In last Saturday’s blog post, I mentioned three reasons why San Diego real estate was undervalued, and pondered that there are new market forces in play that we haven’t seen before.

While people will scoff at the idea that it could be different this time and insist that the market will always revert to the mean, there are new factors to consider that will have impact on the eventual outcome:

LESS SUPPLY

No foreclosures

Ultra-low rates locking in homeowners to their forever home.

Boomers are older than ever, and are aging-in-place (too old to move).

Holding real estate has never been so sexy.

Longest expected length of ownership ever.

MORE DEMAND

Population is more affluent than ever (SD County has 100,000+ millionaires, fifth in USA).

Work From Home has expanded the choices for buyers, increasing the demand in desirable areas.

Hoarding real estate is cool (high rents, kids to inherit).

Current homeowners have more equity than ever to use when buying again.

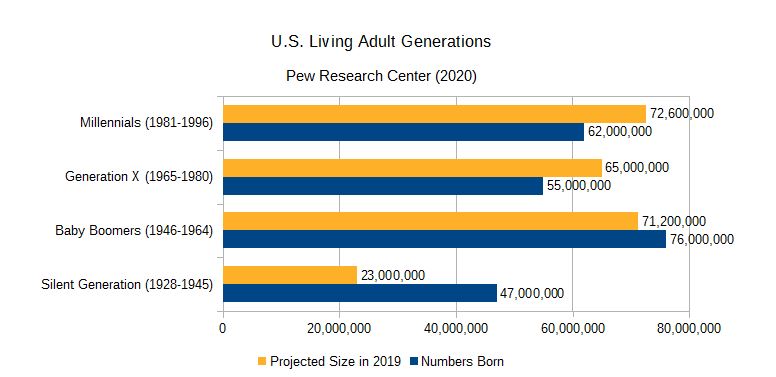

There are more people than ever in the homebuying ages.

We probably only needed supply OR demand to change by 5% or 10% to make a difference. But it seems like BOTH have changed more than that….in opposite directions, which has really stirred it up.

It used to be that when home prices were hitting new highs, sellers would come out of the woodwork to take advantage. But not this time – which is different!