Mortgage rates sure are cooperating with the peak selling season! Let’s hope the economy stays alive, and the political circus doesn’t get any worse.

From MND who quotes rates with zero-points:

Part of the recent move lower in rates is due to anticipation of just such a “sell stocks, buy bonds” trend–just like the one seen in the first 6 weeks of 2016. If stocks actually do move significantly lower, it’s highly likely that rates would follow. Even now, rates are already very close to the lowest levels in 3 years. In fact, since mid-May 2013, we’ve only seen rates any lower than today 2-3 times, depending on the lender. As for particulars, the most aggressive lenders are back to quoting 3.5% on top tier conventional 30yr fixed scenarios, with the bulk being at 3.625%.

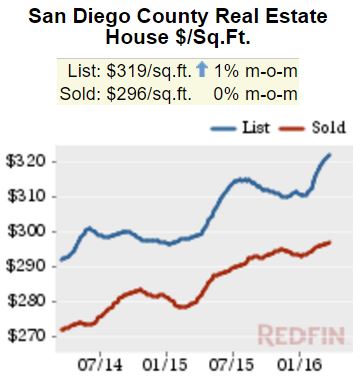

Let’s also note what appears to be the new trend of seller euphoria that kicks off the spring selling season now:

With house prices so high, I don’t care how low the mortgage rate goes. Unless it goes negative and the banks pay us to hold a mortgage! 🙂

Also, paying higher prices for a house you get stuck with a higher property tax for the next 30 years.

Another way I look at it, with a higher rate I get a bigger mortgage deduction from the IRS! 😀