Coronavirus Changes to Housing

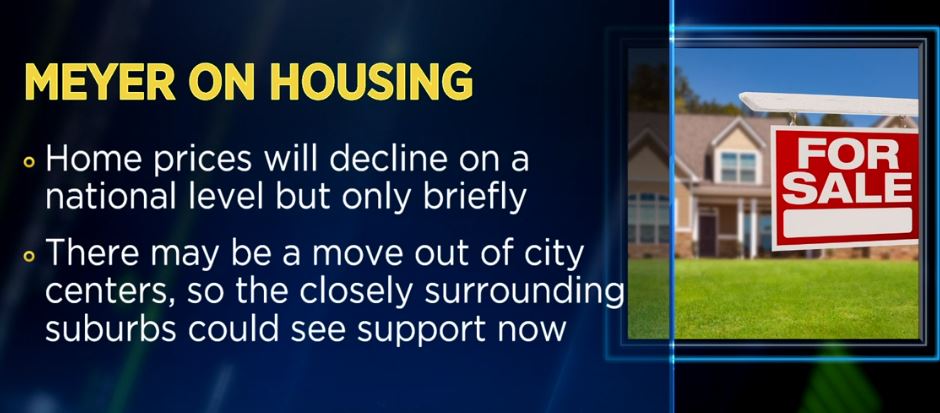

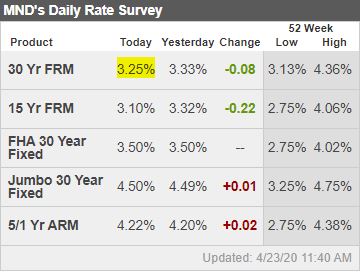

Rates are getting more attractive and it seems that people are a little more comfortable going out.

What will be the priorities for homebuyers?

San Diego is The Downsizer’s Upgrade!

As people hunker down in quarantine throughout the state, many must be asking themselves if they are in the right house for them – and if it isn’t, then where to move.

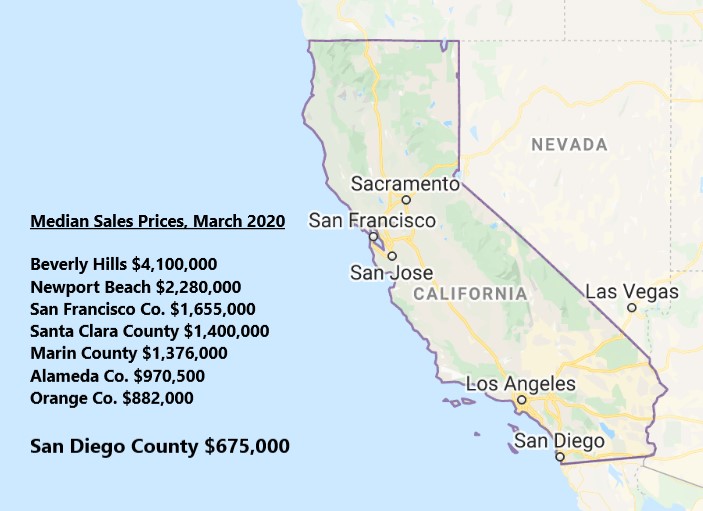

Thankfully, most of the densely-populated parts of coastal California are more expensive than in San Diego County, which makes for a natural progression.

For downsizers who want to live in the same size or larger home, they can come to San Diego and make out nicely! Or get a smaller home AND pocket big profits from their previous sale.

San Diego County real estate should fare well in the coming years – we enjoy a natural housing demand from baby boomers who are looking for a less-costly coastal experience.

It’s good for the ego too – who would criticize them for wanting to move here!

Realtor.com COVID-19 Report

Of all the traditional real estate economists, Lawrence Yun probably gets the most press coverage – but Danielle has been around too. She was at NAR for nine years, then went to realtor.com where she’s been for the last three years:

Master Bathroom of the Week

The before-and-after photos below start with a ‘before’ photo. I like the idea about creating a drawer as part of the sink cabinet:

[houzz=https://www.houzz.com/ideabooks/132304834/list/bathroom-of-the-week-neutrals-warm-a-contemporary-master-bath w=620]

Rule-of-Thumb for Affordability

Generally, the cost of homeownership is under-stated. Let’s figure this to be around 0.175% of purchase price:

For many Americans, their expected mortgage payment may not be all that different from their current monthly rent. But even if you have a down payment saved up, you still may fall short when it comes to paying for all the monthly expenses of owning a home.

When you buy a home, you have to pay property taxes, insurance and maintenance costs on top of your mortgage payment, Suzy Orman says. Plus, if you put less than 20% of the home’s purchase price as the down payment, you’ll also have to pay private mortgage insurance, or PMI, to offset the risk your lender is taking in approving you for a home loan.

Those costs add up. Orman estimates that these extra, but necessary expenses, will cost you an additional 45% over your mortgage, just to keep your home.

In order to figure out if you can afford to buy, Orman says first-time homebuyers should test their finances. “I want you to play house,” says Orman.

Let’s assume you pay $1,000 in rent and estimate that your mortgage will cost about the same.

Over the next six to eight months, take $450 a month and put it in a savings account on the first of every month. That’s in addition to the eight-month emergency fund and the 20% down payment that Orman recommends having in place before you even start to look at local real estate ads.

“If in six to eight months from now, you are able to do it on time every single month, you can afford that home,” Orman says. Plus, after eight months, you’ll have almost $4,000 to put toward your closing costs.

Link to ArticleBoquita Cultured Marble

Now that Boquita has closed escrow, let’s go back in time to when I sold it to the former owners in 2009.

It was a true fixer that took a major effort to get it into shape. The new master bathroom in the photos above turned into a real highlight, especially when you see how it started:

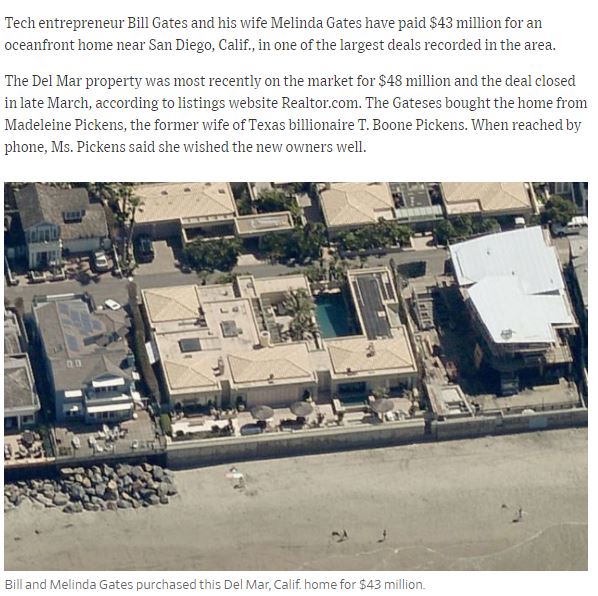

Bill Hits The Beach

The six-bedroom home spans about 5,800 square feet, according to the listing. It has a 10-person Jacuzzi overlooking a fire pit, a long oceanfront deck, limestone flooring, and a swimming pool.

Mr. Gates, one of the world’s richest people and the co-founder of Microsoft, has been in the public eye recently due to his early warnings about the global pandemic. This purchase adds to the couple’s already sprawling real estate portfolio, although Mr. Gates has historically treated his compound in Medina, Wash., as his primary home. In 2014, he also bought weight-loss guru Jenny Craig’s Rancho Santa Fe, Calif., equestrian estate for $18 million.

Link to ListingNSDCC Sales, April 1-15

The closed sales in May will likely be worse than April – which hasn’t been too bad so far (just -26% yoy). We have 82 pendings currently that have opened escrow this month.

NSDCC April 1-15 Sales & Pricing

| Year | ||||

| 2017 | ||||

| 2018 | ||||

| 2019 | ||||

| 2020 |

We were off to a good start in 2020 prior to the coronavirus, so not surprised that the momentum kept these sales closing. But each of these buyers wired their funds into escrow in the midst of the some of the worst news they have ever heard in their life – and they still closed.

Buyers’ Market

Here are some tips to help buyers and sellers in the corona era: