Home Elevators

For those who would stay in their home if they could figure out how to travel between floors, a residential elevator might be for you. Here is a simple installation and operation:

They typically run $20,000 to $50,000.

For those who would stay in their home if they could figure out how to travel between floors, a residential elevator might be for you. Here is a simple installation and operation:

They typically run $20,000 to $50,000.

Seniors (55 and over) who are looking for new single-story houses may want to consider Auberge, a gated community near Santaluz:

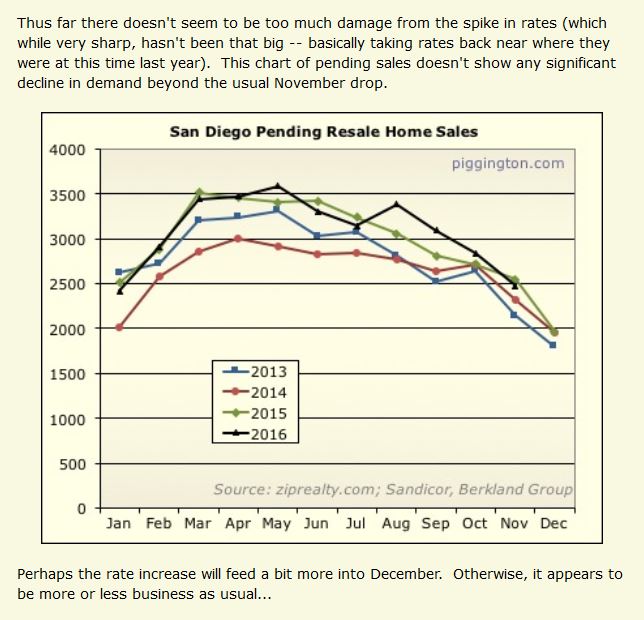

This tends to be a blog for analytical folks, so let’s further dissect the market stats to assist in making better comparisons and decisions about home buying and selling.

We’ve discussed how the supply and demand for one-story homes is quite different from the staired variety. Older folks are hanging onto their single-levels so the supply is lower, and with 76 million baby-boomers heading into retirement with bad knees and arthritis, the demand is growing.

Our MLS imposes a cap on the number of listings for research at 650. So I broke down the numbers below into price categories to help demonstrate the differences in pricing between one-story homes, and not-one-story (two-story, three-story, four-story, split-level, and other):

Pricing of NSDCC Annual Sales Between $1,000,000 – $1,400,000

| Year | ||

| 2013 | ||

| 2014 | ||

| 2015 | ||

| 2016 |

Pricing of NSDCC Annual Sales Between $1,400,000 – $1,800,000

| Year | ||

| 2013 | ||

| 2014 | ||

| 2015 | ||

| 2016 |

It’s probably not a big surprise to anyone reading this that one-story homes are more popular. But let’s note two important points:

Get Good Help!

How do you know if the market conditions are improving? There are the regular indicators to watch to judge whether market momentum is building:

General Market Indicators

Number of Sales is steady or rising.

Pricing is steady or rising.

Average Days on Market is low and dropping.

Months of inventory is tight and dropping (currently 3.0 in NSDCC)

Mortgage rates aren’t jumpy.

Bidding Wars.

But those are mostly feel-good stats and known well after the fact. How can we know which way the market is breaking in real time?

You can expect the well-kept, beautifully staged homes to sell, and most anything with an attractive price should go quickly too. Those with a recent tune-up will be more popular, and having a hot-ticket item will help – great location, one-story, newer, top schools, culdesac, beachy, and walkable.

The best tell-tale signs of market momentum is how the inferior homes do. Make a note when you see a house in this category, and if a few of these go pending around you, then you know the market is starting to cook:

Homes in bad locations.

Houses with long market times (90+ days)

Houses in original condition.

Anti-staging – a house full of old furniture.

Funky floor plans.

A house listed for a price you think is ridiculous.

Wait until the sale is closed to confirm the actual sales price before jumping to any radical conclusions – maybe the sellers had to give one away. Besides, it might only mean that a few weak, anxious buyers dived in too high, too soon, and their agents didn’t stop them.

If you see inferior homes starting to pile up – especially those who lowered their price with no luck – then you know the buyers are winning. When you see a series of inferior homes sell for retail or close, then you can expect the sellers’ confidence to be brimming, and momentum on their side.

There are very few one-story houses that are right on the golf course in Carlsbad. This one is mostly original, but it has good bones!

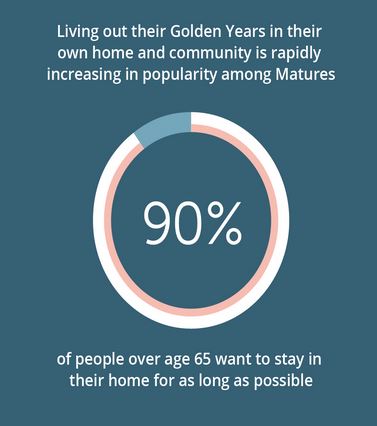

The Baby Boomer generation began in 1946, after World War II. Those born prior to 1946 are now at least 70 years old, and hopefully well off.

I’m not expecting the Matures to have any need for liquidation. Their houses were paid off long ago, and though their income might be limited, they value their home base and don’t want to leave. Most have probably been in their home for more than 30 years!

Construction companies that specialize in converting living rooms to master suites should be very popular! One-story homes are great insurance!

P.S. This is the second week in a row that I used a C.A.R. promotional piece!

The author calls for a better look at how baby boomers impact the housing market, which is great. Talk to realtors who work the street – we are the ones who have the direct one-on-one contact with buyers and sellers.

Excerpted here:

Location, location, location. It’s the long accepted golden rule of real estate. Could it be possible that the golden rule of real estate is being rewritten to focus on the golden years?

The National Association of Realtors does a great job studying real estate trends and providing data that could be powerful to local municipalities if interpreted correctly and applied strategically.

In its 2016 Home Buyers and Sellers Generational Trends report, the data showed that sellers ranging in age from 61 to 90 pick the same top three choices as a reason for selling. This homeowner demographic chose to sell to move closer to family and friends, downsize, or retire.

That’s not new news. Older homeowners have always sold their homes to move closer to family and friends, downsize, or retire. What’s new is that older homeowners may make up the majority of the homeowners in your town. That could mean an oversupply of inventory, which could mean longer market times or falling prices, even if activity is strong and the number of units sold is up.

As it continues to unfold, some communities will feel the pain of falling prices fueled by oversupply of inventory as seniors need to sell in numbers larger than younger buyers are moving in. Some communities will feel the pain of rising prices fueled by low inventory and increased demand if they are a retirement destination and the beneficiary of relocating seniors. Some communities will boom if buyers both young and old penetrate their market, benefitting from the enormity of both the baby boom and the echo boom.

As a nation, we’re accustomed to the real estate market moving in concert, either up or down, in response to a variety of economic factors. The market has never really had simultaneous hot spots and cold spots with no clear economic indicator, and it is confusing because local age distributions are not currently being factored into the statistics, so demographics are not part of the conversation.

Let’s change that. Here is an all-call for housing analysts to look at the data through a different pair of glasses as the boomers move through their aging years, so the public is more educated on this dynamic. Municipal planners need to analyze their age distribution relative to housing inventory so residents understand a local supply or demand issue.

In addition, builders need to identify markets that are drawing more than their fair share of one or both generations to accurately project demand, which may not be the same communities that needed new construction in the past.

Finally some real evidence on how the Bank of Mom and Dad has been influencing the real estate market – see the bold print:

http://www.freddiemac.com/finance/report/20160608_55ers_significant_impact_housing_market.html

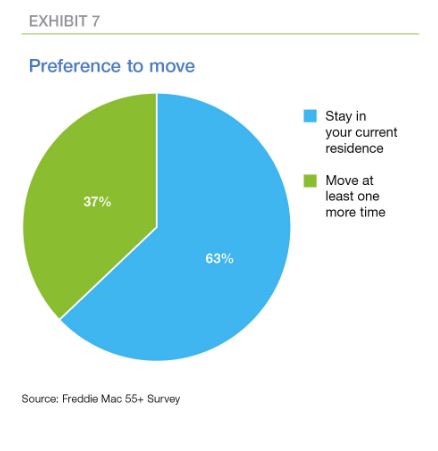

With 55+ homeowners controlling almost two-thirds or $8 trillion of the nation’s home equity*, the housing decisions they make in the coming years will significantly reshape America’s housing market.

The first Freddie Mac 55+ Survey focuses on this 55+ generation of 67 million people because of the impact they are having, and will continue to have, on affordable housing inventories, home prices, and the transition of America’s housing stock from one generation to the next.

The overwhelming message in this first survey is that homeownership works and that 55+ers are confident as they head into retirement or are already there. Some of the key findings include the following.

Baby Boomer Homeowners Expect a Financially Comfortable Retirement

Why Baby Boomers Drive the Housing Market for Millennials

On June 11th we noted two single-story homes for sale in Carlsbad.

This 2,726sf single-story house in SW Carlsbad listed on June 9th for $1,149,999 – and it had the extras like a good yard and view.

They received multiple offers, and it closed for $1,165,000, or $427/sf!

http://www.sdlookup.com/MLS-160031583-6678_Cabela_Carlsbad_CA_92011

How do two-story homes compare?

This is asking $278/sf nearby and unsold:

http://www.sdlookup.com/MLS-160022454-1365_Cassins_St_Carlsbad_CA_92011

Asking $299/sf with ocean view:

http://www.sdlookup.com/MLS-160030800-6393_Ebb_Tide_Carlsbad_CA_92011

Base-grade tract house at $286/sf:

http://www.sdlookup.com/MLS-160026464-1672_Fisherman_Dr_Carlsbad_CA_92011

Get Good Help!

A good article that examines how baby boomers and millennials are competing for their housing needs – read the last two paragraphs below:

In South Carolina, baby boomers elbowed out entry-level buyers to snap up single-story floor plans at Riverwalk, a bike-friendly, outdoor-oriented community with recreation and office space on the Catawba River in Rock Hill. Builder Evans Coghill had not foreseen that 55-plus buyers would provide such a boost to Riverwalk’s customer base, says chief marketing officer Alan Banks. “We thought it would all be families,” he says, but older buyers flocked to Riverwalk after seeing a newspaper ad for the downstairs-master ranch houses.

As a result, the Charlotte, N.C.–based firm will include more single-story homes and homes with master bedrooms downstairs in the community’s next phase, with subtle yet simple changes that appeal to boomers such as covered outdoor living spaces, walk-in showers, built-in shelving and storage (to hold a lifetime of treasures), and remote-access security.

A similar scenario occurred at Rancho Mission Viejo, a 23,000-acre community in California that eventually will include 14,000 homes and 17,000 acres of open space. When sales opened for the community’s first phase, developers were surprised to find their target audience (boomers) didn’t flock to its 55-plus communities. Following tradition for multigenerational developments, developers initially included three gated neighborhoods with age-restricted houses and amenities in the project.

But it turns out that the baby boomers and empty-nesters were just as—if not more—interested in the market-rate neighborhoods intended for young families. In Rancho Mission Viejo’s second village, Esencia, the 55-plus housing is integrated into all-ages neighborhoods, and gates are a thing of the past.

The public builders are taking note of this trend as well. Companies like D.R. Horton and LGI Homes have launched product lines (or, in LGI’s case, entire business models) around building no-frills homes for the first-time buyer. But when these developments open, the builders are finding out that it’s not just millennials who are scooping up the entry-level homes.

“When we launched Express in Florida, 40%, 45% were actually the people buying their last home, not their first home,” said Horton CEO David Auld on the builder’s second quarter 2016 earnings call. “And that’s something we’re taking note of, and making sure that we’re in a position to accommodate those buyers.”

Riverwalk and Rancho Mission Viejo are evidence of a trend that will change the way communities are built and marketed for years, and likely decades, to come. It happened at NorthWest Crossing, a family-friendly traditional neighborhood development in Bend, Ore., where older buyers account for 60% percent of sales, and at Skylar at Playa Vista, contemporary single-story flats designed for young professionals in Los Angeles where more than half the residents in the first phase were 55 and older. Taking note, PulteGroup is building 1,900-square-foot townhouses with flexible three- to five-bedroom floor plans designed to appeal to both millennials and boomers in Minnesota

Boomers have been swiping the best of their kids’ culture in everything from fashion to technology since the millennials began coming of age. The Christian Science Monitor first noted this trend in a 2002 article (“parents and kids today dress alike, listen to the same music, and are good friends,”), and it’s become more intense as millennials have become adults.

For perhaps the first time ever, similarities between a parental generation and the generation it raised far outweigh differences. They mingle at concerts, over craft beers and cocktails, on bike paths and hiking trails. They’re all foodies. A 2015 Eventbrite survey found that boomers and millennials have surprisingly similar spending habits and attend the same live music events, according to an Elite Daily article, “The Fun Is Over: Music Festivals Are Being Invaded By Baby Boomers.” Festival promoters have taken note, and last year Billy Joel played Bonnaroo.

“Boomers are in the process of downsizing and getting rid of junk, and millennials don’t have junk,” he says. “Neither wants a big yard, but they both want a place for a dog.”

Millennials and boomers are more alike than different in everything from technology to ethics, according to a Synchrony Financial report, “Balancing Multi-Generational Retail Strategies.” Millennials are only moderately more likely to own digital devices, according to the report. They’re no more likely than boomers to shop at socially conscious or environmentally friendly retailers (67% of all generations say they would). Both generations are very comfortable with browsing, researching, and shopping online, but they respond differently to marketing messages. The ideal strategy for reaching both, the report states, “is one where the boomer population feels valued and delighted, while the millennial feels excited and interested.”

“Millennials like iPhones, Macs, riding their bikes,” says Manny Gonzalez, principal of KTGY, which designed Skylar at Playa Vista. “I’m 62. We’re finding that people my age like the same sorts of things. We’ve worked with computers, and we’re tech savvy. We may not go to the exact same restaurants as millennials, but we still go to the same downtown area. We still like being part of that whole buzz.”

Home builders have paid more attention to boomers because they’re better off financially, thanks largely to history. Boomers launched during a prosperous time for the middle class and compounded assets, while millennials launched (or didn’t) into the Great Recession with crippling student loan debt. Many boomers are fortunate to have home equity (if they didn’t lose it in the housing crisis), but they’re retiring into murky financial waters. Three-quarters of them plan to fund their retirements solely with Social Security, says John Mulville, vice president of the consulting group for Real Estate Economics. Pension plans are in trouble, and 401(k) retirement accounts are just as vulnerable to market corrections now as they were in 2008. Home equity could become many retirees’ only asset.

Mulville says this has already fueled a boomer migration in Southern California as empty nesters sell the coastal homes they raised kids in for $1 million or more and pick up new, lower-maintenance homes in Riverside or San Bernardino for a couple hundred thousand dollars.

“People haven’t sacked away the balances they need, and they’re being forced to extract the accumulated equity in their homes and put it in the bank for retirement,” he says. “It’s all very new, and it will really intensify in the next few years.”

Read full article here:

http://www.builderonline.com/building/boomers-and-millennials-alike-demand-entry-level-housing_o