Elfin Horse Ranch

If you are looking for a horse facility that is closer to town than most, yet has plenty of hills and trails for riding, check out this property:

If you are looking for a horse facility that is closer to town than most, yet has plenty of hills and trails for riding, check out this property:

Can we predict what sellers will do next year?

Let’s look at what they are doing now – certainly today’s sellers have heard that market is hot due to the low inventory, and they are hoping to capitalize. Can they keep their optimism under control?

This should be a conservative look too, because anyone who is listing their house for sale in November is probably more motivated than those putting their home on the market in springtime:

New listings of NSDCC detached-homes between October 1 and November 15th

| Year | # of New Listings | LP avg $/sf |

| 2010 | ||

| 2011 | ||

| 2012 |

Fewer are coming on this year, but on average, they are listing for 15% higher than last year. Sellers are pushing it, and that is likely to continue. If buyers don’t respond, we should have an OPT-glut by April/May. The over-priced turkeys tend to feed off each other, justifying their high price by comparing to their neighbor’s similar fantasyland price.

This year there have been 189 of the 464 (41%) marked contingent, pending or sold, which is pretty good for the holiday season. The 27 that closed have averaged $485/sf, but if you remove the 3 highest and lowest sales, the average drops to $420/sf.

Buyers aren’t letting up in their pursuit of a purchase! Will they pay more?

There are probably those who are formulating their predictions about the 2013 market, and now that the comments are on, are getting ready to share with us what they see coming down the road.

Lately the media has been unabashed in their fondness for the apparent recovery underway, and even I have been unusually optimistic about the near-future.

Carmel Valley has been our litmus test, with its rows of newer tract homes, outstanding schools, and central location. What can the CV tell us today?

It appears that CV buyers are starting to resist the seller exuberance.

Could the spring selling season turn into a dud because of greed?

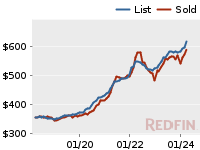

Here is the all-San Diego graph, which masks the detail of the more-localized graph above:

What do you do when a house falls out of escrow when there was a load of interest and/or offers?

Usually you’ll see the listing agent immediately throw the property back into the MLS’s active category, subject to cancellation of the previous escrow. If previously interested parties see that the listing is back in the actives, they will think that it will be another bidding war, and get discouraged. Is that what’s best for the seller?

Hear me out on this tactical strategy.

I think it is better to go back to the interested parties first.

They have already been involved with the property, and are the most likely to buy it. But they got their dreams stomped on when it went pending the first time, and most buyers try to forget all about it and move on.

The listing agent has to re-ignite the urgency. If you come back and offer them an insider’s first shot at it, they will likely respond favorably, because that’s what every buyer wants – a clean shot at buying the house.

They will look it up on-line and see that it is still shown as pending – confirming the exclusivity. Give them a few hours or a day’s headstart – then change the listing to active again to spur them on further. The race will be on!

Once multiple offers are in, I pit the bidders against one another by telling them the other offers, and encourage them to beat them.

Most agents think it should be top secret, but it is in the seller’s best interest to make it easy for buyers to bid up the price. If a buyer hears that if they don’t increase their offer, they are going to lose the property, then they will either respond accordingly, or at least know that they had a fair chance to buy it.

Here’s an example:

Terramar is my favorite neighborhood in Carlsbad.

It is about 300 houses within two blocks of the beach near Cannon and Carlsbad Blvd. where you find older houses on 7,000sf to 11,000sf lots with no fees and just a bunch of great neighbors.

It’s also where the nickname “Jim the Realtor” was born. I was re-selling my old house in 1995 and was beseiged with so many visitors at open house that I started identifiying myself as Jim the Realtor so people knew who was in charge. CB Mark was there, and can verify!

It’s the week of Thanksgiving – thanks for being here!

On September 27th when the comments went off, I thought we’d lose a third of the audience.

Over the last thirty days we’ve had only 13% fewer unique visitors than during the 30 days prior to September 27th. The visits and page views are down 20% and 38% respectively, which I think is a result of readers taking a more casual involvement here, which is good. I appreciate you being here – check in every few days for an update!

Over the last thirty days we’ve had only 13% fewer unique visitors than during the 30 days prior to September 27th. The visits and page views are down 20% and 38% respectively, which I think is a result of readers taking a more casual involvement here, which is good. I appreciate you being here – check in every few days for an update!

Bubbleinfo’s Google Analytics Aug 29 – Sept 27

Bubbleinfo’s Google Analytics Oct 19 – Nov 18

With the market in such unprecedented territory, readers continue to request a wider perspective. We want to hear eveyone’s thoughts about what they are seeing out there! Having a moderator is the happy compromise where I don’t have to drop everything to respond to a comment. If you can live with occasional delays in seeing your comment posted, then this should work for everybody.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The ACT/CONT+PEND count was 844/563 on October 21st. Today it is 768/545, which means there hasn’t been much holiday drop-off in sales. Let’s separate out the higher-end stats to appreciate how active the market is below – sizzling hot:

| NSDCC House Listings | # of ACT | LP Avg $/sf | # of CONT/PEND | LP Avg $/sf |

| Under $1.25M | ||||

| Over $1.25M | ||||

| Total |

Here is the breakdown of the contingents and pendings – the upper crust appears to be pretty comfortable, with only 18 short-sales in the works:

| NSDCC House Listings | # of CONT | LP Avg $/sf | # of PEND | LP Avg $/sf |

| Under $1.25M | ||||

| Over $1.25M | ||||

| Total |

Deal-seekers will be sorry to see them go, but it looks like short sales are winding down. The underwater folks have to be itching to stick around another year or two to see if they might re-gain their equity. At this stage, it seems irresistible for them to wait-and-see!

They try to sell this house every year between tenants, which is a smart move.

They did lower the price this year, from the $1,985,000 they’ve been asking over the last 3 years. They paid $1,625,000 in 2004:

This was on the bubbleinfo twitter a couple of days ago, but this excerpt deserves specific attention for those who are wondering who is creating the floor in the market:

Blackstone, the world’s largest private-equity firm, has spent about $1.5 billion on 10,000 foreclosed properties in the U.S. this year, making it the biggest buyer of single-family homes in the country, Gray said. Blackstone has been buying $100 million of houses a week, Stephen Schwarzman, chairman of the New York-based firm, said during an Oct. 18 earnings call.

“This is the kind of thing that happens once — every once in a while, where you see something that’s a market-turning trend and we are loading the boat,” Schwarzman said.

Blackstone fell 2.7 percent to $13.98 today in New York. It’s returned 0.5 percent, including dividends, during the past year, compared with 11 percent for the Standard & Poor’s 500 Index.

Thomas Barrack’s Colony Capital LLC, a private-equity firm, has bought about 5,500 homes since April, spending more than $500 million, and expects to reach $1.5 billion invested by the end of next year. Closely held Waypoint Homes has said it has bought about 2,500 homes and expects to have 10,000 homes by the end of next year.

Blackstone, Colony and other investors buying homes in bulk to rent have said they could create real estate investment trusts out of the properties to take public, paying dividends from the rental income on the homes, similar to the wave of apartment REITs such as Equity Residential that went public in the early 1990s.

“There are differing opinions about whether the opportunity will continue beyond 2-3 years to buy houses at yields that make sense to institutional investors,” said Colin Wiel, co-founder and managing director of Waypoint Homes. “I believe this is an evergreen opportunity.”

While investment yields “will come down,” from about 7 percent today, excluding debt, to a level more in line with apartment-property yields, or about 5.5 percent, Wiel said, “I think institutional investors will be comfortable with that because the asset class will be ‘established’ by then.”

Blackstone paid less than $150,000 on average for homes that were valued during the 2006 peak at more than $300,000, Gray said. Blackstone has formed a company called Invitation Homes to focus on about 10 metropolitan areas that were particularly hard hit by the credit crisis. It has partnered with closely held Riverstone Residential Group based in Dallas to manage the properties.

“It’s grown to be a sizable investment for us,” Gray said. “One of the key questions is, can you make this work?”

Blackstone plans to attract tenants by renovating the homes and providing better property management, Gray said. Because it’s buying homes after lenders have foreclosed, the properties generally are in poor condition and require investment to make them more livable.

“We’re coming in and deploying significant capital,” Gray said. “We’ve got to make this as efficient as possible,” he said. “I think it’s one of the barriers to entry. You have to make a huge infrastructure investment in order to execute.”

Owning 400 single-family homes spread out by geography, as opposed to one apartment building with 400 units, presents challenges for investors, Gray said. Blackstone is focused on about 10 markets, including Northern and Southern California, Phoenix, Tampa and Orlando in Florida, Atlanta, Chicago, Charlotte in North Carolina, Las Vegas and Seattle, he said.

One exit strategy for the firm is to sell stock to the public in the management company when the time is right, Gray said. “We can create a business investors will want on an income basis,” he said. “I think we can create a real company that can be taken public.”

It is getting easier to investigate realtors on-line.

We’ve already seen that www.neighborcity.com allows you to research an agent’s recent sales history. The realtor-groups that pool all the team’s sales under one agent are still deceiving (Redfin and most top-producing agents), but at least you have some way of verifying that somebody has been successful in getting people to the finish line.

In a different twist, www.homelight.com allow you to search your preferred neighborhoods to find an agent, and then screen by price range, and agent characteristics too.

The data provided by both of these websites is less than 100% accurate – the actual sales counts fluctuate, and homelight says that one of the areas I work is Castle Park? But at least there is independent data available.

The best gauge of how an agent can help you is simply the number of closed sales – that verfies the agent’s skill and ability to successfully juggle all the wide-ranging variables encountered in each sale. An agent who sells at least 1-2 houses per month is nimble, and experienced in navigating this market.

The only common thing about agents is that each of us has gotten at least 70% correct on the state’s 150-question multiple-choice test. Other than that, you are left to believe what the agent tells you – unless you do some research on websites like these.

This is a good example of being close, but not close enough – buyers are very picky: