Lowball Season

Let’s face it, at least 90% of the current listings aren’t coming off their price much. To get a deal, you have to make offers! Here are some good tips:

Let’s face it, at least 90% of the current listings aren’t coming off their price much. To get a deal, you have to make offers! Here are some good tips:

It was back when some homeowners had little equity that my favorite seller quote became a t-shirt legend.

But we still hear it today – when it comes to price, home sellers regularly say, “I’m Not Giving It Away!”.

Their equity positions used to be pennies, compared to today. Back in 2009, there were plenty who were just hoping to break even, and maybe come out with enough cash at closing to buy a steak dinner!

Now that every NSDCC homeseller has hundreds of thousands of dollars’ worth of equity, will they loosen up a bit? After all, the last 20% to 30% came pretty easy (in just a year or two) and if they had to give up some or all to make the deal, they certainly could

But will they?

Many potential sellers get so mad about paying the capital-gains tax that it prevents them from moving. Those who are on the open market in October of 2022 have already dealt with that fact mentally, so they must have a fairly good reason to sell.

Those who will dump on price must be really motivated. It probably also means their house isn’t that great because nobody wanted to buy it at retail, or for a little under. Can you live with one of those?

The stock market has been cooking this week, and bond yields coming down in hopes the Fed might slow down the pace of their rate increases. Or maybe even pause, and take a look around at what they created?

If that were to happen, then the 2023 Selling Season should be somewhat healthier as rates dip into the 5s just as more quality homes are coming to market. If current sellers start to get a sniff of that, then they will cancel their listing and wait until next year.

Which means those who are still actively trying to sell the rest of this year must be unusually motived – and your best candidates to test whether they will give it away! Stay in the hunt!

Bill’s take – there may be more deals available sooner than you think:

We were discussing the “mold” found by a home inspector, who wasn’t qualified to comment on the subject – though that didn’t stop him from trying to scare the daylights out of the buyer just so he could CYA.

I suggested that it was the garden-variety mildew that could be removed with a squirt of bleach and a wipe of a cloth. After all, it tested ‘dry’ and the minor stain under the kitchen sink looked like it was years old.

Of course, they asked, “What do you know about mold?”

Plenty, lady…..plenty:

Here’s more click bait on the front page of the local paper, and most people won’t read any further – it’s too easy to decide to do nothing, which is fine. Wait as long as you want, and we will see where it goes.

It’s a great plan if you’re a buyer and don’t care much about what you are buying. But if you are picky and want to wait until the headlines ease, then you can expect there will be others acting quicker than you, and probably with more horsepower. The affluent aren’t as concerned about timing the exact bottom of the market when they just want a nice house.

Take my Aviara listing. It’s priced at 12% under the last model-match sale in June, and even the buyer of the comparable sale around the corner said mine was better than hers. In the story above, the San Diego County median price came down 6%, so I’m lower than that, and it’s got all the extras.

Yet, as I’m talking to open-house attendees, there was a steady flow of the usual soft stuff:

‘I don’t want to get into a bidding war’.

‘I want to wait-and-see where this goes’.

‘Prices are going down’.

Ok, no problem. But given what we’ve been through, you can’t expect that buying a quality home is going to get easier. Even if the price was lower, there will be competition for the good buys – and when you think about it, there always has been in recent years. We had plenty of bidding wars and people paying over list prior to the pandemic – it isn’t a new thing.

Besides, if the market became so desolate that you could walk into an open house that you thought was a quality buy and nobody else wanted it, wouldn’t that scare you off too?

I have multiple offers on my listing and we’ll sell it for a decent price, so don’t worry about me. I just want buyers to keep looking, and when you see something you like, don’t let the headlines written by ivory-tower guys talk you out of it.

I had another 80+ people attend my open house on Sunday, and a total of more than 200 people for the weekend. Virtually everyone who came was older, and the overwhelming message was that the buyer pool for one-story homes is large and they are hungry for product.

We have received one full-price cash offer so far, and there should be 2-3 more coming in today.

This smaller tract was built by Davidson in 1996, and sold in the $300,000s originally. Only 12 of the 82 homes are the one-story floor plan – which is typical (some newer tracts don’t have ANY one-story plans). Of the 82 homes, 57 of them, or 70% were purchased for less than $1,000,000.

I sure get the feeling that there are boomers occupying most of the newer tract homes in North San Diego County’s coastal region, and they aren’t going anywhere – unless they can buy a single-story home.

The most interesting part is that my listing will be the third sale of this floor plan in 2022, in a neighborhood where there hasn’t been a sale of this model since June, 2018. It could be another few years before the next one sells, because those who have a single-story home tend to hang onto them.

The doomers want to blame higher rates for the slowdown in sales, but unless we get a flood of one-story homes for sale, the inventory will probably keep shrinking – and be mostly made up of the two-story homes where boomers have gotten lucky and snagged one of the few single-story homes coming to market, or where they gave up and left town. It makes it tough on those buyers who are coming here to retire!

Are you waiting to buy a home until you can get a sizable discount?

Is it because you know a guy who will give you a deal on any home improvements needed; you’ve got your eye on some new appliances down at the scratch-and-dent outlet; and you were thinking about going through Redfin until you heard they are cancelling their rebates? You want a deal on everything!

Well, here you go!

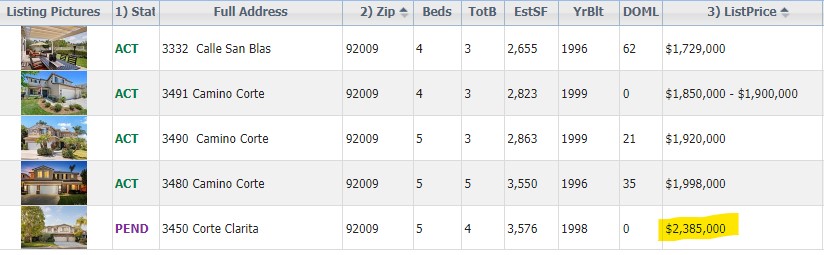

These late-1990s tract homes in SE Carlsbad and in the Encinitas school district are priced LOW. The pending listing on Corte Clarita should close at $2,300,000+ because it had already gone pending once in mid-August but came back on market – then the agent refreshed the listing once he found a second buyer a couple of weeks later. He told me there was no big discount happening there:

You know that my listing is going to be closing for $2,250,000 nearby, plus this one should be over $2,300,000…..so these actives are 10% to 20% under. It looks like the market is crashing….is there a catch?

Look at their locations:

The first three are on the corner of Calle Acervo, and the fourth is next door, but hey, La Costa Canyon High School is walking distance! But you have the traffic from high-school drivers too, and you know it will be a madhouse during football games. A deal is a deal though, and you can save hundreds of thousands compared to the remodeled home with larger canyon lot (in purple at bottom).

Or save millions here! This house is listed for $32,500,000, or go down the street and buy this home that was newly priced today for only $4,900,000! Both are oceanfront La Jolla!

https://www.compass.com/app/listing/5650-dolphin-place-la-jolla-ca-92037/1136258851857198681

The difference? This house is 1,167sf on a 2,982sf lot….at least for now. But it’s 85% cheaper! And the more-expensive one RAISED their price from $25,000,000.

My point? The low comps won’t suck down the expectations of future sellers of superior homes – it’s too easy for them to ignore/explain away the low comps, and will only consider pricing theirs like the other superior sales nearby – which there will be some.

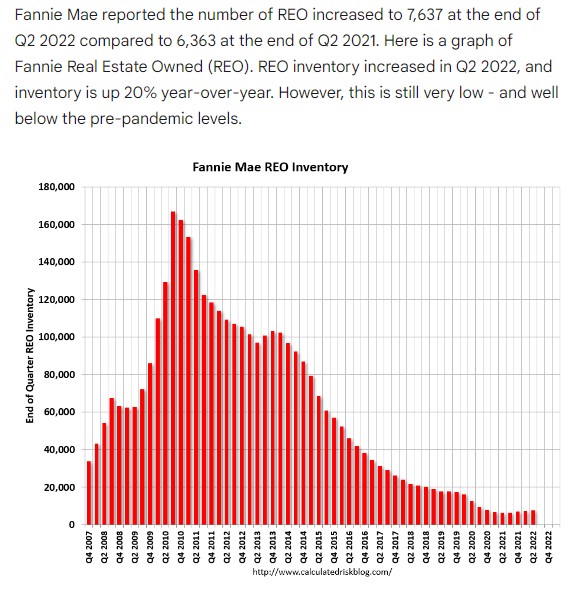

Oh, what about a foreclosure? Well, they are starting to spike:

Or are you going to wait until you can rub my sizable nose in it?

Hey, I wish prices were lower, and if they crashed it would only mean more opportunity for buyers, and hopefully more volume, which is what I want. I’m not trying to coax buyers into paying too much – I’m showing you where the deals are today, if you don’t mind an inferior home or location.

I just hoping that the coming standoff only lasts a couple of years, instead of 5-10.

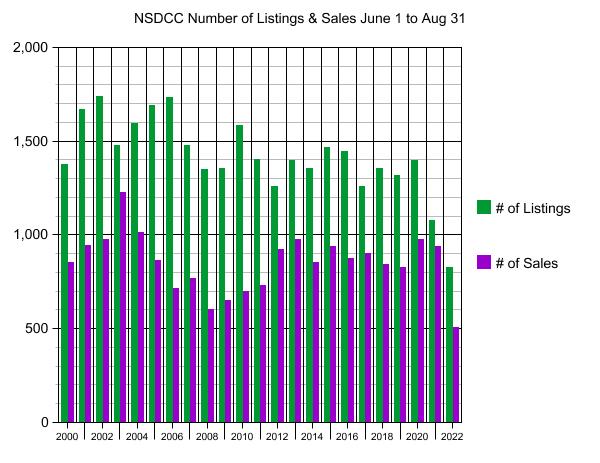

Chris asked how the current environment compares to the 2008 downturn.

In the summer of 2008, there were only 601 NSDCC sales between June 1st and August 31st, in spite of there being 1,348 listings that summer. For the next two years, the number of listings far exceeded the number of sales, and in the 2008-2010 period there were twice as many listings as sales. The 2010 ratio was the worst at 2.3 to 1.

This summer we only had 825 listings, and 504 sales, which is a 1.6 to 1 ratio!

The 2022 sales were 16% lower than the previous record in 2008, but there were 39% fewer listings!

We’ve never had so few listings to consider. Now that the Fed is making it so obvious that they intend to cause a recession, more potential sellers – who tend to casually read the headlines only – will delay their decision to move. Does anybody HAVE to move in 2023? Every potential seller will give it a second or third thought if they believe it will cost them several hundreds of thousands of dollars.

The NSDCC inventory next year will be the lowest ever – even Ray Charles can see that coming.

We opened escrow today on my first contingent sale in 2+ years – where my buyer has to sell their home to purchase the subject property.

There were two offers submitted – and BOTH were contingent upon selling another property!

Thankfully, the house we’re going to sell is a single-level home in Aviara, which was well-known to the listing agent – plus I submitted my price, a thorough set of comps, and photos to help him with the decision.

It means we’ll have an open-house extravaganza coming this weekend, and get to test the demand for a prime one-story home with all the extras….including an attractive price! Stay tuned for more on Thursday!

For those who prefer a single-level home and would like to peruse a curated group, check out this on-going collection of my favorite one-story homes for sale between La Jolla and Carlsbad here:

https://www.compass.com/c/jim-klinge/nsdcc-one-story-houses?agent_id=5b51d51d9474a8364b9a8353

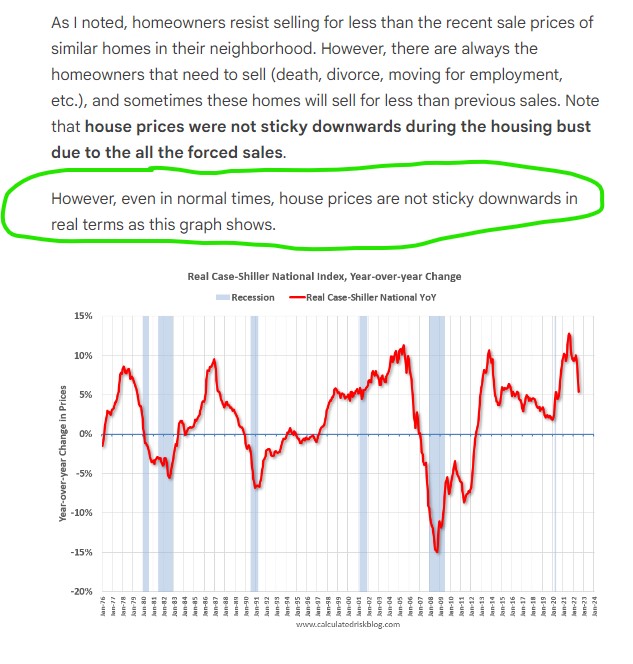

The wildcard on pricing is that every potential seller has sufficient equity to dump on price if needed.

Why a seller would give it away when there are so many other alternatives (renting, reverse mortgages, hard-money loans, etc.) is beyond me. Even flipper companies like Opendoor (who owns 197 properties in SD County today), have to pay somewhat close to retail to get business.

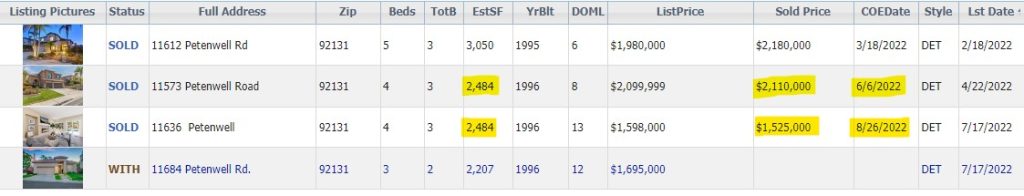

But there are cases where sellers can, and do, dump on price – like here, where I had the competing listing and we withdrew and rented, rather than give it away:

Those sellers paid $875,000 in 2016, so they still left town with a smile on their face – but you can guess that the neighbors didn’t appreciate it. Especially the two who paid over $2,000,000 just months earlier.

It would take a few desperate sellers dumping at the same time to call it a trend.

But if there were enough of those closings sprinkled throughout the county, the median sales price (a terrible measuring device) could fall 10% or more pretty easily.

When looking at 2023 and beyond, you can probably expect that there won’t be many realtors like me that advise sellers to hold out on price. It doesn’t change their paycheck much if they dump and run, and there won’t be anybody in the press or social media sticking up for sellers either.

There is a chance it could get ugly – just because sellers have so much equity that it feels like free money, and they will still walk with hundreds of thousands of dollars, even if they decide to give it away.