Mid-Selling-Season

April felt busy though we had no new listings (the La Costa Valley listing hit on March 31st). Thankfully, there are more to come:

April felt busy though we had no new listings (the La Costa Valley listing hit on March 31st). Thankfully, there are more to come:

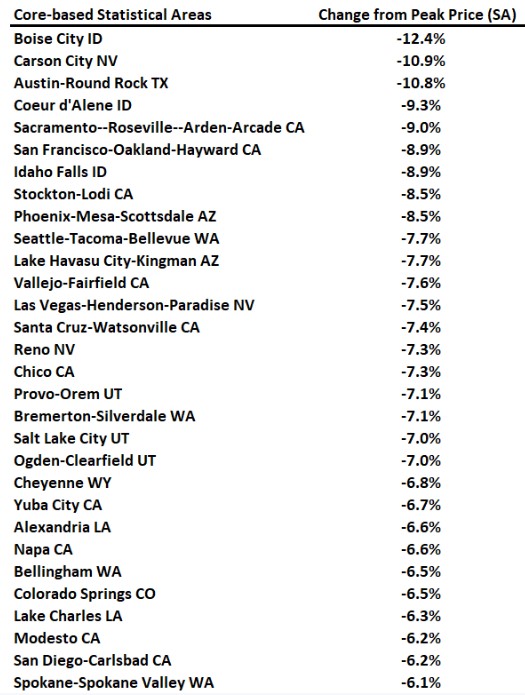

For those who are leaving San Diego and want to know where the best deals are, here are the metro areas ranked by their Freddie Mac HPI change from the peak:

Or how about a river town?

https://www.worldatlas.com/cities/7-most-charming-river-towns-in-california.html

This closed for $1,300,000 in April, 2019, and then sold again this week for $2,270,000 – almost a million more in just four years!

https://www.compass.com/app/listing/3312-james-drive-carlsbad-ca-92008/1267594068434581625

The doomers will love this article but no mention of heirs living in their inherited family home, instead of selling it – which around here should be a significant group:

Millennials are fueling a generational housing bubble that’s set to burst over the next decade as demand for homes falls off, according to researchers.

In a recent report from the Indiana University Center for Real Estate Studies and the Indiana Business Research Center, researchers said Millennials — who are between their mid-20s and early-40s, are in the prime-homebuying age — have pushed up home prices in recent years as demand outweighs supply.

But the situation will start to reverse over the next decade, as Baby Boomers begin age out of the housing market. Meanwhile, post-Millennial generations will be smaller as population growth slows.

That could lead to an excess of housing, potentially pushing down prices and sparking a crash in the real estate sector.

“Plainly put – a generational housing bubble is on the horizon. New housing built now to meet strong demand may sit vacant in a decade. Demand reversal will intensify by the mid-2030s, when the annual number of homes that seniors add back to the market is expected to be 40% higher than current levels,” researchers said.

The could be offset by policies that encourage seniors to age at home instead of nursing facilities, ease first-time home purchases, or boost immigration, the report added.

But population trends indicate that many housing markets will peak in the next decade, it cautioned.

“As Millennials pass through their first-home buying years and Baby Boomers through their last stages of life, the current period of strong demand will transition into a period of slowly declining demand,” the report said. “The industry must adjust current business decisions to this eventual changeover in market conditions or risk substantial oversupply and value loss in the housing market of the future.”

In the short term, industry experts have floated the possibility of a housing rebound over the coming year.

Home prices climbed month-per-month in February for the first time in seven months, according to the Case-Shiller data, and Goldman Sachs predicted prices could stop crashing as soon as mid-2023.

I like to promote my listings at the local broker meetings, just in case someone might have a buyer. It would be really beneficial if the big agents attended these meetings and participate like they do in La Jolla – the camaraderie alone is worth it. Then the open houses of the new listings later in the day help agents sharpen their market knowledge:

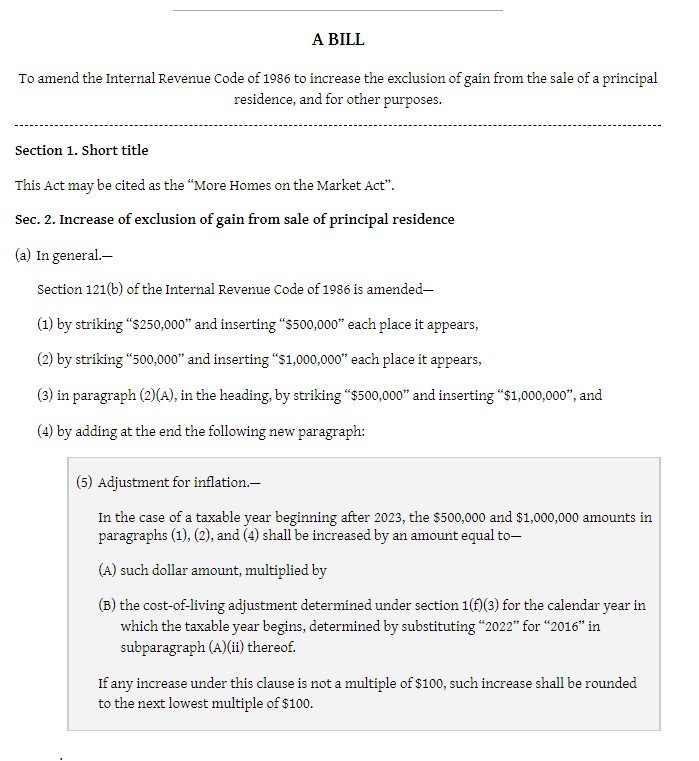

Congressman Jimmy Panetta (Monterey, CA) and Mike Kelly (PA-16) introduced H.R. 1321 – More Homes on the Market Act – which would double the capital gains exemption on the sale of a personal residence to $500,000 for a single filer and $1,000,000 for joint filers. This bi-partisan bill has been referred to the Ways and Means Committee.

This sounded really good until I found this – hopefully they will find a way:

Coming up on Saturday, April 29th! Here’s how they sounded last year:

https://www.adamsavenuebusiness.com/event-info/adams-avenue-unplugged/

For the buyers who want to live in a master-planned community with good schools, how bleak is it?

No one will be surprised to see the newer tracts hunkered down for another decade or longer, so let’s look at the older communities – those that are 20-25 years old. Those original owners are bouncing around in their empty nest, and should be cashing in and downsizing by now, shouldn’t they?

Yeah….no.

For homeowners who are planning their move carefully, April should be seen as the ideal month to list a home for sale. Yet look at the results:

The Carmel Valley tracts used were Belmont, The Breakers, and Lexington.

I know there are still a few days on April left this year, but it doesn’t look good for buyers so far!

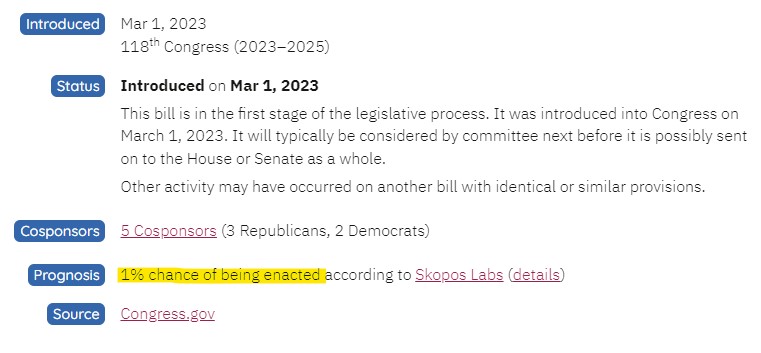

Bill charts the seasonal flow of the national median home price below:

His full article:

https://www.calculatedriskblog.com/2023/04/the-normal-seasonal-pattern-for-median.html

San Diego County doesn’t have the drastic weather changes which impact sales in other parts of the country, but there are some fluctuations….at least before Covid. This graph is interactive:

For buyers who want to pay less, the pricing is more favorable in the off-season. But you have to ask yourself – with the inventory being so bleak during the selling season, how much worse will it be in winter?

Thankfully, it only takes one!

We know that 80% of readers don’t go past the headlines, so the UT is challenging their customers lately to figure out the direction of the real estate market.

These are their headlines from the past two days:

Yesterday

Today

I have reached out to the author previously, but no response.

Get Good Help!