If you are thinking about moving out-of-state, here’s another data point to consider:

This year, Uncle Sam took his cut of the past year’s earnings on May 17, slightly later than usual due to the COVID-19 pandemic. Many taxpayers are undoubtedly wondering how this year’s Tax Day will affect their finances, as a lot of people are struggling financially as a result of the pandemic.

Since the tax code is so complicated and has rules based on individual household characteristics, it’s hard for the average person to tell how they will be impacted.

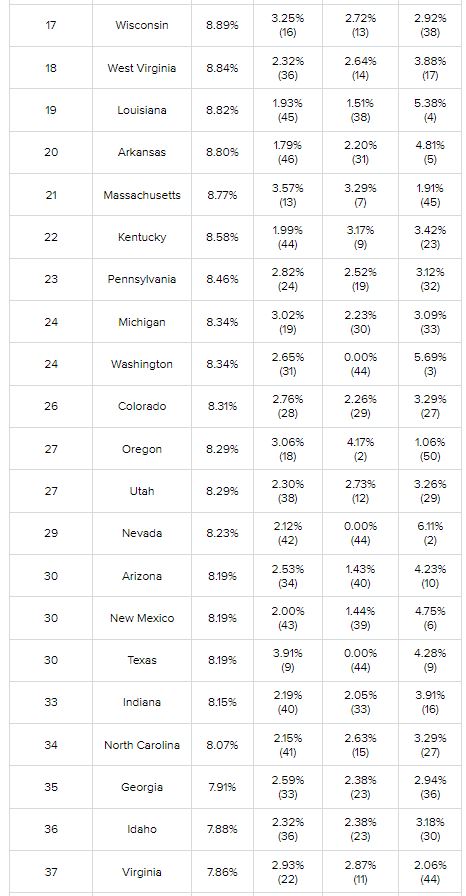

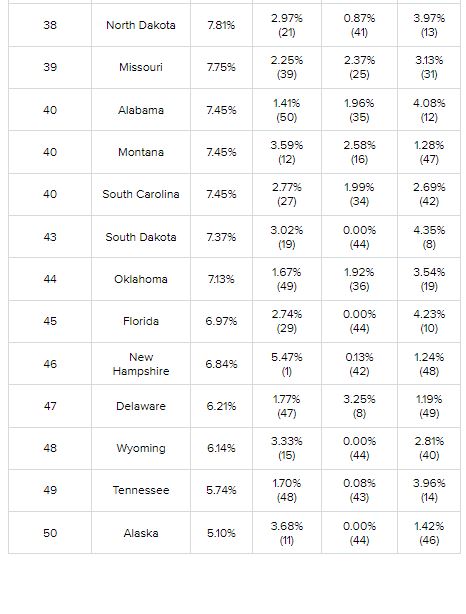

One simple ratio known as the “tax burden” helps cut through the confusion. Unlike tax rates, which vary widely based on an individual’s circumstances, tax burden measures the proportion of total personal income that residents pay toward state and local taxes. And it isn’t uniform across the U.S., either.

To determine the residents with the biggest tax burdens, WalletHub compared the 50 states across the three tax types of state tax burdens — property taxes, individual income taxes and sales and excise taxes — as a share of total personal income in the state.

https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494

fires…..drought…..floods…..tornados….hurricanes…..

those are all major offsets against states with lower tax burdens.

choose wisely

Not even remotely believable. For but one instance; CA Sales and excise burden 3.06%? Sales taxes 8-10% and gas taxes 20%+. And income taxes. 3.78%. That’s reasonable but needs context. So many people don’t pay income taxes that it hides those of us who do at more than double that. Pardon the risque analogy but this study’s reasoning would lead to the conclusion that the average person has one boob and one ball.

😆 I should probably stick to real estate items!