The frenzy wasn’t going to last forever.

Coming off the initial covid months, everyone thought the red-hot market was an acceptable reaction to the way our world had changed. But it’s gone too far, and somebody had to do something – and the Fed is going to do it again tomorrow, which will continue the rise in mortgage rates.

It means sales are going to tumble, which is nothing we can’t handle.

Here’s how it looks so far:

NSDCC June Sales

2017: 360

2018: 299

2019: 282

2020: 274

2021: 357

2022: 61

Currently there are 198 homes in escrow, and 68 of those were marked pending this month.

Of those that went pending prior to June 1st, let’s guess that 100 of them will close in June – and there might be a few others that are just coming together this week with a quick close date in June too.

It will make for around 180-200 NSDCC sales this month! It’s quite a bit lower than usual, but we’ll survive.

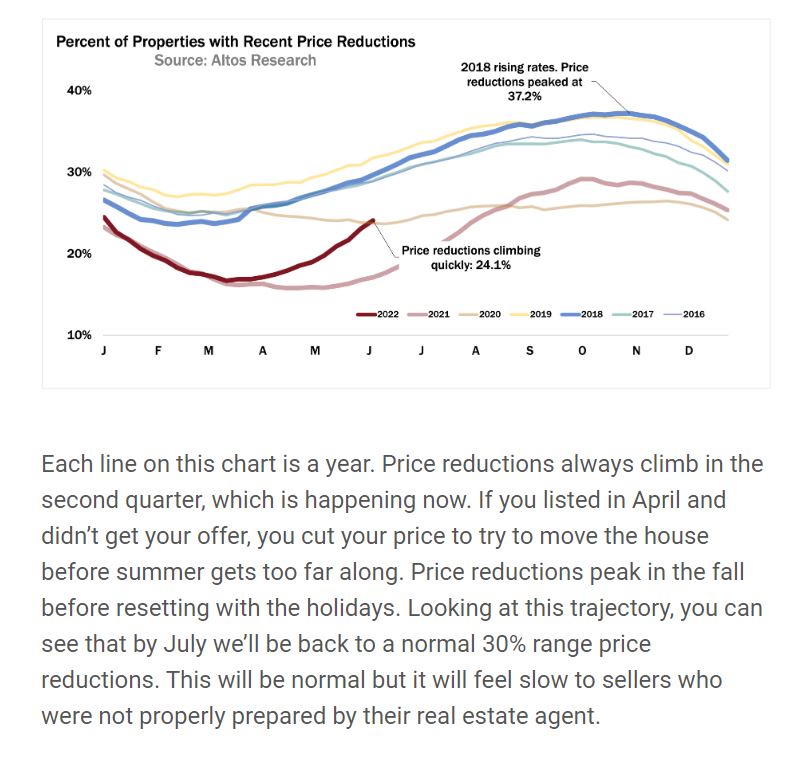

We’ll have more unsold listings, longer market times, price reductions, and fewer sales – it’s all part of the recalibration! Additional price reductions are an unreliable indicator because you don’t know how crazy the recent list prices were in the beginning, and they have never been so optimistic, even for the frenzy.

The closed-sales pricing will be the last thing to change, if at all.

I’m sticking with my +/- 5% for NSDCC pricing here in Plateau City.

The 10-year Treasury yield rose to its highest level in more than a decade as investors continued to assess the prospect of the Federal Reserve taking the most aggressive step yet in its fight to lower soaring inflation.

The yield on the benchmark 10-year Treasury note was last up 7 basis points to 3.44%, after breaking above 3.45%. That marks a high not seen since April 2011. The 2-year yield rose 14 basis points to 3.425% while the 30-year Treasury bond was last up 5 basis points to 3.423%. Yields move inversely to prices, and a basis point is equal to 0.01%.

After ending May at 2.74%, the 10-year yield has rocketed higher this month as hot inflation readings caused investors to dump bonds and ratcheted up their bets for aggressive Fed tightening. The 10-year is also up sharply from where it started 2022 at — 1.51%.

We’ll survive this – I think we were top-heavy anyway.

Layoffs hit the brokerage world Tuesday, with Compass and Redfin announcing they were cutting hundreds of employees amid a cooling housing market and stock market correction.

Compass’ cuts amount to 10 percent of its staff, or about 450 employees, according to SEC filings. The firm is also winding down Modus Technologies, the title and escrow arm it acquired in 2020.

The company will also pause mergers, acquisition activity and new market expansion for the rest of the year.

Based on recent news, it seems that a lot of companies are building up their cash reserves by laying off staff and getting ready to go into hunker down mode. “By the pricking of my thumbs, something wicked this way comes!”