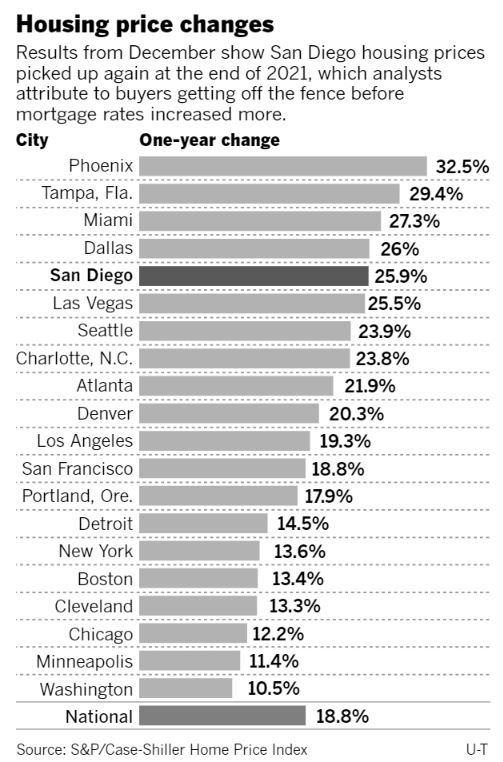

San Diego had the fifth highest year-over-year gain in 2021, behind metros with much lower price points (Phoenix, Tampa, Miami, and Dallas).

Our month-over-month gain in December was #1 nationwide (tied with Miami).

San Diego Non-Seasonally-Adjusted CSI changes

| Observation Month | |||

| Jan ’20 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| Jun | |||

| Jul | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov | |||

| Dec | |||

| Jan ’21 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| Jun | |||

| Jul | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov | |||

| Dec |

The experts have run out of superlatives, and roll out the same old explanations to describe the uptick in December – which was really the third month of the ramp-up into 2022:

Home prices rose 18.8% in 2021, according to the S&P CoreLogic Case-Shiller US National Home Price Index, the biggest increase in 34 years of data and substantially ahead of 2020’s 10.4% gain.

All regions saw price gains last year, but were strongest in the South and the Southeast, each up over 25%. Phoenix, Tampa and Miami reported the highest annual gains among the 20 cities in the index in December. Phoenix led the way for the 31st consecutive month with prices in December 32.5% over the year before. It was followed by Tampa with a 29.4% increase, and Miami with a 27.3% increase.

“We continue to see very strong growth at the city level,” said Craig J. Lazzara, Managing Director at S&P DJI. “All 20 cities saw price increases in 2021, and prices in all 20 are at their all-time highs.”

Over the past several months home prices have been rising at very high, but decelerating rates, said Lazzara. But that deceleration paused in December.

Lazzara said that strength in the US housing market is being driven in part by a change in location preferences as households react to the pandemic.

A persistent low inventory of homes dropped to record low levels in December, according to the National Association of Realtors. In the face of continued strong demand, prices were pushed higher. Newly constructed homes are in the pipeline, but a long-running shortage in supply combined with the lingering effects of the pandemic mean it will take years to meet demand.

“More data will be required to understand whether this demand surge simply represents an acceleration of purchases that would have occurred over the next several years rather than a more permanent secular change,” Lazzara said. “In the short term, we should soon begin to see the impact of increasing mortgage rates on home prices.”

Mortgage rates, which had risen only gradually since August, began to abruptly climb in late December closing in on the 4% threshold for a 30-year fixed-rate mortgage.

“Home prices continued to surpass expectations in December, but a marked change may be ahead for growth as rising mortgage rates eat into homebuyer purchasing power,” said Danielle Hale, Realtor.com’s chief economist. “While typical asking prices continue to accelerate, the pace of median sales price growth has slowed, signaling a potential gap between what buyers are willing and able to pay and what sellers are hoping to net.

Higher mortgage rates have added more than $200 to the monthly cost of a typical for-sale home since December 2020 — when rates were at all-time lows — with more than half of that increase occurring over the past eight weeks, Hale said.

“With home prices expected to continue rising, even at a slower pace, affordability will increasingly challenge 2022 buyers as a decade-long underbuilding trend has left the housing market 5.8 million homes short of household growth,” said Hale. “At the same time, we expect pandemic trends like workplace flexibility and competitive labor market conditions to give workers the boost in income and wider search areas they need to navigate a still-challenging housing market successfully.”

It is a shame the old “ZipLAT” data went private. I always looked forward to the LATimes monthly sales data by zip code for all of SoCal.

I don’t know what metric Redfin uses but:

https://www.redfin.com/county/358/CA/Ventura-County/housing-market

Seems low.