Del Mar Open House

A great first day of the open house extravaganza in Del Mar:

A great first day of the open house extravaganza in Del Mar:

Our regular commenter elbarcosr backed me up on how wacky the zestimates have been lately. They seem to be getting worse, which is hard to believe.

Being a Zillow homer now, I thought I better look into it.

Let’s serve up a nice big softball. Certainly the zestimates have to be accurate on recently-sold homes, don’t they? We saw how Redfin’s evaluator can cozy up close to a recent list or sales price, and you can’t blame them. After a few years, the database would look pretty consistent.

Does Zillow do the same? Wouldn’t it make sense to have your algorithm compute a recent sales price into the property’s zestimate? Because if you did, it would also help value the nearby homes that haven’t sold recently – because that’s how everyone would value them.

Evaluations in unique, non-tract areas is tougher. But if we are just looking at recently-sold properties, and their zestimates – the uniqueness shouldn’t matter as much!

I looked at 28 homes sold in La Jolla, Del Mar, and Rancho Santa Fe that closed between $2,000,000 and $3,000,000 in 4Q15, and compared their sales price (the definition of value) to their zestimates.

The average margin of error was 16%, and after removing the four that were wrong by more than $1,000,000, the average error was still 12%.

These are houses recently sold, and their sales price defines the actual value!

Even though the $2,000,000 to $3,000,000 range is the lower end for those areas and there are plenty of comps to help pin-point a zestimate, let’s consider an easier target.

Carmel Valley should be the hotbed of zestimate accuracy, especially when we look at the low-end where every data point is a pure tract house.

There were 57 CV sales in the fourth quarter between $1,000,000 and $2,000,000 that were considered.

The average margin of error was 3.6%, which is probably acceptable. But if it was any higher, there would be concerns – these are tract houses that just sold in 4Q15, and have a long history of steady comps around them!

My takeaway?

The only zestimates that might be close are in pure tract neighborhoods.

Disregard all others.

Zillow’s new video format leaves a lot to be desired – no audio, no zoom, and no graphics. Here I am commenting on my latest Zillow video while watching it on my computer screen:

With home prices still going up, people wonder how the real estate market can continue to grow. From John Burns Real Estate Consulting:

Housing affordability has become a big problem in many major metros in the country. In fact, many middle-class buyers can no longer afford a new home. Consider the following:

Strong wage growth seems to be right around the corner, which will help affordability. Incomes should rise steadily over the next few years due to demand for high-income workers and a shortage of workers overall.

Job growth remains healthy in most markets, especially in high-income jobs. High-income job growth has recently emerged as a primary driver of new home demand, particularly in higher-priced markets. Nationwide, high-income jobs are up 2.6% year over year. However, growth in high-income sectors has played out very unevenly across the major metros.

Read full article here:

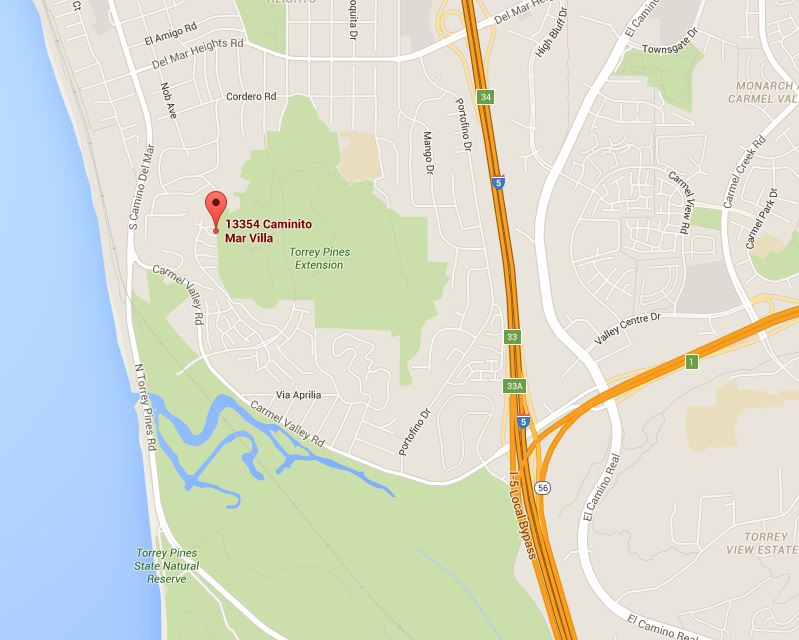

There has only been one Sea Village sale in the upper section over the last 3+ years – and this end unit also borders the Torrey Pines State Reserve Extension, which hikers will love! Come by this weekend – the whole team will be out:

The zestimate has gone bonkers here – dropped $200,000 in the last 30 days:

http://www.zillow.com/homedetails/13354-Caminito-Mar-Villa-Del-Mar-CA-92014/16766333_zpid/

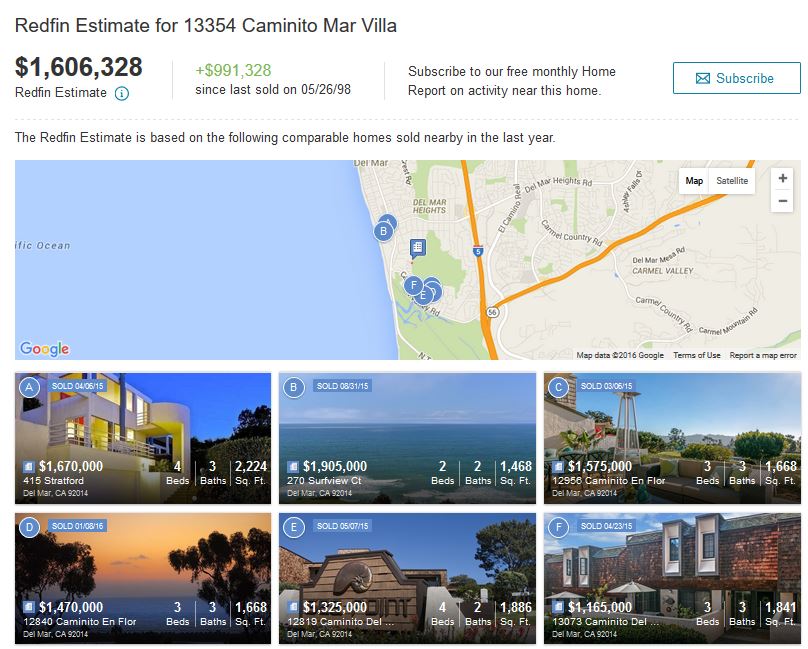

The Redfin value is $1,606,328, which was generated before they had my MLS listing:

https://www.redfin.com/CA/Del-Mar/13354-Caminito-Mar-Villa-92014/home/4441814

The Grammys had notable tributes to icons who have passed recently. Lady Gaga broke new ground with a techno-beginning that would have made Bowie proud, the B.B. King tribute was spot on, and the Eagles probably played their last show together.

But Natalie Cole barely got mentioned, and for someone who won nine Grammys, she probably deserved a little more. She was more than just her daddy’s daughter too, she could sing – how many could keep up with Whitney?

Our favorite doomer is predicting 15% to 20% drops in pricing net year (link in twitter feed in right-hand column). Mark has been making these dire predictions for years now, and eventually he might be right.

But it would take surge in supply to start a downturn…..so all we have to do is keep an eye on inventory counts. If the number of homes increased modestly, sales should respond accordingly.

Where is the balance of too much supply? It will vary in each area, and be based mostly on price. You could have 1-2 over-priced homes not selling in one area, and look like a glut, while in other areas have 5-10 well-priced homes hit the market and all get gobbled up.

I’ll speculate that a surge of more than 20% in the inventory counts is cause for concern. How are we doing so far?

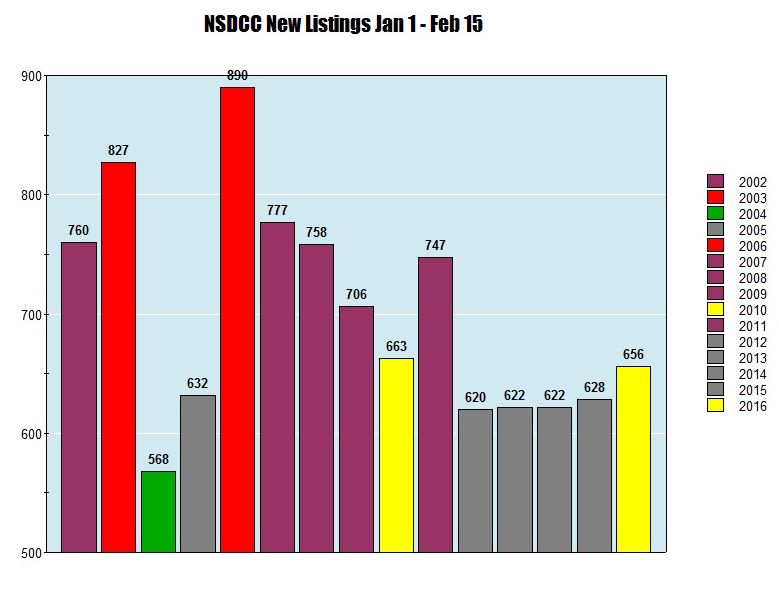

When comparing to the very consistent last few years, a 4% rise in new listings this year stood out. But compared to 2002-2011, the inventory has been remarkably predictable lately – we even had two years with identical counts:

In addition, this year’s increase could purely be due to old listings being re-freshed, an annoying trend that seems to be more popular than ever.

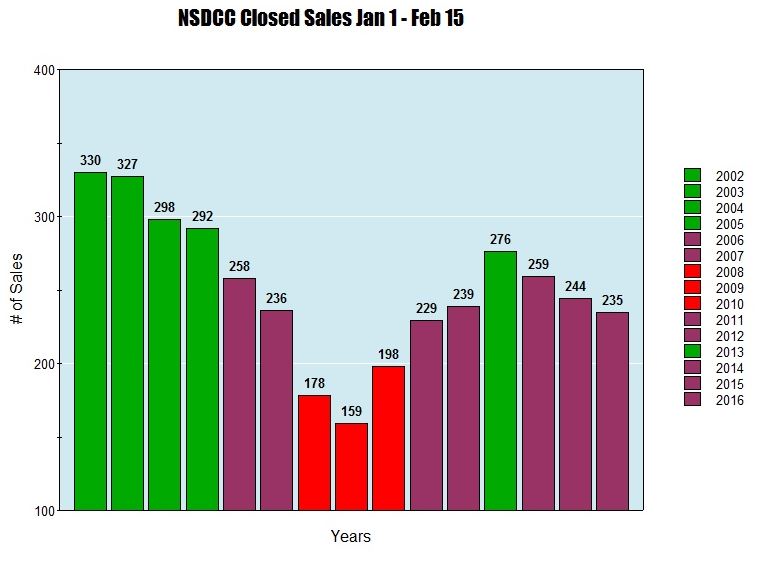

Can we learn from the sales count too?

Absolutely, and any drastic swing in the sales count is the ultimate sign of demand. We will still have late-reporters adding to this year’s count, which should easily get it above the 2015 sales:

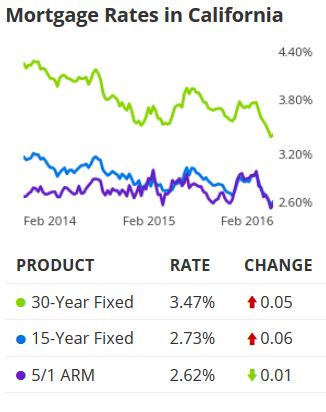

As long as rates are in the 3s, we should be fine this season!

There hasn’t been a sale in Derby Hill, one of the premier newer tracts in Carmel Valley, in almost six months. Will buyers mind picking up where they left off last summer?

Here’s a great reason to list your home with Jim the Realtor – Zillow is giving ‘special preference’ to listings by Premier Agents that feature a video tour.

Home sellers will have one more way to evaluate which listing agent to hire – who does the best video tour!

The home video tour also gives the listing agent direct access to the buyers, allowing them to sell the house using video and audio – which might be the more important benefit of the two.

The Big Quandary for many sellers. Plenty of folks love the house, but which one will step up and pay the price? How long do you wait?