Beach Report

Five-hour open house today doing what I love to do – talk to interesting people about real estate!

Five-hour open house today doing what I love to do – talk to interesting people about real estate!

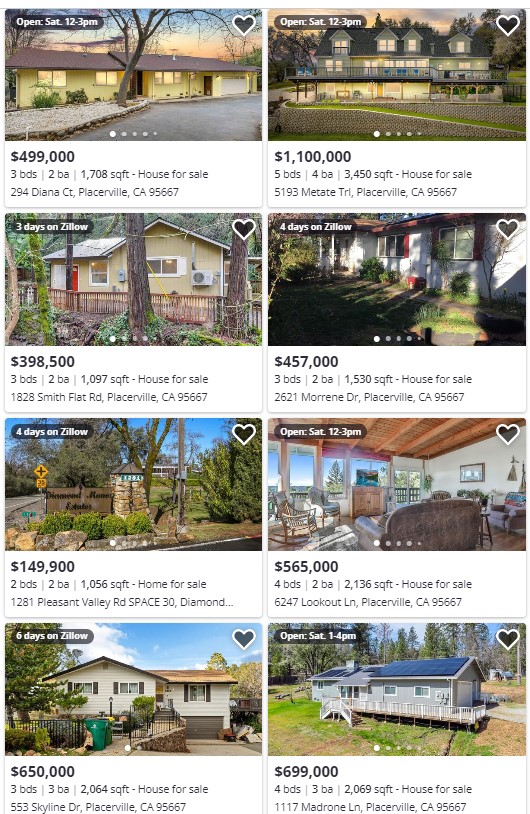

If you’d like to move to a small town in Northern California of 11,000 people with its own historic downtown area and yet close to other amenities, consider moving to Placerville:

More stress in the financial sector today is forcing the bond yields lower, which means mortgage rates should be dropping too. There is also talk about the Fed having to pivot and begin cutting rates this year.

Wouldn’t that be nice!

But would it fix real estate?

Everyone has said that the high rates have killed affordability, and that’s why the real estate market is in trouble. You see the estimates every week that buying the same house today is 30% to 40% more costly than it was a year ago, and that home prices need to plunge to compensate.

We also hear that the inventory is so scarce because 90% of homeowners have a mortgage rate under 4%. It’s been called the Golden Handcuffs because nobody would trade a 2.5% rate for a 7% rate.

Jay Powell said he is going to cause a real estate reset, but admitted that he doesn’t know what to expect.

Whether he causes a recession or a banking meltdown, rates might come down some day. Will that save us?

Specifically, if rates came back to 3%, would it save real estate?

No, because rates aren’t our biggest problem here. Our biggest problem is the lack of inventory, because 1) it’s too difficult to find a better home locally, and 2) nobody wants to leave the area. As a result, everyone has bought their forever home here (whether they knew it or not), regardless of rates.

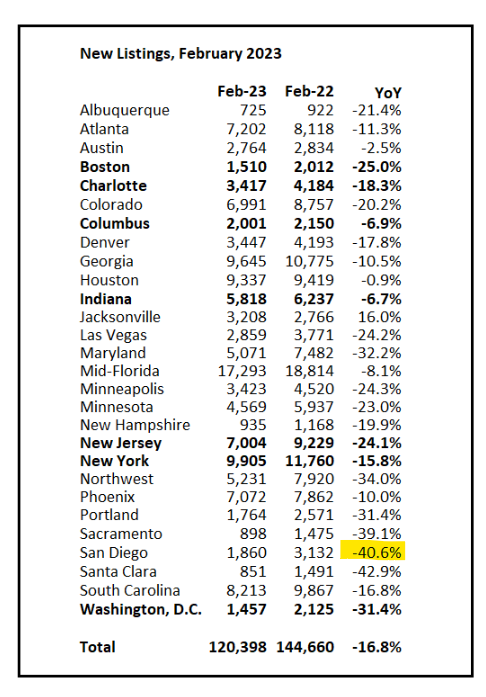

Look at Bill’s chart above. San Diego and Santa Clara consistently have the worst inventory numbers.

Rates and prices will bounce around, but it will always be tough to move because of the lack of inventory – and here it gets worse every day.

The low inventory is feeding on itself now, because the first-timers and out-of-towners who don’t own a home here yet are so frustrated that they will outbid locals who already own a home here.

It’s why lower rates won’t change our inventory. Heck, even higher prices didn’t cause more people to sell, and now, just about everybody won’t sell at ANY price. Yikes!

At what price are you a seller?

See what I mean!

Cute & cozy beach bungalow in front, plus a 2br/2ba ADU in back with ocean views! The most exclusive real estate in the world is within one block from the beach, and its value is soaring!

Garfield condos selling for $2,000,000-$2,500,000, Garfield triplex closed at $3,329,000 ($1,180/sf), Terramar and Ocean Street teardowns selling for $2,000,000+, Shore Drive over $3,000,000, Encinitas east-side of Neptune over $4,000,000, Solana Beach teardowns selling for $3,800,000 and $3,900,000, and Del Mar is over $5M! With no inventory, how many more of these will be under $3M? Zoned duplex – you could build two new homes!

When the rest of the world has gone mad, you want to own real estate one block from the Pacific!

3831-33 Garfield St., Carlsbad

2br/1ba bungalow in front, and 2br/2ba unit in back for a total of 4br/3ba, 2,278sf

YB: 1950

LP – $2,600,000

Open 12-3pm Saturday & Sunday March 25 & 26!

https://www.compass.com/app/listing/3831-33-garfield-street-carlsbad-ca-92008/1273282660568118209

Open 12-3pm Saturday & Sunday March 25 & 26!

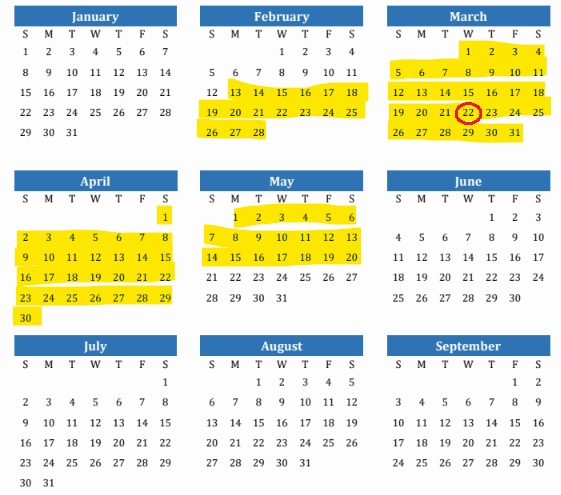

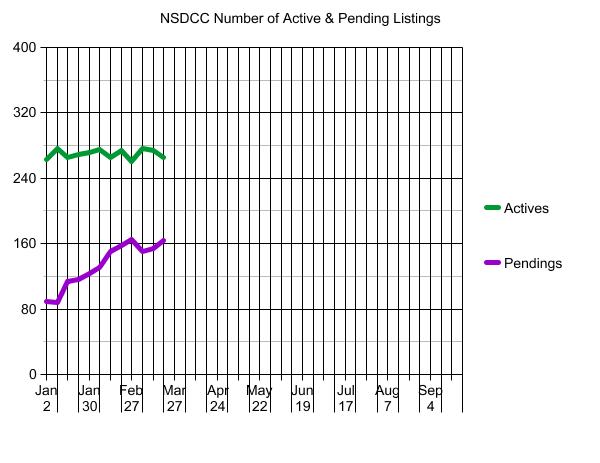

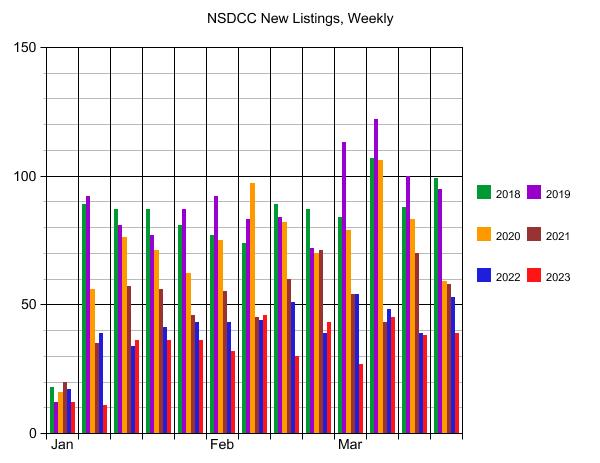

I know that season of spring just started this week, but our home-selling season has been underway since the Super Bowl. It usually lasts until the graduation season starts in mid-May, then Memorial Day is the first long weekend in a couple of months. After that, people wil get busy with vacations and the market gets soggy as the unsold inventory starts piling up.

It means we have about eight weeks left of solid home-selling time.

While it was predictable that potential sellers would adopt a wait-and-see approach in early-2023, we can only hope they’ve liked what they’ve seen so far and will be coming to market in the next couple of months. This year’s NSDCC inventory has been 20% lower than last year (which was the previous record low).

Let’s go around the block and identify some of the action:

Davidson’s Starboard tract in LC Oaks – the neighborhood where I said we won’t see another house sell for less than $2,000,000 (last two sales in 2022 were $2,250,000 and $2,150,000). The only listing this year priced at $2,899,000 went pending in 4 days.

La Costa Valley – The first La Costa Villages tract built in the late-1990s with 1,073 single-family homes – shouldn’t there be some empty-nesters leaving? Four listings this year and only one under $2,000,000.

La Costa Ridge – One of the most expensive LCR houses ever was listed last year for $3,599,000 with no takers. They relisted last week for $3,748,800 and went pending in five days.

Encinitas Ranch – Between Jan 1-Mar 21, there were 10 listings last year, and five this year.

Carmel Valley – Between Jan 1-Mar 21, there were 90 listings last year, and 52 this year. The median list price is 3% lower this year.

You get the picture – fewer and fewer sellers. The total sales between La Jolla and Carlsbad are down about 25% YTD compared to the same time last year. But with inventory also down 20%, it means the demand is only slightly less than it was at peak frenzy when rates were half what they are today.

Hopefully there will be a surge of new listings over the next eight weeks, because the second half of the year could slow to a crawl without more homes to sell.

I was going through some old footage and found these – and I’m not sure they’ve been seen before:

For those who don’t know, our daughter Kayla worked worked with us for five years before moving to Manhattan in 2018, where she’s a realtor. Here is her Instagram account (she is a great agent!): https://www.instagram.com/kaylaklinge/

She’s been doing real estate videos for ten years!

A great quote about higher-end listings from this free WSJ article:

Tomer Fridman, a luxury agent with Compass said the prices on some of the homes were exorbitant in the first place, so the reductions represent a long-overdue correction. “When you do a price adjustment at this level, that seller has to make it impactful,” he said. “You have to show you mean business.”

Once a home is for sale but not selling, how do you know what to do? Just dump on price? Lower in small increments and risk irritating buyers? Isn’t there a guide somewhere?

Both buyers and sellers can apply my List-Price-Accuracy Gauge:

Once on the open market, if you are……

It’s nothing personal, it’s just a simple guide to know how close you are to selling.

The serious buyers rush out the first week to take a look, but after that it’s crickets, with only an occasional visitor. It is tough for sellers to cope, or make adjustments. But once the initial urgency has expired, you have to do something – don’t just sit there.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

How quickly should sellers make adjustments? The DOM clock is ticking!

0-14 days on market – Hot property, sellers have max negotiating power.

15-30 days on market – Buyers get suspicious, want to pay under list.

30+ days on market – The jig is up, and buyers expect deep discounts.

After being unsold for two weeks, sellers will suspect that something is wrong. But it is natural to resist changing the price and instead blame everything else.

Sellers, and agents, need to shake that off and act quickly to keep the urgency higher. The first price reduction should be for at least 5% and happen in the first 15-30 days for maximum effectiveness. If the home doesn’t sell in the next two weeks, then another 5% is in order, and by then the fluff is eliminated.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Where do sellers go wrong? They don’t properly price in the negatives.

Typically sellers just pick apart the comps to convince themselves why their home is the best around, and then settle on a list price that will show everyone who’s the boss. If you don’t have any negatives, then you probably will get your price! But typically sellers are forced to come to grips with the negatives of their house, and adjust accordingly.

Do sellers have to lower their price? No, not neccesarily.

There are other alternatives:

1. Make your house easier to show. Listing agents who insist on buyers jumping several hurdles just to see the home aren’t realistic about today’s market conditions. Make the home easy to see!

2. Fix the problems. New carpet and paint is the best thing you can do: 1) it looks clean, 2) it smells new, 3) you have to clean out your house to install it, and 4) you are managing a business transaction now – it is the logical solution. Utilize staging too.

3. Improve the Internet presence. Have at least a 12-25 hi-res photos and a simple youtube tour.

4. Wait for the market to catch up. If unsold for 60+ days, cancel and try again later – probably next year.

5. Reset the Days-on-Market stat. As long as the MLS allows agents to refresh their listings, then it’s in the best interest of the seller to reset the DOM. It is a gimmick, and instead sellers should concentrate on creating real value for buyers – that’s what will cause them to pay more.

The longer it takes to sell, the more discount the buyers will be expecting – usually about a 1% off for each week on the market. When other homes are flying off the market, the buyers’ obvious conclusion is that your price is wrong, and they load up the lowball offers.

Even if you complete one or all of the five ideas above, don’t be surprised if you need to lower the price too. Keep it attractive!

When Bing Crosby and the other Hollywood guys started racing horses at the track in Del Mar, there was an aiprort nearby that made the excursions from Burbank to the Turf by the Surf much easier. Think if the airport was still in use!

https://www.sandiegoreader.com/news/2013/jan/23/stringers-del-mar-racetracks-long-lost-airport/

It’s natural for people to wonder how this will all play out.

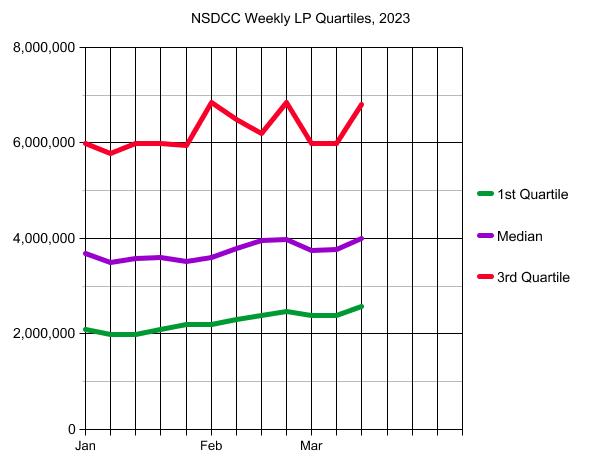

The Fed raising their rate until they crush inflation (and everything else), home prices are higher than just about anyone can afford, and inventory levels so low that prices will probably keep trending higher too.

How could this all stay afloat?

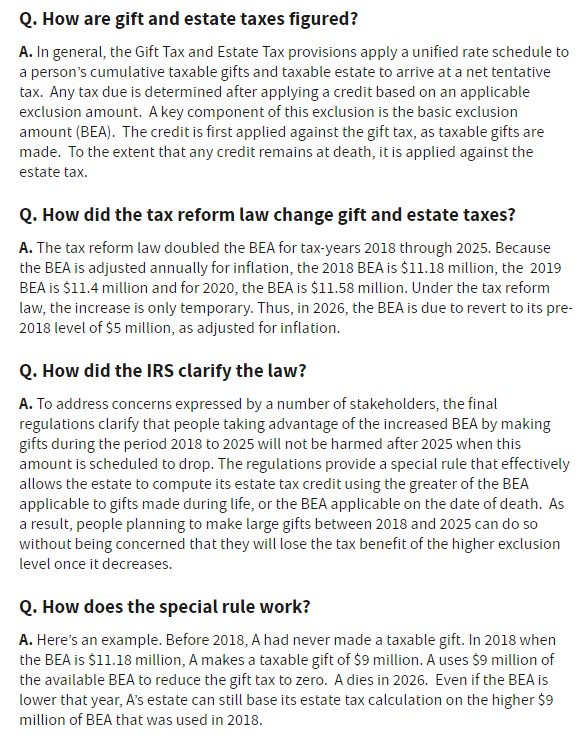

We are already in the midst of the greatest wealth transfer in the history of the world. Unless there are changes in the law, those who have accumulated between $5,000,000 and $11,000,000 will be expediting their distributions over the next three years to save on taxes before the limit is lowered in 2026:

https://www.irs.gov/newsroom/estate-and-gift-tax-faqs

The free-and-easy money has already been flooding into our real estate market. Back in the old days, the cash buyers always demanded a discount – but today the craziest sales are to buyers paying all-cash.

With the gift and estate taxes changing in 2026, it should continue, and possibly increase.

Until there is a significant increase in inventory, we won’t know how the current market conditions are affecting the demand, if at all. I thought we’d get off to a sluggish start, but this is shockingly low:

Total NSDCC Detached-Home Listings, First 13 Readings of the Year

2018: 1,067

2019: 1,110

2020: 932

2021: 670

2022: 545

2023: 431

This is how the new listings look on a weekly basis:

Mortgae rates have improved considerably, and now buyers can get a rate in the fives, instead of the sevens, which sounds attractive. But if there aren’t enough quality listings, who cares?

Lower rates should mean that buyers can get a little more for their money, but sellers want to squeeze some of that benefit too:

More listings are needed – let’s go sellers!