Corelogic reported September sales yesterday, and Doom-Doom Diana rejoiced.

She wrote an article with the headline ‘Southern California suffers its worst housing slump in over a decade’, and reported that sales were down 18%. Then she tweeted the article with the same soundbite (above).

But further down in her own article was this gem:

“There was one caveat to last month’s sharp annual sales decline — this September had one less business day for recording transactions. Adjusting for that, the year-over-year decline would be about 13 percent, still the largest in four years.”

Even though she knew it was really only the worst in four years, she pushed the worst-in-decade angle. Rather than commit to honest reporting, she would rather distort the truth in order to attract the maximum eyeballs.

What’s really happening?

It is natural for homebuyers to tap the brakes when rates and prices are going up at the same time. It’s not because they don’t want to buy. It because they wonder if prices will come down, and they don’t want to pay too much.

The result? Sales naturally go down.

I’m glad to see that buyers are paying close attention – they should!

People are moving fast and are addicted to soundbites. We been trained to live in a binary world, and just want to hear if the market is going up or down, like with stocks and bonds.

I’d rather get into the minutiae and ramble on about all the variables. But realistically, who is going to listen when Doom-Doom Diana will give you a sexy hot take in one sentence?

The other tenet that determines the housing market is the seller’s mantra: “I don’t have to move, I have plenty of time, and I’m not going to give it away!”

Sellers get a vote.

If they aren’t going to sell for less, then we roll into Stagnant City. In the past, banks had to sell for what the market would bear, and they would lead the market down as they scrambled to get out.

But banks aren’t required to foreclose any more.

Which leaves us with the question: Which seller has to sell for whatever the market will bear today, even if it is substantially below their perceived value?

The answer is ‘None’. Today’s home sellers might knock off a couple of bucks, but they’re not going to give it away.

So let’s determine a way to gauge the market in an easy binary way, and measure the most important tenet – are sellers capitulating?

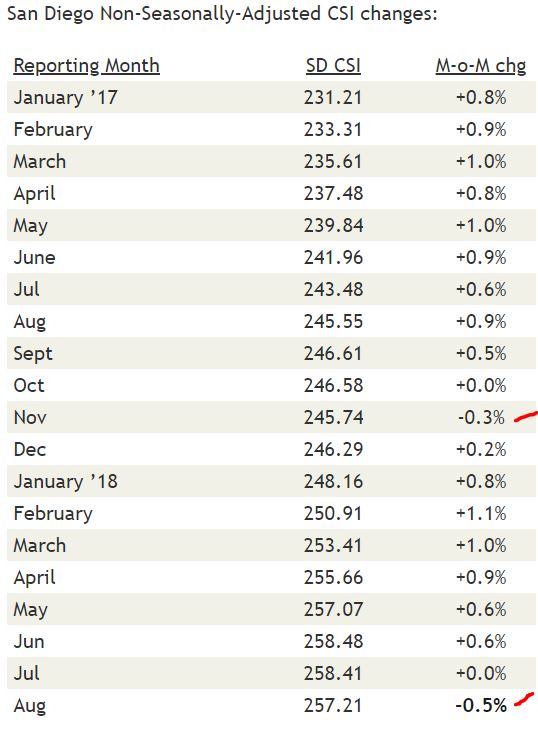

Sellers always want more than the last sale nearby. Here is a simple way to follow the trend to see if sellers are getting what the last guy got – the month-over-month changes in the Case-Shiller Index:

Recently, sellers have been getting about what the last guy got, or a little more. But if we see a series of negative numbers over the next few months, we know that buyers are winning.

Sellers have loads of equity – more than ever – so you would think they wouldn’t mind giving some of it back to make a deal. But homes are personal, and the ego is a funny thing. It would take a full panic for sellers to capitulate.

Still plenty of doom to go around, if you are into that kind of thing. Everybody is an expert on housing (H/T Richard):

https://wolfstreet.com/2018/10/30/declines-in-the-most-splendid-house-price-bubbles-in-america/

The velocity of home sales decline should greatly concern you. You can look at charts and trends to find the right one that will bias your opinion, but there’s a bigger picture going on. For the past couple of years unemployment dropped, stock values gained and people had the sense they can afford more. They bought homes while holding on to their old one for investment which pushed the inventory down and prices higher. Now that rates are rising and layoffs increasing, buyers are side-lining to get a sense of where the bottom will go while sellers are still trying to find a ceiling to sell. Foreign workers on visa don’t want to buy because they’re not sure how long until they get kicked out. Visas are already getting denied extension and people forced back to their home country. Why is this a concern? Because my coworker is from India and her husband works at Qualcomm and markets in Calfornia, Texas, and New York all depend on foreign workers who want to stay and buy. I’m hearing a lot of stories 1st person that you don’t hear in the news. Drive down any business park in Carlsbad you’ll see a “for rent” sign on every driveway. Homes that went up for sale during peak months are still on the market even after dropping their prices 20% over the last 4 months or pulling out of the market all together. Those investors that held onto their properties are starting to add to the pool of homes for sale because the rate of appreciation will be far less than interest rates they will be paying and the likelihood of being vacant is increasing. We all know the market runs in cycles and the bull market in my opinion has officially ended this past summer.

You always seemed to have a good handle on the numbers and the data . Do real estate agents ever serve as expert witnesses and if so, have you ever considered that?

Thought I would mention below story in case any of your readers are interested in it. Some friends recently have made up their mind to buy a house now (not in San Diego). They are real tired of renting but they were concerned because what if we are nearing a peak. Their concern was in part because they have seen the headlines similar to the one in this article.

I asked them: How long are they planning to stay in the home they buy? Do they anticipate their income to be stable enough to support the monthly payment for a long period of time ?

If the market goes down, they as a homeowner will not lose money until they sell. Likewise they do not make money until they sell even if the market goes up. If the market goes down, the issue is if they have to sell during a crash or refinance during a crash, then it becomes a problem. Crashes limit their options. If their lives and cash flow are such that they don’t anticipate needing or wanting to sell or refi, that will increase their chances of being able to ride out a crash and they will still be able to accomplish their desire to buy now.

Not that I am not a financial planner by the way and this is not meant to be financial advice. Everyone’s circumstances are unique. People should seek out their financial planner for guidance but thought I would share my friends’ situation.

I dont agree … these points are not applicable to our local Coastal Markets.

Folks on Work Visas are not part of California Coastal Market … they cant afford to live here on their salaried jobs even if they get Green Cards or Citizenship. But yes they may influence specific market locales in Texas or Mid-West states.

Home Owners who bought their investment properties in the past decade do not care … they locked in under 4% rate for the next 30 years … most of them can easily beak-even or cash flow with their monthly payments. They will NOT sell unless there there is a big life event.

There is no systematic problems (like in the previous downturn cycles)

On the contrary .. look at the population growth projections for San Diego county for next 10 years … and check how much more land is left available on or near coast.

Do real estate agents ever serve as expert witnesses and if so, have you ever considered that?

Yes, I have testified in court as an expert witness. Interesting work, and very technical and specific in nature.

With the tepid pace of interest rate hikes, I doubt we’ll have any sort of correction/crash like what happened ten years ago. Today’s banks are still too big to fail or even bigger than they were ten years ago.

The banks also learned that all they have to do is not foreclose and that the central bank will float them all the cash they could ever want at rates close to zero, for as long as it takes.

The horses have left the barn and we’ll never get back to normal, whatever “normal” was before the Great Recession.

Like a lot of people say “Don’t fight the fed.” They have the power to take rates back down to zero or even negative! Or just drop money out of helicopters!

The velocity of home sales decline should greatly concern you. You can look at charts and trends to find the right one that will bias your opinion, but there’s a bigger picture going on.

The velocity?

In my mind, the housing market should be more volatile every month just from the difference in type of homes selling, and people involved – it is a completely different mix each and every month, unlike stocks and bonds. It’s amazing that stats are as steady as they’ve been.

Let’s say we really should have normal swings of 5% or so every month – in both number of sales and pricing.

Then if we have one month were sales are down 13%, is it that big of a deal? Not in my mind.

But then again, there’s nothing that greatly concerns me, because I know that price will fix anything! 😆

Corelogic is a lagging indicator and Olick works in the business of financial news.

There is no trend (yet) but the awareness this has created is noteworthy. Nothing more.

If we hit month 3 of similar patterns and total stagnation, it will be interesting to see how that ebb and flow will ride.

One point on a graph or chart does not make a trend. Several points make a trend line. Only time will tell.