by Jim the Realtor | Jul 24, 2021 | Foreclosures, Loan Mods |

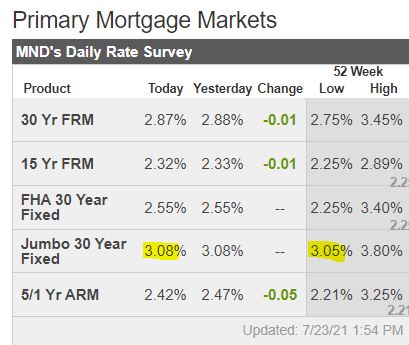

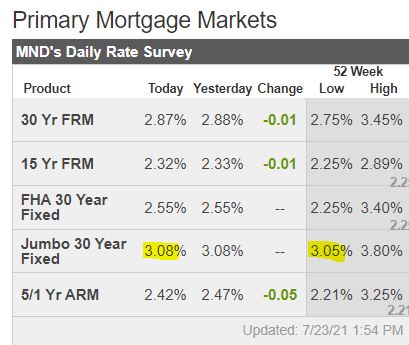

Regardless where the inventory goes (likely to retreat), the potential home buyers should stay interested, just because of rates staying low. Many of them may be looking forward to when the foreclosures start pouring in.

What’s the latest on the delinquencies/forbearances? From Black Knight:

Total U.S. loan delinquency rate (loans 30 or more days past due, but not in foreclosure): 4.37%

– Month-over-month change: -7.62%

– Year-over-year change: -42.39%

Total U.S. foreclosure pre-sale inventory rate: 0.27%

– Month-over-month change: -1.73%

– Year-over-year change: -24.23%

Total U.S. foreclosure starts: 4,400

– Month-over-month change: 15.79%

– Year-over-year change: -25.42%

Top 5 states by 90-plus days delinquent percentage:

Mississippi: 4.89%

Louisiana: 4.59%

Hawaii: 4.14%

Nevada: 4.14%

Maryland: 4.08%

The takeaway:

The national delinquency rate is at its lowest level since the pandemic hit, even below the pre-Great Recession average.

While there’s been improvement, however, there are still 1.5 million homeowners 90 or more days past due on their mortgages but who are not in foreclosure—nearly four times pre-pandemic levels.

There are 1.5 million homeowners who are 90+ days late but who are not in foreclosure? Do you need any more evidence that lenders aren’t interested in foreclosing? They will give loan mods when they get around to it.

It’s a great time to be a deadbeat!

by Jim the Realtor | Jan 27, 2021 | 2021, Foreclosure Count, Foreclosures, Foreclosures/REOs, Loan Mods, REOs, REOs Coming to Market

Thanks to KCM for providing this report:

According to the latest report from Black Knight, Inc., a well-respected provider of data and analytics for mortgage companies, 6.48 million households have entered a forbearance plan as a result of financial concerns brought on by the COVID-19 pandemic.

Here’s where these homeowners stand right now:

- 2,543,000 (39%) are current on their payments and have left the program.

- 625,000 (9%) have paid off their mortgages.

- 434,000 (7%) have negotiated a repayment plan and have left the program.

- 2,254,000 (35%) have extended their original forbearance plan.

- 512,000 (8%) are still in their original forbearance plan.

- 116,000 (2%) have left the program and are still behind on payments.

This shows that of the almost 3.72 million homeowners who have left the program, only 116,000 (2%) exited while they were still behind on their payments. There are still 2.77 million borrowers in a forbearance program. No one knows for sure how many of those will become foreclosures. There are, however, three major reasons why most experts believe there will not be a tsunami of foreclosures as we saw during the housing crash over a decade ago:

- Almost 30% of borrowers in forbearance are still current on their mortgage payments.

- Banks likely don’t want to repeat the mistakes of 2008-2012 when they put large numbers of foreclosures on their books. This time, many will instead negotiate a modification plan with the borrower, which will enable households to maintain ownership of the home.

- With the significant equity homeowners have today, most can sell their home, rather than get foreclosed.

Will there be foreclosures coming to the market? Yes. There are hundreds of thousands of foreclosures in this country each year. People experience economic hardships, and in some cases, are not able to meet their mortgage obligations.

Here’s the breakdown of new foreclosures over the last three years, prior to the pandemic:

- 2017: 314,220

- 2018: 279,040

- 2019: 277,520

Through the first three quarters of 2020 (the latest data available), there were only 114,780 new foreclosures. If 10% of those currently in forbearance go to foreclosure, 275,000 foreclosures would be added to the market in 2021. That would be an average year as the numbers above show.

Link to KCM Article

by Jim the Realtor | Mar 27, 2017 | Boomer Liquidations, Boomers, CA Homeowners Bill of Rights, Foreclosures/REOs, Jim's Take on the Market, Loan Mods, Market Conditions, Mortgage News |

Our local home prices have risen so quickly that it feels like we’re in ‘bubble’ conditions again – could the bubble burst this time?

The last two times the real estate bubble has popped, it was due to banks having to offload their foreclosed properties for whatever the market will bear. They flooded the market, and buyers – and prices – backed off.

But that has all changed now.

Look at the new devices being used to avoid a flood of desperate selling:

- New accounting rules.

- California Homeowners Bill of Rights

- Reverse mortgages

The accounting rules were altered so banks could hold their REO properties longer, and the California Homeowners Bill of Rights has, in effect, stopped foreclosing. Lenders are now required to offer a loan modification to anyone in default, and only if the homeowner can’t or won’t qualify are they at risk of being foreclosed. With today’s higher rents, there isn’t much relief for those in default to give back their house and go lease one nearby. Besides, with our higher home values today, they can always sell before getting foreclosed.

Homeowners who need money can get a reverse mortgage too, as long as they haven’t been tapping into their equity already.

We end up with virtually no desperate sellers who need to dump on price. Someone who wants to cash out quickly can price their home at last year’s comps and look like a deal!

The game is rigged – the Banking Cartel won’t let the bubble pop again!

For the bubble to pop, we would need a dramatic shift in the supply and demand – either a flood of homes hit the market, and/or we run out of buyers.

I thought we’d be seeing more baby boomers unloading their homes due to downsizing or sickness, and while the market consists mainly of those listings, there aren’t enough of them to call it a flood – at least not yet. Because they are in quality locations, more kids are probably trying to buy out their siblings and take over their parents’ house, rather than sell it. They could be moving in with the folks too, rather than sending them to assisted living.

Could we run out of buyers? You would think there would be a price point where buyers can’t or won’t go any higher, but there seems to be a steady flow of people with more horsepower. We saw two weeks ago the prediction that the population of San Diego County is expected to grow by 700,000 people by 2050, which is over 21,000 per year – where are they going to live? Will they be rich? They will need to be!

There hasn’t been enough (has there been any?) sellers so desperate that they had to dump on price – instead, they just keep waiting. We would need more than a few price-dumpers to start a panic, which could cause the market to flood with supply and burst the bubble.

Some air might escape occasionally, but it is doubtful that a market change could occur without the government finding a way to save the bankers.

People like this guy think the conditions are ripe for a downturn. But if prices started falling, sellers are more likely to wait, than dump, which would cause our market to stagnate, rather than crash.

by Jim the Realtor | Aug 20, 2015 | Bailout, Housing Tax Credit, Interest Rates/Loan Limits, Loan Mods, Local Government, Mortgage News, Mortgage Qualifying

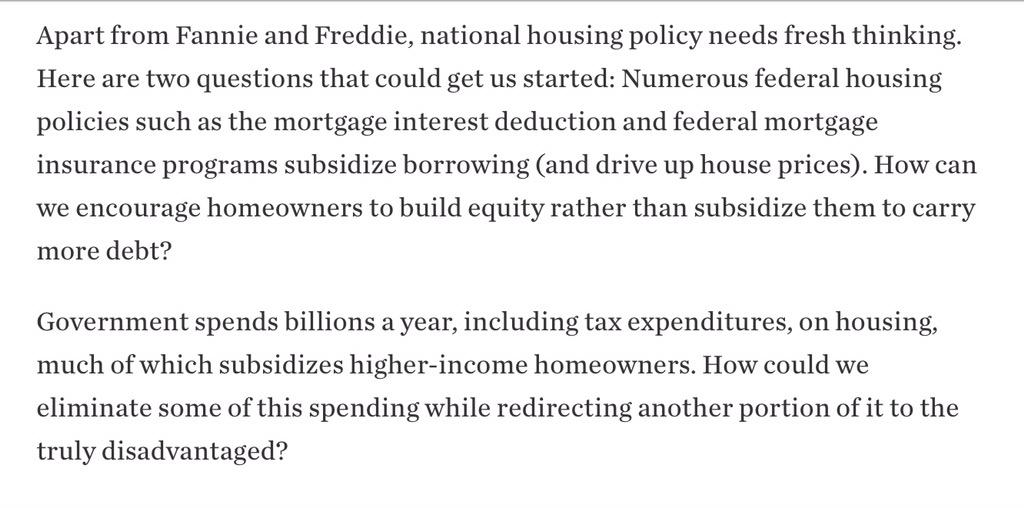

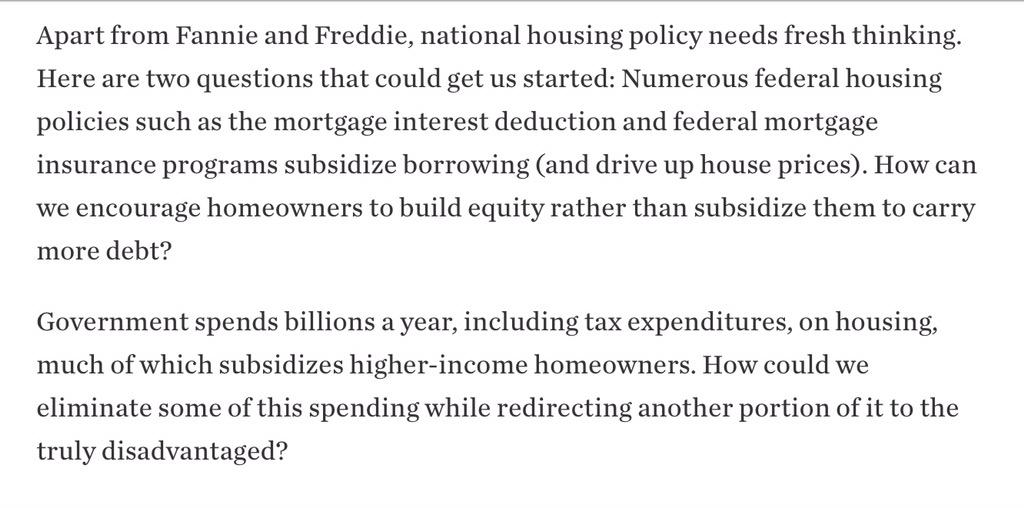

I saw these questions from Ed DeMarco on Twitter. My answers:

1. Have the M.I.D. apply towards primary residence only (not second homes), and lower from $1,000,000 to $500,000. Those buying in hopes of a bigger write off will still buy a house, and take the partial benefit – and be in it for the appreciation and to raise a family (make wifey happy).

2. Have the mortgage interest deduction be in effect for the first ten years of ownership only. It would encourage borrowers to pay off mortgages in the ten years, and not refinance every year.

3. Require that only the buyers can pay for mortgage insurance (sellers can pay in full now).

4. Redirect the disadvantaged folks to subsidized rentals until they aren’t disadvantaged. Only stable, secure, affluent people should buy a house – it’s too late for the rest, unless they drive to the suburbs/outer edge of town.

5. There are several loan programs available to help the disadvantaged already. NACA is still around, helping buyers purchase with no down payment and no closing costs (H/T daytrip):

https://www.naca.com/naca/purchase/purchase.aspx

6. Lower the capital-gains tax for 1-2 years to incentivize those reluctant-but-motivated possible sellers to unload a rental property or two. Cut federal rate to 10% for the first year (currently 20%), and then back to 15% in the second year. The crotchety old guys still won’t sell, so there won’t be a flood. But more inventory = more sales while stabilizing prices.

7. Keep Fannie/Freddie the way they are for now. If they can keep operating in the black, let’s allow the mortgage industry to enjoy the fluidity. I attended a seminar today on the new loan disclosures coming on October 3rd, and it is clear that Fannie/Freddie will be extremely strict on compliance. It doesn’t mean tougher credit, it means the mortgage industry needs to submit the cleanest loan packages ever – which is good for the taxpayers.

8. The new compliance crunch will virtually eliminate mortgage brokers – wholesale lenders won’t want to take a chance on them. Yes, we still have room for you over here to be a realtor – there’s only 11,000 of us chasing 3,500 sales each month.

9. Encourage a private jumbo-MBS market without subsidizing it. Eventually, a private MBS marketplace could help shift the burden from Fannie/Freddie.

10. Run a tight ship. We can handle it.

The powers-that-be have made some great moves to get us this far, now bow out gracefully and let free enterprise take care of the rest.

by Jim the Realtor | Dec 6, 2014 | Bailout, Loan Mods, Mortgage News |

More foreclosure-avoidance incentives were announced this week:

http://www.mortgagenewsdaily.com/12052014_hamp_mfa_programs.asp

An excerpt:

“While the housing sector has strengthened in recent years, there are still many homeowners struggling to make their mortgage payments,” said Secretary of the Treasury Jacob J. Lew. “The changes we are announcing today offer meaningful incentives for borrowers to stay current in their modifications, increase their opportunity to build equity in their homes, and provide vital safety nets for those facing greater financial strains.”

The Home Affordable Modification Program (HAMP), established in 2009, offers homeowners loan modifications with lower monthly payments achieved through lowered interest rates and modified loan terms. Many homeowners with HAMP modifications have been eligible to earn up to $5,000 if they adhere to modification terms for five years. The amount is applied to their outstanding principal balance.

Under the revisions an additional $5,000 will be available to homeowners after a sixth year of on-time payments and they will then have the opportunity to re-amortize the reduced mortgage balance, thus further lowering their monthly payment. HUD/Treasury estimate some one million borrowers with HAMP modifications may be eligible for the new incentive.

HAMP Tier 2 was developed as an alternative for homeowners who can’t qualify or are unable to sustain a HAMP Tier 1 modifications. It provides modifications with a low fixed rate for the life of the loan. The revision announced this week will include reducing the interest rate for these modified loans by 50 basis points which will also make more borrowers eligible for the program. It also extends the sixth year $5,000 pay-for-performance incentive to Tier Two borrowers.

by Jim the Realtor | May 29, 2014 | Loan Mods, Mortgage News |

Occasionally, the ivory-tower set comes up with these wacky ideas to have banks share risk with borrowers. Fannie and Freddie may not be interested just due to the complexity, but if a private bank gave it a run with a good marketing push, they might find an audience. Hat tip to Scott S. who sent this in from Bloomberg BusinessWeek:

http://www.businessweek.com/articles/2014-05-22/redesign-30-year-mortgage-prevent-next-financial-crisis

Entertaining as it is, playing the financial crisis blame game gets us nowhere. A more useful contribution from Mian and Sufi is the shared-responsibility mortgage, their prescription to make economies less vulnerable to debt-fueled bubbles. In such a mortgage, lenders take some of the hit if housing prices fall and reap some of the reward if they rise. “Had such mortgages been in place when house prices collapsed, the Great Recession in the United States would not have been ‘Great’ at all,” they argue. “It would have been a garden variety downturn with many fewer jobs lost.”

Their claim is bold, perhaps too bold, but the strategy for making debt less dangerous by putting a twist into the 30-year fixed-rate mortgage is sound.

If an index of home prices in a home’s ZIP code fell, say, 30 percent, then the borrower’s monthly payment of principal and interest would also fall 30 percent. That’s not achieved by stretching out the length of the loan, which lenders sometimes will do: Despite the smaller payment, the mortgage would still get paid off over 30 years. Financially speaking, it would be equivalent to getting a reduction in principal.

If prices recover, payments go back up, but never above the original amount. Lenders would ordinarily charge a higher rate for that protection, but Mian and Sufi calculate that they would be willing to forgo a bump on the rate if they were given some upside potential: 5 percent of any capital gain the homeowner gets upon selling or refinancing the house.

Read full article here:

http://www.businessweek.com/articles/2014-05-22/redesign-30-year-mortgage-prevent-next-financial-crisis

by Jim the Realtor | Oct 30, 2013 | Foreclosures/REOs, Loan Mods, Mortgage News, Principal Reductions, Short Selling |

Hat tip to daytrip for sending in this article from the latimes.com alerting us to the expiring The Mortgage Debt Relief Act of 2007, wrapped around the free cheese in the recent JP Morgan settlement:

http://www.latimes.com/business/hiltzik/la-fi-mh-homeowners-20131029,0,6953798.story#axzz2jD09ygWq

David Dayen spots a new blow for underwater homeowners that thus far has flown under the radar: the coming expiration of the Mortgage Forgiveness Debt Relief Act of 2007, scheduled for Dec. 31.

The act is a mouthful, but it’s been a crucial factor in helping countless families get out from under bad mortgages. Simply put, the act relieves homeowners from having to pay taxes on any loan forgiveness they receive in a mortgage restructuring. (The maximum exemption is $2 million for a couple.) The measure was originally set to expire last Dec. 31, but it was extended another year by the fiscal cliff deal.

The act is a mouthful, but it’s been a crucial factor in helping countless families get out from under bad mortgages. Simply put, the act relieves homeowners from having to pay taxes on any loan forgiveness they receive in a mortgage restructuring. (The maximum exemption is $2 million for a couple.) The measure was originally set to expire last Dec. 31, but it was extended another year by the fiscal cliff deal.

The foreclosure crisis is ebbing, but the relief is still needed. Millions of families are still underwater and facing delinquency, default, and foreclosure. As Dayan notes, those who succeed in obtaining principal reductions will be getting a bill that’s almost certain to be unaffordable.

As an additional irony, the act’s expiration comes just as JPMorgan, one of the banks that contributed massively to the housing crisis, reaches a deal that gives it a tax break on its multibillion-dollar settlement of federal charges related to the disaster.

He suggests folding an extension of the homeowner relief act into the JPMorgan settlement, but the extension looks like something that would have to clear Congress all by its lonesome. What are the chances of that? Congress has a lot to do as the end of the year looms. Somehow the things that aren’t on its agenda are all needed to help the less advantaged of society — food stamp extensions and now mortgage relief. Come New Year’s Day, we’ll be asking once again: Who do the people on Capitol Hill work for?

by Jim the Realtor | Aug 7, 2013 | Loan Mods, Local Government |

The highlight was him mentioning that he and Michelle lived with her mother for two years before buying a starter condo:

by Jim the Realtor | Jul 30, 2013 | Loan Mods, Local Government, Mortgage News |

Hat tip to daytrip for sending this in from nytimes.com – an excerpt:

Robert and Patricia Castillo paid $420,000 for a three-bedroom, one-bathroom home in Richmond, Calif., in 2005. It is now worth $125,000.

The power of eminent domain has traditionally worked against homeowners, who can be forced to sell their property to make way for a new highway or shopping mall. But now the working-class city of Richmond, Calif., hopes to use the same legal tool to help people stay right where they are.

Scarcely touched by the nation’s housing recovery and tired of waiting for federal help, Richmond is about to become the first city in the nation to try eminent domain as a way to stop foreclosures.

The results will be closely watched by both Wall Street banks, which have vigorously opposed the use of eminent domain to buy mortgages and reduce homeowner debt, and a host of cities across the country that are considering emulating Richmond.

The banks have warned that such a move will bring down a hail of lawsuits and all but halt mortgage lending in any city with the temerity to try it.

But local officials, frustrated at the lack of large-scale relief from the Obama administration, relatively free of the influence that Wall Street wields in Washington, and faced with fraying neighborhoods and a depleted middle class, are beginning to shrug off those threats.

“We’re not willing to back down on this,” said Gayle McLaughlin, the former schoolteacher who is serving her second term as Richmond’s mayor. “They can put forward as much pressure as they would like but I’m very committed to this program and I’m very committed to the well-being of our neighborhoods.”

The city is offering to buy the loans at what it considers the fair market value. In a hypothetical example, a home mortgaged for $400,000 is now worth $200,000. The city plans to buy the loan for $160,000, or about 80 percent of the value of the home, a discount that factors in the risk of default.

Then, the city would write down the debt to $190,000 and allow the homeowner to refinance at the new amount, probably through a government program. The $30,000 difference goes to the city, the investors who put up the money to buy the loan, closing costs and M.R.P. The homeowner would go from owing twice what the home is worth to having $10,000 in equity.

Read full article here:

http://www.nytimes.com/2013/07/30/business/in-a-shift-eminent-domain-saves-homes.html?pagewanted=1&_r=1&ref=business&

by Jim the Realtor | Jul 24, 2013 | Loan Mods |

Another hat tip to daytrip for sending this in from cnnmoney:

Nearly 1.2 million mortgage modifications have been completed since the Home Affordable Modification Program (HAMP) was first launched four years ago.

Yet more than 306,000 borrowers have re-defaulted on their loans and more than 88,000 are at risk of following suit, the Special Inspector General for the Troubled Asset Relief Program (SIGTARP) found in its quarterly report to Congress.

In addition, the watchdog found that the longer a homeowner stays in the HAMP modification program, the more likely they are to default. Those who have been in the program since 2009, are re-defaulting at a rate of 46%, the inspector general found.

Read full article here:

http://money.cnn.com/2013/07/24/real_estate/hamp-default/index.html