Home Inspectors That Kill Deals

Some home inspectors are notorious for having terrible bedside manner. In this case, the inspector mistakes worn-out carpet as a sloping floor, and scares the first-time buyer right out of escrow.

Some home inspectors are notorious for having terrible bedside manner. In this case, the inspector mistakes worn-out carpet as a sloping floor, and scares the first-time buyer right out of escrow.

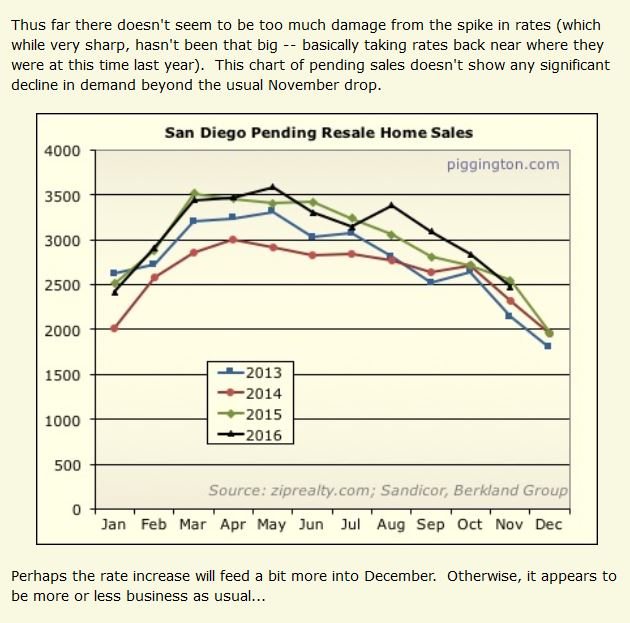

Rich Toscano’s latest housing data rodeo:

http://piggington.com/november_2016_housing_data

Considering the higher pricing, this year has been spectacular, statistically.

Thanks Rich!

In the film, Giorgio is pursuing how housing became the critical component of the middle class. The racial injustice is real – agents will tell you that we still see it regularly in the C.C&Rs of older neighborhoods that blacks were forbidden to own there.

Thankfully those covenants have been struck down, and declared invalid. But as you heard in the movie trailer, the damage has been done.

There are other atrocities seen daily that could be stopped, if desired.

But there is no desire within the industry to end the rampant fraud being perpetrated by realtors upon the unsuspecting real estate consumers.

It ranges from the blundering incompetence of not including decent photos and remarks to the deliberate and intentional felony fraud that we see every day.

The lack of transparency fuels the fraud, and the realtor community does nothing to stop it. When was the last time you saw a realtor do a perp walk? Yet there are realtors committing fraud and deceit every day.

The breakdown is with the brokers – they aren’t properly supervising their agents, and I don’t think they have a clue what is really going on.

Yes, buyer beware, blah blah. But real estate consumers don’t do this enough to have ample education or experience in selling and buying homes – that’s why they hire us! But agents prey on consumers, and the industry does nothing to stop it.

This is the movie I want to do!

Giorgio?

Giorgio’s movie is wrapping up – here is the trailer:

Cost per Square Foot is a documentary film project about the singular and perverse nature of the American housing economy. Though much has been written and filmed about the 2008 housing collapse, we seem to have failed to ask a fundamental question:

What is it that we are actually building?

This documentary attempts to answer that question. And in the process, it tell a larger story about housing in America that many people don’t know.

In the years since the US housing market became the epicenter of an unprecedented global economic collapse, protests in Baltimore, Ferguson, and Southside Chicago have highlighted the stark disparities of opportunity that define many American cities. These phenomena are not unrelated – they are divergent paths set in motion by postwar housing policy, a feat of social engineering that simultaneously created the world’s largest middle class, by directly subsidizing suburban development, while systematically depriving inner cities of resources and denying huge swaths of the US population the ability to build wealth through homeownership.

This was by design.

Cost per Square Foot is a historical road trip through the American housing landscape, in all its glory and all its blunder. The film invites viewers into a deeper conversation about our housing economy, one that addresses the fundamental issues of segregation, inequality, and financial instability. Through the stories of a retired NYC cop, a quietly socialist war bride, an aspiring Youtube star / realtor, and a young photographer whose photos of the Baltimore riots propel him into the national spotlight, Cost per Square Foot charts a course between the imagined wealth of seemingly endless “neo-taco-mediterranean special” suburban tract homes built atop razed orange groves, and the stark realities of life in many of America’s inner cities.

If you’d like to contribute, click here:

https://www.indiegogo.com/projects/the-cost-per-square-foot-documentary-architecture#/

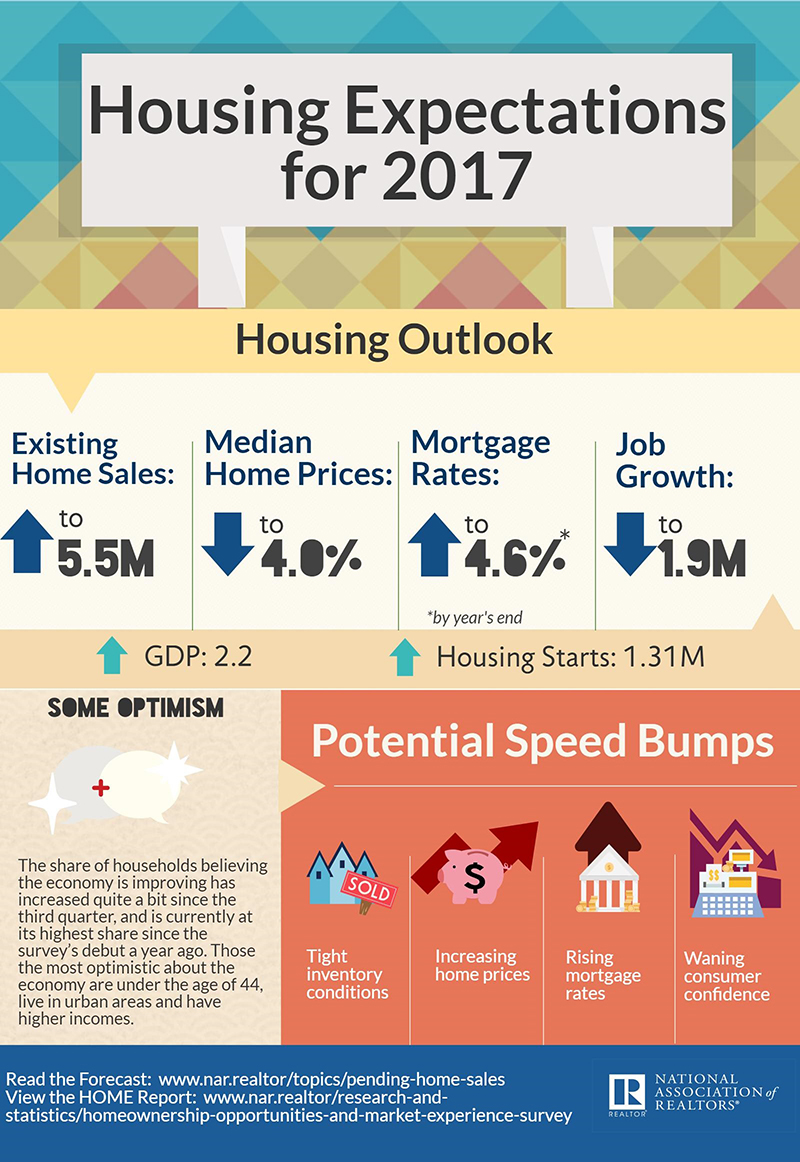

Just two months ago, on October 5th, the NAR prediction was for 6 million existing home sales in 2017 – they have backed it down to 5.5 million now.

Fannie, Freddie, and the MBA are predicting 6.2 million and higher, but the 5.5 million looks more realistic. We have higher prices and rates – it would be a miracle for sales to increase too.

Two big shows this weekend. X is playing four nights at the Casbah (I’ll be there on Friday), plus Stevie Nicks and Chrissie Hynde are playing at the Fabulous Forum on Sunday:

A bad day for rates – mostly because they look like they will keep going up in 2017. Elective sellers won’t budge until they get 1-2 years’ worth of proof that the market won’t support their price.

http://www.mortgagenewsdaily.com/consumer_rates/688422.aspx

Mortgage rates skyrocketed (relatively) following today’s rate hike from the Fed. It wasn’t the rate hike itself, however, that markets find most troubling. In fact, the hike was almost universally expected. Rather, this was one of the 4 Fed meetings of 2016 that included updated economic projections (sometimes referred to as “the dots” due to the dot-plot chart the Fed uses to show where members see the Fed Funds rate in coming years).

Today’s dots showed that the Fed now sees an additional rate hike in 2016 compared to the last set of projections. Longer term rates like mortgages and 10yr Treasuries had already adjusted for today’s hike, but they had not yet adjusted for any change in the dots. With time running out for traders to take advantage of liquidity ahead of the holidays, the race was on to sell bonds as quickly as possible. When traders sell bonds, it pushes rates higher.

Nearly every lender raised rates this afternoon–some of them multiple times. At first that took the form of mere increases in upfront costs (i.e. the contract rate itself wasn’t moving higher), but subsequent reprices added up to an eighth of a point in rate for several lenders. From a range of 4.125-4.25%, top tier conventional 30yr fixed quotes moved up to a range of 4.25-4.375%–well into the highest levels in more than 2 years.

To recap: this isn’t happening because the Fed hiked. This is a reaction to the shift in rate hike expectations among Fed members. It means they’re having a Matrix-eque moment where they’re “starting to believe.” In this movie, the belief isn’t about Kung Fu and dodging bullets, but rather about the ability to continue gently raising rates.

Sounds like Zillow’s Make Me Move, but they charge 1.5% to 2.5% which sounds like a brokerage – and they are going to start it in New York. Whoever spends millions on advertising could win:

Jarred Kessler, a 15-year Wall Street veteran and former head of US equities at financial services firm Cantor Fitzgerald, came up with his big idea when a friend lost his job.

His friend was in a tough spot and thought about putting his house on the market, but didn’t want the associated “public scrutiny” of a “For Sale” sign on his lawn or neighbors talking.

He wanted to keep it discreet, and he wanted to know the value of his home in case he needed to sell. He wanted to test the market without being in the market, Kessler told Business Insider.

Kessler realized that no other services currently on the market offered potential sellers a chance to quietly assess the value of their homes. Then, trouble with regulators at his Wall Street job pushed him to leave Cantor and create one.

Enter EasyKnock.

EasyKnock is a residential real estate technology startup on a mission to change the process of listing and selling one’s home. It should be up and running by February.

Remember when Carson Palmer bought the hilltop lot in Del Mar at auction for $4,000,000, plus the 10% buyer’s premium? This is what he built:

Word on the street was there were offers that were close, but no sale – it was listed on the range $19,995,000 to $24,995,000.

The home is currently off-market.