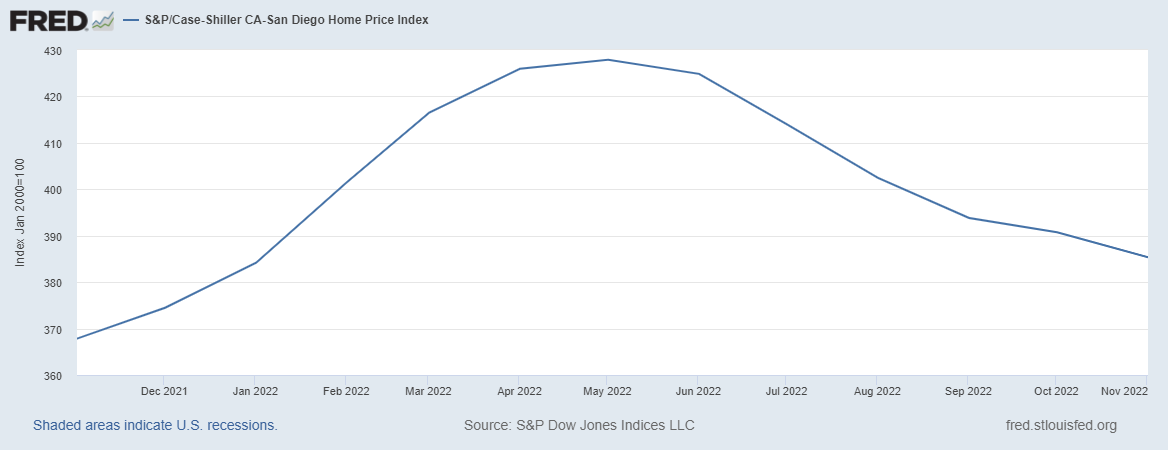

Today’s local Case-Shiller reading for November is the fifth in a row that reflects the much-higher mortgage rates. The index has dropped 9% since May – don’t be surprised if in the future we see a similar trend of enthusiasm in springtime, and doldrums in the off-season:

San Diego Non-Seasonally-Adjusted CSI changes

| Observation Month | |||

| Jan ’21 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| Jun | |||

| Jul | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov | |||

| Dec | |||

| Jan ’22 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| Jun | |||

| Jul | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov |

If the index keeps dropping over the next few months (likely), it should mean that it will get down to the late-2021 numbers. Will that be enough to impress buyers that prices are reasonable now? Or will they just go out and buy because it’s springtime?