What to Expect

Since June, I’ve been saying “Wait until springtime”.

Here is what’s coming:

Since June, I’ve been saying “Wait until springtime”.

Here is what’s coming:

Even though I’ve had a record amount of inquiries already, I don’t think there will be many sales early on. The inventory of quality homes is excruciatingly low, the prices are filled with early-season exuberance, the market uncertainty is off the charts, plus come on – it’s only January 8th!

Sales in the first quarter will be done by those who go out and create them while most people are standing around, waiting to see what happens. The tougher, the better for me. This should be my favorite year ever!

Our new listing in Carmel Valley! Open 12-3 this weekend.

Check out this attractively-priced Portico home with fully remodeled kitchen, hardwood floors, 3 bedrooms + loft and downstairs den, sumptuous primary suite with two walk-in closets, and upstairs laundry room. New paint and carpet, private yard, and cool front porch to watch the balloons go by! Live here and send your kids to Solana Ranch Elementary School – verified with the school district on Nov. 16th. The community pool/clubhouse is like a 5-star resort! It’s a good distance away from Carmel Valley Road too. This model sold for $2,086,000 on May 9th. Look at the savings – our list price is 20% off, and the 30-yr jumbo rate is back down in the 5s! Fed governor Bullard said today that the Fed Funds rate might have to go 1% to 3% higher. This home is the best discounted price/low rate combo you’ll see in the next 1-2 years! Only $1,675,000.

I tell potential home buyers to keep looking because you never know when you will find the right house – which is the most important part of the equation. Most will convince themselves that it will be easier to find the right house if prices came down, and besides, the current crop isn’t that interesting.

To keep it simple, let’s just calculate how mortgage rates have changed the equation:

Purchase Price: $2,000,000

Loan Amount: $1,600,000

30-yr jumbo rate: 3%

Monthly pmt: $6,746

Buyers who expect the sellers to make up the entire difference with a lower sales price will have to wait until they can find a home that meets this description:

Purchase Price: $1,400,000

Loan Amount: $1,120,000

30-yr jumbo rate: 6%

Monthly pmt: $6,715

If home prices come down 30%, it will enable buyers to buy the same house for the same monthly payment – and with a $120,000 smaller down payment too. If it happened over the next five years, it means we only need to drop about 6% per year, and we’ve already dropped more than that in 2022.

Or let’s say you want to roll back to pre-pandemic pricing.

NSDCC homes that sold in February, 2020 closed at a median of $509/sf, and last month the median was $793/sf which means we’d need a 36% decline to get back to pre-pandemic pricing.

How are you going to play it?

Are you going to wait until you actually see homes selling for 30% to 36% off to get back into the game?

Are are you going to wait until rates come back to 3%?

Or do we acknowledge that the buyers who have more horsepower are going to jump back in sooner, and there’s not much chance of prices dropping the full 30% to 36%? The highly-motivated affluent folks will probably be satisfied with 20% off, and they will derail a full decline. It’s what happened in 2012.

Can you live with 20% off?

Because if you can, then you need to stay in the game.

If the #1 variable is buying the right house, then #2 is timing.

I think the affluent will be looking next spring, and if they find a suitable house, they are going to buy it. By then, some of the statistical pricing gauges will be showing 10% to 20% declines, either nationally or in isolated markets. Because the local pricing isn’t that nuanced and buyers just want a house, they will decide that’s close enough and go ahead with the purchase.

To support my suspicion, I’ll note that during the frenzy, it was the same mentality, just in reverse.

When people found the right house, they just paid whatever it took – even if it meant paying $500,000 to $1,000,000 over the list price! Nothing else mattered besides getting the right house.

Most buyers won’t believe their eyes, and the volume will be thin. But sellers will appreciate any momentum and be encouraged to price their home for about what they thought they could get, with not much discount. Buyers who want discounts will be relegated to scouring through the dent-and-scratch bin, or hope that moving during the off-season might be more fruitful. Great for them.

What are you going to do?

Let’s face it, at least 90% of the current listings aren’t coming off their price much. To get a deal, you have to make offers! Here are some good tips:

We were discussing the “mold” found by a home inspector, who wasn’t qualified to comment on the subject – though that didn’t stop him from trying to scare the daylights out of the buyer just so he could CYA.

I suggested that it was the garden-variety mildew that could be removed with a squirt of bleach and a wipe of a cloth. After all, it tested ‘dry’ and the minor stain under the kitchen sink looked like it was years old.

Of course, they asked, “What do you know about mold?”

Plenty, lady…..plenty:

Last week, reader TOB talked about a buyer he knew who walked away from a deal over the Rampart fireplace. Here’s a list of other issues that might be deal-killers, but we try to find a way to solve them before giving up!

https://www.hunker.com/13772386/signs-you-should-walk-away-after-a-home-inspection

Home buyers don’t have much – if any – control over the process, which leads to frustration and disappointment. They don’t have any way to cause more homes to list for sale, and the only way to eliminate the competition is to out-bid them, which can be even more harrowing.

One solution is for buyers to expand their parameters, but that’s not easy and can lead to another ailment that a client described yesterday as “frozen in indecision”.

Just when you want to give up……it looks like others might have beaten you to it!

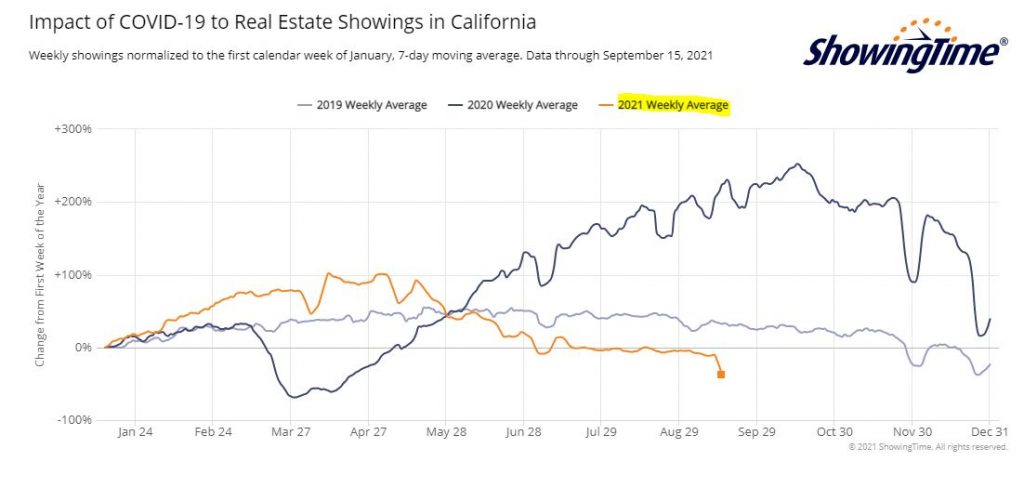

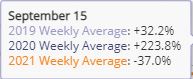

Showings throughout the state are lower than they were during the first week of January!

It’s been mentioned that not every agent uses this service, but it is such a large sample size that the trend should be a decent indicator of buyer sentiment – they’re exhausted.

Sure, active listings are half of what they were at this time last year, but the showings are 260% different!

Just like with selling, when is the best time to be a buyer? When no one else is!

We already know what’s going to happen with sales in 2022 – they will be the same as this year, with a possible adjustment of +/- 10%.

But the rest of 2021 could get wacky!

It looks like the competition is dwindling, and any seller who comes to market around the holidays has to be motivated! Buyers – stay in the hunt!

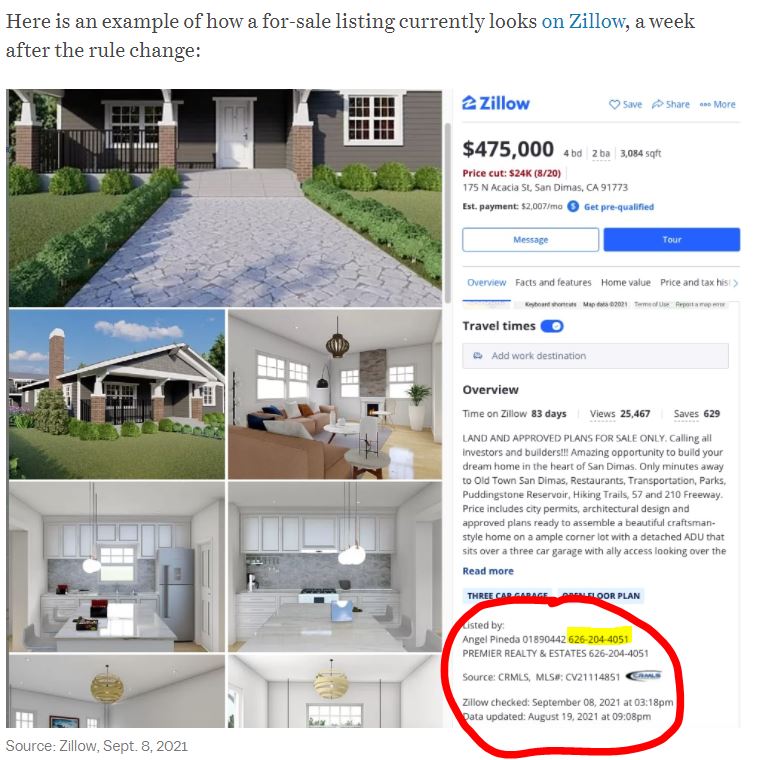

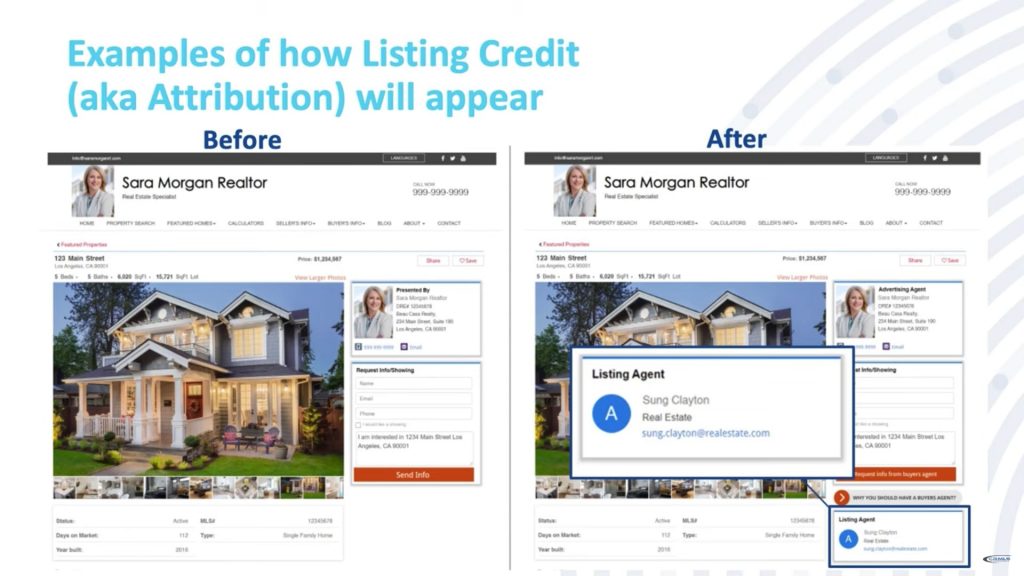

The old rule was that any agent could advertise any MLS listing via the IDX, as long as the listing agent’s name and brokerage was displayed. But now you have to include their contact information too. He sounds confident because this is clearly a shot at Zillow but the unintended consequences from directing the consumer to the listing agent is promoting single agency which will eventually eliminate broker cooperation as we know it.

The discouragement of buyers getting their own representation from a buyer-agent is part of the dumbing-down of the business. Sellers and listing agents prefer buyers who just pay whatever it takes and don’t ask questions, and when the History of the 2020-2021 Frenzy is written, it should include that it was fueled in part by crazy buyers getting no good help.

In an emailed statement, a Zillow spokesperson said, “As part of our switch to IDX feeds and becoming CRMLS participants earlier this year, we agreed to comply with all CRMLS rules and regulations, which includes adhering to listing credit and display rules — such as the updates that went into effect this month.

“One of our core values is to empower consumers and increase transparency in real estate, which includes efforts to give shoppers the information they need to connect with listing agents. For more than a decade, our philosophy of ‘turning on the lights’ for consumers has meant that we’ve consistently displayed listing agents’ names and contact information, something not done on all IDX sites today.”

Why you should Get Good Help!

Kim Rohrer was looking forward to leaving the leaky windows in the two-bedroom Berkeley rental duplex that she shared with her husband and two small children.

The couple recently found a three-bedroom, two-bathroom chalet-style house in Berkeley listed for $799,000, which seemed relatively affordable for the area.

The house needed significant work, including plumbing upgrades, but the couple wasn’t deterred. “It was like a dream house,” said Ms. Rohrer, who works in human resources for a tech company. (Her husband works at the University of California, Berkeley.)

The couple offered well above the asking price: $850,000. They knew there would likely be multiple offers but they also needed to save some money for the necessary repairs. They didn’t get the house.

They didn’t even come close. The home sold for $1.4 million — nearly double its asking price. “It’s terrible,” she says of her house hunting experience so far. “Completely terrible.”