by Jim the Realtor | Sep 25, 2021 | Local Flavor |

Lots of local real estate stories included here:

https://www.sandiegoreader.com/news/2021/sep/22/cover-san-franciscans-and-others-driving-san-diego/

We’ve all heard about how home prices in San Diego have never been higher, and that demand is so great that homes for sale typically get multiple bids and wind up selling for more than the list price — in some cases, significantly more. What we haven’t heard much about is what’s triggering this boom.

Local realtors say one of the most significant factors is the arrival of home buyers from the San Francisco Bay Area and Silicon Valley, where the tech explosion years ago sent home prices skyrocketing. Covid-19 forced many businesses to send their workers home, while the Delta variant squashed what many had expected would be a mass return to the office. As a result, many tech firms — including Google, Twitter, and Facebook, all headquartered up north — now offer telecommuting as a regular option.

Over the last few months, “we have had a huge influx of Bay Area people moving down for the ‘lower’ prices,” says Devonee Alfrey, a realtor who focuses on North County. With Covid-19 and remote working, she says, “being present in Silicon Valley is no longer necessary to do the job.”

The median sales price of a single-family home in San Diego County was $860,000 in July, according to the California Association of Realtors — compared to $1.3 million in the San Francisco Bay Area. The median sales price in the city of San Francisco was nearly $1.9 million and, in San Mateo, $2.1 million. Meanwhile, Zillow Research in mid-August reported that as of July, list prices of homes for sale in San Francisco over the last year have dropped 4.9 percent year over year, while the number of homes for sale has nearly doubled.

Full article here:

https://www.sandiegoreader.com/news/2021/sep/22/cover-san-franciscans-and-others-driving-san-diego/

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

by Jim the Realtor | Sep 25, 2021 | Builders, Carlsbad |

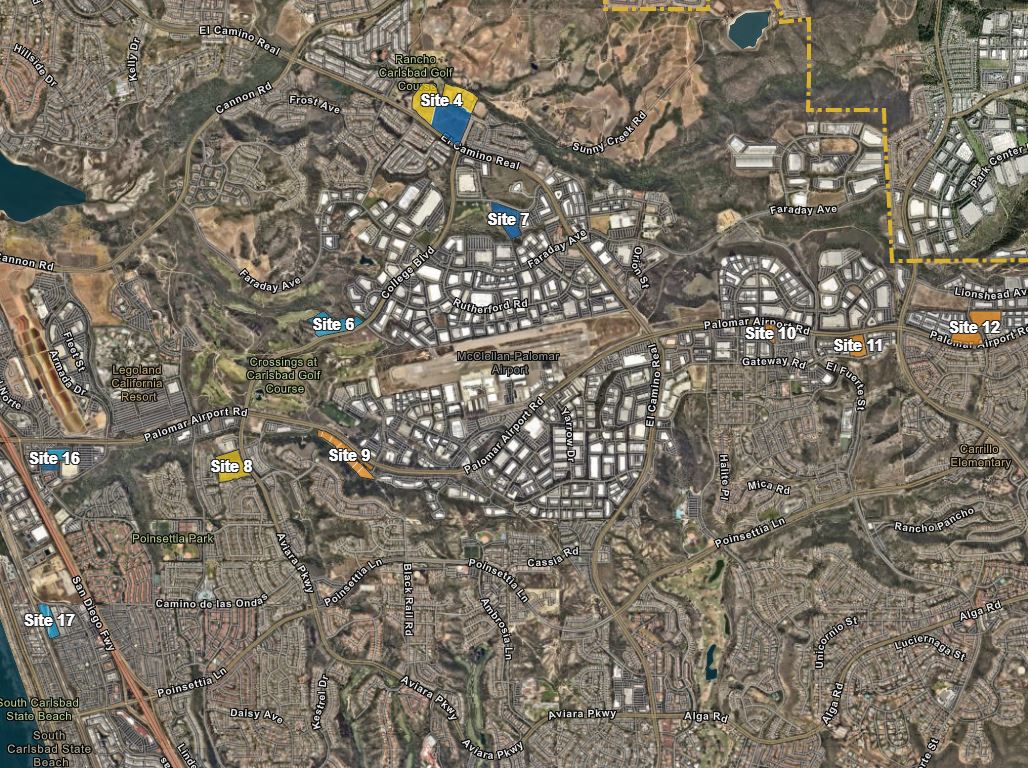

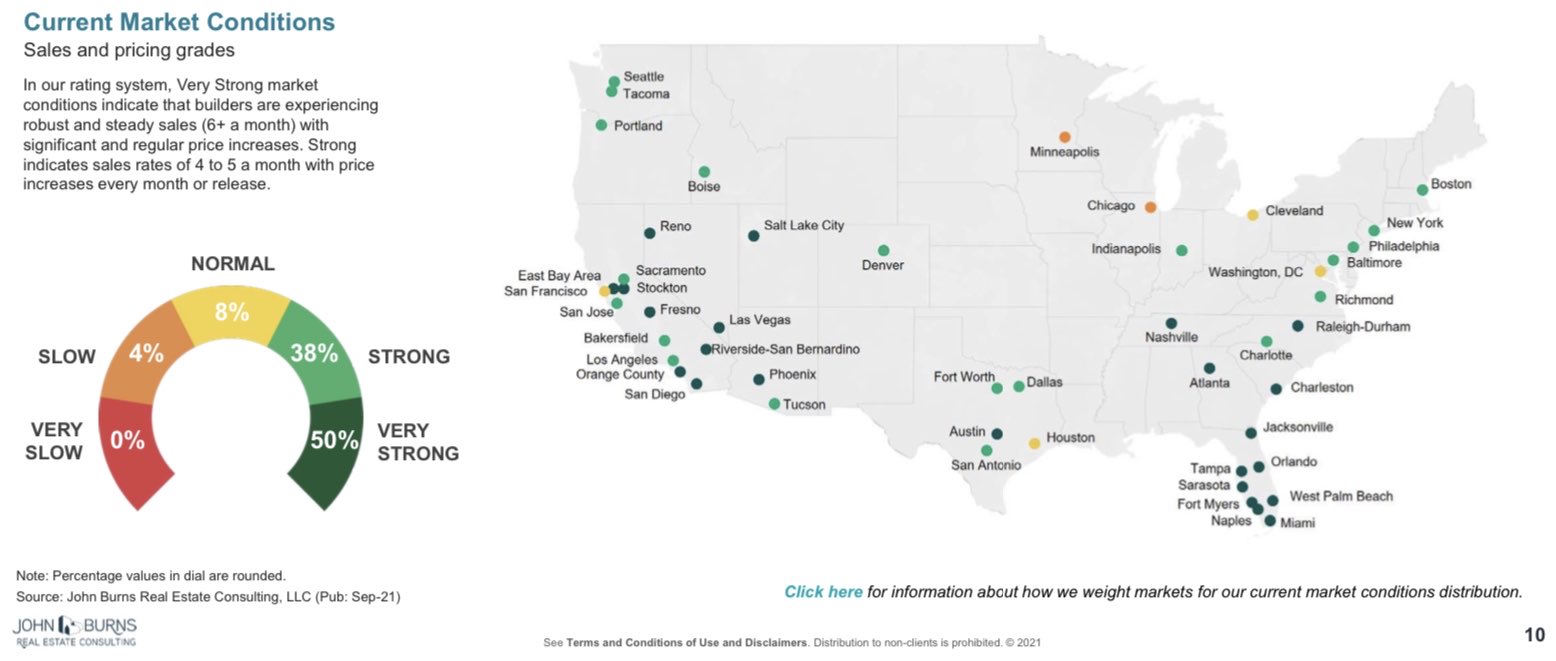

Give input on locations for future housing

The city is seeking input on where new housing units could be built in Carlsbad to satisfy a state requirement that cities accommodate their fair share of the region’s housing needs, including homes for people of all income levels and stages of life.

Eighteen proposed locations were chosen based on public input gathered last year, input from a citizens advisory committee and direction from the City Council.

Over the next eight years, Carlsbad was assigned 3,900 new housing units.

The city can meet some of this number through existing locations and approved projects, but the city still needs to identify locations for about 2,600 new homes. Most of those need to be affordable for people with moderate to low incomes, according to state formulas for household income levels.

Review sites on an online map.

The city is seeking input on proposed sites that would need to be rezoned, either to allow housing where it’s not allowed today or increase the number of units allowed on sites already zoned for housing. Owners and people living within 600 feet of all the potentially affected properties have been notified by mail of the potential rezoning.

The city would not build housing on these sites. Instead, the city’s obligation is to identify space for housing and create policies that would facilitate new housing to be built based on different income levels and stages of life.

All feedback gathered will be presented to the City Council in early 2022.

https://www.carlsbadca.gov/Home/Components/News/News/588/15

by Jim the Realtor | Sep 24, 2021 | Carlsbad, Local Flavor |

by Jim the Realtor | Sep 24, 2021 | Jim's Take on the Market, Thinking of Selling?, Why You Should List With Jim |

Looking at the monthly selling trends, average days on market, and a price to sale amount ratios over the last years……these are the best months to sell a home across the U.S.

by Jim the Realtor | Sep 24, 2021 | About the author, Bubbleinfo Readers |

It was 16 years ago today that the blog began with this post – which still has some relevance today:

https://www.bubbleinfo.com/2005/09/24/20-25-appreciation-per-year-how-can-that-happen/

Here is a summary of where we’ve been:

https://www.bubbleinfo.com/2019/09/24/happy-birthday-bubbleinfo/

I am grateful for you being here! We appreciate the business from readers, and your friends and family. Thank you so much!

by Jim the Realtor | Sep 23, 2021 | 2021, Actives/Pendings, Frenzy, Frenzy Monitor |

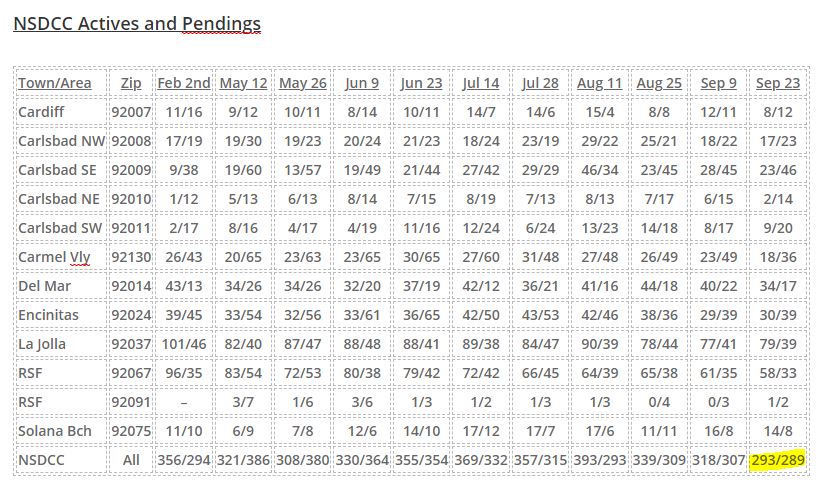

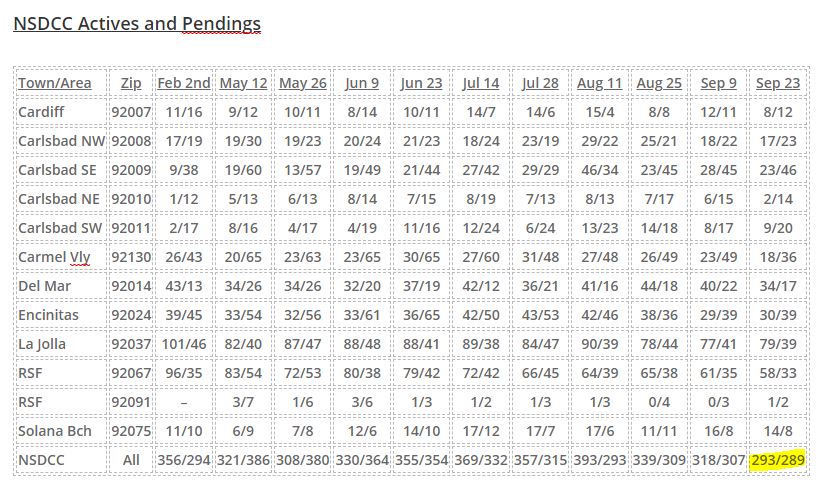

The reason for breaking down the active and pending listings by zip code is to give the readers a closer look at their neighborhood stats.

It’s interesting to see that the total number of actives and pendings are so similar – as close as they were in late-June as the max frenzy was unwinding. The big split in the counts on August 11th made it look like the frenzy was coming apart, but they’ve gotten back in line nicely since:

But with fewer homes for sale combined with the time of year, we probably won’t see much change. Let’s call it low-grade frenzy conditions for now.

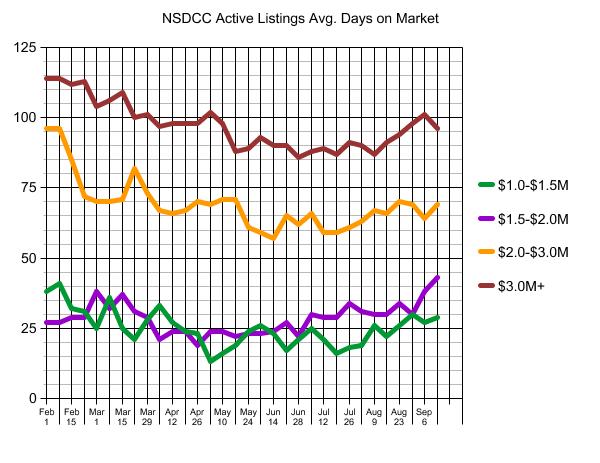

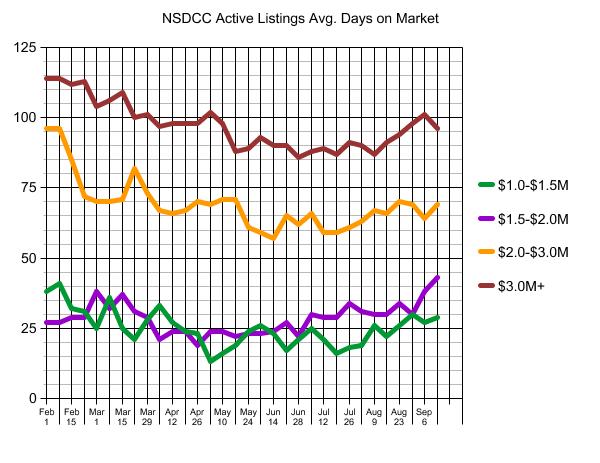

The average days on market is creeping upward, but still no big concerns. There will always be sellers who would rather wait for the lucky sale, than adjust their price – and longer average market times indicate more sellers doing the former. Though we should note that the hottest range ($1.5 – $2.0) must have a lot of dogs lying around:

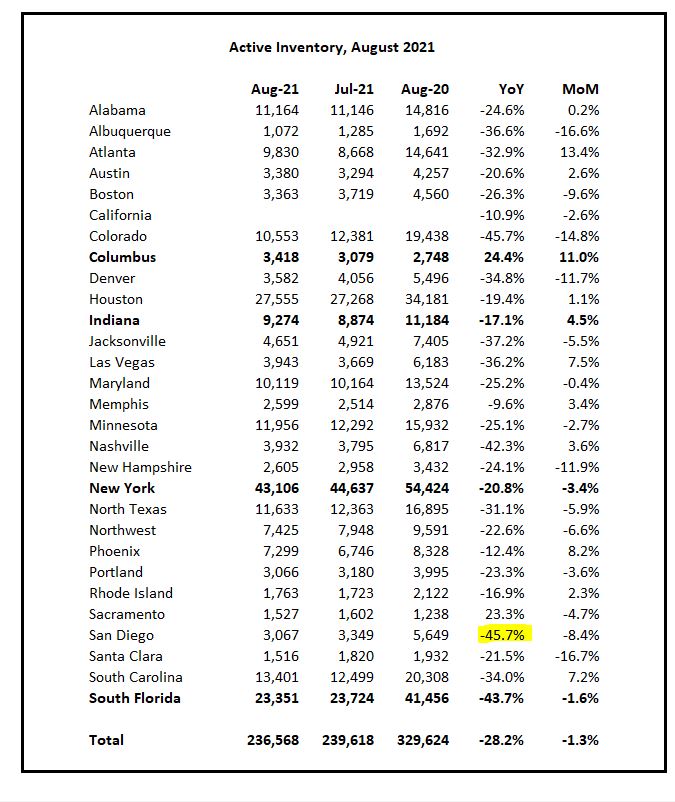

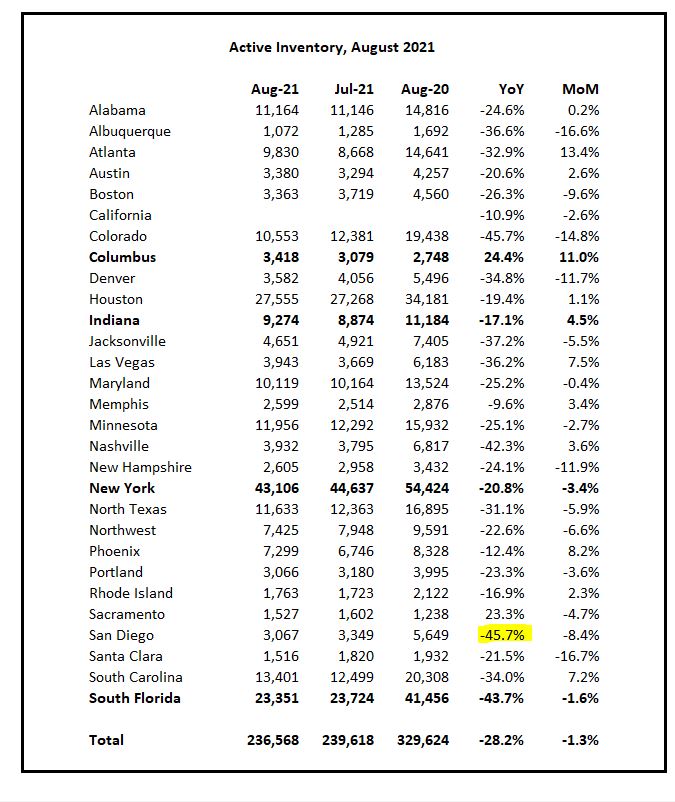

San Diego County has experienced the worst YoY change of active listings IN THE NATION. Three thousand houses for sale in a county of 3.3 million people? Yikes!!

And that was the August report. Today in San Diego County:

ACTIVES: 1,760

PENDINGS: 2,600

Wow!

by Jim the Realtor | Sep 23, 2021 | Market Conditions, NSDCC Pendings, Thinking of Building?, Thinking of Buying? |

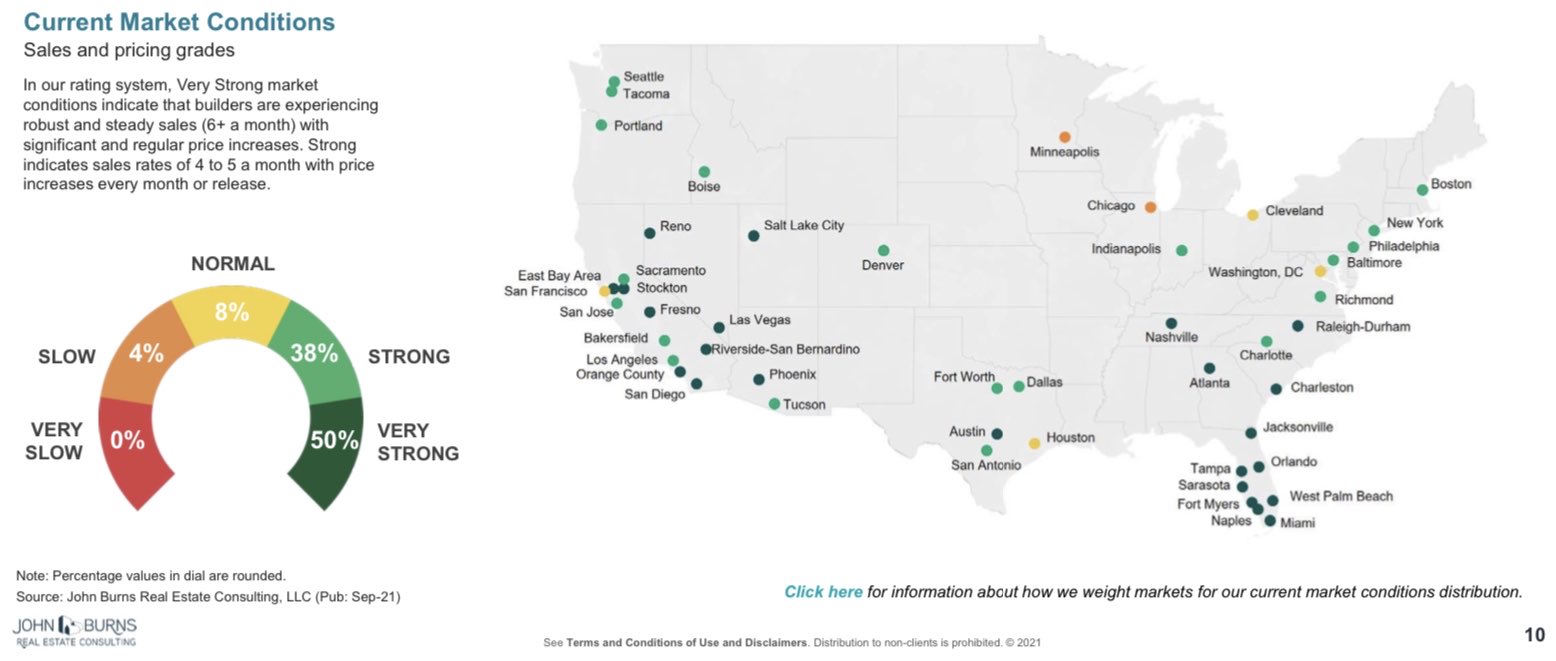

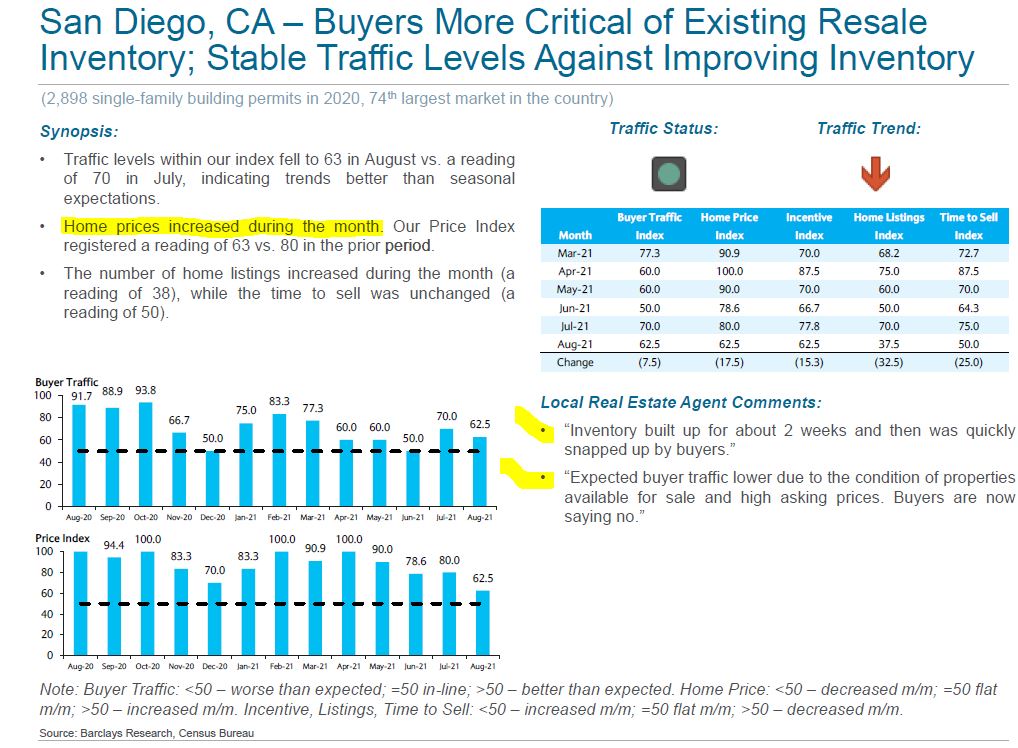

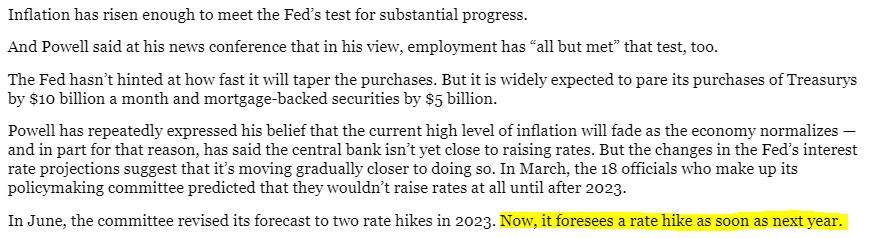

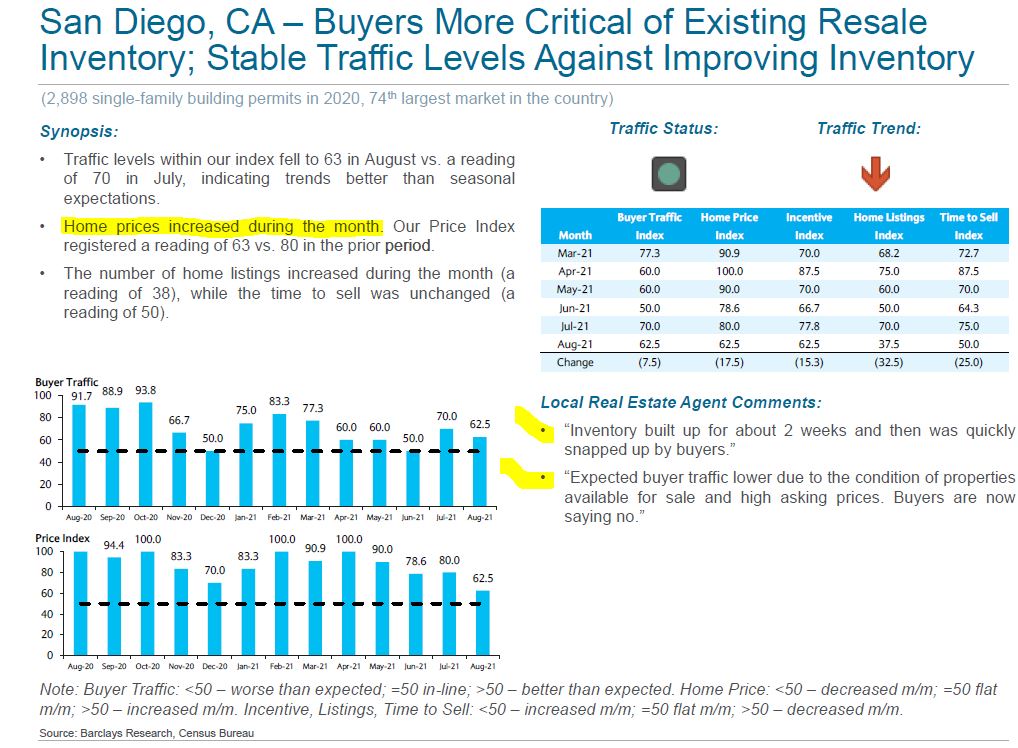

This company surveys new-home and resale agents every month, and this report confirms more of what we’ve been experiencing:

- A few more listings (but NSDCC listings are dropping off now).

- More listings not selling/buyers getting pickier.

- Buyer traffic is steady, and better than expected.

The Home Listings Index dropped from 70 to 37.5, which means the number of listings increased, which is bad for the new-home agents. But for resale agents, it’s good!

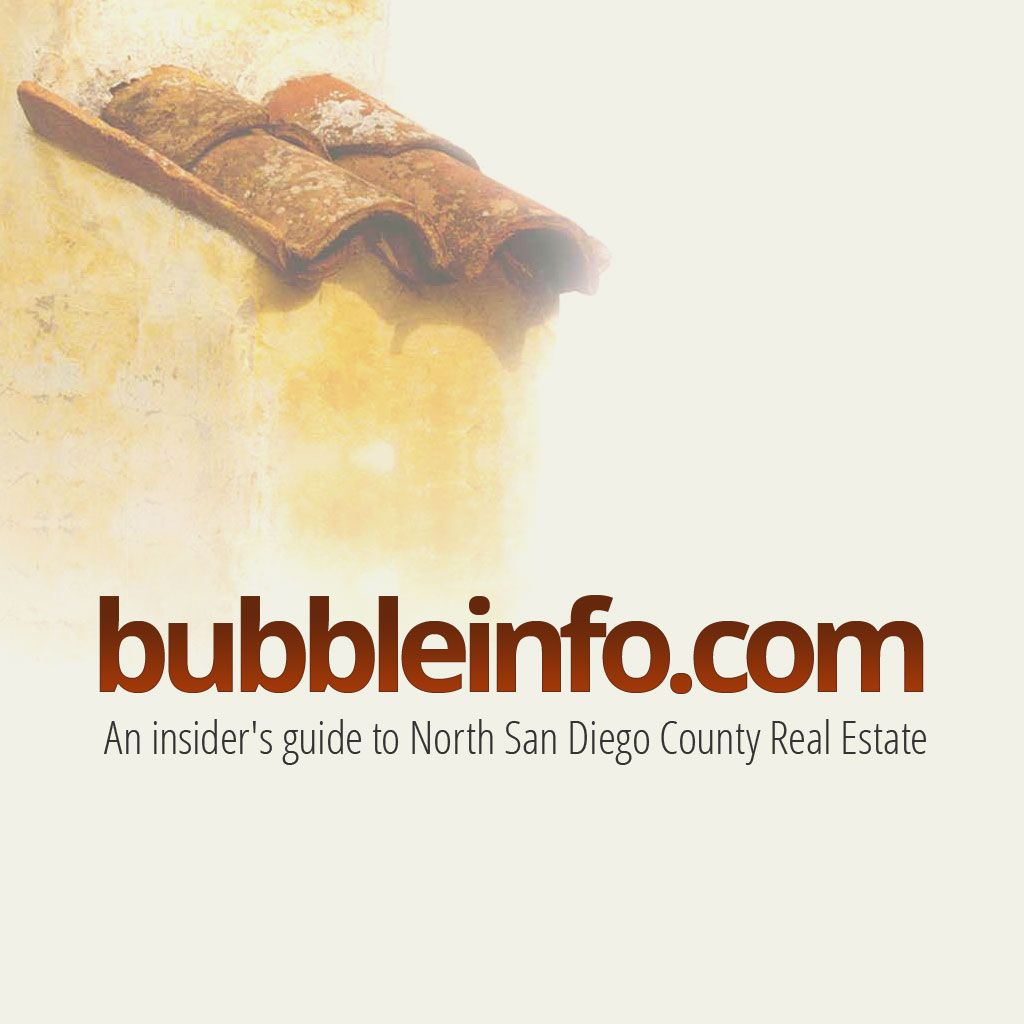

by Jim the Realtor | Sep 22, 2021 | Interest Rates/Loan Limits, Mortgage News |

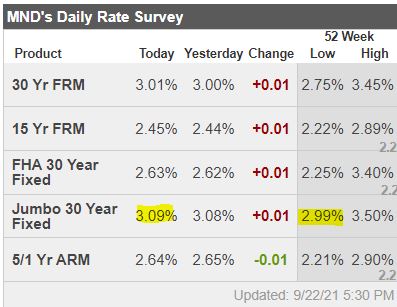

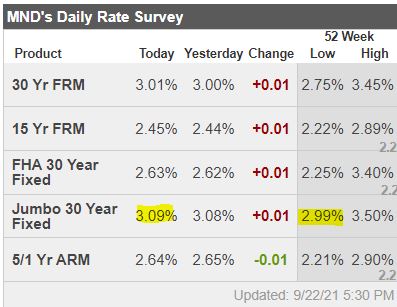

The jumbo rate was 3.25% on April 22nd

From Mortgage News Daily – thank you:

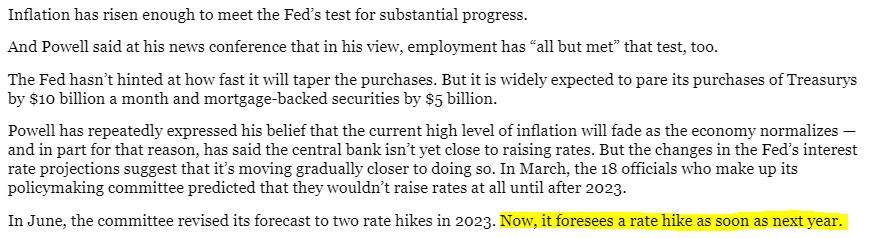

Mortgage rates were surprisingly steady today as the bond market reacted to a new policy announcement from the Fed. Perhaps “reacted” is the wrong word considering the market’s response. Specifically, the bond market (which dictates interest rates on mortgages and beyond) was hard to distinguish from most any other random trading day. That’s nothing short of impressive given what transpired.

So what transpired? That requires a bit of background, but let’s make it quick.

- The Fed is currently buying $120 bln / month in new Treasuries and MBS. These purchases greatly contribute to the low rate environment for mortgages.

- The Fed has done this, off and on in the past since 2009.

- 2013 was the first major example of the Fed “tapering” its monthly bond purchases after an extended period of accommodation. Markets freaked out and rates spiked at the fastest pace in years.

- Late 2021 is well understood to be the second major example of Fed tapering and markets have been speculating as to when it would become official.

Today’s announcement advanced the verbiage that suggests the Fed will begin tapering at the next policy meeting in November. Then, in the post-meeting press conference, Fed Chair Powell bluntly and explicitly confirmed the Fed is indeed planning on announcing the tapering plan at the next meeting unless the next jobs report is surprisingly bad.

Bonds definitely experienced some volatility during today’s Fed events, but again, that volatility existed within a perfectly normal range. The absence of a bigger market reaction is a testament to the Fed’s transparency efforts.

In short, they ended up saying almost exactly what they’ve been telegraphing in the past month of speeches, and markets revealed themselves to be positioned for an “as-expected” result. So not only was the Fed transparent, but markets were also fully betting on that transparency. Relative to some of the drama in 2013, today amounted to a perfectly threaded needle of epic proportions.

What does it mean for mortgage rates? Today? Nothing really. Lenders barely budged from yesterday.

All of the above having been said, sometimes it takes a few days for post-Fed rate momentum to truly kick in. Additionally, we’d expect some of today’s potential impact to instead be seen in the wake of the next jobs report on October 8th.

http://www.mortgagenewsdaily.com/consumer_rates/986363.aspx

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

by Jim the Realtor | Sep 22, 2021 | Carlsbad, Local Flavor |

Did you know that a major resort in SW Carlsbad has been in the works since 2007?

Here is their timeline:

https://www.newage-resorts.com/timeline

by Jim the Realtor | Sep 21, 2021 | 2021, Frenzy, Thinking of Selling?, Why You Should List With Jim |

While we’re talking about the median sales price of detached-homes in San Diego County, let’s review the last ten years. There usually is some dropoff towards the end of the year:

The last frenzy in 2013 saw the median sales price increase 26% between January and September.

The Greatest Frenzy of All-Time started with closings in May, 2020 that had a median sales price of $660,000. It peaked in June/July at $875,000, which is a 33% increase and lasted five more months than in 2013. I’m happy with it, the fun was great while it lasted, and now here we are.

Well, at least until 2022.

There was some hesitancy in the market at the end of 2013, but it took off again in 2014.

Look at the difference though (the graph is interactive).

The increase was only +7% between September, 2013 and June, 2014 before it decelerated again – and the median sales price in November was back to where it was in the previous September!

Sellers should appreciate the big boost we’ve had, and the uncertainty of the future. Don’t attempt to time the market for max return – it’s great where it is today.