http://www.nytimes.com/2015/07/23/technology/qualcomm-earnings-q3.html

The Qualcomm press release today:

An excerpt:

The company expects to fire about 15% of its semiconductor business’ full-time staff, significantly reduce its temporary workforce, and streamline its engineering organization.

They expect to layoff around 4,500 people company-wide. What does that mean for the local real estate market? Let’s point out the general changes:

1. YOU DON’T HAVE TO MAKE YOUR PAYMENTS.

A result of the financial crisis – banks are equipped to let you ride for months or years without making payments.

2. CUSHION

There will be severance packages, plus stock and stock options to live on.

3. ONLY RECENT PURCHASERS WOULD FEEL THE SQUEEZE.

If a Q-employee bought their home more than 3 years ago, they have plenty of equity, and have probably re-financed at a low rate. Payment amounts are tolerable, especially compared to rents in the same area.

4. MICKELSON EFFECT

Phil Mickelson made a big stink about the state tax he has to pay (probably around 13%) – but you haven’t heard a peep out of him since. Why? My guess is that his wife put her foot down, and told him they aren’t moving anywhere. The same thing would happen here – even if a spouse or both are laid off, they will exhaust all avenues to maintain the same lifestyle and kids’ upbringing. Selling the house would be the absolute last resort.

5. BANK OF MOM AND DAD

The kids have been very successful up to now, and the grandparents will drain a few accounts to help keep the grandkids’ lifestyle in place.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

There would be loads of buyers today of homes priced at 20% under today’s values. If that is the floor, then about 10% off would be a retail-price target. We could have a few different factors contribute to a similar discount (Fed move, Grexit, unknown factors, etc.), but we already endured the most severe downtown in the history of real estate and the premium areas didn’t take much of a hit.

Let’s use Carmel Valley as the target market to follow:

| May + June stats | ||||

| 2007 | ||||

| 2012 | ||||

| 2015 |

A mass exodus of elderly or foreign homeowners is much more of a concern – they’re urgency is higher, they have less reasons to stay, and they can probably afford to dump.

I listened to the whole hour of razzle-dazzle – they are confident that these moves will be effective:

http://edge.media-server.com/m/p/aywoxt5p

http://www.voiceofsandiego.org/topics/economy/the-biggest-threats-facing-qualcomm/

One thing you’re not accounting for is nowadays in tech businesses more and more people are working from home. Business are using this as a “perk” (when in actuality it’s a cost savings to them). I wouldn’t be surprised if many of the qualcommers picked up this kind of work if something happened.

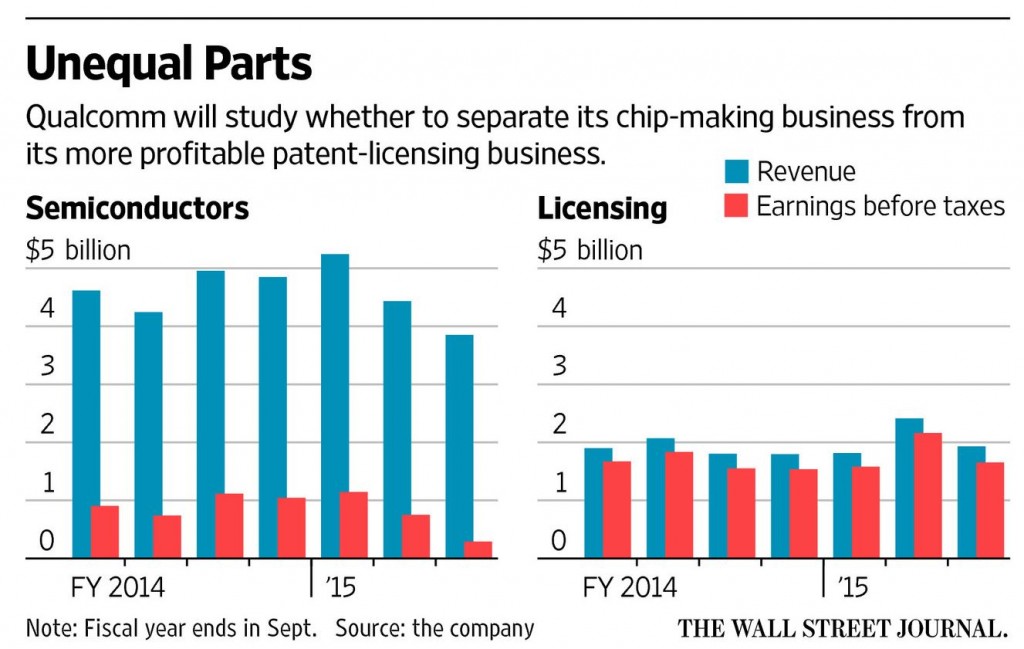

Qualcomm is laying off 4,500 people worldwide. Not 4,500 people in San Diego. I’m not familiar with Qualcomm’s operations, but my guess is most of the chip manufacturing is already offshore. It’s not profitable to manufacture chips in the US. They are separating that business to sell it, no doubt, as have many other chip companies. Those are the people that will get fired in the streamlining. Improve the numbers, then off-load the headache.

When the lay-off numbers for San Diego are published, that’s when the impact of the lay-off on San Diego housing prices can be estimated.

“1. YOU DON’T HAVE TO MAKE YOUR PAYMENTS.

A result of the financial crisis – banks are equipped to let you ride for months or years without making payments.”

JtR…..could you expand on this point? If someone has a decent amount of equity in the house (>10%), wouldn’t the banks be more inclined to speed up the foreclosure process?

No – they can’t, now that we have the Homeowners’ Bill of Rights.

The lender has to take you through the waterfall of choices available, and offer you a loan mod first.

I sincerely hope I never have to take advantage of said bill of rights, but this is comforting to know.

Thanks JtR.

Nevada has the same bill of rights that has effectively stopped foreclosures for 3-4 years plus.

My best friend finally got a HAMP loan mod after 10 tries with Ocwen. They wouldn’t foreclose on him since 2009. Kept telling him to “try again”. I helped him with the proper ratios needed to qualify and finally- voila- 200k principal reduction(substantial on a 500k home) and half the payment. The whole process is rigged and we cant do anything about so why not join them?

The latest CA state WARN report doesn’t show the Qualcomm layoffs for San Diego yet.

Here’s the link to the latest report (07/01/2015 – 07/10/2015)

http://www.edd.ca.gov/jobs_and_training/warn/eddwarn15_07102015.pdf

The crash caused all sorts of protections for consumers to be implemented. The CFPB and said Homeowners Bill of Rights are two examples of that. Definitely a much different climate! They are even replacing the HUD and other docs at closing.

Its 4700 jobs. Probably 2500 or more from San Diego, as it does not make sense to cut jobs in india or china. In 2007 tech companies (and specially Qcom) were hiring. Those who bought a place 1997-2004, again bought another one at 2007-2011 as an investment where people who were hired recently rented. 2011 market revival was brought in by investors. Some of them have huge equity and may run into -ve cash flow if some of the engineers leave the city. Average San Diego income cannot afford those houses in 4s or carmel valley. Whats more alarming Qcom is the strongest of chip companies. BCom already left town, INTEL is not having a good day as well. GOOG got rid of local chip company. In 2007, there were consumers for those house. Many retirees live in 4s ranch in their investment home, they would like to sell their house and move up north(they are waiting for highest equity possible). 2500 people is too small for San Diego(some areas may be effected). The only reason, 4s ranch houses were more expensive than carsbad was those techies earning 140k and needing a place close to a good school. Otherwise Carlsbad is a better place to live. Around 2006-2007 SONY’s move to San Diego (and QCOM hiring like crazy) helped the city a lot. As the city has become as expensive as OC, many companies might move jobs to cheaper cities.