by Jim the Realtor | Mar 8, 2024 | Jim's Take on the Market, Tax Reform |

It looks like the over-heated housing market will cause the government to do something so it looks like they care. There was a $8,000 first-time homebuyer credit back in 2009-2010 that was free money given to those who just happened to buy a house then – nobody bought a house just because of the credit. The same will happen now – it will just be free cheese for those buyers and sellers in the right place, at the right time.

How the two credits would work, according to the White House:

- “Middle-class” first-time homebuyers would get an annual tax credit of $5,000 a year for two years. The White House didn’t specify what “middle class” means.

- A one-year tax credit of up to $10,000 to “middle-class families who sell their starter home, defined as homes below the area median home price in the county, to another owner-occupant.”

President Biden is calling on Congress to pass a mortgage relief credit that would provide middle-class first-time homebuyers with an annual tax credit of $5,000 a year for two years. This is the equivalent of reducing the mortgage rate by more than 1.5 percentage points for two years on the median home, and will help more than 3.5 million middle-class families purchase their first home over the next two years.

To qualify, home buyers must meet the following eligibility standards:

- Must not have owned a home in the last three years.

- Must not be a prior recipient of a first-time home buyer tax credit.

- Must not earn more than 60% above than the area’s median income.

- Must be making an arms-length transaction.

- Must be at least 18 years old.

The President’s plan also calls for a new credit to unlock inventory of affordable starter homes, while helping middle-class families move up the housing ladder and empty nesters right size. Many homeowners have lower rates on their mortgages than current rates. This “lock-in” effect makes homeowners more reluctant to sell and give up that low rate, even in circumstances where their current homes no longer fit their household needs.

The President is calling on Congress to provide a one-year tax credit of up to $10,000 to middle-class families who sell their starter home, defined as homes below the area median home price in the county, to another owner-occupant. This proposal is estimated to help nearly 3 million families.

To qualify for the $10,000 Home Seller Tax Credit, sellers must meet the following eligibility requirements:

- The home seller must live in the home they’re selling as their primary residence.

- The home buyer must make the home their primary residence.

- The home buyer must not earn more than 60% above the area median income.

Additionally, the home for sale must be a starter home which is defined as a home that sells for less than the county’s median home price. Eligible property types include single-family homes, condominiums, townhomes, multi-unit homes, and any other home zoned for residential residence.

The bill will increase available housing inventory for homes selling between $100,000-250,000 which, according to the National Association of REALTORS® Existing Home Sales report, is the fastest-selling segment of U.S. homes.

To take effect, these proposals would require Congressional approval. As of today, neither Democratic nor Republican leadership in the House or Senate has come out to support the measure.

President Biden also called on Congress to pass the Downpayment Toward Equity Act, a downpayment assistance program for first-generation home buyers that gives up to $25,000 in cash grants. The bill was originally introduced in the 2021-2022 Congress, then re-introduced in 2023. It has 44 co-sponsors in the House of Representatives. A corresponding bill is expected to be introduced in the Senate soon.

by Jim the Realtor | Jan 16, 2024 | Tax Reform |

Dear Liz: My husband died in November 2022. I was told that if I sell the house within two years of his death, I can benefit from two capital gains exclusions, his and mine, each for $250,000. The house was appraised at $912,000 based on his date of death. I don’t imagine it would sell for much more than that now. Can you tell me approximately what I would owe in capital gains? My tax rate is 24%.

Answer: That’s a great question to ask a tax pro, since there are a number of variables involved.

If you live in a community property state such as California, then both halves of the property got a favorable step-up in tax basis when your husband died. That means the house’s new tax basis would be $912,000.

If you don’t live in a community property state, then only half of the house got the step up at his death (to $456,000, or half of $912,000). The other half — yours — retains its original tax basis. If the original purchase price of the home was $300,000, for example, your basis would be $150,000. The home’s total basis would be $606,000 (which is $456,000 plus $150,000). If you sold the house for $912,000, your capital gain could be $306,000, which would be well below the $500,000 exemption you could take if you sell the house within two years of the death. If you sell after the two-year mark, the gain above your single $250,000 exemption would be taxable.

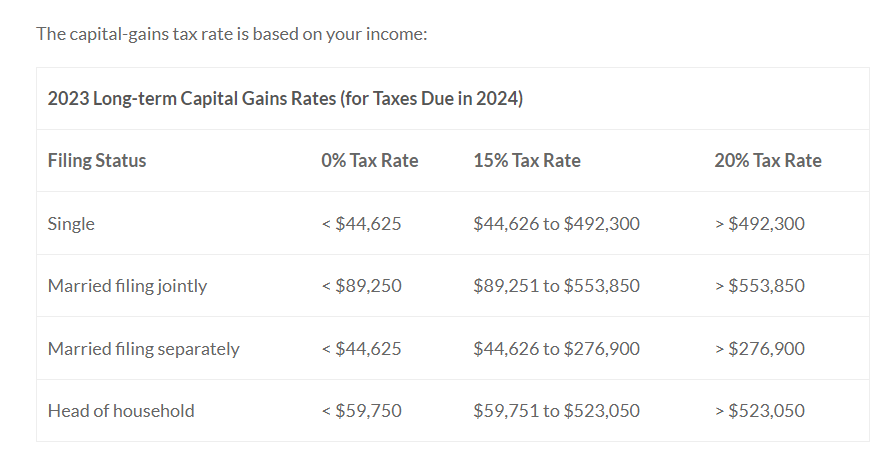

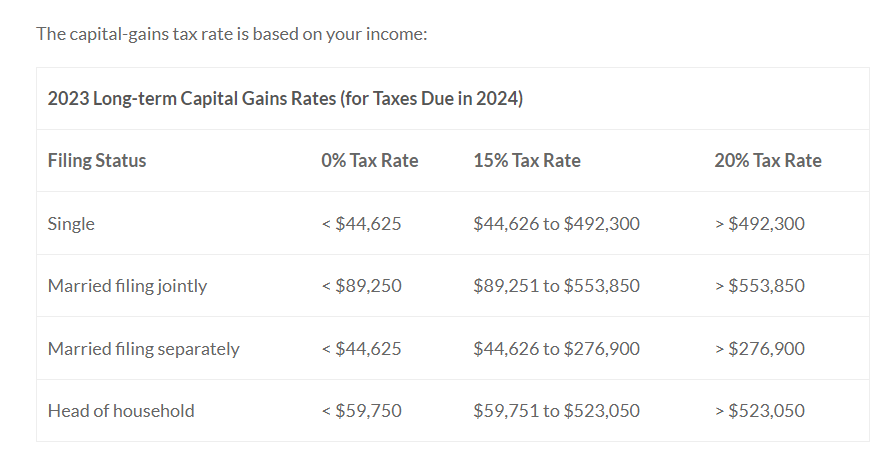

The rate you would pay depends on your taxable income and what state you live in.

For example, a single person with taxable income of between $47,026 and $518,900 in 2023 would pay a 15% federal capital gains rate, plus whatever rate their state imposes. (California doesn’t have a separate capital gains tax system, so any taxable gain would be subject to the state’s regular income tax.)

These numbers are just to give you an idea of how capital gains taxes work. Your mileage may vary. If you renovated the kitchen or did any other significant improvements on the home, those costs could be added to your tax basis to reduce any potentially taxable gain. Also, selling costs will reduce what you actually pocket from the sale and your potentially taxable gain. For more information, see IRS Publication 523, Selling Your Home.

Taxes shouldn’t be your only consideration, of course. Relocating can be disruptive and expensive. Getting the house sold before the two-year mark makes sense if you were planning to move anyway, but don’t let fear of taxes scare you out of a home that otherwise suits you.

by Jim the Realtor | Jan 7, 2024 | Tax Reform |

Prop. 19 allows homeowners 55 and older, the severely disabled, or the victims of a wildfire to move their lower Prop. 13 tax base up to three times to anywhere in California.

Before the law was enacted in 2021, homeowners only got one base tax transfer and it only worked if the new home was of equal or lesser value. Also, only a handful of counties at the time allowed the tax transfer. Today, owners can buy up with the price differential added to their property tax rate.

Here’s an abbreviated version of one recent case:

“For my wife and I, Prop. 19’s relief for retirees who want or need to change residences was a godsend,” Bruce said. “When we retired, we moved into a west Torrance neighborhood (in 2014) from a Redondo Beach townhouse. We thought it would be the last one we would ever move to. We were wrong.”

Bruce explained that shortly after they moved into the townhouse, local parents found an elementary school access point by the Steele’s home, which became flooded with traffic twice a day during the week. His neighborhood, Bruce said, became a cut-through street “subjecting us to rude and dangerous drivers.”

When Prop 19. was enacted, the Steeles were able to sell their Torrance townhome and buy a home in Rancho Palos Verdes, for which they paid $1.9 million. They bought the townhouse in Torrance for $950,000 and sold it in April 2021 for $1,660,000.

“With the help of Prop. 19 and the sale of some Oregon property, it did not create a property tax obstacle to our move,” Bruce said. “Otherwise, we might have had to move to a less desirable location or leave California.” He noted their townhouse was bought by a young family with children.

So far, thousands of homeowners age 55 and older in Southern California have taken advantage of Prop. 19’s tax-transfer benefit since the law was enacted.

More than 2,400 homeowners in Los Angeles County have been assessed and granted a tax transfer, according to Stephen Whitmore, public information officer at the county’s Office of the Assessor. There are 400 pending with the appraisal team now, he said.

The assessor’s office receives about 100 new transfer requests per month, Whitmore told me.

Orange County’s total transfers to date are approximately 4,520 with about 200 new transfer requests each month, said Neal Shah at the Orange County Assessor’s Office. The office has a backlog of 91 transfers.

In Riverside County, transfers total 2,009 with an average of 80 new monthly transfer requests, according to Sean Downs, chief appraiser at Riverside County Assessor-Clerk-Recorder. San Bernardino County officials could not provide any data by press time.

The above transfer data, by the way, excludes grandparent or parent/child transfers eligible under Prop. 19.

There are a few distinctions regarding the tax transfer. Homebuyers must file for the tax exemption in the first year of a new purchase — it’s not automatic. You have up to three years to file the base year transfer papers with your county assessor. The good news? There is no price cap with respect to the new home compared with the former home’s value.

If you are buying down in value “or equal or lesser value,” then the original home’s factored base year value may be transferred to the replacement home without any value adjustment.

You also can buy your up-leg residence first and then sell your former primary residence. Or, you can sell your departing residence first and then buy your up-leg home, so long as either of these is accomplished within a two-year window.

Here’s another example: A homeowner sells their Laguna Niguel home for $1 million with a factored base value of $500,000. Within the first year of the sale, the former Laguna Niguel resident buys a Newport Beach home for $2 million.

Here is the math: $1,000,000 x 105% = $1,050,000 (if the replacement residence is bought in year two, then you factor 110%). Take the full cash value of the replacement home of $2 million minus the adjusted cash value of the original property or $1,050,000. The difference is $950,000. Now add the $950,000 difference to the base value of $500,000. Your new property tax base is $1,450,000. That’s not bad when you consider the homeowner could have been paying property taxes on a $2 million home. So, thank you Prop. 19.

Whitemore also noted that if a senior over the age of 55 receives a property tax benefit due to Prop. 19 and then later moves out but continues to own the property, then that home will continue to enjoy Prop. 13 protections.

The California State Board of Equalization has a wealth of information at boe.ca.gov/prop19. You also can contact your county assessor’s office to clarify any questions.

https://www.dailynews.com/2023/06/01/prop-19-s-property-tax-transfer-a-godsend-for-southern-california-seniors/

by Jim the Realtor | Dec 18, 2023 | Tax Reform |

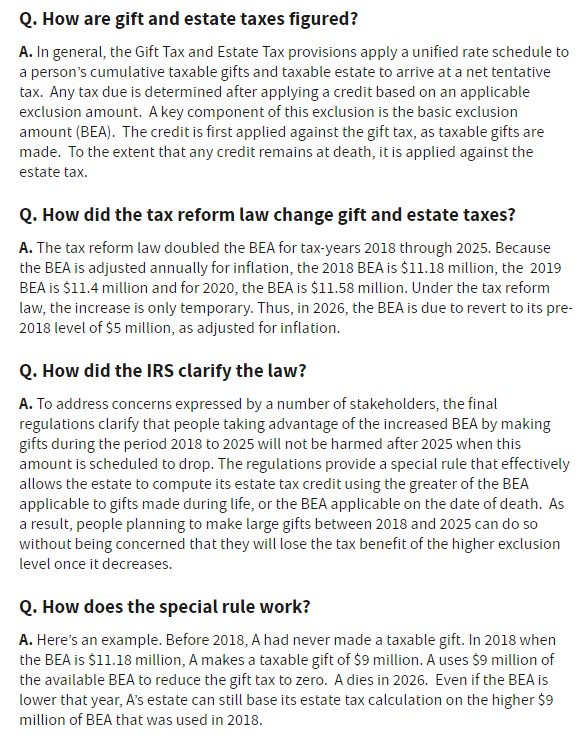

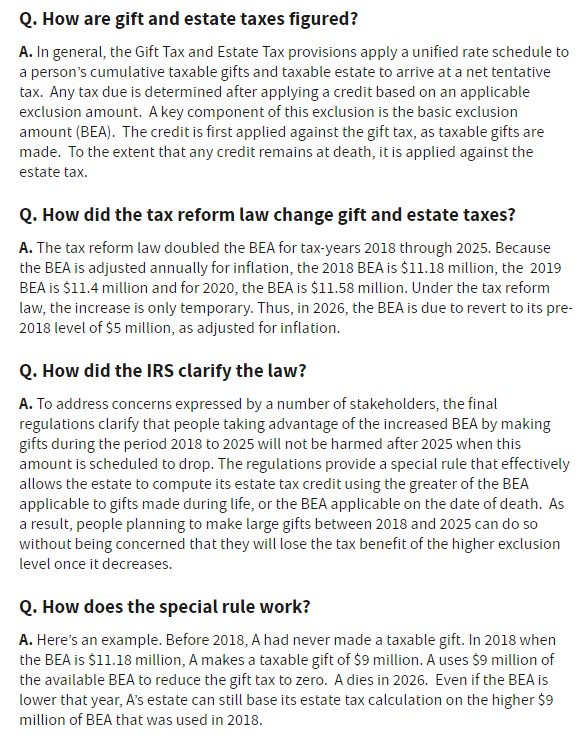

One of the main reasons that the real estate market could levitate at these price points is the monumental wealth transfer between baby boomers and their kids. A major tax advantage is closing out at the end of 2025, and those with a healthy portfolio will be letting it flow – another opinion on it here:

Unless Congress acts, on Jan. 1, 2026, the estate, gift and generation-skipping transfer (GST) tax exemption amounts will be cut in half. A decrease in the exemption amount could result in significant additional transfer taxes for families with federally taxable estates. However, there is still ample opportunity for high-net-worth families to plan to utilize the current exemption amounts. This article will explore potential wealth transfer opportunities to capture and utilize the exemption amount before it may be lost.

In 2017, the Tax Cuts and Jobs Act (TCJA) doubled the existing estate and gift tax exemption amounts from $5.6 million per person (or $11.18 million per married couple) to $11.18 million per person (or $22.36 million per married couple), indexed for inflation annually. In 2023, the estate and gift tax exemption amount is $12.92 million per person (or $25.84 million per married couple).

The TCJA is set to expire at the end of 2025. Let’s assume that the estate and gift tax exemption amount has increased to $14 million by this time (due to adjustments for inflation). In that case, if Congress does not act, the exemption amount would decrease to about $7 million per person or $14 million per married couple. This loss in exemption amount could increase overall transfer taxes for certain families by millions of dollars.

We’ve been in a similar position in prior years and have seen that congressional gridlock can make reaching an agreement on preserving or increasing the exemption extremely difficult. While it is uncertain what, if any, tax-related legislation will come out of Congress in 2024 and 2025, it may be wise to explore one’s options to use the current existing exemption well before 2026.

If you can afford to use a portion or all of your existing exemption amount before Jan. 1, 2026, the amount used now cannot later be taken away from you. It has also been confirmed that if you use more exemption during life than is available at death (due to the decrease), the IRS cannot impose estate tax on those “excess” gifts as part of the taxpayer’s taxable estate when they pass. (Please note that there are some minimal exceptions to this rule for certain types of gifts made within three years of death.)

In addition, it’s important to note that when using your exemption during your life, you use it from the “bottom up.” This means that if you have $12.92 million of exemption and you use $6 million by making a gift (leaving you with $6.92 million), if the exemption amount is then cut in half, the $6 million of exemption you have used is considered to come out of the remaining amount, not the amount that was taken away.

In the above example, if you make a $6 million gift and the exemption amount is cut in half from $14 million to $7 million, you will have only $1 million remaining for future gifts or to shield assets from taxes upon your death. Consequently, locking in the exemption amount that may be taken away requires large gifts close to or at the full exemption amount before the amount potentially drops.

Read the full article here:

https://www.kiplinger.com/retirement/estate-tax-law-changes-how-to-prepare

by Jim the Realtor | Aug 24, 2023 | Local Government, Tax Reform |

From the La Jolla Light:

If the San Diego Housing Federation is able to place a progressive real estate transfer tax on the November 2024 ballot, La Jolla homeowners will be unfairly impacted.

The proposed tax would require property owners in San Diego to pay an additional 1.75 percent to 2.25 percent on all residential and commercial property sales above $2.5 million. A certain percentage of the funds generated from the tax would go to homelessness prevention assistance, eviction support programs and tenants’ rights education.

Roughly 90 percent of the available single-family detached homes on the market in La Jolla would meet the criteria for the proposed “mansion tax.” This potential tax imposition would weigh down property owners in La Jolla, leading to an imbalanced burden. While acknowledging the homeless and housing crisis in San Diego, it is important to recognize that excessively taxing specific groups of property owners or communities is not a viable solution.

San Diego homeless-service providers have already received $2.37 billion from local governments, and even with all that money, San Diego’s homelessness crisis is growing faster than it can be contained.

Levying additional taxes on property owners and throwing more money at the problem has proved not to work. The city of Los Angeles recently implemented a real estate transfer tax on luxury home sales to try to help the city tackle its homelessness crisis. Measure ULA, the “Homelessness and Housing Solutions Tax,” was approved by Los Angeles voters, and while this new tax is commonly referred to as the “mansion tax,” it applies to all real estate sales, not just residential properties. This also would be the case with San Diego’s transfer tax.

The Los Angeles tax became effective April 1 and increased the real property transfer tax on certain transactions by more than 1,000 percent. Moreover, Measure ULA was in addition to, not in lieu of, the existing base real property transfer tax, so property owners were hit twice as hard.

Before the implementation of Los Angeles’ “mansion tax,” home sellers were hustling to unload their homes quickly. Home prices were slashed and million-dollar transactions were hastened through escrow. A few sellers were even giving away cars and lavish incentives to entice potential buyers to close deals on their properties before the end of March. This flurry of activity was driven by the desire to evade Measure ULA before it went into effect.

It was projected the tax would generate about $56 million a month for the city of Los Angeles. However, in its inaugural month, it managed to generate only a modest $3.6 million because property owners simply pulled their homes off the market and the money that could have been generated through reassessment was not realized. Since March, sales of luxury homes in Los Angeles have almost stopped.

Homelessness involves addressing a variety of issues, including mental health, housing, employment, drug addiction and alcoholism. Changes in the law are needed to get people off the streets and into the help they need to function in society, not excessive tax increases on property owners.

While it might be tempting to believe that affluent property owners can effortlessly absorb an additional tax, it’s important to recognize that many of them may choose not to sell, as was evident in Los Angeles when the city implemented its “mansion tax.”

The unintended consequences of such a tax in trying to solve San Diego’s homelessness crisis greatly outweigh the benefits. The practice of raising property taxes on a small number of property owners is simply wrong.

Mark Powell is a licensed California real estate broker and a board member of the Greater San Diego Association of Realtors. He also served as president of the La Jolla Sunrise Rotary Club.

Link to Article

by Jim the Realtor | May 2, 2023 | Tax Reform |

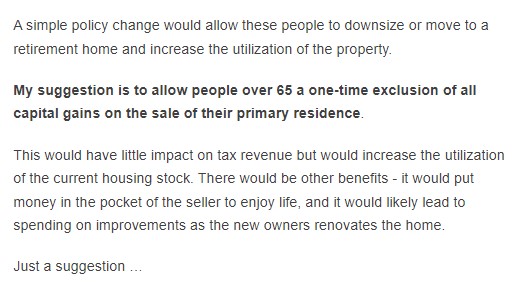

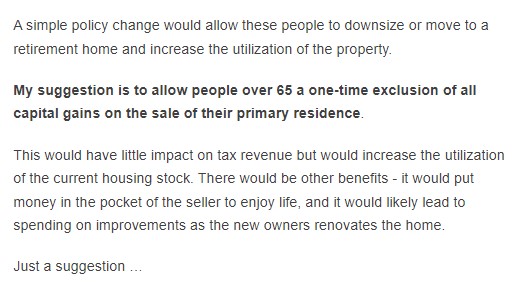

Bill has a great suggestion here, and the powers that be should strongly consider it.

Key points:

- The long-time homeowners who are aging-in-place just because of the heavy capital-gains tax will be freed up to move – and it would have little impact on tax revenue. Why? Seniors are so adamant about not paying Uncle Sam a penny that they will die in the house if necessary. The heirs don’t pay ANY tax, so it wouldn’t change the current tax revenue if a one-time exclusion was available – it’s not being paid anyway.

- More boomer liquidations would boost the property-tax revenue sooner.

- The gentriying neighborhoods would upgrade faster.

- It’s fair because it’s available to everyone. You just have to wait until you turn 65.

Something needs to be done because Jay Powell’s real estate reset isn’t going too well, and neither is the California take-your-property-tax-basis-with-you program. The older boomers have already decided to pack it in – and nothing is going to get them to move now.

But without some change in the current policy, there will be a lag in inventory for the next 10-20 years as the younger boomers start retiring. They are the ones who might cash out and leave the state – and without those moves, the Southern California market will be stuck with artificial restraints on the inventory.

Link to Bill’s article

by Jim the Realtor | Apr 27, 2023 | Tax Reform |

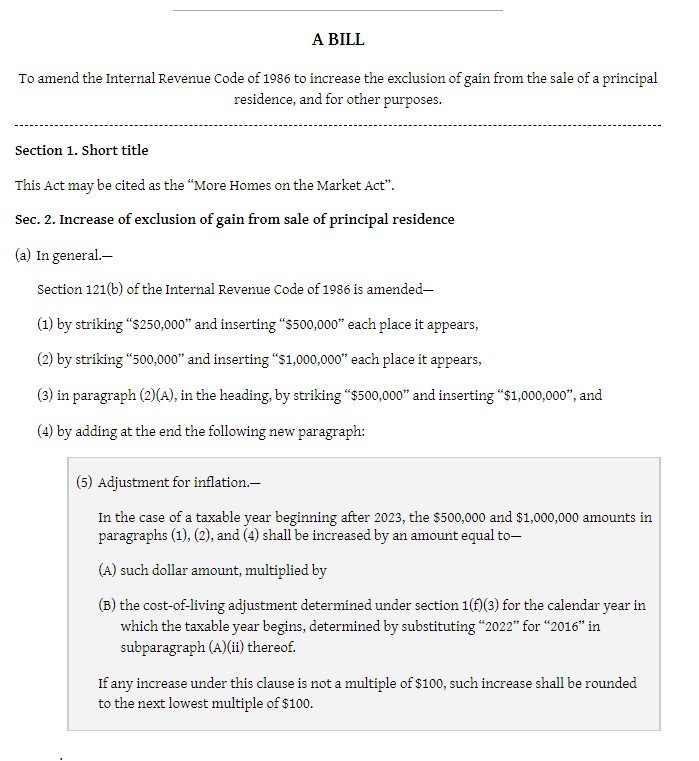

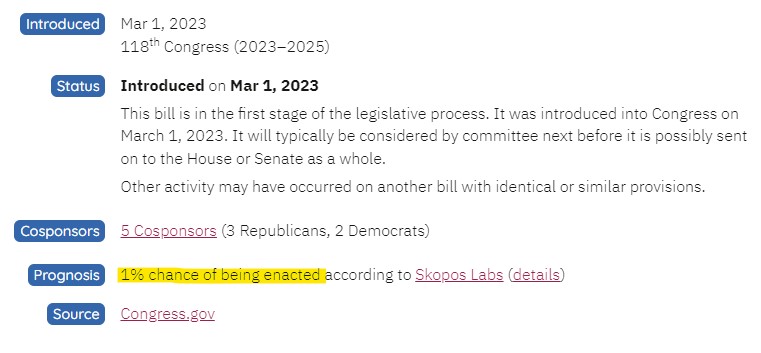

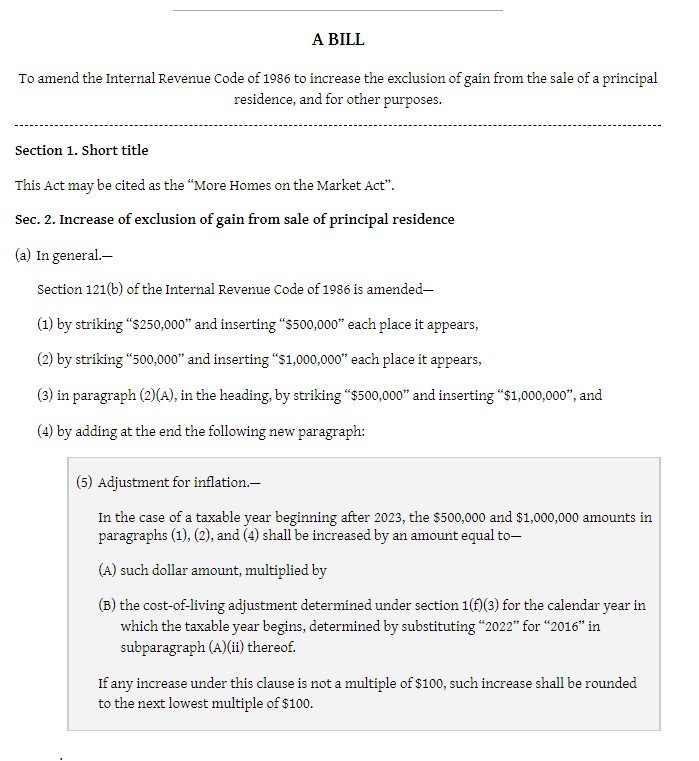

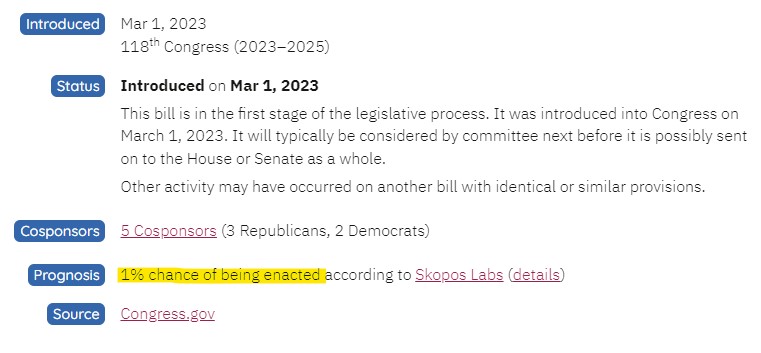

Congressman Jimmy Panetta (Monterey, CA) and Mike Kelly (PA-16) introduced H.R. 1321 – More Homes on the Market Act – which would double the capital gains exemption on the sale of a personal residence to $500,000 for a single filer and $1,000,000 for joint filers. This bi-partisan bill has been referred to the Ways and Means Committee.

This sounded really good until I found this – hopefully they will find a way:

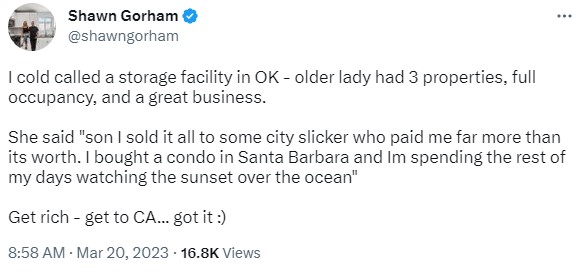

by Jim the Realtor | Mar 20, 2023 | 2023, Frenzy, Jim's Take on the Market, Tax Reform |

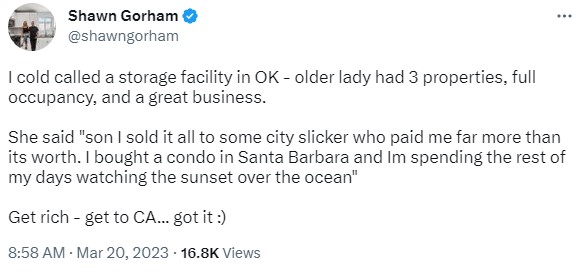

It’s natural for people to wonder how this will all play out.

The Fed raising their rate until they crush inflation (and everything else), home prices are higher than just about anyone can afford, and inventory levels so low that prices will probably keep trending higher too.

How could this all stay afloat?

We are already in the midst of the greatest wealth transfer in the history of the world. Unless there are changes in the law, those who have accumulated between $5,000,000 and $11,000,000 will be expediting their distributions over the next three years to save on taxes before the limit is lowered in 2026:

https://www.irs.gov/newsroom/estate-and-gift-tax-faqs

The free-and-easy money has already been flooding into our real estate market. Back in the old days, the cash buyers always demanded a discount – but today the craziest sales are to buyers paying all-cash.

With the gift and estate taxes changing in 2026, it should continue, and possibly increase.

by Jim the Realtor | Mar 9, 2023 | Tax Reform |

President Biden’s budget was released today, and it includes modifying the IRS Code 1031 tax-deferred exchanges. His current version probably has no chance of passing as-is:

The proposal would allow the deferral of gains up to an aggregate amount of $500,000 for each taxpayer ($1 million in the case of married individuals filing a joint return) each year for real property exchanges that are like-kind. Any gains from like-kind exchanges in excess of $500,000 (or $1 million in the case of married individuals filing a joint return) a year would be recognized by the taxpayer in the year the taxpayer transfers the real property subject to the exchange.

But limits on net profit would encourage investors to sell their properties more often, which would create more inventory – when there aren’t many other ways to encourage selling. Want to avoid capital-gains tax on your primary residence? Move every time you reach the $500,000 limit on net profits!

https://www.cnbc.com/2022/04/26/what-bidens-proposed-1031-exchange-limits-mean-for-investors-economy.html

by Jim the Realtor | Jan 24, 2023 | Tax Reform |

It’s doubtful that any 1031 changes will get passed this year, but they are going to keep knocking. If you are a longtimer who would like to sell your primary residence but don’t want to pay the hefty tax, I recommend doing the double move as the best solution (move temporarily for two years – rent your primary residence then exchange it):

Potential changes to the 1031 exchange

The President’s 2023 budget currently includes some proposed tax changes to the 1031 exchange benefit. The proposed changes, if passed, could limit 1031 exchanges to an annual maximum deferral of $500,000 per person. This means that if you sold a rental property for a $800,000 taxable gain, a 1031 exchange may only help you defer up to $500,000 of that gain and the remaining $300,000 could be taxable in the current year.

To be fair, there is no indication that this section in the proposed budget will pass and become law anytime soon. But even outside of the potential law change, there are times when a 1031 exchange is not the most ideal solution when it comes to tax deferral. With the hot real estate market, it can sometimes be difficult to identify and close on properties within the timeline and monetary restrictions of a 1031 exchange. In addition, investors may be interested in keeping some of the cash from the sale and not roll all of it into another property. Or if you are no longer interested in being a landlord and prefer to be a passive investor, then a traditional 1031 exchange may not be as appealing to you either.

So, this brings up the question:

Are there alternative ways to offset taxable gain outside of using a 1031 exchange?

If you have a healthy gain built up in your real estate, here are some other strategies that can potentially help you to minimize the tax bite.

https://www.american-apartment-owners-association.org/uncategorized/how-to-sell-real-estate-and-pay-little-to-no-taxes/