Merry Christmas

From me to you – Thank you, and Merry Christmas!

From me to you – Thank you, and Merry Christmas!

Spanish Colonial Revival Style Estate in the Covenant of Rancho Santa Fe from Video Sells Real Estate on Vimeo.

Our Carmel Valley sale closed yesterday, with two notable lessons for me.

Note #1 – We had seven offers, but couldn’t get anyone to pay 1% over list – the list price was $729,000, and it closed for $735,000. Usually when there are multiple offers, one or two of them will break out and pay 5% to 10% above the list price because they gotta have it.

But the willingness to pay over list was subdued. It was probably a function of it being a two-bedroom, 1,410sf two-story home, so the demand is specific, but these are the least-expensive detached homes in Carmel Valley!

It has been the trend in the neighborhood though. There have been 6 sales over the last six months, and they have all closed right around list price.

Note #2 – When homes are selling for a record prices, buyers expect more.

We’ve seen it all year now. The lists of repair requests have grown longer, and more detailed – and buyers are checking to make sure the work was done to their satisfaction.

Yesterday, I was over there installing a new door knob myself!

In our hot seller’s market, listing agents were able to blow off any buyer requests, and the deal closed anyway. Not any more.

We’ll see the same in 2017 – buyers are going to be more reluctant on price, and they will expect a house in better condition.

Get Good Help!

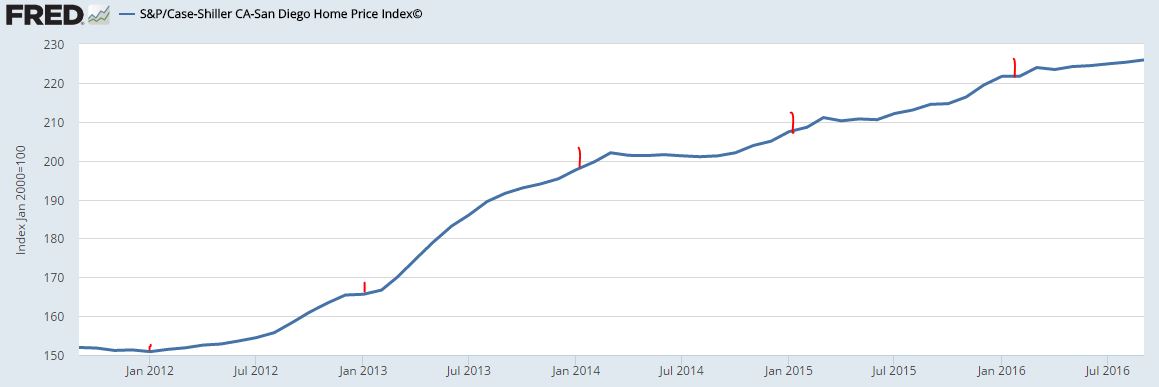

To help guess about what might happen in 2017, let’s look at the history of the San Diego Case-Shiller Index over the last five years.

The red marks are the January readings.

It looks like we have gotten off to a quick start the last three years, but I think this data backs up my theory that only the creampuffs are selling early on.

If you were a buyer coming into a new year, would you jump on a fixer in January or February? Their prices probably aren’t that attractive yet, and buyers want to wait-and-see if they can get better quality later. As the selling season evolves, the fixers start to sell after the creampuffs are pricing higher and the longer-lasting dumps get sharper on price. With more fixer sales in the blend, the pricing statistics cool off.

The second half of this year hasn’t seen the Case-Shiller reflect end-of-year improvement that we saw the last four years, but the last reading on this graph is for September, 2016 – which includes July and August data too. We might see a pop in the Case-Shiller next week for the same reason – only the better quality homes are selling in the off-season. Buyers would rather wait-and-see than buy a dump.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Could the ‘Trump-Effect’ fuel a flurry of real estate activity next year?

This guy had some great thoughts:

https://www.linkedin.com/pulse/reflections-trump-presidency-one-month-after-election-ray-dalio

An excerpt:

This particular shift by the Trump administration could have a much bigger impact on the US economy than one would calculate on the basis of changes in tax and spending policies alone because it could ignite animal spirits and attract productive capital. Regarding igniting animal spirits, if this administration can spark a virtuous cycle in which people can make money, the move out of cash (that pays them virtually nothing) to risk-on investments could be huge. Regarding attracting capital, Trump’s policies can also have a big impact because businessmen and investors move very quickly away from inhospitable environments to hospitable environments.

Any tax relief on the sale of real estate could free up more inventory – but not too much please, just a little more (+10% is perfect)!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Yes, we do have that pesky little concern that higher rates could spoil the party. But the buyers who are sensitive to higher rates, and/or adamant about getting some clawback on price, will just stay on the sidelines – especially in early 2017. Our market has been dependent upon rich people keeping it going – we will need richer people to carry the ball next year. But inheritances and gifts from parents are a powerful market force.

Let’s get into the holiday spirit, shall we?

Home sales that aren’t a result of a bidding war usually have some give and take in price negotiations. It has been a seller’s market since 2009 around here, and the trend of the sellers getting what they want is baked in the cake by now.

Will it change in 2017?

Sellers want their price or close, and believe they deserve it. Almost all of them have their own hand-selected comps to prove they are right, and will wear out the market for months or years before they believe otherwise.

Will buyers dig in, and walk away from deals over the last 1% to 3%?

When most of the sellers have been long-time owners and have loads of equity, it seems ridiculous that a seller would hold out for an extra $10,000 or $20,000 when he already has $500,000+ coming. But it happens all the time.

The listing agents are so used to winning – and used to getting beat up when they are on the buyers’ side – that they don’t think much about changes in the selling environment. And if it’s a new listing, they are getting enough calls that their ego is brimming.

This is where the 2017 market will be made – will buyers walk away when sellers counter over $10,000 or $20,000? If they do, will sellers give?

Sellers aren’t going to give, so if buyers are willing to walk, then we will have the stagnant market stare-down.

My guess?

If it happens, it won’t be until June. By then, there will be enough OPTs starting to pile up, and the buyers who are still looking will be those who missed out on the other houses that were snatched up by the frenzied buyers who let the seller win the extra 1% to 3%.

The MLS remarks are a personal pet peeve, but touchy. I once had sellers object to what I thought was a more-crafty description, and they insisted that it sounded more like the rest. I’m glad the author included ‘boasts’ – see link at bottom:

When listing your home for sale, the goal is to generate interest and capture the attention of discerning buyers. Beyond high-quality photos and a competitive listing price, a property description can go a long way in attracting potential homeowners. To make homes stand out, agents and sellers pepper their listings with attention-grabbing buzzwords — and understandably so. “When you’re writing for marketing materials, you’re going to have to use these kind of descriptors, because otherwise the copy is bland,” explains Bruce Withey, marketing director of the Steven Cohen Team of Keller Williams Realty in Boston, MA.

So, how can you effectively use these ubiquitous popular real estate terms? For one, be wary of overuse. “A lot of agents will be inspired by other people’s descriptions, which means there’s a lot of carry-over from one property description to the other,” says real estate agent Aaron Floyd. “Buyers are seeing the same words used over and over again.” Second, be wary of the misuse of certain descriptive words. When these labels are used ad nauseam or incorrectly, they can actually hurt your home’s chance at a sale.

Below are four terms that won’t necessarily help sell your home — and some expert insight on how to make your listing more powerful.

Read full article here (and 81 comments!):

https://www.trulia.com/blog/avoid-these-terms-house-descriptions/#sthash.oLyTJHXr.dpuf

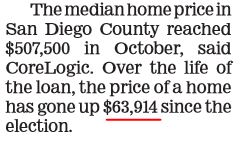

Logically, it would make sense to expect that higher rates AND prices would raise the home-selling intensity to a whole new level.

Buyers will expect prices to re-trace somewhat, and will probably think, “Can’t we just go back to 2015 prices?” And sellers will think, “Not Me!”

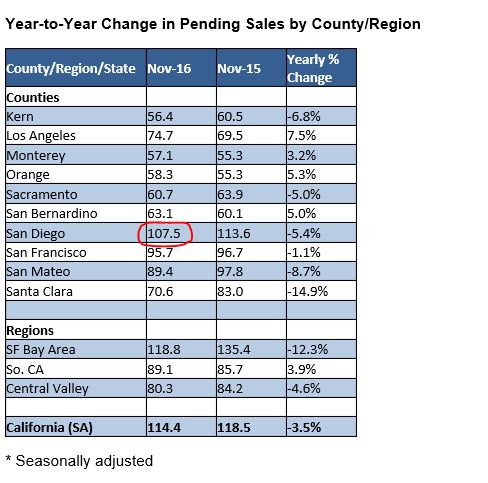

First, let’s reflect on the 2016 stats – how did we do?

NSDCC Detached-Homes, Jan-Nov

| Year | ||||

| 2012 | ||||

| 2013 | ||||

| 2014 | ||||

| 2015 | ||||

| 2016 |

We have been striking a fine balance between listings and sales.

Because we only had a few more listings in 2017, the buyers didn’t flinch. Instead, they kept buying!

Every year we have a whole new set of buyers and sellers, yet we expect them to all behave the same as in the previous year. Will it happen again? Yes. Why?

Because that’s the other part of the fine balance. If you are a buyer, either you buck up and pay these prices, or you don’t buy. If you are a seller, you want/need to spruce up your house, get a good agent, and put an attractive price on it, or you will struggle to sell. Buyers will be pickier than ever!

There will be a few on each side that get lucky and beat the odds, but for the most part, the market conditions are going to remain the same until we run out of rich people, or something catastrophic happens.

I’m not any better at guessing the actual stats than the next guy, but here goes.

JtR Predictions

On January 7, 2016, mortgage rates were 3.98%, and I guessed were would see 2016 sales drop 5%. For the Jan-Nov period, it has been a virtual dead heat – 2775 sales this year vs. 2771 in 2015. But I might get lucky if our rapidly rising mortgage rates killed a bunch of deals this month, and the YoY sales dip under 2015 by a couple of points.

We have eight business days left, plus late-reporters, so I’ll say no luck for me and predict that the final total of 2016 will match the 3,011 sales from 2015.

| Year | ||

| 2012 | ||

| 2013 | ||

| 2014 | ||

| 2015 | ||

| 2016 |

The current momentum is so strong that I’m going to say the Trump mojo will cause sales to increase enough in the first half of the year that next year’s sales will top those in 2016.

My guess is for 3,100 sales in 2017, and median sales price of $1,200,000. A paltry 3% gain for each category, which is about as safe as it gets!

There will be winners and losers – here are examples:

Whether it’s due to rising rates, the Trump effect, or just pure demand, our local market keeps rocking!

New NSDCC detached-home listings this week: 45

New NSDCC detached-home pendings this week: 58

In spite of being smack dab in the middle of the holiday season, and two days of rain – the 58 new pendings are the most since October!

Click on the ‘Read More’ link below for the NSDCC active-inventory data: