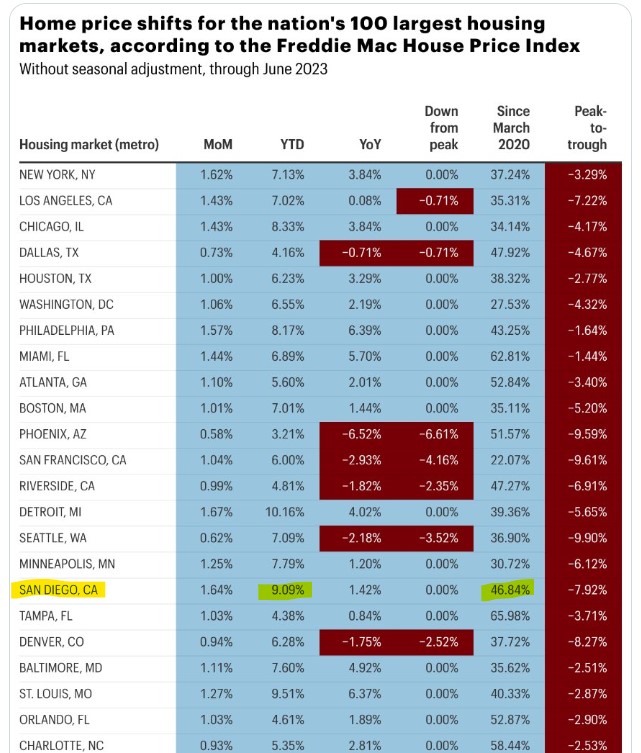

Of all the higher-end metros, San Diego is doing the best this year!

To see the rest of the Top 100 markets, click here:

https://twitter.com/NewsLambert/status/1686805363557888023

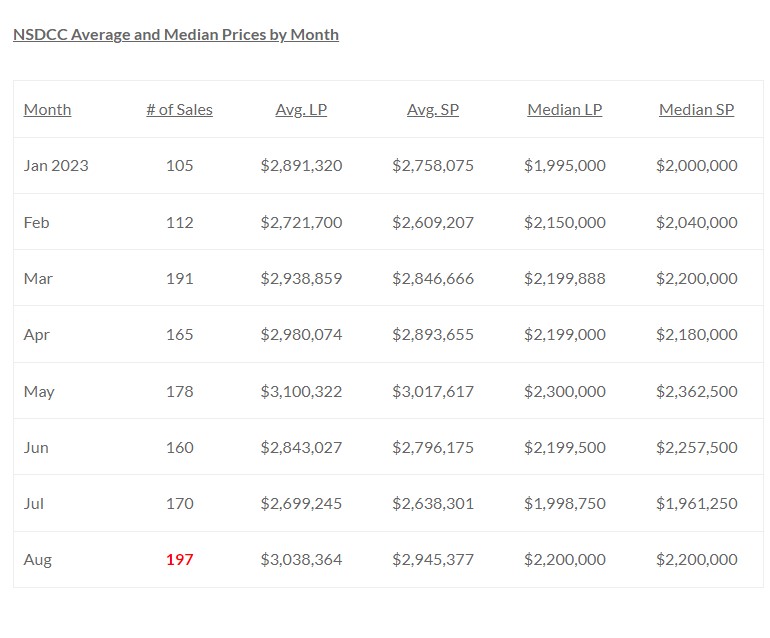

by Jim the Realtor | Aug 2, 2023 | 2023, Frenzy, Jim's Take on the Market, Over List |

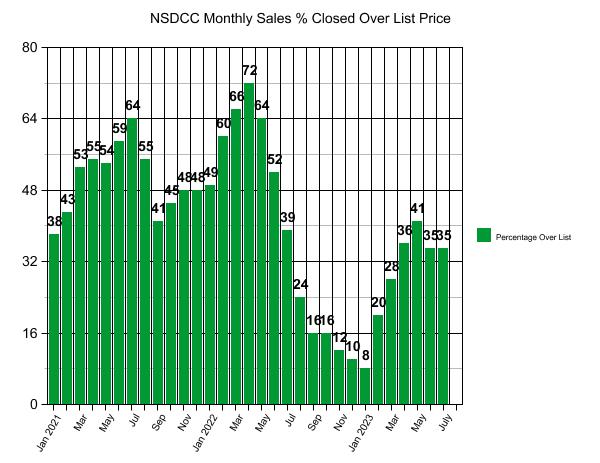

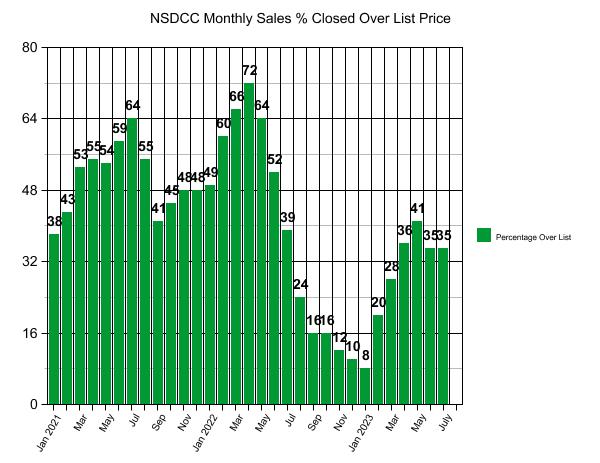

The average and median sales prices last month were similar to what they were in December, even though the same percentage of buyers paid over the list price.

It might make you think that this market is retreating quickly!

But look at the difference of the number of lower-end sales, and square footages:

The size of the houses weren’t that different, so what’s up?

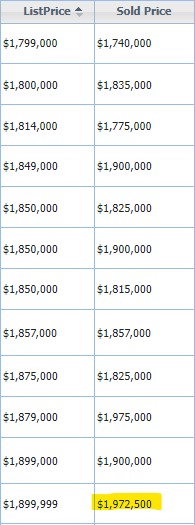

Buyers aren’t bidding up the prices like they were before. Here’s an example of those right under the median sales price last month:

Instead of overbidding by hundreds of thousands of dollars, buyers in July mostly stayed in their shoes and only offered a little over the list price. Expect that trend to continue!

by Jim the Realtor | Jul 18, 2023 | 2023, Bidding Wars, Frenzy, Jim's Take on the Market, Why You Should List With Jim |

We’ve received ELEVEN offers on our new listing at 7114 Columbine!

The five cash buyers have declined to go any higher, so the six financed offers will be competing today for the win. We sent all of them a highest-and-best counter with a 4pm deadline today. Meanwhile, any other agents who want to show and sell are encouraged to do so – we don’t stop the showings or offers, like most agents do.

We’re already $100,000+ over the list price!

by Jim the Realtor | Jul 14, 2023 | 2023, Frenzy |

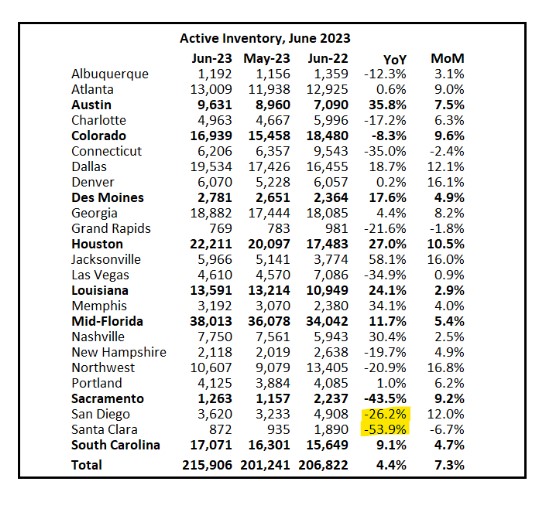

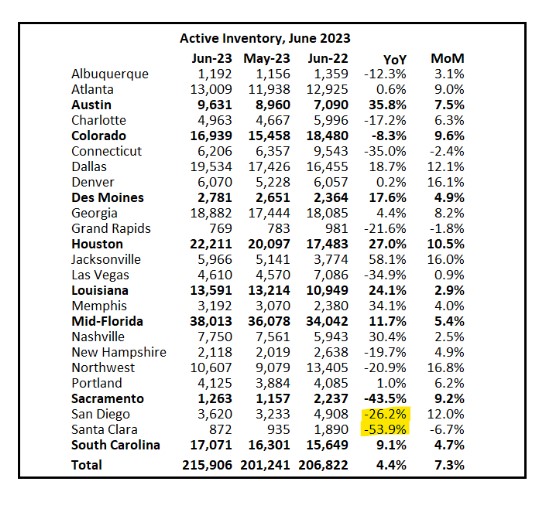

Though the local inventory has ticked up a bit, San Diego still has an extreme shortage of homes for sale.

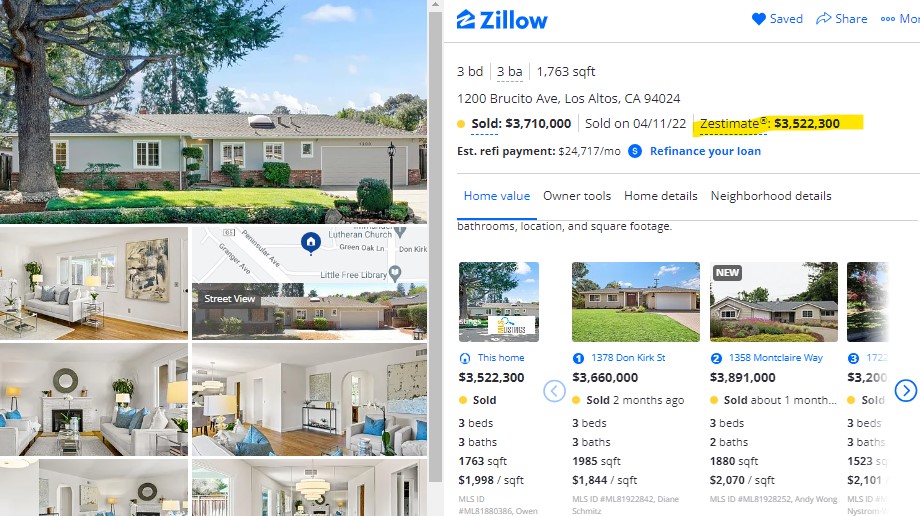

Santa Clara is probably the most interesting metro though. For all the stories about tech layoffs, there sure doesn’t seem to be a mass exodus – inventory is 53.9% lower than last year?

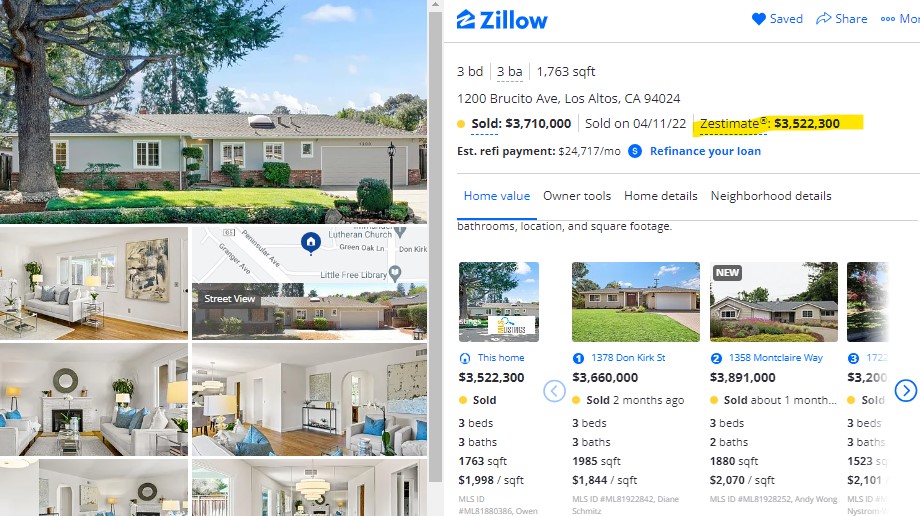

Prices seem to be holding up too. We’ve been using this house as our marker.

It listed for $3,195,000 on March 2, 2022 and was overbid substantially during the red-hot frenzy and closed for $3,710,000.

But look at the recent sales nearby. They look supportive of the overbid sales price paid during the frenzy!

But with their inventory way down, one thing to fear is fewer people moving here from the Bay Area! Could it be that the whole California market is slowing considerably? It could grind to a halt in 4Q23.

by Jim the Realtor | Jul 12, 2023 | 2023, Frenzy, Frenzy Monitor, Jim's Take on the Market |

The Carlsbad market has been surviving quite well – there are 14% more pendings today than last July.

The other areas are all above the 2:1 ratio of actives-to-pendings (our standard for a healthy market). The number of actives in Encinitas DOUBLED in less than a month!

Last July there were 171 pendings, and it’s the same number today!

The pendings should steadily decline like last year, and by December the count should be around 110.