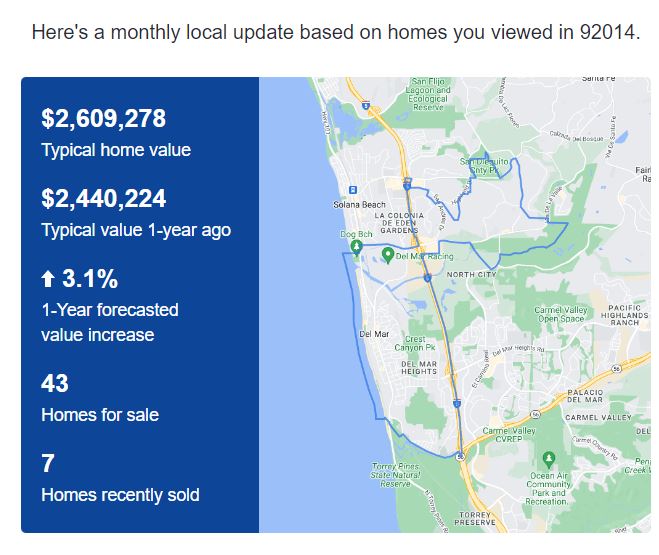

Zillow Local Forecasts

Last month their annual appreciation guesses were in the 3% to 4% range, now they are up to 4.9% to 6.3% for the next 12 months!

We’ll probably exceed those in the first quarter of 2024!

Last month their annual appreciation guesses were in the 3% to 4% range, now they are up to 4.9% to 6.3% for the next 12 months!

We’ll probably exceed those in the first quarter of 2024!

If Zillow made their predictions based on traffic to their website, it would be impressive. I’m not sure how they figure these though.

Generally, they are expecting +3% to 4% in home values around here over the next 12 months:

Homes.com says they are going to be a primary real estate search portal, and well, it’s go time! One of the 30-second Super Bowl ads cost $7 million – a great place to spend big money if you’re trying to make a splash. This are just teasers for their Super Bowl ads:

The last video appears to have CoStar’s CEO Andy Florance in a cameo board room scene (:15). Both of them teasing the “2.11.24” Super Bowl date. He likes to go big with their promotion, and nothing is bigger than a Super Bowl ad. Should be fun to watch!

We will be seeing ads for Homes.com everywhere this year:

View this post on Instagram

Zillow keeps feasting on lazy realtors!

Any agent could walk around their next listing with their phone’s camera running and comment on what people are seeing and why they should buy the house! The extra audio will be far more effective than any whiz-bang product that comes to market at any price.

Why don’t agents do that?

There is a common belief that it takes longer to sell homes that are more expensive.

The statistics back it up too.

But the belief is a self-fulfilling prophecy that is executed by realtors and sellers every day. It’s hard enough to put an attractive price on a more-expensive custom home, and then sellers and listing agents can’t resist goosing their price by another 5% or so, just to make sure they don’t leave any money on the table.

It looks like Zillow is going to help bring an end to this sloppy practice.

We know that the zestimates are way wronger than they admit, especially with custom homes. Once a home hits the MLS, we also see them adjust the zestimate to within pennies of the list price – so they are unreliable at best, and fraudulent by most common standards.

But I’ve also noticed on this listing that the zestimate has been going down since we went for sale.

After a week on the market, the zestimate was down to $3,419,900 on Jan 22nd:

Then today the zestimate is even lower, and the spread between the views and the saves is getting larger because the highly-motivated buyers see it in the first few days and run up the count of saves:

Buyers have full access to all data now, and the longer a home is on the market, the less they will want to pay. If a recognized authority (in their mind) is also lowering their zestimate on the home publicly, it will fortify the buyers’ belief that they should offer less. Thanks Zillow!

I can’t change that belief – I’m just going to try and sell my listings early on!

It’s a new year and many, including Zillow economists, are optimistic. After a year in which almost half of agents reported selling one home or less, optimism is a valuable tool. To that end, there are a few major macroeconomic tailwinds that might fuel the early months of 2024:

Benchmark rate cuts can mean mortgage rate softening. Mortgage rate softening means more sellers loosen their grip on rate lock. Taken together, these trends drive a healthier housing market.

That’s the glass-half-full picture. Now let’s take a deeper look at a few trends.

Twenty-one percent of homeowners are considering selling within the next three years, according to Zillow research from December. That’s up 15% year over year.

Here are some of the most common reasons why:

A Zillow analysis of United Van Lines data shows that long-distance movers are heading to metro areas that are less expensive and have less competition from other home buyers.

“Housing affordability is reshaping migration trends. Buyers are moving where homes are more affordable and where there’s less competition,” says Zillow Senior Economist Orphe Divounguy. “Affordability remains the biggest challenge for most homebuyers today. Helping them navigate it by pointing them to a loan officer first is key. It’s even more crucial if they’re new to the area.”

Out are states like New Jersey, New York, North Dakota, Illinois, Michigan, and California. Top destinations include Charlotte (Zillow’s hottest market prediction for 2023), Providence, Indianapolis, Orlando, and Raleigh.

Additionally, a recent Brookings report found that tech jobs are spreading out. Traditionally concentrated in hubs like San Francisco, Seattle, and New York, tech employment is branching out to new “rising star” metros. Since 2020, cities like Dallas, Austin, Denver, Miami, Nashville and Salt Lake City are pulling larger shares of tech work.

The study found that this phenomenon was already underway, but that the pandemic, remote work, and high mortgage rates likely accelerated it.

Takeaway: Cities and states gaining workers are almost all more affordable than the traditional tech hubs. Out-of-town leads in these rising star metros may have healthy incomes and be looking to view upper-tier buys.

Rent growth is slowing in many major metros and rents are even falling in a few. Nationally, rents are still up 3.3% from a year ago, but they dipped (0.2% from the previous month). Forty-five of the 50 largest metro areas have seen annual increases.

Rental concessions, like free months of rent or free parking, have surged unexpectedly. In December, 32.7% of rentals on Zillow offered at least one concession. That’s up just 0.7 percentage points from November but 10.1 percentage points from last year. This rise is especially prevalent in cities like Oklahoma City and Memphis, which each saw a 4 percentage point increase from November to December.

Takeaway: Leads may be weighing another lease before a purchase. But equity starts when you buy. Those who plan to live in their new home for long enough can start building that equity now, and most experts agree that significant rate drops won’t happen anytime soon.

https://www.zillow.com/agent-resources/blog/january-market-report-tailwinds/

Here’s how our new listing stacks up.

Nine of the 22 homes for sale in the 92011 are mobile homes, and two are attached homes.

This zip code has a population of ~25,000, but there are only NINE houses for sale, ranging from $1,995,290 to $3,779,000…..and now two are for sale on the same street! We expected that the one down the hill at 7210 Aviara Drive would re-enter the market, because it had been for sale for months at the end of last year and cancelled for the holidays.

I didn’t advertise on Zillow that we are doing the broker preview today because the HOA is tough and I don’t want to stir it up. But the competition went ahead with publicizing their open house today so both of us should benefit. If you’re interested, come on by – we’re having breakfast burritos!

The specialized Zillow listing kit that they started selling this year for $529 includes prominent placement of the listing for the first seven days, but when there are only 22 for sale, it means that everyone is up front. But I don’t mind the #1 spot – here’s how our listing has scored so far:

The saves-divided-by-views = 8%, which is better than my rule-of-thumb of at least 5% for hot listings, and then Zillow adjusting their zestimate to within 0.4% of my list price doesn’t hurt either. It was just slightly different last week:

The Zillow listing kit includes photos, 30-second video (too short for big homes), drone shots, 3D tour, and floor plan. They require that agents use their 3D tour and floor plans in the MLS to receive the 7-day prominent placement, and it makes you wonder what else they will require once they gain more traction.

Here is the pro video we did with our usual guy (not Zillow). It’s the best one yet:

Come by 10:30am-1pm today, or on Saturday, 12-3pm!

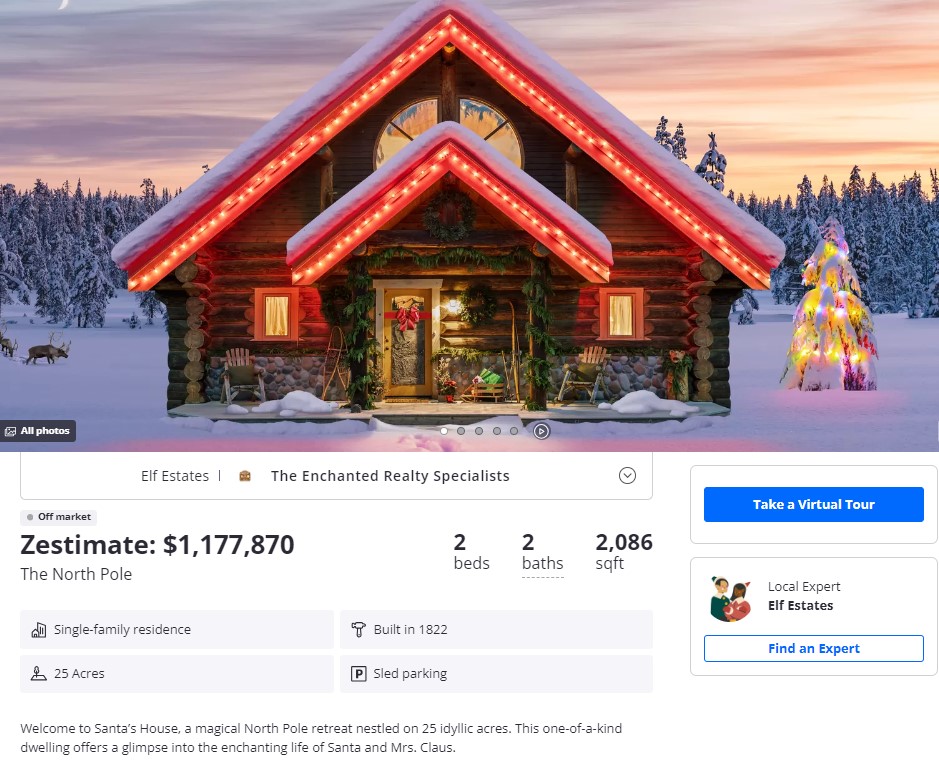

Santa’s House is featured with Listing Showcase, the elevated listing experience available only on Zillow. Showcase listings are powered by artificial intelligence and feature immersive media and an entirely new design to help give you richer insights into the home’s layout and features. Sellers interested in showcasing their home can ask their agent about Listing Showcase.

Check it out here:

https://www.zillow.com/house/santas-house/

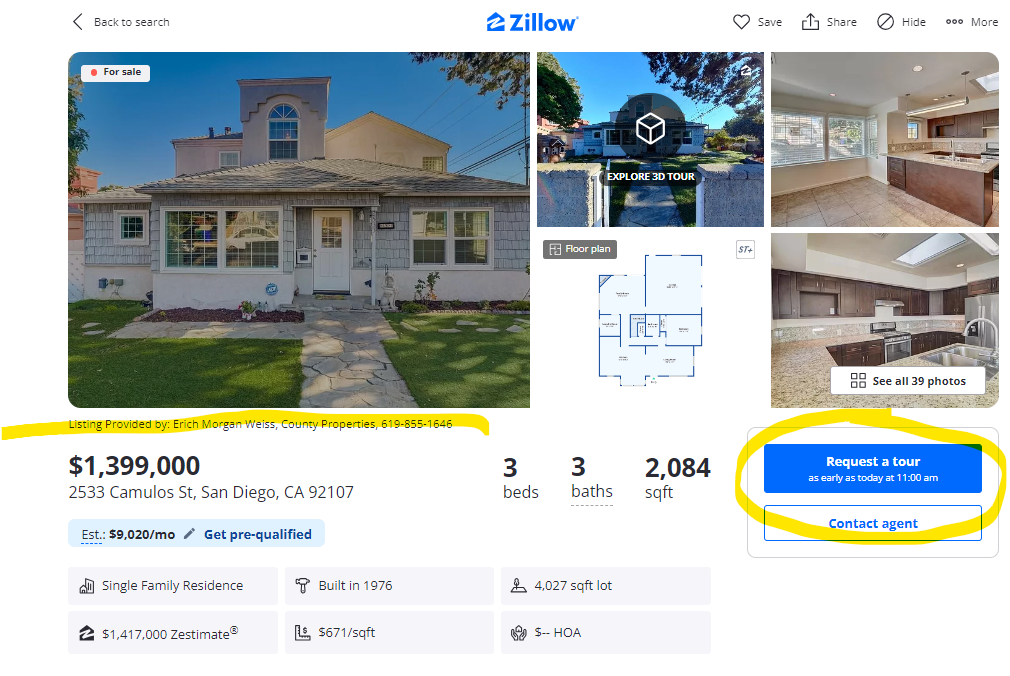

The gradual phasing out of buyer-agents is underway, and it shouldn’t be long now.

Zillow’s new format features the listing agent’s phone number under the main photo!

The three-headed agent display was removed and now when a reader clicks on the right side for Request a tour or Contact agent, they are linked to the Zillow call center instead. There they get processed/qualified on the phone by Zillow employees, sent to Zillow Mortgage, and then get assigned to an agent who is paying big money to Zillow for the privledge.

Buyers will figure it out pretty quick. By clicking on the right side, you get a 3rd party agent who isn’t the listing agent and has never been to the home. With the listing agent’s phone number now prominently displayed, it is inevitable that buyers will call the listing agent next time.

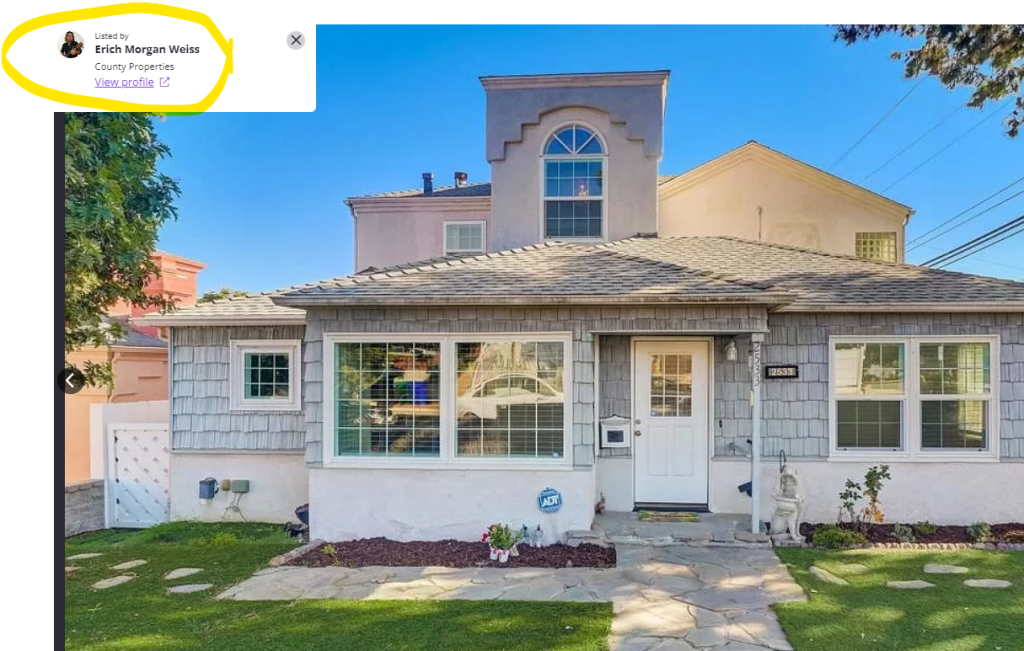

If they need a prompt, they will get one when they start clicking on the photos – which every viewer does immediately. This is what they will see now:

Yep – the listing agent is in the upper-left corner of every photo!

https://www.zillow.com/homedetails/2533-Camulos-St-San-Diego-CA-92107/16966353_zpid/

With the threat of buyers having to pay a buyer-agent a hefty commission out of pocket, it will be irresistible for them to contact the listing agent to see what they have to offer – in hopes of avoiding a separate payment due to a buyer-agent. The listing agents will be happy to oblige because they will already have their full fee packed into the listing side.

By the time the realtor lawsuits get resolved, it will be too late – there won’t be any need for a buyer-agent.

Zillow is offering a full marketing package to listing agents too.

Package Includes:

The Listing Placement Boost on Zillow?

Listing agents who purchase a marketing package will have their new listings displayed first in the home’s area for seven days – a very nice feature for agents looking to capture buyers for their listings.

While the rest of the industry was grumbling about lawsuits over the last few months, Zillow created a new format that will solve everything. But nobody knows what fee the listing agent charges because it is never disclosed to anyone but the seller – the person who just wants to hurry up and get their money.

What is the best thing a consumer can do to prepare for the 2024 selling season?

Get Good Help!

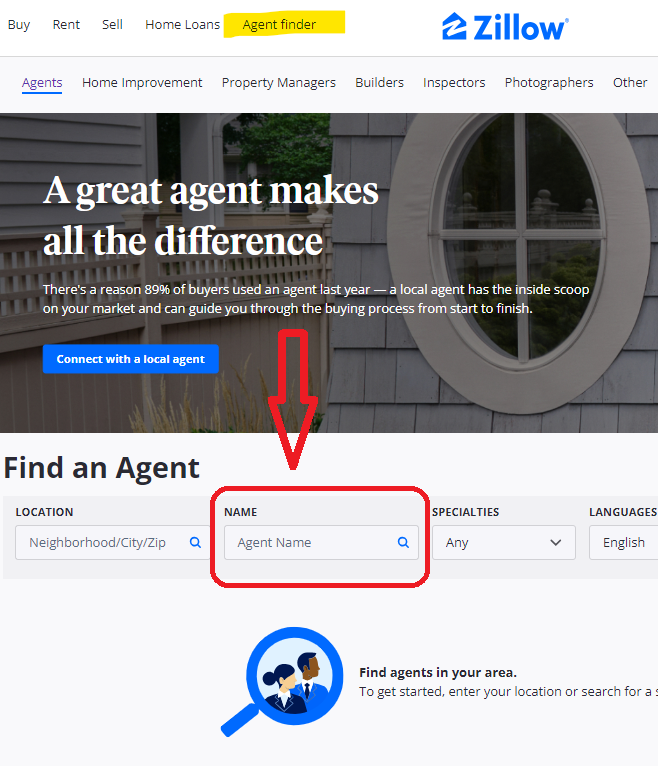

To check an agent’s qualifications, go to Zillow and click on the Agent Finder at the top of their page. Zillow wants you to use one of the agents they display prominently, but all you know about them is that those agents pay the most money to be featured there.

If you have a realtor you are investigating, you’ve probably checked their business website – and noticed how they all tend to look the same. It’s why Zillow is the reliable go-to website, because they are pulling the sales data directly from the MLS so agents can’t manipulate it.

What are you looking for?

You want to hire an experienced agent who has a well-honed set of sales skills. An agent who has proven history of getting a variety of people to the finish line. An agent who can handle anything that happens, and still deliver a smooth and easy experience for you.

Things to Consider:

Everyone is in a hurry and wants to grab and go. But if there was ever a time to patiently investigate the choices, it’s when you’re making one of the most critical decisions of your life.

Get Good Help!